SAN JOSE, Calif.--(BUSINESS WIRE)--Nutanix, Inc. (NASDAQ: NTNX), a leader in hybrid multicloud computing, today announced financial results for its second quarter ended January 31, 2024.

“Our disciplined execution enabled us to deliver a solid second quarter financial performance against an uncertain, but stable macro backdrop,” said Rajiv Ramaswami, President and CEO of Nutanix. “We continue to remain focused on being a long-term strategic and innovative partner to our customers as they look to operate in a hybrid multicloud world.”

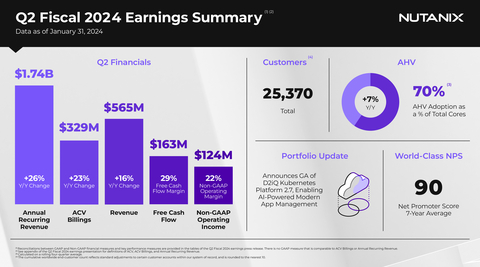

“Our second quarter results demonstrated a good balance of top and bottom line performance with 26% year-over-year ARR growth and strong free cash flow generation,” said Rukmini Sivaraman, CFO of Nutanix. “We also achieved GAAP operating profitability for the first time, reflecting the progress we’ve made in driving operating leverage in our model and optimizing the difference between our GAAP and non-GAAP results.”

Second Quarter Fiscal 2024 Financial Summary

|

Q2 FY’24 |

Q2 FY’23 |

Y/Y Change |

|||

Annual Contract Value (ACV)1 Billings |

$329.5 million |

$267.6 million |

23% |

|||

Annual Recurring Revenue (ARR)2 |

$1.74 billion |

$1.38 billion |

26% |

|||

Average Contract Duration3 |

2.8 years |

3.0 years |

(0.2) year |

|||

Revenue4 |

$565.2 million |

$486.5 million |

16% |

|||

GAAP Gross Margin |

85.6% |

82.2% |

340 bps |

|||

Non-GAAP Gross Margin |

87.3% |

84.8% |

250 bps |

|||

GAAP Operating Expenses |

$446.6 million |

$456.2 million |

(2)% |

|||

Non-GAAP Operating Expenses |

$369.4 million |

$342.5 million |

8% |

|||

GAAP Operating Income (Loss) |

$37.0 million |

$(56.5) million |

$93.5 million |

|||

Non-GAAP Operating Income |

$123.9 million |

$70.0 million |

$53.9 million |

|||

GAAP Operating Margin |

6.6% |

(11.6)% |

18.2% pts |

|||

Non-GAAP Operating Margin |

21.9% |

14.4% |

7.5% pts |

|||

Net Cash Provided by Operating Activities |

$186.4 million |

$74.1 million |

$112.3 million |

|||

Free Cash Flow |

$162.6 million |

$63.0 million |

$99.6 million |

Reconciliations between GAAP and non-GAAP financial measures and key performance measures, to the extent available, are provided in the tables of this press release.

Third Quarter Fiscal 2024 Outlook

|

|

|

ACV Billings |

$265 - $275 million |

|

Revenue |

$510 - $520 million |

|

Non-GAAP Gross Margin |

~85% |

|

Non-GAAP Operating Margin |

7.5% to 8.5% |

|

Weighted Average Shares Outstanding (Diluted)5 |

Approximately 301 million |

Fiscal 2024 Outlook

|

|

|

ACV Billings |

$1.09 - $1.11 billion |

|

Revenue |

$2.12 - $2.15 billion |

|

Non-GAAP Gross Margin |

85% to 86% |

|

Non-GAAP Operating Margin |

12.5% to 13.5% |

|

Free Cash Flow |

$420 - $440 million |

Supplementary materials to this press release, including our second quarter fiscal 2024 earnings presentation, can be found at https://ir.nutanix.com/financial/quarterly-results.

Webcast and Conference Call Information

Nutanix executives will discuss the Company’s second quarter fiscal 2024 financial results on a conference call today at 4:30 p.m. Eastern Time/1:30 p.m. Pacific Time. Interested parties may access the conference call by registering at this link to receive dial in details and a unique PIN number. The conference call will also be webcast live on the Nutanix Investor Relations website at ir.nutanix.com. An archived replay of the webcast will be available on the Nutanix Investor Relations website at ir.nutanix.com shortly after the call.

Footnotes

1Annual Contract Value, or ACV, is defined as the total annualized value of a contract, excluding amounts related to professional services and hardware. The total annualized value for a contract is calculated by dividing the total value of the contract by the number of years in the term of such contract, using, where applicable, an assumed term of five years for contracts that do not have a specified term. ACV Billings, for any given period, is defined as the sum of the ACV for all contracts billed during the given period.

2Annual Recurring Revenue, or ARR, for any given period, is defined as the sum of ACV for all non life-of-device contracts in effect as of the end of a specific period. For the purposes of this calculation, we assume that the contract term begins on the date a contract is booked, unless the terms of such contract prevent us from fulfilling our obligations until a later period, and irrespective of the periods in which we would recognize revenue for such contract.

3Average Contract Duration represents the dollar-weighted term, calculated on a billings basis, across all subscription and life-of-device contracts, using an assumed term of five years for life-of-device licenses, executed in the period.

4Revenue was negatively impacted by a year-over-year decline in the average contract duration, including as a result of Nutanix’s transition to a subscription-based business model.

5Weighted average share count used in computing diluted non-GAAP net income per share.

Non-GAAP Financial Measures and Other Key Performance Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, this press release includes the following non-GAAP financial and other key performance measures: non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income, non-GAAP operating margin, free cash flow, Annual Contract Value Billings (or ACV Billings), Annual Recurring Revenue (or ARR), and Average Contract Duration. In computing non-GAAP financial measures, we exclude certain items such as stock-based compensation and the related income tax impact, costs associated with our acquisitions (such as amortization of acquired intangible assets, income tax-related impact, and other acquisition-related costs), costs related to the impairment and early exit of operating lease-related assets, restructuring charges, litigation settlement accruals and legal fees related to certain litigation matters, the amortization of the debt discount and issuance costs, interest expense related to convertible senior notes, gains on divestitures, and other non-recurring transactions and the related tax impact. Non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income, and non-GAAP operating margin are financial measures which we believe provide useful information to investors because they provide meaningful supplemental information regarding our performance and liquidity by excluding certain expenses and expenditures such as stock-based compensation expense that may not be indicative of our ongoing core business operating results. Free cash flow is a performance measure that we believe provides useful information to our management and investors about the amount of cash generated by the business after necessary capital expenditures, and we define free cash flow as net cash provided by (used in) operating activities less purchases of property and equipment. ACV Billings is a performance measure that we believe provides useful information to our management and investors as it allows us to better track the topline growth of our business during our transition to a subscription-based business model because it takes into account variability in term lengths. ARR is a performance measure that we believe provides useful information to our management and investors as it allows us to better track the topline growth of our subscription business because it takes into account variability in term lengths. We use these non-GAAP financial and key performance measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. However, these non-GAAP financial and key performance measures have limitations as analytical tools and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. Non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income, non-GAAP operating margin, and free cash flow are not substitutes for gross margin, operating expenses, operating income (loss), operating margin, or net cash provided by (used in) operating activities, respectively. There is no GAAP measure that is comparable to ACV Billings, ARR, or Average Contract Duration, so we have not reconciled the ACV Billings, ARR, or Average Contract Duration data included in this press release to any GAAP measure. In addition, other companies, including companies in our industry, may calculate non-GAAP financial measures and key performance measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures and key performance measures as tools for comparison. We urge you to review the reconciliation of our non-GAAP financial measures and key performance measures to the most directly comparable GAAP financial measures included below in the tables captioned “Reconciliation of GAAP to Non-GAAP Profit Measures” and “Reconciliation of GAAP Net Cash Provided By Operating Activities to Non-GAAP Free Cash Flow,” and not to rely on any single financial measure to evaluate our business. This press release also includes the following forward-looking non-GAAP financial measures as part of our third quarter fiscal 2024 outlook and/or our fiscal 2024 outlook: non-GAAP gross margin, non-GAAP operating margin, and free cash flow. We are unable to reconcile these forward-looking non-GAAP financial measures to their most directly comparable GAAP financial measures without unreasonable efforts, as we are currently unable to predict with a reasonable degree of certainty the type and extent of certain items that would be expected to impact the GAAP financial measures for these periods but would not impact the non-GAAP financial measures.

Forward-Looking Statements

This press release contains express and implied forward-looking statements, including, but not limited to, statements regarding: our business momentum and prospects, our third quarter fiscal 2024 outlook, and our fiscal 2024 outlook.

These forward-looking statements are not historical facts and instead are based on our current expectations, estimates, opinions, and beliefs. Consequently, you should not rely on these forward-looking statements. The accuracy of these forward-looking statements depends upon future events and involves risks, uncertainties, and other factors, including factors that may be beyond our control, that may cause these statements to be inaccurate and cause our actual results, performance or achievements to differ materially and adversely from those anticipated or implied by such statements, including, among others: the inherent uncertainty or assumptions and estimates underlying our projections and guidance, which are necessarily speculative in nature; any failure to successfully implement or realize the full benefits of, or unexpected difficulties or delays in successfully implementing or realizing the full benefits of, our business plans, strategies, initiatives, vision, and objectives; our ability to achieve, sustain and/or manage future growth effectively; the rapid evolution of the markets in which we compete, including the introduction, or acceleration of adoption of, competing solutions, including public cloud infrastructure; failure to timely and successfully meet our customer needs; delays in or lack of customer or market acceptance of our new solutions, products, services, product features or technology; macroeconomic or geopolitical uncertainty, including supply chain issues; our ability to attract, recruit, train, retain, and, where applicable, ramp to full productivity, qualified employees and key personnel; factors that could result in the significant fluctuation of our future quarterly operating results (including anticipated changes to our revenue and product mix, the timing and magnitude of orders, shipments and acceptance of our solutions in any given quarter, our ability to attract new and retain existing end-customers, changes in the pricing and availability of certain components of our solutions, and fluctuations in demand and competitive pricing pressures for our solutions); our ability to form new or maintain and strengthen existing strategic alliances and partnerships, as well as our ability to manage any changes thereto; the impact of a pandemic or major public health concern; our ability to make share repurchases; and other risks detailed in our Annual Report on Form 10-K for the fiscal year ended July 31, 2023 filed with the U.S. Securities and Exchange Commission, or the SEC, on September 21, 2023 and our subsequent Quarterly Reports on Form 10-Q filed with the SEC. Additional information will be set forth in our Quarterly Report on Form 10-Q for the fiscal quarter ended January 31, 2024, which should be read in conjunction with this press release and the financial results included herein. Our SEC filings are available on the Investor Relations section of our website at ir.nutanix.com and on the SEC's website at www.sec.gov. These forward-looking statements speak only as of the date of this press release and, except as required by law, we assume no obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any of these forward-looking statements to reflect actual results or subsequent events or circumstances.

About Nutanix

Nutanix is a global leader in cloud software, offering organizations a single platform for running apps and data across clouds. With Nutanix, companies can reduce complexity and simplify operations, freeing them to focus on their business outcomes. Building on its legacy as the pioneer of hyperconverged infrastructure, Nutanix is trusted by companies worldwide to power hybrid multicloud environments consistently, simply, and cost-effectively. Learn more at www.nutanix.com or follow us on social media @nutanix.

© 2024 Nutanix, Inc. All rights reserved. Nutanix, the Nutanix logo, and all Nutanix product and service names mentioned herein are registered trademarks or unregistered trademarks of Nutanix, Inc. in the United States and other countries. Other brand names and marks mentioned herein are for identification purposes only and may be the trademarks of their respective holder(s). This press release contains links to external websites that are not part of Nutanix.com. Nutanix does not control these sites and disclaims all responsibility for the content or accuracy of any external site. Our decision to link to an external site should not be considered an endorsement of any content on such a site.

NUTANIX, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) |

||||||||

|

|

As of |

|

|||||

|

|

July 31,

|

|

|

January 31,

|

|

||

|

|

(in thousands) |

|

|||||

Assets |

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

512,929 |

|

|

$ |

679,246 |

|

Short-term investments |

|

|

924,466 |

|

|

|

964,714 |

|

Accounts receivable, net |

|

|

157,251 |

|

|

|

189,046 |

|

Deferred commissions—current |

|

|

120,001 |

|

|

|

138,606 |

|

Prepaid expenses and other current assets |

|

|

147,087 |

|

|

|

108,825 |

|

Total current assets |

|

|

1,861,734 |

|

|

|

2,080,437 |

|

Property and equipment, net |

|

|

111,865 |

|

|

|

115,224 |

|

Operating lease right-of-use assets |

|

|

93,554 |

|

|

|

97,307 |

|

Deferred commissions—non-current |

|

|

237,990 |

|

|

|

214,555 |

|

Intangible assets, net |

|

|

4,893 |

|

|

|

6,884 |

|

Goodwill |

|

|

184,938 |

|

|

|

185,235 |

|

Other assets—non-current |

|

|

31,941 |

|

|

|

29,892 |

|

Total assets |

|

$ |

2,526,915 |

|

|

$ |

2,729,534 |

|

Liabilities and Stockholders’ Deficit |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

29,928 |

|

|

$ |

39,544 |

|

Accrued compensation and benefits |

|

|

143,679 |

|

|

|

177,837 |

|

Accrued expenses and other current liabilities |

|

|

109,269 |

|

|

|

22,401 |

|

Deferred revenue—current |

|

|

823,665 |

|

|

|

893,889 |

|

Operating lease liabilities—current |

|

|

29,567 |

|

|

|

29,151 |

|

Total current liabilities |

|

|

1,136,108 |

|

|

|

1,162,822 |

|

Deferred revenue—non-current |

|

|

771,367 |

|

|

|

814,605 |

|

Operating lease liabilities—non-current |

|

|

68,940 |

|

|

|

73,720 |

|

Convertible senior notes, net |

|

|

1,218,165 |

|

|

|

1,250,434 |

|

Other liabilities—non-current |

|

|

39,754 |

|

|

|

39,635 |

|

Total liabilities |

|

|

3,234,334 |

|

|

|

3,341,216 |

|

Stockholders’ deficit: |

|

|

|

|

|

|

||

Common stock |

|

|

6 |

|

|

|

6 |

|

Additional paid-in capital |

|

|

3,930,668 |

|

|

|

4,039,779 |

|

Accumulated other comprehensive (loss) income |

|

|

(5,171 |

) |

|

|

879 |

|

Accumulated deficit |

|

|

(4,632,922 |

) |

|

|

(4,652,346 |

) |

Total stockholders’ deficit |

|

|

(707,419 |

) |

|

|

(611,682 |

) |

Total liabilities and stockholders’ deficit |

|

$ |

2,526,915 |

|

|

$ |

2,729,534 |

|

NUTANIX, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) |

||||||||||||||||

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

||||||||||

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

||||

|

|

(in thousands, except per share data) |

|

|||||||||||||

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Product |

|

$ |

250,538 |

|

|

$ |

299,660 |

|

|

$ |

459,112 |

|

|

$ |

546,582 |

|

Support, entitlements and other services |

|

|

235,957 |

|

|

|

265,573 |

|

|

|

460,992 |

|

|

|

529,705 |

|

Total revenue |

|

|

486,495 |

|

|

|

565,233 |

|

|

|

920,104 |

|

|

|

1,076,287 |

|

Cost of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Product (1)(2) |

|

|

15,506 |

|

|

|

9,402 |

|

|

|

28,022 |

|

|

|

19,636 |

|

Support, entitlements and other services (1) |

|

|

71,299 |

|

|

|

72,154 |

|

|

|

141,278 |

|

|

|

143,879 |

|

Total cost of revenue |

|

|

86,805 |

|

|

|

81,556 |

|

|

|

169,300 |

|

|

|

163,515 |

|

Gross profit |

|

|

399,690 |

|

|

|

483,677 |

|

|

|

750,804 |

|

|

|

912,772 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Sales and marketing (1)(2) |

|

|

229,788 |

|

|

|

236,702 |

|

|

|

466,010 |

|

|

|

472,025 |

|

Research and development (1) |

|

|

142,301 |

|

|

|

160,401 |

|

|

|

291,744 |

|

|

|

312,376 |

|

General and administrative (1) |

|

|

84,109 |

|

|

|

49,529 |

|

|

|

130,213 |

|

|

|

97,032 |

|

Total operating expenses |

|

|

456,198 |

|

|

|

446,632 |

|

|

|

887,967 |

|

|

|

881,433 |

|

(Loss) income from operations |

|

|

(56,508 |

) |

|

|

37,045 |

|

|

|

(137,163 |

) |

|

|

31,339 |

|

Other (expense) income, net |

|

|

(10,112 |

) |

|

|

2,096 |

|

|

|

(23,528 |

) |

|

|

(3,179 |

) |

(Loss) income before provision for income taxes |

|

|

(66,620 |

) |

|

|

39,141 |

|

|

|

(160,691 |

) |

|

|

28,160 |

|

Provision for income taxes |

|

|

4,170 |

|

|

|

6,346 |

|

|

|

9,613 |

|

|

|

11,218 |

|

Net (loss) income |

|

$ |

(70,790 |

) |

|

$ |

32,795 |

|

|

$ |

(170,304 |

) |

|

$ |

16,942 |

|

Net (loss) income per share attributable to Class A common stockholders, basic |

|

$ |

(0.31 |

) |

|

$ |

0.13 |

|

|

$ |

(0.74 |

) |

|

$ |

0.07 |

|

Net (loss) income per share attributable to Class A common stockholders, diluted |

|

$ |

(0.31 |

) |

|

$ |

0.12 |

|

|

$ |

(0.74 |

) |

|

$ |

0.09 |

|

Weighted average shares used in computing net (loss) income per share attributable to Class A common stockholders, basic |

|

|

231,924 |

|

|

|

243,853 |

|

|

|

230,229 |

|

|

|

242,667 |

|

Weighted average shares used in computing net (loss) income per share attributable to Class A common stockholders, diluted |

|

|

231,924 |

|

|

|

298,540 |

|

|

|

230,229 |

|

|

|

294,851 |

|

(1) |

Includes the following stock-based compensation expense: |

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

||||||||||

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

||||

|

|

(in thousands) |

|

|||||||||||||

Product cost of revenue |

|

$ |

2,113 |

|

|

$ |

1,697 |

|

|

$ |

4,272 |

|

|

$ |

3,625 |

|

Support, entitlements and other services cost of revenue |

|

|

8,172 |

|

|

|

7,183 |

|

|

|

13,518 |

|

|

|

14,299 |

|

Sales and marketing |

|

|

23,570 |

|

|

|

20,738 |

|

|

|

44,042 |

|

|

|

42,209 |

|

Research and development |

|

|

36,491 |

|

|

|

40,541 |

|

|

|

75,113 |

|

|

|

78,945 |

|

General and administrative |

|

|

14,944 |

|

|

|

15,810 |

|

|

|

29,300 |

|

|

|

30,889 |

|

Total stock-based compensation expense |

|

$ |

85,290 |

|

|

$ |

85,969 |

|

|

$ |

166,245 |

|

|

$ |

169,967 |

|

(2) |

Includes the following amortization of intangible assets: |

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

||||||||||

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

||||

|

|

(in thousands) |

|

|||||||||||||

Product cost of revenue |

|

$ |

2,531 |

|

|

$ |

749 |

|

|

$ |

5,341 |

|

|

$ |

1,860 |

|

Sales and marketing |

|

|

198 |

|

|

|

82 |

|

|

|

547 |

|

|

|

119 |

|

Total amortization of intangible assets |

|

$ |

2,729 |

|

|

$ |

831 |

|

|

$ |

5,888 |

|

|

$ |

1,979 |

|

NUTANIX, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) |

||||||||

|

|

Six Months Ended

|

|

|||||

|

|

2023 |

|

|

2024 |

|

||

|

|

(in thousands) |

|

|||||

Cash flows from operating activities: |

|

|

|

|

|

|

||

Net (loss) income |

|

$ |

(170,304 |

) |

|

$ |

16,942 |

|

Adjustments to reconcile net (loss) income to net cash provided by operating activities: |

|

|

|

|

|

|

||

Depreciation and amortization |

|

|

39,479 |

|

|

|

36,389 |

|

Stock-based compensation |

|

|

166,245 |

|

|

|

169,967 |

|

Amortization of debt discount and issuance costs |

|

|

21,082 |

|

|

|

22,300 |

|

Operating lease cost, net of accretion |

|

|

18,158 |

|

|

|

16,046 |

|

Early exit of lease-related assets |

|

|

(1,109 |

) |

|

|

— |

|

Non-cash interest expense |

|

|

9,817 |

|

|

|

10,064 |

|

Other |

|

|

(2,427 |

) |

|

|

(8,859 |

) |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

||

Accounts receivable, net |

|

|

(28,649 |

) |

|

|

(19,662 |

) |

Deferred commissions |

|

|

19,110 |

|

|

|

4,830 |

|

Prepaid expenses and other assets |

|

|

(28,348 |

) |

|

|

40,575 |

|

Accounts payable |

|

|

(3,171 |

) |

|

|

8,695 |

|

Accrued compensation and benefits |

|

|

(11,467 |

) |

|

|

34,158 |

|

Accrued expenses and other liabilities |

|

|

52,423 |

|

|

|

(86,009 |

) |

Operating leases, net |

|

|

(19,965 |

) |

|

|

(14,884 |

) |

Deferred revenue |

|

|

78,723 |

|

|

|

101,329 |

|

Net cash provided by operating activities |

|

|

139,597 |

|

|

|

331,881 |

|

Cash flows from investing activities: |

|

|

|

|

|

|

||

Maturities of investments |

|

|

529,112 |

|

|

|

429,219 |

|

Purchases of investments |

|

|

(508,984 |

) |

|

|

(455,254 |

) |

Payments for acquisitions, net of cash acquired |

|

|

— |

|

|

|

(4,500 |

) |

Purchases of property and equipment |

|

|

(30,772 |

) |

|

|

(36,784 |

) |

Net cash used in investing activities |

|

|

(10,644 |

) |

|

|

(67,319 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

||

Proceeds from sales of shares through employee equity incentive plans |

|

|

22,896 |

|

|

|

15,153 |

|

Taxes paid related to net share settlement of equity awards |

|

|

— |

|

|

|

(53,180 |

) |

Repayment of convertible notes |

|

|

(145,704 |

) |

|

|

— |

|

Repurchases of common stock |

|

|

— |

|

|

|

(59,192 |

) |

Payment of finance lease obligations |

|

|

(2,344 |

) |

|

|

(1,758 |

) |

Net cash used in financing activities |

|

|

(125,152 |

) |

|

|

(98,977 |

) |

Net increase in cash, cash equivalents and restricted cash |

|

$ |

3,801 |

|

|

$ |

165,585 |

|

Cash, cash equivalents and restricted cash—beginning of period |

|

|

405,862 |

|

|

|

515,771 |

|

Cash, cash equivalents and restricted cash—end of period |

|

$ |

409,663 |

|

|

$ |

681,356 |

|

Restricted cash (1) |

|

|

3,062 |

|

|

|

2,110 |

|

Cash and cash equivalents—end of period |

|

$ |

406,601 |

|

|

$ |

679,246 |

|

Supplemental disclosures of cash flow information: |

|

|

|

|

|

|

||

Cash paid for income taxes |

|

$ |

16,191 |

|

|

$ |

14,168 |

|

Supplemental disclosures of non-cash investing and financing information: |

|

|

|

|

|

|

||

Purchases of property and equipment included in accounts payable and accrued and other liabilities |

|

$ |

18,646 |

|

|

$ |

1,648 |

|

(1) |

Included within other assets—non-current in the consolidated balance sheets. |

Reconciliation of Revenue to Billings (Unaudited) |

||||||||||||||||

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

||||||||||

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

||||

|

|

(in thousands) |

|

|||||||||||||

Total revenue |

|

$ |

486,495 |

|

|

$ |

565,233 |

|

|

$ |

920,104 |

|

|

$ |

1,076,287 |

|

Change in deferred revenue |

|

|

42,602 |

|

|

|

51,250 |

|

|

|

78,723 |

|

|

|

101,329 |

|

Total billings |

|

$ |

529,097 |

|

|

$ |

616,483 |

|

|

$ |

998,827 |

|

|

$ |

1,177,616 |

|

Disaggregation of Revenue and Billings (Unaudited) |

||||||||||||||||

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

||||||||||

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

||||

|

|

(in thousands) |

|

|||||||||||||

Disaggregation of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Subscription revenue |

|

$ |

450,948 |

|

|

$ |

531,983 |

|

|

$ |

853,872 |

|

|

$ |

1,011,461 |

|

Professional services revenue |

|

|

23,442 |

|

|

|

25,008 |

|

|

|

45,720 |

|

|

|

47,843 |

|

Other non-subscription product revenue |

|

|

12,105 |

|

|

|

8,242 |

|

|

|

20,512 |

|

|

|

16,983 |

|

Total revenue |

|

$ |

486,495 |

|

|

$ |

565,233 |

|

|

$ |

920,104 |

|

|

$ |

1,076,287 |

|

Disaggregation of billings: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Subscription billings |

|

$ |

494,363 |

|

|

$ |

572,759 |

|

|

$ |

935,793 |

|

|

$ |

1,101,673 |

|

Professional services billings |

|

|

22,629 |

|

|

|

35,482 |

|

|

|

42,522 |

|

|

|

58,960 |

|

Other non-subscription product billings |

|

|

12,105 |

|

|

|

8,242 |

|

|

|

20,512 |

|

|

|

16,983 |

|

Total billings |

|

$ |

529,097 |

|

|

$ |

616,483 |

|

|

$ |

998,827 |

|

|

$ |

1,177,616 |

|

Subscription revenue — Subscription revenue includes any performance obligation which has a defined term, and is generated from the sales of software entitlement and support subscriptions, subscription software licenses and cloud-based Software as a Service, or SaaS offerings.

- Ratable — We recognize revenue from software entitlement and support subscriptions and SaaS offerings ratably over the contractual service period, the substantial majority of which relate to software entitlement and support subscriptions.

- Upfront — Revenue from our subscription software licenses is generally recognized upfront upon transfer of control to the customer, which happens when we make the software available to the customer.

Professional services revenue — We also sell professional services with our products. We recognize revenue related to professional services as they are performed.

Other non-subscription product revenue — Other non-subscription product revenue includes $10.9 million and $18.7 million of non-portable software revenue for the three and six months ended January 31, 2023, respectively, $7.0 million and $15.2 million of non-portable software revenue for the three and six months ended January 31, 2024, respectively, $1.2 million and $1.8 million of hardware revenue for the three and six months ended January 31, 2023, respectively, and $1.2 million and $1.8 million of hardware revenue for the three and six months ended January 31, 2024, respectively.

- Non-portable software revenue — Non-portable software revenue includes sales of our enterprise cloud platform when delivered on a configured-to-order appliance by us or one of our OEM partners. The software licenses associated with these sales are typically non-portable and can be used over the life of the appliance on which the software is delivered. Revenue from our non-portable software products is generally recognized upon transfer of control to the customer.

- Hardware revenue — In transactions where the hardware appliance is purchased directly from Nutanix, we consider ourselves to be the principal in the transaction and we record revenue and costs of goods sold on a gross basis. We consider the amount allocated to hardware revenue to be equivalent to the cost of the hardware procured. Hardware revenue is generally recognized upon transfer of control to the customer.

Annual Contract Value Billings and Annual Recurring Revenue (Unaudited) |

||||||||||||||||

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

||||||||||

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

||||

|

|

(in thousands) |

|

|||||||||||||

Annual Contract Value Billings (ACV Billings) |

|

$ |

267,622 |

|

|

$ |

329,481 |

|

|

$ |

483,142 |

|

|

$ |

598,407 |

|

Annual Recurring Revenue (ARR) |

|

$ |

1,377,713 |

|

|

$ |

1,737,364 |

|

|

$ |

1,377,713 |

|

|

$ |

1,737,364 |

|

Reconciliation of GAAP to Non-GAAP Profit Measures (Unaudited) |

||||||||||||||||||||||||||||||||

|

|

GAAP |

|

|

Non-GAAP Adjustments |

|

|

Non-GAAP |

|

|||||||||||||||||||||||

|

|

Three Months Ended January 31, 2024 |

|

|

(1) |

|

|

(2) |

|

|

(3) |

|

|

(4) |

|

|

(5) |

|

|

(6) |

|

|

Three Months Ended January 31, 2024 |

|

||||||||

|

|

(in thousands, except percentages and per share data) |

|

|||||||||||||||||||||||||||||

Gross profit |

|

$ |

483,677 |

|

|

$ |

8,880 |

|

|

$ |

749 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

493,306 |

|

Gross margin |

|

|

85.6 |

% |

|

|

1.6 |

% |

|

|

0.1 |

% |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

87.3 |

% |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Sales and marketing |

|

|

236,702 |

|

|

|

(20,738 |

) |

|

|

(82 |

) |

|

|

194 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

216,076 |

|

Research and development |

|

|

160,401 |

|

|

|

(40,541 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

119,860 |

|

General and administrative |

|

|

49,529 |

|

|

|

(15,810 |

) |

|

|

— |

|

|

|

— |

|

|

|

(227 |

) |

|

|

— |

|

|

|

— |

|

|

|

33,492 |

|

Total operating expenses |

|

|

446,632 |

|

|

|

(77,089 |

) |

|

|

(82 |

) |

|

|

194 |

|

|

|

(227 |

) |

|

|

— |

|

|

|

— |

|

|

|

369,428 |

|

Income from operations |

|

|

37,045 |

|

|

|

85,969 |

|

|

|

831 |

|

|

|

(194 |

) |

|

|

227 |

|

|

|

— |

|

|

|

— |

|

|

|

123,878 |

|

Operating margin |

|

|

6.6 |

% |

|

|

15.2 |

% |

|

|

0.1 |

% |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

21.9 |

% |

Net income |

|

$ |

32,795 |

|

|

$ |

85,969 |

|

|

$ |

831 |

|

|

$ |

(194 |

) |

|

$ |

117 |

|

|

$ |

16,651 |

|

|

$ |

177 |

|

|

$ |

136,346 |

|

Weighted shares outstanding, basic |

|

|

243,853 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

243,853 |

|

||||||

Weighted shares outstanding, diluted (7) |

|

|

298,540 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

298,540 |

|

||||||

Net income per share, basic |

|

$ |

0.13 |

|

|

$ |

0.36 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

0.07 |

|

|

$ |

- |

|

|

$ |

0.56 |

|

Net income per share, diluted (8) |

|

$ |

0.12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

0.46 |

|

||||||

(1) |

|

Stock-based compensation expense |

(2) |

Amortization of intangible assets |

|

(3) |

Restructuring charges (reversals) |

|

(4) |

Other |

|

(5) |

Amortization of debt discount and issuance costs and interest expense related to the convertible senior notes |

|

(6) |

Income tax effect primarily related to stock-based compensation expense |

|

(7) |

Includes 54,687 potentially dilutive shares related to the convertible senior notes and the issuance of shares under employee equity incentive plans |

|

(8) |

In accordance with ASC 260, in order to calculate GAAP net income per share, diluted, the numerator has been adjusted to add back $4,271 of interest expense related to the convertible senior notes |

|

|

GAAP |

|

|

Non-GAAP Adjustments |

|

|

Non-GAAP |

|

|||||||||||||||||||||||

|

|

Six Months Ended January 31, 2024 |

|

|

(1) |

|

|

(2) |

|

|

(3) |

|

|

(4) |

|

|

(5) |

|

|

(6) |

|

|

Six Months Ended January 31, 2024 |

|

||||||||

|

|

(in thousands, except percentages and per share data) |

|

|||||||||||||||||||||||||||||

Gross profit |

|

$ |

912,772 |

|

|

$ |

17,924 |

|

|

$ |

1,860 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

932,556 |

|

Gross margin |

|

|

84.8 |

% |

|

|

1.6 |

% |

|

|

0.2 |

% |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

86.6 |

% |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Sales and marketing |

|

|

472,025 |

|

|

|

(42,209 |

) |

|

|

(119 |

) |

|

|

194 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

429,891 |

|

Research and development |

|

|

312,376 |

|

|

|

(78,945 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

233,431 |

|

General and administrative |

|

|

97,032 |

|

|

|

(30,889 |

) |

|

|

— |

|

|

|

— |

|

|

|

(273 |

) |

|

|

— |

|

|

|

— |

|

|

|

65,870 |

|

Total operating expenses |

|

|

881,433 |

|

|

|

(152,043 |

) |

|

|

(119 |

) |

|

|

194 |

|

|

|

(273 |

) |

|

|

— |

|

|

|

— |

|

|

|

729,192 |

|

Income from operations |

|

|

31,339 |

|

|

|

169,967 |

|

|

|

1,979 |

|

|

|

(194 |

) |

|

|

273 |

|

|

|

— |

|

|

|

— |

|

|

|

203,364 |

|

Operating margin |

|

|

2.9 |

% |

|

|

15.8 |

% |

|

|

0.2 |

% |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

18.9 |

% |

Net income |

|

$ |

16,942 |

|

|

$ |

169,967 |

|

|

$ |

1,979 |

|

|

$ |

(194 |

) |

|

$ |

1,083 |

|

|

$ |

32,998 |

|

|

$ |

451 |

|

|

$ |

223,226 |

|

Weighted shares outstanding, basic |

|

|

242,667 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

242,667 |

|

||||||

Weighted shares outstanding, diluted (7) |

|

|

294,851 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

294,851 |

|

||||||

Net income per share, basic |

|

$ |

0.07 |

|

|

$ |

0.69 |

|

|

$ |

0.01 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

0.14 |

|

|

$ |

- |

|

|

$ |

0.91 |

|

Net income per share, diluted (8) |

|

$ |

0.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

0.76 |

|

||||||

(1) |

|

Stock-based compensation expense |

(2) |

Amortization of intangible assets |

|

(3) |

Restructuring charges (reversals) |

|

(4) |

Other (amount has been adjusted to reflect an immaterial change to the prior quarter and is now reflected correctly for the year-to-date period) |

|

(5) |

Amortization of debt discount and issuance costs and interest expense related to the convertible senior notes |

|

(6) |

Income tax effect primarily related to stock-based compensation expense |

|

(7) |

Includes 52,184 potentially dilutive shares related to the convertible senior notes and the issuance of shares under employee equity incentive plans |

|

(8) |

In accordance with ASC 260, in order to calculate GAAP net income per share, diluted, the numerator has been adjusted to add back $8,451 of interest expense related to the convertible senior notes |

|

|

GAAP |

|

|

Non-GAAP Adjustments |

|

|

Non-GAAP |

|

|||||||||||||||||||||||||||

|

|

Three Months Ended January 31, 2023 |

|

|

(1) |

|

|

(2) |

|

|

(3) |

|

|

(4) |

|

|

(5) |

|

|

(6) |

|

|

(7) |

|

|

Three Months Ended January 31, 2023 |

|

|||||||||

|

|

(in thousands, except percentages and per share data) |

|

|||||||||||||||||||||||||||||||||

Gross profit |

|

$ |

399,690 |

|

|

$ |

10,285 |

|

|

$ |

2,531 |

|

|

$ |

— |

|

|

$ |

(35 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

412,471 |

|

Gross margin |

|

|

82.2 |

% |

|

|

2.1 |

% |

|

|

0.5 |

% |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

84.8 |

% |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Sales and marketing |

|

|

229,788 |

|

|

|

(23,570 |

) |

|

|

(198 |

) |

|

|

— |

|

|

|

533 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

206,553 |

|

Research and development |

|

|

142,301 |

|

|

|

(36,491 |

) |

|

|

— |

|

|

|

— |

|

|

|

(45 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

105,765 |

|

General and administrative |

|

|

84,109 |

|

|

|

(14,944 |

) |

|

|

— |

|

|

|

(806 |

) |

|

|

(9 |

) |

|

|

(38,185 |

) |

|

|

— |

|

|

|

— |

|

|

|

30,165 |

|

Total operating expenses |

|

|

456,198 |

|

|

|

(75,005 |

) |

|

|

(198 |

) |

|

|

(806 |

) |

|

|

479 |

|

|

|

(38,185 |

) |

|

|

— |

|

|

|

— |

|

|

|

342,483 |

|

(Loss) income from operations |

|

|

(56,508 |

) |

|

|

85,290 |

|

|

|

2,729 |

|

|

|

806 |

|

|

|

(514 |

) |

|

|

38,185 |

|

|

|

— |

|

|

|

— |

|

|

|

69,988 |

|

Operating margin |

|

|

(11.6 |

)% |

|

|

17.5 |

% |

|

|

0.6 |

% |

|

|

0.2 |

% |

|

|

(0.1 |

)% |

|

|

7.8 |

% |

|

|

— |

|

|

|

— |

|

|

|

14.4 |

% |

Net (loss) income |

|

$ |

(70,790 |

) |

|

$ |

85,290 |

|

|

$ |

2,729 |

|

|

$ |

806 |

|

|

$ |

(514 |

) |

|

$ |

38,185 |

|

|

$ |

15,887 |

|

|

$ |

543 |

|

|

$ |

72,136 |

|

Weighted shares outstanding, basic |

|

|

231,924 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

231,924 |

|

|||||||

Weighted shares outstanding, diluted (8) |

|

|

231,924 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

280,661 |

|

|||||||

Net (loss) income per share, basic |

|

$ |

(0.31 |

) |

|

$ |

0.38 |

|

|

$ |

0.01 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

0.16 |

|

|

$ |

0.07 |

|

|

$ |

- |

|

|

$ |

0.31 |

|

Net (loss) income per share, diluted |

|

$ |

(0.31 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

0.26 |

|

|||||||

(1) |

|

Stock-based compensation expense |

(2) |

Amortization of intangible assets |

|

(3) |

Costs related to early exit of existing leases |

|

(4) |

Restructuring charges |

|

(5) |

Litigation settlement accrual and legal fees |

|

(6) |

Amortization of debt discount and issuance costs and interest expense related to convertible senior notes |

|

(7) |

Income tax effect primarily related to stock-based compensation expense |

|

(8) |

Includes 48,737 potentially dilutive shares related to convertible senior notes and the issuance of shares under employee equity incentive plans |

|

|

GAAP |

|

|

Non-GAAP Adjustments |

|

|

Non-GAAP |

|

|||||||||||||||||||||||||||

|

|

Six Months Ended January 31, 2023 |

|

|

(1) |

|

|

(2) |

|

|

(3) |

|

|

(4) |

|

|

(5) |

|

|

(6) |

|

|

(7) |

|

|

Six Months Ended January 31, 2023 |

|

|||||||||

|

|

(in thousands, except percentages and per share data) |

|

|||||||||||||||||||||||||||||||||

Gross profit |

|

$ |

750,804 |

|

|

$ |

17,790 |

|

|

$ |

5,341 |

|

|

$ |

— |

|

|

$ |

230 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

774,165 |

|

Gross margin |

|

|

81.6 |

% |

|

|

1.9 |

% |

|

|

0.6 |

% |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

84.1 |

% |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Sales and marketing |

|

|

466,010 |

|

|

|

(44,042 |

) |

|

|

(547 |

) |

|

|

— |

|

|

|

(3,283 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

418,138 |

|

Research and development |

|

|

291,744 |

|

|

|

(75,113 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1,661 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

214,970 |

|

General and administrative |

|

|

130,213 |

|

|

|

(29,300 |

) |

|

|

— |

|

|

|

(1,726 |

) |

|

|

(129 |

) |

|

|

(38,185 |

) |

|

|

— |

|

|

|

— |

|

|

|

60,873 |

|

Total operating expenses |

|

|

887,967 |

|

|

|

(148,455 |

) |

|

|

(547 |

) |

|

|

(1,726 |

) |

|

|

(5,073 |

) |

|

|

(38,185 |

) |

|

|

— |

|

|

|

— |

|

|

|

693,981 |

|

(Loss) income from operations |

|

|

(137,163 |

) |

|

|

166,245 |

|

|

|

5,888 |

|

|

|

1,726 |

|

|

|

5,303 |

|

|

|

38,185 |

|

|

|

— |

|

|

|

— |

|

|

|

80,184 |

|

Operating margin |

|

|

(14.9 |

)% |

|

|

18.1 |

% |

|

|

0.6 |

% |

|

|

0.2 |

% |

|

|

0.6 |

% |

|

|

4.1 |

% |

|

|

— |

|

|

|

— |

|

|

|

8.7 |

% |

Net (loss) income |

|

$ |

(170,304 |

) |

|

$ |

166,245 |

|

|

$ |

5,888 |

|

|

$ |

1,726 |

|

|

$ |

5,303 |

|

|

$ |

38,185 |

|

|

$ |

31,617 |

|

|

$ |

1,047 |

|

|

$ |

79,707 |

|

Weighted shares outstanding, basic |

|

|

230,229 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

230,229 |

|

|||||||

Weighted shares outstanding, diluted (8) |

|

|

230,229 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

277,488 |

|

|||||||

Net loss per share, basic |

|

$ |

(0.74 |

) |

|

$ |

0.72 |

|

|

$ |

0.03 |

|

|

$ |

0.01 |

|

|

$ |

0.02 |

|

|

$ |

0.17 |

|

|

$ |

0.14 |

|

|

$ |

- |

|

|

$ |

0.35 |

|

Net loss per share, diluted |

|

$ |

(0.74 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

0.29 |

|

|||||||

(1) |

|

Stock-based compensation expense |

(2) |

Amortization of intangible assets |

|

(3) |

Costs related to early exit of existing leases |

|

(4) |

Restructuring charges |

|

(5) |

Litigation settlement accrual and legal fees |

|

(6) |

Amortization of debt discount and issuance costs and interest expense related to convertible senior notes |

|

(7) |

Income tax effect primarily related to stock-based compensation expense |

|

(8) |

Includes 47,259 potentially dilutive shares related to convertible senior notes and the issuance of shares under employee equity incentive plans |

Reconciliation of GAAP Net Cash Provided by Operating Activities to Non-GAAP Free Cash Flow (Unaudited) |

||||||||||||||||

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

||||||||||

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

||||

|

|

(in thousands) |

|

|||||||||||||

Net cash provided by operating activities |

|

$ |

74,084 |

|

|

$ |

186,408 |

|

|

$ |

139,597 |

|

|

$ |

331,881 |

|

Purchases of property and equipment |

|

|

(11,070 |

) |

|

|

(23,764 |

) |

|

|

(30,772 |

) |

|

|

(36,784 |

) |

Free cash flow |

|

$ |

63,014 |

|

|

$ |

162,644 |

|

|

$ |

108,825 |

|

|

$ |

295,097 |

|