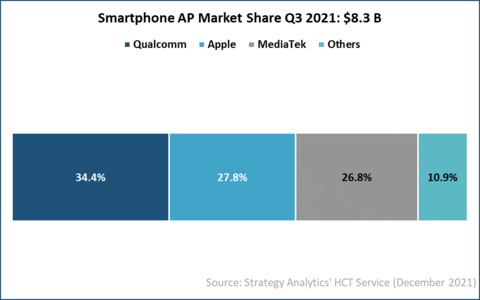

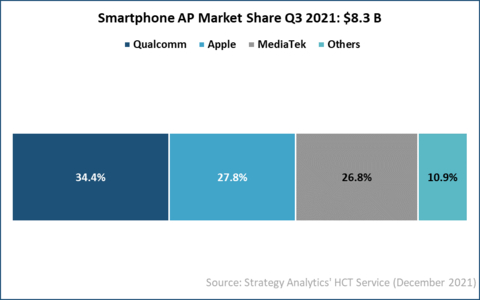

BOSTON--(BUSINESS WIRE)--The global smartphone applications processor (AP) market grew 17 percent to $8.3 billion in Q3 2021, according to Strategy Analytics' Handset Component Technologies (HCT) service report.

Strategy Analytics' research report "Smartphone Apps Processor Market Share Tracker Q3 2021: Qualcomm, MediaTek and Unisoc Post Double-digit Shipment Growth" estimates that Qualcomm, Apple, MediaTek, Samsung LSI and Unisoc captured the top-five revenue share rankings in the smartphone applications processor (AP) market in Q3 2021.

- Qualcomm maintained its smartphone AP leadership with a 34 percent revenue share, followed by Apple with 28 percent and MediaTek with 27 percent.

- MediaTek exited the first nine months of 2021 with a 26-million-unit lead over Qualcomm. Consequently, MediaTek is on track to become the leading smartphone AP vendor in unit terms for the first time on an annual basis in 2021.

- Qualcomm deprioritised mid-range and low-end 4G APs to focus on premium and high tier APs to make the best use of available foundry capacity. As a result, MediaTek gained volume share in 4G APs with its Helio A/G/P lineup.

- 5G-attached AP shipments grew 82 percent year-on-year, driving a 19 percent growth in overall AP average selling prices (ASPs).

- Qualcomm's premium tier AP Snapdragon 888/888+ was the top-selling Android AP during the quarter.

- TSMC manufactured three-fourths of total smartphone APs shipped in Q3 2021, followed by Samsung Foundry.

- Smartphone APs manufactured in 7 nm and below process technologies accounted for 47 percent of total smartphone AP shipments in Q3 2021.

Sravan Kundojjala, author of the report and Associate Director of Handset Component Technologies service at Strategy Analytics, commented, "Qualcomm, MediaTek and Unisoc all posted solid double-digit shipment and revenue growth in smartphone APs in Q3 2021. Qualcomm and MediaTek benefited from HiSilicon's forced exit while Unisoc saw strong growth in its 3G and 4G AP shipments. Strategy Analytics believes that 4G AP foundry capacity continues to be tight. We expect AP vendors to focus more on 5G in 2022 to maximise their revenue and profit."

Mr. Kundojjala continued, "HiSilicon, hit by trade sanctions, saw its smartphone AP shipments decline 96 percent in Q3 2021. On the other hand, Samsung LSI posted a 12 percent decline in its AP shipments. Google, a new entrant, captured a 0.1 percent unit share with its Pixel Tensor AP. Strategy Analytics believes that Google needs to acquire 5G modem technology to strengthen its cost competitiveness in the smartphone AP market."

Source: Strategy Analytics, Inc.

SA_Components

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customised market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

For more information about Strategy Analytics

Service Name: Handset Component Technologies