Majority of Health Insurers Concerned Over No Surprises Act’s Impending Transparency Requirements

Majority of Health Insurers Concerned Over No Surprises Act’s Impending Transparency Requirements

Industry survey highlights level of compliance preparedness and increasing skepticism towards new regulations

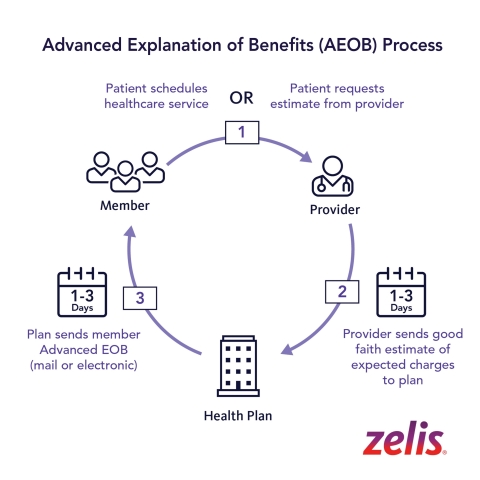

BEDMINSTER, N.J.--(BUSINESS WIRE)--Zelis, the leading payments company in healthcare, today released findings from a survey conducted in July 2021 that polled healthcare insurers to assess their current readiness and preparation plans to meet the requirements set by the No Surprises Act (NSA). The NSA seeks to protect patients from surprise medical bills and includes transparency requirements, including an Advanced Explanation of Benefits (AEOB) for members that applies to both in- and out-of-network care. The way the law is currently written, for any healthcare service, a provider must send the patient’s insurer an estimate of expected charges. With that information, the insurer creates an AEOB, including the patient’s out-of-pocket estimates, and sends it to the patient before the scheduled service.

The poll of more than 100 healthcare executives revealed that a majority of insurers are concerned about the NSA’s transparency requirements.1 The results indicate that:

- Three-quarters of respondents (74%) are concerned about meeting the Advanced Explanation of Benefits (AEOB) requirements.

- Nearly two-thirds (63%) don’t know how they’re going to obtain the provider estimates required for AEOBs.

- More than half (58%) expressed uncertainty about their ability to obtain the additional data required for AEOBs.

This is Zelis’ second NSA survey; the company first polled insurers in January about the healthcare system’s ability to achieve compliance with the NSA by the January 1, 2022 deadline.

According to Zelis’ latest survey, an overwhelming majority of insurers’ current NSA concerns stem from the AEOB requirements.

“The AEOB requirements are going to be a heavy lift for many insurers, considering 73% rely on paper-based processes for payments and more than half aren’t sure how to get the necessary pricing data,” said Matthew Albright, Chief Legislative Affairs Officer at Zelis. “Any insurer still using paper-based billing and member communication should make a plan now to digitize and streamline those processes and make them more efficient, data-driven and faster. Those with outdated systems will struggle to comply with the NSA and will likely experience greater challenges, higher costs, and more administrative work than before.”

“The NSA is a call-to-action for the healthcare industry to better serve and support health plan members. Now more than ever, insurers and providers must collaborate to successfully navigate the complexity of the law,” said Amanda Eisel, Zelis CEO. “Innovative solutions that can be seamlessly integrated are critical.”

Zelis has been working with more than 700 U.S. insurers and a million providers to transform their claims, pricing, payment, and communications processes into more efficient and compliant electronic systems. Notably, 43% of insurers are still looking for a solution to meet the NSA’s cost transparency requirements2. Zelis has been studying the NSA and developing solutions to help clients with compliance. Specific to the transparency requirements, insurers and providers can look to Zelis for support with:

- Median In-Network Reimbursements – Zelis is enhancing its market-based pricing with the ability to price according to median INN rates, helping payers achieve savings and calculate appropriate qualified payment amounts for consumer cost-sharing purposes.

- AEOBs – Zelis will create templates for AEOBs with all NSA required fields, manage member preferences and deliver AEOBs in printed or digital format using client data. Zelis is developing fully integrated solutions, with both adjudication platforms and other transparency vendors, that will enable seamless integration of the data feeds required for AEOBs.

- Machine-Readable Files (MRFs) – Zelis will produce out-of-network (OON) MRFs for Zelis’ OON services’ clients and in-network MRFs for clients using Zelis networks.

- ID Cards – Zelis will design Zelis Member ID templates to each insurer’s compliance specifications with additional information required by the NSA.

- Provider Directories – Zelis will offer compliant directories for clients whose primary networks are owned or managed by Zelis.

For more insights on the NSA from legislative and clinical experts at Zelis, and to learn more about what Zelis can do for your organization, visit the Zelis No Surprises Act Information Hub.

About Zelis

As the leading payments company in healthcare, we price, pay and explain healthcare for payers, providers, and healthcare consumers. Zelis was founded on a belief there is a better way to determine the cost of a healthcare claim, manage payment-related data, and make the payment because more affordable and transparent care is good for all of us. We partner with more than 700 payers, including the top-5 national health plans, Blues plans, regional health plans, TPAs and self-insured employers, 1.5 million providers and millions of members, enabling the healthcare industry to pay for care, with care. For more information, visit www.zelis.com and follow us on LinkedIn.

1 Survey of 119 healthcare payer executives representing 98 payer health plans, third-party administrators (TPAs) and health planned-owned TPAs, conducted by Zelis in July 2021.

2 Survey of 310 healthcare payer executives representing 206 payer health plans, third-party administrators (TPAs) and health planned-owned TPAs, conducted by Zelis in July 2021.

Contacts

Media Contact

Thuy-An Wilkins

Director, Media Relations

908.389.8756

thuy-an.wilkins@zelis.com