MYbank Makes Financing More Accessible for 45 Million SME Clients by Leveraging Digital Technology

MYbank Makes Financing More Accessible for 45 Million SME Clients by Leveraging Digital Technology

HANGZHOU, China--(BUSINESS WIRE)--MYbank, a leading online private commercial bank and an associate of Ant Group, today reported that it served over 45 million small-and-micro enterprise (SME) clients at the end of 2021, representing a nearly 30 percent increase year-on-year, according to its 2021 annual report.

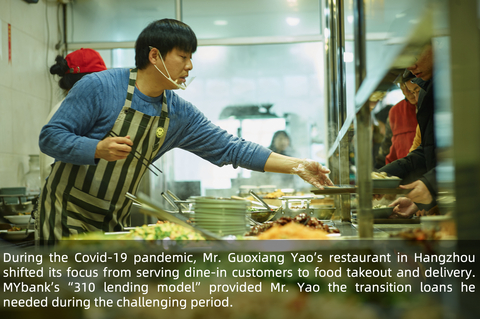

Leveraging its mobile app and cloud-based infrastructure, MYbank pioneered the “310 lending model”. Using this innovative model, it takes SME owners just a few clicks on their phones to obtain a collateral-free business loan. The entire application process can be completed within three minutes, approved within one second and requires zero human interaction.

The model is making mobile financing more accessible to SME owners, many of whom had never obtained a business loan before. More than 80% of MYbank’s new clients in 2021 were first-time borrowers. The average borrowing period was approximately 3 months, with 70% of interest per loan below RMB100 (approximately US$15).

Utilizing technologies such as graph computing, multimodal recognition, blockchain and privacy-preserving computation, MYbank’s supply chain financing solutions support blue-chip brands by providing more financing options for SMEs in their supply chains. In 2021, more than 500 major brands such as China Mobile, Haier and Mengniu Dairy implemented MYbank’s supply chain financing solutions, which helped to increase the accessibility of SME loans to 80% in their supply chains.

In 2021, MYbank continued to invest in technological solutions to make digital SME financing more accessible to clients in rural areas. For example, using remote sensing technologies on farmland, MYbank can effectively assess credit risk and extend credit lines to farmers based on factors such as crop growth and variety.

MYbank applies advanced risk-management technologies to ensure credit lines extended to SMEs are dynamically reviewed and adjusted to match their ability to repay. As a result, MYbank’s non-performing loan (NPL) ratio for its SME business remained fairly consistent in 2021 (1.53%) compared to 2020 (1.52%).

In its 2021 annual report, MYbank announced it will continue to open up its inclusive financing solutions and platform to brands, partner banks and other stakeholders and offer comprehensive services to SMEs and supercharge their growth.

About MYbank

Formed in 2015 with a focus on serving SMEs and farmers, MYbank was among the first batch of pilot private commercial banks in China. It was also the first bank in China to establish its core banking system entirely on the cloud without any physical branches.

MYbank pioneered the “310 model” for SME financing, which offers a collateral-free business loan that takes less than three minutes to apply for on a mobile phone, less than one second to approve and requires zero human interaction.

In addition to advanced risk-management solutions, MYbank has also leveraged technologies, including image recognition and remote sensing, in making credit services more accessible to farmers so that they no longer need to go through lengthy processes or file paper documents to obtain loans.

Contacts

Media Inquiries

MYbank: mediapress@service.mybank.cn