BOSTON--(BUSINESS WIRE)--Many young adults today struggle to navigate their relationship with money – leaving them feeling anxious, uncertain, and defeated from previous failed attempts at budgeting and saving. In fact, results from Fidelity Investments® 2022 Money Mindset study reveal more than half (59%) of young Americans cringe at the thought of checking their bank account balance.

The study examines what challenges, perceptions, and general mindset younger adults (ages 18 to 44) have with spending and saving, made clear that while people want to save, they also don’t want to make drastic changes to how they’re living their daily lives. More than three in four (76%) believe that to save money they must cut back spending on things that make them happy. At the same time, 83% of Gen Z feel it’s important to spend money on experiences that make them happy and 61% admit FOMO (fear of missing out) has them spending more than they initially intended.

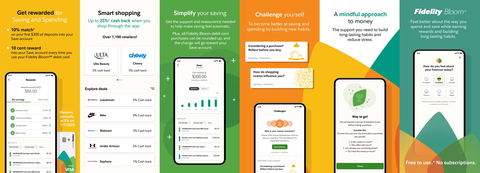

To help tackle the multiple root causes that make it so difficult for Americans to save, Fidelity today is announcing the launch of the Fidelity BloomSM mobile app – a new digital experience grounded in behavioral science that rewards users for smart money moves and helps them save through mindful money habits. The free app1 provides people with simple, attainable steps, and fun challenges, that can help make saving easier by establishing habits that fit within their existing lifestyle and values. Fidelity Bloom leans into the emotional side of money and introduces small changes that can add up – giving users the motivation to develop habits that can stick.

“Fidelity Bloom is the latest example of our commitment to invest in technology and tools that meet the changing needs of customers, especially those of the next generation,” said David Dintenfass, chief marketing officer and head of emerging customers at Fidelity. “The new Fidelity Bloom app is grounded in the insight that positive reinforcement works best in new habit formation, particularly when there is anxiety involved. Based on behavioral science, Fidelity Bloom creates incentives for anyone to establish healthier financial habits. For people who ignore their money because it is a source of negative emotions, Fidelity Bloom can help them find a positive way to engage and take more control of their financial future.”

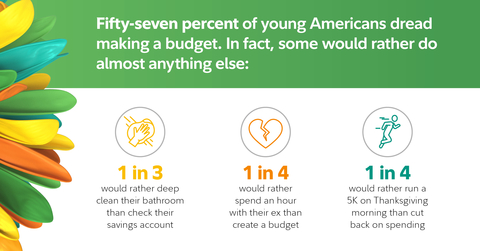

BUDGETING: Younger Generations Would Rather Not

The study reveals nearly two in three adults (65%), ages 18 to 44, feel they should be saving more money, but the thought of finances is too stressful, so they simply avoid thinking about the subject altogether. Even worse, if an emergency expense came up, nearly half (49%) say they wouldn’t even be able to cover an unexpected $1,000 expense. And when it comes to making a budget, some would rather do just about anything else.

HABITS: Small Changes Take Users From “Thinking About” to Actually “Saving”

When asked about receiving a raise at work, 54% of young Americans say they’d put their new additional income into savings, yet more than half (59%) also admit to failing when attempting to save more. Fidelity Bloom allows users to move a small portion of extra spending money to help them save smarter – motivating them through engaging challenges based on a mix of behavioral and AI-based insights, as well as monetary and other rewards.

“Behavioral science and economics are at the core of what makes Fidelity Bloom different,” said Etinosa Agbonlahor, director, behavior research scientist at Fidelity. “By tapping into the psychology of human behavior and introducing small changes and rewards, we’re able to help people be more mindful about how they spend and save on the lifestyle they’ve come to know and love – instead of asking them to change that lifestyle completely. We’re taking the pressure off how they view their relationship with money and are giving them the reassurance, and confidence they need to feel in control of their money decisions.”

REWARDS: Everyone Loves them

Fidelity Bloom brings together a unique combination of rewards in one place and makes the rewards easy to earn. Key features of the app are designed to reinforce positive behaviors right away with automatic rewards. As an added bonus to get started, for a limited time, new customers who open accounts in the Fidelity Bloom app and fund it with $25 will receive $50 in their Fidelity Bloom Save account2, with exclusive opportunities to earn more:

- Fidelity Bloom Spend & Save Accounts: Fidelity Bloom automatically separates spending and saving to help reduce the temptation to spend money meant for savings. Both are brokerage accounts and can be easily opened right from the app.

-

Save Automatically and Earn Rewards: saving is easy – and automatic.

- Annual savings match—Customers receive an annual 5% match on the first $300 into their Fidelity Bloom Save account and, for a limited time new customers will receive a 10% match3 through the end of 2022.

- Earn 10 cents from Fidelity with every purchase—Fidelity will automatically deposit 10 cents into the Fidelity Bloom Save account every time customers use the Fidelity Bloom debit card.

- Receive up to 25%4 cash back—deposited into the Fidelity Bloom Save account when customers shop through the app with 1,100+ participating retailers.

- Round up purchases—Customers can automatically round up5 purchases to the nearest dollar and have the difference moved to savings from their Fidelity Bloom Spend to their Fidelity Bloom Save account.

Learn more about how Fidelity is helping the next generation of customers with education, products & services, and opportunities to join money conversations on TikTok, Instagram, Reddit and other channels.

About Fidelity’s 2022 Money Mindset Study

The 2022 Money Mindset Study presents the findings of an online sample of 2,010 adults 18 years of age and older with a checking or savings account, which represents 98% of American adults, with a focus on the 1,008 respondents 18-44 years old. Interviewing for this CARAVAN omnibus survey was conducted April 15-20, 2022, by ENGINE INSIGHTS, which is not affiliated with Fidelity Investments. The results of this survey may not be representative of all respondents meeting the same criteria as those surveyed for this study.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $10.5 trillion, including discretionary assets of $4.0 trillion as of April 30, 2022, we focus on meeting the unique needs of a diverse set of customers. Privately held for over 75 years, Fidelity employs more than 58,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

The Fidelity Bloom App is designed to help with your saving and spending behaviors through your Save and Spend accounts, which are brokerage accounts covered by SIPC insurance. They are not bank accounts and therefore not covered by FDIC insurance.

The Fidelity Bloom app's functionality is limited to your core position. Fidelity Bloom uses your brokerage accounts’ core position—which defaults to a money market fund** and, much like a wallet, holds your uninvested cash—to process your spending and saving transactions. You can select your core position during account opening. Visit Fidelity.com to access trading and investing features of your account.

**You could lose money by investing in a money market fund. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Before investing, always read a money market fund’s prospectus for policies specific to that fund.

The Fidelity Bloom Debit Card is issued by Leader Bank, N.A., and the debit card program is administered by BNY Mellon Investment Servicing Trust Company. These entities are not affiliated with each other or with Fidelity, although, the parent company of Fidelity has a minority percentage, noncontrolling interest in Leader Bank. Visa is a registered trademark of Visa International Service Association, and is used by Leader Bank pursuant to a license from Visa U.S.A. Inc.

Images contained in the screenshots are for illustrative purposes only.

The trademarks and service marks appearing herein are the property of their respective owners.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC,

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC,

245 Summer Street, Boston, MA 02205

1033574.1.0

©2022 FMR LLC. All rights reserved.

Follow us on Twitter @FidelityNews

Visit About Fidelity and our online newsroom

Subscribe to email alerts for news from Fidelity

___________________________

1 The Fidelity Bloom App does not charge subscription fees. Fees associated with your account positions or transacting in your account apply.

2 Fidelity reserves the right to modify the terms and conditions or terminate the offer at any time. Other terms and conditions, and eligibility criteria, apply. See Fidelity Bloom $50 Offer terms and conditions at https://www.fidelity.com/mobile/bloom.

310% is an introductory, limited-time rate through 12/31/22. Reduces to 5% match each year on 01/01/23.

4 Cash-back rates will vary by vendor. Please review merchant terms before transacting.

5 Fidelity Bloom app users are defaulted into a round-up feature. Users may turn off this feature at any time via the Fidelity BloomSM app preferences center.