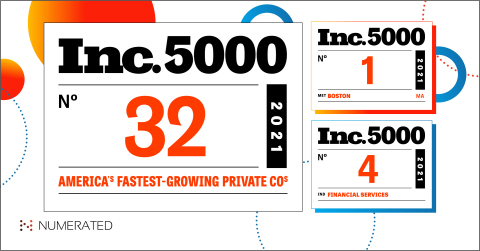

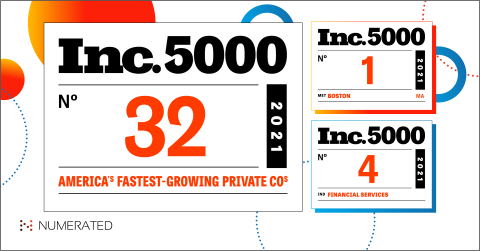

BOSTON--(BUSINESS WIRE)--Numerated, the fast-growing fintech making business banking easy for financial institutions and their clients, ranks No. 32 on the Inc. 5000 List – Inc. magazine’s annual ranking of America’s fastest-growing private companies. Numerated is the No. 1 Boston-based company to make the list and No. 4 in the Financial Services sector.

Founded on a vision of radically simplifying business banking for financial institutions and their clients through data, Numerated has been building the future of digital lending since 2017. When COVID-19 brought lockdowns and branch closures, it catalyzed an industry-wide digital transformation and brought the company's vision front and center, overnight. Banks and credit unions turned to Numerated as a trusted partner when their customers needed them most, and Numerated helped them facilitate more than $50B in Paycheck Protection Program loans, reaching more than 700,000 small businesses in the process.

“Our customers’ belief in our vision for the future of lending has driven our success,” said Dan O’Malley, CEO and co-founder of Numerated. “We’re grateful for their partnership and excited to continue to build the future of business banking with them. Today, we’re working to take the learnings of the last year and turn them into the best borrowing experience in the world, for any business banking product. I’m incredibly proud of the team we’ve built and excited to share that we are investing tens of millions of dollars into our technology to rapidly drive even more efficiencies for you, our partner institutions.”

Numerated is a digital lending platform for business banking that dramatically reduces work for financial institutions and their customers by using data. Banks and credit unions use Numerated to make their business lending more efficient and to offer convenient digital channels to their clients.

The platform pulls in data at each stage of origination, including pre-filling borrower applications, aggregating data to speed banker reviews and offers, and fully automating the preparation of time-consuming document packages. More than 130 top financial institutions, totalling $1 trillion in assets, leverage the Numerated platform today including Bremer Bank, Dollar Bank, Eastern Bank, MidFirst Bank, Montecito Bank & Trust, People's United Bank and Pinnacle Bank.

Inc. has produced a list of America’s fastest-growing private companies since 1982 and provided the first national exposure for household names like Intuit, Microsoft, and Zappos. The Inc. 5000 is widely considered a prestigious recognition honoring the entrepreneurial success of private companies and this year represents some of the most resilient and flexible companies in America, given 2020’s unprecedented challenges.

For the complete results of the 2021 Inc. 5000, visit www.inc.com/inc5000. Learn more about Numerated and their digital lending platform, visit www.numerated.com.

About Numerated

Numerated is the fast-growing fintech making business banking easy for financial institutions and their clients. Banks and credit unions use Numerated’s digital lending platform to meet business expectations for digital convenience and to bring efficiency gains to their internal teams. The platform is unique in its use of data to streamline the origination of any business banking product, from application to decision to close. More than 400,000 businesses and 30,000 financial institution associates have used Numerated to process $50 billion in lending. The company was recently recognized as one of 2020’s Top 250 FinTechs by CB Insights and 2021’s Best Overall Business Lending Company by FinTech Breakthrough.