FRANKFURT, Germany--(BUSINESS WIRE)--MV Index Solutions (MVIS®) today announced that at year-end 2021 there was US$21bn in Thematic asset products attached to licensed MVIS indices, which equates to approximately 5% of the total market share. The firm is proud to be working with its worldwide clients (Including VanEck, Defiance, Migdal, Direxion, KSM and others) to provide investors with some of the largest and most liquid investment products in the Thematic space.

In total, the total market capitalization of Thematic ETFs and ETPs reached US$437 billion with 25 months of consecutive net inflows (as reported by ETFGI in January 2022). MV Index Solutions (MVIS) is excited to be part of this significant growth story.

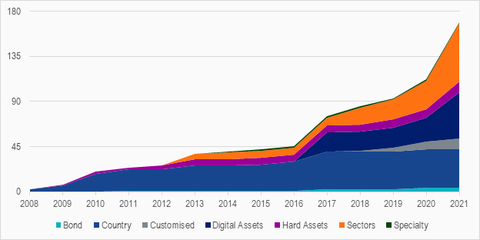

Thematic indices are part of MVIS growing sector index family. In 2021, MVIS launched 29 new Sector indices. MVIS' 58 sector indices are part of a multiple asset class family of indices that are 170 strong and growing.

The MVIS Thematic Indices fall under 10 meta themes: Clean Energy, Health Care Innovation, Financials 2.0, NextGen Hardware & Communications, NextGen Software, Consumer Trend, Thematic Industrials & Infrastructure, Thematic REITS, Materials, and Disruptive Technology. 2021 was a strong year for NextGen Hardware & Communications which ended the year returning 33% USD, led by strong performance in semiconductors. MVIS NextGen Hardware & Communications meta theme includes the following Thematic indices:

• MVIS US Listed Semiconductor 25 (ticker: MVSMHTR)

• MVIS US Listed Semiconductor 10% Capped (ticker: MVSMCTR)

• BlueStar 5G Communications (ticker: BFIVGTR)

• BlueStar US Machine Learning and Quantum Computing (ticker: BUQFCNTR)

• BlueStar Global 5G Connectivity (ticker: BGFGNTR)

• BlueStar Internet Infrastructure (ticker: BIINFNTR)

To find out more about MVIS Thematic indices, please read the latest MVIS Quarterly Thematic Paper, available here.

Heading into 2022, MVIS is excited to partner in the continued growth and development of the thematic space together with our clients.

Note to Editors:

About MV Index Solutions - www.mvis-indices.com

MV Index Solutions GmbH (MVIS®) develops, monitors and licenses the MVIS Indices, a selection of focused, investable and diversified benchmark indices. The indices are especially designed to underlie financial products. MVIS Indices cover several asset classes, including equity, fixed income markets and digital assets and are licensed to serve as underlying indices for financial products. Approximately USD 31.09 billion in assets under management (as of 27 January 2022) are currently invested in financial products based on MVIS Indices. MVIS is a VanEck company.