PARIS--(BUSINESS WIRE)--Regulatory News:

Teleperformance (Paris:TEP), a global leader in business digital services, today released its quarterly and nine-month revenue figures for the period ended September 30, 2023.

Nine months 2023: |

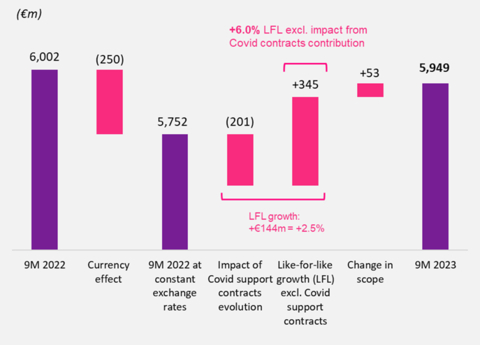

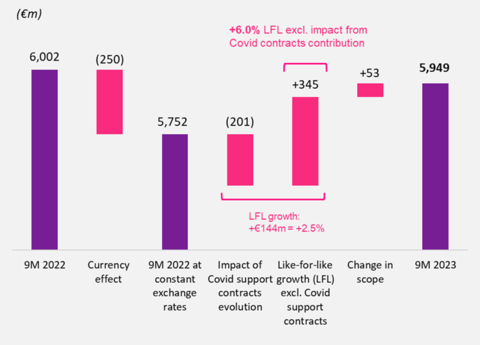

€5,949 million, up +6.0% like-for-like, excluding impact of Covid contracts* |

- Growth over the period was led by:

- Solid gains in European operations, India, and Specialized Services

- A diversified client portfolio, with robust momentum in the social media, content moderation, financial services and healthcare markets

- Continued innovation in artificial intelligence (AI) and capability to attract the best talent, which drove enhanced outsourcing solutions across the Group

- A well-balanced, agile, multilingual operating model combining offshore (53% of revenue**) and work-from-home solutions (around 40% of employees)

- Majorel acquisition finalized, ahead of schedule

- Finalized on November 3, 2023, with more than 99.9% of shares tendered at the expiration of the post-acceptance period

- Teleperformance’s positioning significantly enhanced in key markets, particularly in Europe, verticals with high growth potential, and strong added-value lines of business

- Strengthened leadership position, with more than €10 billion in annual revenue and more than €2 billion in EBITDA***

- Confirmation of the integration plan and estimated cost synergies well into the €100 million to €150 million initial target range

- Full-year 2023 guidance confirmed

- Like-for-like revenue growth at around +6%*, excluding the exchange rate volatility impact related to countries with hyperinflation (est. +50 bps/-50bps annual impact)

- EBITA margin target of around 16% is maintained

- Consolidation of Majorel will be from November 1, 2023

- Strong financial structure after acquisition: Net debt/EBITDA ratio of ~2x***

- Cash return to shareholders of nearly €600 million by year-end 2023, resulting from dividends and share buy-backs

* At constant scope of consolidation and exchange rates, and excluding the impact of lower revenue from Covid support contracts (“Covid contracts”)

** % of revenue from Core Services & D.I.B.S.; *** est. 2023 aggregated annual figures from the combination of Teleperformance and Majorel

Daniel Julien, Teleperformance’s Chairman and Chief Executive Officer, said: “As we enter the final months of 2023 which has been a highly eventful and challenging year but also rich in opportunities for the Group, I would like to share two significant pieces of news that confirm Teleperformance’s robust strength.

Success of the consolidation: we are very pleased to announce that the Majorel acquisition was finalized on November 3, ahead of schedule and with more than 99.9% of the company’s shares tendered in the offer. This success reflects the transaction’s relevance and the potential of high value creation for our shareholders. The acquisition has driven the emergence of a new Teleperformance, one that is stronger in every way, especially in terms of geographies, verticals, and lines of expertise. It sets the stage for robust growth and global leadership over the coming years.

On a proforma basis, Teleperformance will have around 500,000 employees, more than €10 billion in revenue, over €2 billion in EBITDA and nearly €1 billion in net free cash flow. Strong financial flexibility will allow the Group to continue to grow with a highly-efficient allocation of capital, including share buybacks and acquisitions.

As we embark on this promising new journey, I am delighted to welcome Majorel’s team to the Teleperformance family. Together, with our shared commitment to the core values of Integrity, Respect, Professionalism, Innovation and Commitment, we will continue to be a best-in-class example of diversity, equity, and inclusion.

Resilience of the Group business model: following our like for like growth of + 6 % posted in the first nine months, our revenue growth guidance for the year remains around +6%, excluding the exchange rate volatility impact related to countries experiencing hyperinflation. The environment is still challenging with many US companies tightening their budgets and the evolution of consumer behavior post Covid confinement. Our profitability model is a best-in-class in the industry, with around 16% EBITA margin targeted for the full year.”

Thomas Mackenbrock, CEO of Majorel Group, said: “Becoming part of the Teleperformance family is an incredibly positive next step for Majorel. We share the same core values and the opportunities for our clients and our teams are very exciting. We are confident that the ”new Teleperformance” will create even more impact for all of our stakeholders worldwide."

NINE-MONTH AND THIRD-QUARTER 2023 GROUP REVENUE

€ millions |

2023 |

2022 |

% change |

||

Like-for-like

|

Like-for-like |

Reported |

|||

Average exchange rate (Nine months) |

€1 = US$1.08 |

€1 = US$1.06 |

|||

Nine months |

5,949 |

6,002 |

+6.0% |

+2.5% |

-0.9% |

Third quarter |

1,989 |

2,056 |

+4.0% |

+3.1% |

-3.3% |

CONSOLIDATED REVENUE

Revenue for the first nine months of 2023 amounted to €5,949 million, representing an increase of +2.5% at constant exchange rates and scope of consolidation (like-for-like). As expected, reported like-for-like growth was dampened by the non-recurring impact of the year-on-year decline in the contribution from Covid contracts (totaling -€201 million over the first nine months). Adjusted for this impact, like-for-like growth stood at +6.0% for the period.

On a reported basis, revenue ended the nine-month period down -0.9% year-on-year. The currency effect was highly unfavorable, at -€250 million overall, with an adverse impact, particularly in the third quarter, due to the decline against the euro of the US dollar, the Egyptian pound, the Colombian peso, and the Indian rupee. Changes in the scope of consolidation added +€53 million to revenue, reflecting the consolidation of PSG Global Solutions from November 1, 2022 and of Capita Translation & Interpreting from January 1, 2023.

Over the first nine months of 2023, like-for-like growth was satisfactory, even as the economic and geopolitical environment remained uncertain. This performance reflects the resilience and diversity of Teleperformance’s client portfolio by region, by industry and by service line. Growth was particularly varied by industry vertical. The fastest growing were financial services, social media and entertainment, and government agencies (excluding Covid contracts).

In Core Services & D.I.B.S., growth (excluding Covid contracts) was especially robust in the EMEA region. However, the Group saw a slowdown in business volume in the North American market in the post Covid period, which held back growth in the LATAM-based offshore operations and in the North America & Asia-Pacific regions, particularly in such verticals as retail, technology, and telecom.

The steady momentum in offshore solutions continued to exert downward pressure on the Group’s revenue growth over the first nine months but had a positive impact on margins.

Specialized Services also continued to expand at a strong pace, driven by the still very fast post-Covid rebound in TLScontact's global travel visa application management business and continued growth in LanguageLine Solutions' interpretation business.

Third-quarter 2023 revenue came to €1,989 million, a like-for-like increase of +4.0% (excluding Covid contracts) that reflected high prior-year comparatives and a sequential slowdown in business. On a reported basis, revenue declined by -3.3% over the quarter under the net impact of (i) a deeply unfavorable currency effect (-€142 million), stemming primarily from the decline against the euro of the US dollar; and (ii) favorable changes in the scope of consolidation resulting from the inclusion of PSG Global Solutions and Capita Translation & Interpreting.

Although the environment remains uncertain in the fourth quarter, particularly in the North American market and in light of the exchange rate volatility related to countries with hyperinflation for the Core Services & D.I.B.S. activities, the Group’s growth should be eased by a more favorable basis of comparison over the period.

REVENUE BY ACTIVITY

|

Nine months

|

Nine months

|

% change |

||

€ millions |

|

|

Like-for-like,

|

Like-for-like |

Reported |

CORE SERVICES & D.I.B.S.* |

4,940 |

5,160 |

+4.2% |

+0.1% |

-4.3% |

North America & Asia-Pacific |

1,873 |

1,947 |

-0.2% |

-0.2% |

-3.8% |

LATAM |

1,179 |

1,237 |

+1.8% |

+1.8% |

-4.7% |

Europe & MEA (EMEA) |

1,888 |

1,976 |

+9.9% |

-0.7% |

-4.5% |

SPECIALIZED SERVICES |

1,009 |

842 |

+17.1% |

+17.1% |

+19.8% |

TOTAL |

5,949 |

6,002 |

+6.0% |

+2.5% |

-0.9% |

|

Q3 2023 |

Q3 2022 |

% change |

||

€ millions |

|

|

Like-for-like,

|

Like-for-like |

Reported |

CORE SERVICES & D.I.B.S.* |

1,643 |

1,749 |

+1.8% |

+0.7% |

-6.0% |

North America & Asia-Pacific |

618 |

683 |

-1.3% |

-1.3% |

-9.4% |

LATAM |

391 |

434 |

-2.7% |

-2.7% |

-9.9% |

Europe & MEA (EMEA) |

634 |

632 |

+8.0% |

+5.2% |

+0.3% |

SPECIALIZED SERVICES |

346 |

307 |

+16.9% |

+16.9% |

+12.4% |

TOTAL |

1,989 |

2,056 |

+4.0% |

+3.1% |

-3.3% |

* Digital Integrated Business Services

- Core Services & Digital Integrated Business Services (D.I.B.S.)

Core Services & D.I.B.S. revenue totaled €4,940 million in the first nine months of 2023, representing like-for-like growth of +4.2% year-on-year, excluding the impact of the lower contribution from Covid contracts. Including the impact of the Covid-related contracts, like-for-like growth was virtually unchanged over the period, at +0.1%, while reported revenue was down -4.3%, primarily due to the decline against the euro of the Egyptian pound, the US dollar, the Colombian peso, the Indian rupee, the Turkish lira, the Philippine peso and most other operating currencies.

Nine-month like-for-like growth, excluding the Covid contracts, was satisfactory in an uncertain economic and geopolitical environment. This performance was chiefly attributable to the Group’s robust, diversified client portfolio.

Business rose steadily in Europe over the period, while the North American market slowed year-on-year, with lower volume in the post Covid period, impacting the Group’s activities in the North America & Asia-Pacific and LATAM regions. The best results were reported in the social media (content moderation), financial services, healthcare and government agency verticals (excluding Covid contracts). On the other hand, business in the retail, technology and telecom verticals declined over the period.

In the third quarter alone, Core Services & D.I.B.S. revenue amounted to €1,643 million, representing like-for-like growth of +1.8%, excluding the impact of Covid contracts, and of +0.7%, including this impact. Reported revenue was down -6.0% due to the decline against the euro of the US dollar, the Egyptian pound, the Colombian peso, the Indian rupee and most other operating currencies. The slowdown in like-for-like growth, excluding the Covid contracts, primarily reflected the persistently high prior-year comparatives and the weaker business in the North American market during the quarter.

Although the environment remains uncertain in the fourth quarter, notably in the North American market and in light with currencies volatility in hyperinflation countries, growth in Core Services & D.I.B.S. activities should benefit from a more favorable basis of comparison over the period.

o North America & Asia-Pacific

Regional revenue came to €1,873 million in the first nine months of 2023, more or less stable on a like-for-like basis at -0.2% year-on-year. Reported revenue was down -3.8% for the period, reflecting the unfavorable currency effect from the decline against the euro of the Indian rupee and, in the third quarter, the US dollar. In the third quarter, revenue edged back -1.3% on a like-for-like basis.

Like-for-like growth in the region remained limited throughout the first nine months, held down by the US budget constraints and the slowdown of volumes during the post Covid period in the industry in the North American market which impacted such industries as telecommunications, technology, and retail. Growth was affected by a decline in business volumes and client project cancellations, as well as by program scale-backs and postponements. Moreover, the deflationary impact of the growth in offshore operations, particularly in India, weighed somewhat on regional revenue.

In the Asia-Pacific region, revenue growth was robust throughout the first nine months of the year, supported in particular by the ramp-up of new contracts in China in the financial services and travel verticals.

Across the region, content moderation (Trust & Safety), back-office services and customer acquisition activities expanded at a steady pace.

o LATAM

Nine-month revenue for the LATAM region stood at €1,179 million, a year-on-year increase of +1.8% like-for-like. Reported revenue ended the period down -4.7%, primarily due to the decline against the euro of the Colombian peso. In the third quarter alone, revenue contracted by -2.7% on a like-for-like basis.

Over the first nine months of the year, regional growth was led by the robust momentum in the social media content moderation and financial services verticals, but held back by softer business in transportation services and retail.

The region’s offshore activities are facing the slowdown in the North American market, particularly in the third quarter.

o Europe & MEA (EMEA)

Regional revenue came to €1,888 million in the first nine months of 2023, delivering very strong +9.9% like-for-like growth, excluding Covid contracts. In the third quarter alone, revenue rose by +8.0% excluding the Covid contracts, building on the favorable trend observed in the preceding three months.

Multilingual activities, which are the primary contributors to the region’s revenue stream and mainly serve large global industry leaders, notably in the digital economy, reported sustained growth in the first nine months. The Greek hub benefited from a ramp-up resulting from recent contract wins, particularly in the automotive and consumer goods verticals, while the Egyptian and Turkish hubs continued to grow their business at a sustained pace.

Business in the United Kingdom rose sharply over the period, driven by the ramp-up of new contracts in financial services and with government agencies (excluding Covid contracts).

Operations in Germany expanded at a satisfactory pace, thanks in particular to fast growth in nearshore services in the Balkans and robust business development in the social media, travel and consumer electronics verticals.

Including the impact of the Covid contracts (which were phased out in late 2022 in the Netherlands, the UK, France and Germany), revenue in the first nine months of 2023 declined by -0.7% on a like-for-like basis and by -4.5% as reported. The difference between the two rates corresponds to the negative currency effect arising mainly from the decline against the euro of the Egyptian pound, the Turkish lira and the pound sterling.

- Specialized Services

Revenue from Specialized Services stood at €1,009 million for the first nine months of 2023, a year-on-year increase of +17.1% like-for-like and of +19.8% as reported. The difference between the two growth rates stemmed from the net impact of (i) the positive scope effect of consolidating PSG Global Solutions from November 1, 2022 and Capita Translation & Interpreting from January 1, 2023; and (ii) the negative impact of the unfavorable currency effect following the decline in the US dollar against the euro over the period. In the third quarter, revenue rose by +16.9% like-for-like, extending the robust gains reported in the first two quarters of the year.

LanguageLine Solutions, the main contributor to Specialized Services’ revenue, continued to drive meaningful growth throughout the nine-month period. This strong performance was led by market share gains in this fast-growing industry, supported by the continued growth of video and voice only interpreting solutions.

TLScontact's activities continued to grow very rapidly over the first nine months of the year, driven by the still highly robust post-Covid rebound in the visa application management business, which is leveraging the favorable environment created by increased travel and strong growth in additional premium services.

OPERATING HIGHLIGHTS

- Majorel acquisition finalized, ahead of schedule

Finalization and next steps:

Teleperformance announced the finalization of the Majorel acquisition on November 3, 2023, one month ahead of the initial schedule set when the acquisition was announced on April 26. At the close of the post-acceptance period on November 3, 2023, more than 99.9 % of Majorel shares had been tendered in the offer. This extremely high contribution rate attests to the strong support of Majorel's shareholders for the Group’s project and the relevance of the acquisition.

The final settlement is scheduled for November 8, 2023. Given that Teleperformance will own more than 95% of Majorel’s issued capital and voting rights as of the final settlement, the Group is willing to initiate squeeze-out proceedings as soon as practicable.

Teleperformance will also request the delisting of Majorel shares from Euronext Amsterdam, which should take place on December 11, 2023.

A new springboard to drive sustained growth in the years ahead:

The acquisition will enable Teleperformance to broaden its presence in Europe, especially in France and Germany, where Teleperformance has a relatively small presence and in a number of high-growth potential verticals, such as social media, luxury goods, automotive and travel, and further develop strong added-value lines of expertise.

It will also strengthen (i) Teleperformance’s exposure to European clients, whereas its current client portfolio is mainly American; and (ii) its senior management, with the integration of Majorel's seasoned executive teams who share the same corporate culture.

The combination will create a wide range of synergies, in terms of both revenue and costs. The cost synergy plan announced last April 26 is confirmed, with projected savings well into the €100 million to €150 million initial target range.

Also as announced last April, the acquisition will be accretive to earnings per share before synergies from 2024 onwards.

It is also projected to strengthen Teleperformance’s global leadership, with the combined company representing around 500,000 employees worldwide, and with more than €10 billion in revenue, and more than €2 billion in EBITDA (est. 2023 aggregated figures from the combination of the companies).

- €500 million share buy-back program

On August 2, 2023, Teleperformance launched a share buy-back program for a total amount of up to €500 million. Most of the acquired shares will be canceled. The opportunity to initiate the buy-back program arose from the Group’s strong cash-flow generation, its unrivaled, industry-leading performance in a challenging macroeconomic environment, and its future growth prospects, all of which were not properly reflected in its current stock price.

The fact that most of the acquired shares are set to be canceled will offset some of the dilution resulting from the completion of the Majorel acquisition.

The buy-back program will be rewarding for Teleperformance’s long-term shareholders, without impacting the Group’s S&P credit rating of BBB or its ability to seize acquisition opportunities.

More than €300 million in shares have been bought back since the beginning of the year. The Group does not rule out launching new programs in the future should the stock price continue to undervalue the strength of the Group’s business model.

Following the acquisition of Majorel and completion of the €500 million share buy-back program, Teleperformance’s financial flexibility will remain fully intact, with an investment capacity of around €1 billion and net debt leverage of around 2.0x EBITDA (based on est. 2023 aggregated figures from the combination of Teleperformance and Majorel).

OUTLOOK FOR 2023

Despite the persistently disruptive and uncertain environment, Teleperformance expects to benefit from more favorable comparatives in the final months of the year.

The Group has confirmed and specified the following full-year targets:

- Like-for-like revenue growth at around +6%*, excluding the exchange rate volatility impact related to countries with hyperinflation (est. +50 bps/-50bps annual impact)

- EBITA margin target of around 16% maintained

- Consolidation of Majorel as from November 1, 2023

Teleperformance expects to return nearly €600 million of cash to shareholders in 2023, resulting from dividends for €227 million and share buy-backs for more than €300 million.

* At constant scope of consolidation and exchange rates, and excluding the impact of lower revenue from Covid support contracts (“Covid contracts”)

---------------------------------

DISCLAIMER

All forward-looking statements are based on Teleperformance management’s present expectations of future events and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. For a detailed description of these factors and uncertainties, please refer to the "Risk Factors" section of the Universal Registration Document, available at www.teleperformance.com. Teleperformance undertakes no obligation to publicly update or revise any of these forward-looking statements.

WEBCAST/CONFERENCE CALL WITH ANALYSTS AND INVESTORS

A conference call and webcast will be held today at 6:00 PM CEST. The webcast will be available live or for delayed viewing at: https://channel.royalcast.com/landingpage/teleperformance/20231106_1/

INDICATIVE INVESTOR CALENDAR

Full-year 2023 results: February 28, 2024

First-quarter 2024 revenue: April 30, 2024

ABOUT TELEPERFORMANCE GROUP

Teleperformance (TEP – ISIN: FR0000051807 – Reuters: TEPRF.PA - Bloomberg: TEP FP), is a global leader in digital business services, blending the best of advanced technology with human empathy to deliver enhanced customer care that is simpler, faster, and safer for the world’s biggest brands and their customers. The Group’s comprehensive, AI-powered service portfolio ranges from front-office customer care to back-office functions, including Trust and Safety services that help defend both online users and brand reputation. It also offers a range of specialized services such as collections, interpreting and localization, visa and consular services, and recruitment process outsourcing services. With more than 410,000 inspired and passionate people speaking more than 300 languages, the Group’s global scale and local presence allows it to be a force of good in supporting communities, clients, and the environment. In 2022, Teleperformance reported consolidated revenue of €8,154 million (US$8.6 billion, based on €1 = $1.05) and net profit of €645 million.

Teleperformance shares are traded on the Euronext Paris market, Compartment A, and are eligible for the deferred settlement service. They are included in the following indices: CAC 40, STOXX 600, S&P Europe 350, MSCI Global Standard and Euronext Tech Leaders. In the area of corporate social responsibility, Teleperformance shares are included in the CAC 40 ESG since September 2022, the Euronext Vigeo Euro 120 index since 2015, the EURO STOXX 50 ESG index since 2020, the MSCI Europe ESG Leaders index since 2019, the FTSE4Good index since 2018 and the S&P Global 1200 ESG index since 2017.

Visit the Group at www.teleperformance.com.

APPENDIX 1 – QUARTERLY AND NINE-MONTH REVENUE BY ACTIVITY

|

Nine months

|

Nine months

|

% change |

||

€ millions |

|

|

Like-for-like,

|

Like-for-like |

Reported |

CORE SERVICES & D.I.B.S.* |

4,940 |

5,160 |

+4.2% |

+0.1% |

-4.3% |

North America & Asia-Pacific |

1,873 |

1,947 |

-0.2% |

-0.2% |

-3.8% |

LATAM |

1,179 |

1,237 |

+1.8% |

+1.8% |

-4.7% |

Europe & MEA (EMEA) |

1,888 |

1,976 |

+9.9% |

-0.7% |

-4.5% |

SPECIALIZED SERVICES |

1,009 |

842 |

+17.1% |

+17.1% |

+19.8% |

TOTAL |

5,949 |

6,002 |

+6.0% |

+2.5% |

-0.9% |

|

Q3 2023 |

Q3 2022 |

% change |

|

|

€ millions |

|

|

Like-for-like,

|

Like-for-like |

Reported |

CORE SERVICES & D.I.B.S.* |

1,643 |

1,749 |

+1.8% |

+0.7% |

-6.0% |

North America & Asia-Pacific |

618 |

683 |

-1.3% |

-1.3% |

-9.4% |

LATAM |

391 |

434 |

-2.7% |

-2.7% |

-9.9% |

Europe & MEA (EMEA) |

634 |

632 |

+8.0% |

+5.2% |

+0.3% |

SPECIALIZED SERVICES |

346 |

307 |

+16.9% |

+16.9% |

+12.4% |

TOTAL |

1,989 |

2,056 |

+4.0% |

+3.1% |

-3.3% |

|

|

|

|||

|

Q2 2023 |

Q2 2022 |

% change |

|

|

€ millions |

|

|

Like-for-like,

|

Like-for-like |

Reported |

CORE SERVICES & D.I.B.S.* North America & Asia-Pacific LATAM Europe & MEA (EMEA) SPECIALIZED SERVICES |

1,612 609 392 611 342 |

1,700 636 421 643 284 |

+3.3% -0.2% +1.6% +7.7% +17.4% |

+0.0% -0.2% +1.6% -0.9% +17.4% |

-5.2% -4.3% -6.7% -5.0% +20.4% |

TOTAL |

1,954 |

1,984 |

+5.3% |

+2.5% |

-1.5% |

|

Q1 2023 |

Q1 2022 |

% change |

||

€ millions |

|

|

Like-for-like,

|

Like-for-like |

Reported |

CORE SERVICES & D.I.B.S.* |

1,685 |

1,711 |

+7.3% |

-0.4% |

-1.6% |

North America & Asia-Pacific |

646 |

628 |

+0.8% |

+0.8% |

+2.8% |

LATAM |

396 |

382 |

+7.0% |

+7.0% |

+3.6% |

Europe & MEA (EMEA) |

643 |

701 |

+13.6% |

-5.7% |

-8.2% |

SPECIALIZED SERVICES |

321 |

251 |

+17.0% |

+17.0% |

+28.3% |

TOTAL |

2,006 |

1,962 |

+8.6% |

+1.9% |

+2.2% |

* Digital Integrated Business Services

APPENDIX – GLOSSARY - ALTERNATIVE PERFORMANCE MEASURES

Change in like-for-like revenue:

Change in revenue at constant exchange rates and scope of consolidation = [current year revenue - prior year revenue at current year rates - revenue from acquisitions at current year rates] / prior year revenue at current year rates.

EBITDA before non-recurring items or current EBITDA (Earnings before Interest, Taxes, Depreciation and Amortization):

Operating profit before depreciation and amortization, amortization of intangible assets acquired as part of a business combination, goodwill impairment charges and non-recurring items.

EBITA before non-recurring items or current EBITA (Earnings before Interest, Taxes and Amortization):

Operating profit before amortization of intangible assets acquired as part of a business combination, goodwill impairment charges and non-recurring items.

Non-recurring items:

Principally comprised of restructuring costs, incentive share award plan expense, costs of closure of subsidiary companies, transaction costs for the acquisition of companies, and all other expenses that are unusual by reason of their nature or amount.

Net free cash flow:

Cash flow generated by the business - acquisitions of intangible assets and property, plant and equipment net of disposals - financial income/expenses.

Net debt:

Current and non-current financial liabilities - cash and cash equivalents.

Diluted earnings per share (net profit attributable to shareholders divided by the number of diluted shares and adjusted):

Diluted earnings per share is determined by adjusting the net profit attributable to ordinary shareholders and the weighted average number of ordinary shares outstanding by the effects of all potentially dilutive ordinary shares. These include convertible bonds, stock options and incentive share awards granted to employees when the required performance conditions have been met at the end of the financial year

-----------