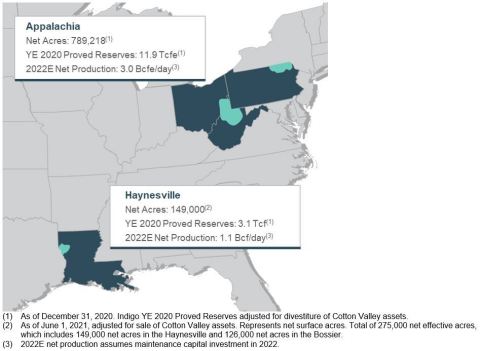

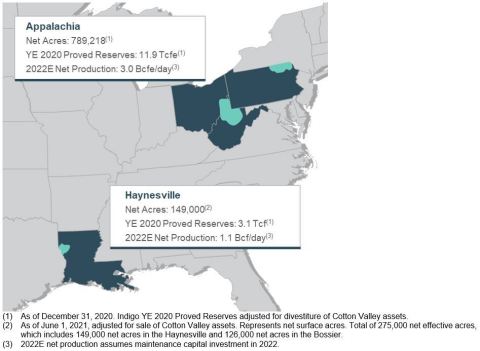

SPRING, Texas--(BUSINESS WIRE)--Southwestern Energy Company (NYSE: SWN) (the “Company” or “Southwestern”) today announced that it has entered into a definitive merger agreement with Haynesville producer Indigo Natural Resources, LLC (“Indigo”) under which it will acquire Indigo for approximately $2.7 billion. The transaction is expected to close early in the fourth quarter of 2021, subject to customary closing conditions. Transaction highlights include:

- Increases projected cumulative free cash flow to approximately $1.2 billion from 2021 to 2023;

- Improves estimated 2022 free cash flow per share ~30% and cash flow per debt adjusted share ~15%;

- Accelerates expected delivery of sustainable leverage ratio below 2.0x in 2021 and progressing to 1.7x in 2022;

- Expands 2022 estimated margins by 12% resulting from low cost access to premium markets in the growing Gulf Coast LNG corridor;

- Complements existing portfolio, increases high-return dry gas inventory with over 1,000 locations added; and

- Leverages operational expertise of integrating and developing operated, large-scale natural gas assets; increases net production to over 4 Bcfe per day, consisting of approximately 85% natural gas.

“Today we are proud to announce another accretive transaction that will benefit the Company’s shareholders for years to come. This acquisition enhances Southwestern’s position as a leading natural gas producer and aligns with our disciplined strategy to generate free cash flow, enhance our balance sheet, optimize performance and build scale. Indigo has done a terrific job building its business, and its balance sheet strength, low cost structure and high-quality acreage position in the core of the Haynesville play accelerates the delivery of our strategic goals,” said Bill Way, Southwestern Energy President and Chief Executive Officer.

Way continued, “Our footprint now extends across the two premier natural gas basins in the country and includes top-tier dry gas and liquids rich inventory. The value of this high-quality inventory is further enhanced by our diverse transportation portfolio providing access to premium markets in the Gulf Coast and within Appalachia. Southwestern Energy’s unique combination of a strong balance sheet, high-quality assets and resilient vertically integrated business is positioned to deliver long-term value creation.”

Indigo is one of the largest private US natural gas producers, with core dry gas assets across the stacked pay Haynesville and Bossier zones in northern Louisiana. Its high-margin assets are located in close proximity to the growing demand in the Gulf Coast LNG corridor. Indigo currently produces 1.0 Bcf per day net and expects to produce approximately 1.1 Bcf per day net upon closing. As of March 31, 2021, and adjusted for the recent sale of its non-core Cotton Valley assets, Indigo had $631 million of net debt and a leverage ratio of 1.1 times.

Outlook

Southwestern Energy expects to invest at maintenance capital levels again in 2022, with activity across all of its operating areas. On the acquired acreage, the Company expects to run a 4 rig program in 2022, placing 30 to 40 wells to sales. With a maintenance capital program, the Company projects 14 years of economic inventory at current strip prices across its assets in Appalachia and Haynesville.

Preliminary 2022 estimates for certain key metrics of the newly combined enterprise are shown below. Estimates are based on $2.75 NYMEX and $58 WTI.

Preliminary 2022 Estimates |

|

SWN |

|

SWN + Indigo |

|

Increase (Decrease) (1) |

|

|

|

|

|

|

|

EBITDA (non-GAAP) ($ in billions) |

|

$1.3 |

|

$2.0 |

|

54% |

Net cash flow (non-GAAP) ($ in billions) |

|

$1.2 |

|

$1.9 |

|

58% |

Capital investment ($ in billions) |

|

$0.9 |

|

$1.4 |

|

56% |

Free cash flow (non-GAAP) ($ in billions) |

|

$0.24 |

|

$0.47 |

|

96% |

Net debt to EBITDA (non-GAAP) |

|

2.1x |

|

1.7x |

|

(0.4x) |

E&P margin ($ per Mcfe) (2) |

|

$1.15 |

|

$1.30 |

|

12% |

Net Production (Bcfe/day) |

|

3.0 |

|

4.1 |

|

37% |

(1) |

Change represents SWN+Indigo as compared to SWN. |

(2) |

E&P Margin defined as weighted average realized price less lease operating expenses, general and administrative expenses and taxes other than income. |

Synergies are expected to be approximately $20 million in G&A reductions with further operational and financial cost savings anticipated. There are opportunities for additional value creation by leveraging the Company’s core competencies for large scale, operated natural gas development, including its vertically integrated business, reservoir and base decline optimization, and use of innovation and data analytics. The Company’s increased scale provides the opportunity for credit upgrades and cost of capital reductions, which would deliver additional accretion to financial performance.

Transaction and Timing

The total consideration of $2.7 billion will be comprised of $400 million in cash, approximately $1.6 billion in SWN common stock and $700 million of assumed 5.375% senior notes due 2029.

The stock consideration consists of approximately 339 million shares of Southwestern Energy common stock, calculated utilizing the 30-day volume-weighted average price as of May 28, 2021, of $4.72. No Indigo shareholder will receive more than 10% of Southwestern Energy’s pro forma outstanding shares in connection with this transaction.

The transaction was unanimously approved by each of Southwestern Energy’s and Indigo’s board of directors. The transaction is expected to close early in the fourth quarter of 2021, subject to regulatory approvals, customary closing conditions and the approval by Southwestern Energy’s shareholders.

Advisors

Goldman Sachs & Co. LLC served as the exclusive financial advisor to Southwestern and Skadden, Arps, Slate, Meagher & Flom LLP serve as legal advisor. Credit Suisse Securities (USA) LLC served as the exclusive financial advisor to Indigo and Kirkland & Ellis LLP served as legal advisor.

Conference Call

Southwestern Energy will host a conference call today, June 2, 2021, at 10:00 a.m. Central to discuss this transaction. To participate, dial US toll-free 877-883-0383, or international 412-902-6506 and enter access code 0998867. A live webcast will also be available at ir.swn.com.

About Southwestern Energy

Southwestern Energy Company is an independent energy company engaged in natural gas, natural gas liquids and oil exploitation, development, production and marketing.

About Indigo Natural Resource

Indigo Natural Resources LLC is one of the largest natural gas producers in the Haynesville Shale and the third largest private natural gas producer in the U.S. Indigo is an experienced operator, focused in northern Louisiana with direct access to Gulf Coast markets and associated industrial and LNG demand growth. Indigo is headquartered in Houston, Texas. For more information, please visit the Company’s website at www.ndgo.com.

Forward-Looking Statements

Certain statements and information in this news release may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act, as amended. The words “believe,” “expect,” “anticipate,” “plan,” "predict," “intend,” "seek," “foresee,” “should,” “would,” “could,” “attempt,” “appears,” “forecast,” “outlook,” “estimate,” “project,” “potential,” “may,” “will,” “likely,” “guidance,” “goal,” “model,” “target,” “budget” and other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. Statements may be forward looking even in the absence of these particular words. Examples of forward-looking statements include, but are not limited to, statements regarding the proposed acquisition of Indigo Natural Resources LLC (the “Proposed Transaction”), expected synergies and other benefits from and costs in connection with the Proposed Transaction, estimated financial metrics giving effect to the Proposed Transaction, our financial position, business strategy, production, reserve growth and other plans and objectives for our future operations, and generation of free cash flow. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. The forward-looking statements contained in this document are largely based on our expectations for the future, which reflect certain estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions, operating trends, and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. As such, management’s assumptions about future events may prove to be inaccurate. For a more detailed description of the risks and uncertainties involved, see “Risk Factors” in our most recently filed Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other SEC filings. We do not intend to publicly update or revise any forward-looking statements as a result of new information, future events, changes in circumstances, or otherwise. These cautionary statements qualify all forward-looking statements attributable to us, or persons acting on our behalf. Management cautions you that the forward-looking statements contained herein are not guarantees of future performance, and we cannot assure you that such statements will be realized or that the events and circumstances they describe will occur. Factors that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements herein include, but are not limited to: the timing and extent of changes in market conditions and prices for natural gas, oil and natural gas liquids (“NGLs”), including regional basis differentials and the impact of reduced demand for our production and products in which our production is a component due to governmental and societal actions taken in response to COVID-19 or other public health crises and any related company or governmental policies and actions to protect the health and safety of individuals or governmental policies or actions to maintain the functioning of national or global economies and markets; our ability to fund our planned capital investments; a change in our credit rating, an increase in interest rates and any adverse impacts from the discontinuation of the London Interbank Offered Rate; the extent to which lower commodity prices impact our ability to service or refinance our existing debt; the impact of volatility in the financial markets or other global economic factors; difficulties in appropriately allocating capital and resources among our strategic opportunities; the timing and extent of our success in discovering, developing, producing and estimating reserves; our ability to maintain leases that may expire if production is not established or profitably maintained; our ability to realize the expected benefits from recent acquisitions or the Proposed Transaction; costs in connection with the Proposed Transaction; the consummation of or failure to consummate the Proposed Transaction and the timing thereof; costs in connection with the Proposed Transaction; integration of operations and results subsequent to the Proposed Transaction; our ability to transport our production to the most favorable markets or at all; the impact of government regulation, including changes in law, the ability to obtain and maintain permits, any increase in severance or similar taxes, and legislation or regulation relating to hydraulic fracturing, climate and over-the-counter derivatives; the impact of the adverse outcome of any material litigation against us or judicial decisions that affect us or our industry generally; the effects of weather; increased competition; the financial impact of accounting regulations and critical accounting policies; the comparative cost of alternative fuels; credit risk relating to the risk of loss as a result of non-performance by our counterparties; and any other factors listed in the reports we have filed and may file with the SEC that are incorporated by reference herein. All written and oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary statement.

Use of Non-GAAP Information

This news release contains non-GAAP financial measures, such as net cash flow, free cash flow, net debt and adjusted EBITDA, including certain key statistics and estimates. We report our financial results in accordance with accounting principles generally accepted in the United States of America (“GAAP”). However, management believes certain non-GAAP performance measures may provide users of this financial information additional meaningful comparisons between current results and the results of our peers and of prior periods. Please see the Appendix for definitions of the non-GAAP financial measures that are based on reconcilable historical information.

Additional Information and Where To Find It

This news release is being made in respect of the proposed acquisition (the “Proposed Transaction”) of Indigo Natural Resources LLC ("Indigo") by Southwestern Energy Company ("SWN”). The issuance of the stock consideration for the Proposed Transaction will be submitted to the shareholders of SWN for their approval. In connection with the proposed transaction, SWN will file with the U.S. Securities and Exchange Commission (the "SEC") a proxy statement (the "proxy statement"). INVESTORS AND SHAREHOLDERS OF SWN ARE URGED TO CAREFULLY READ THE PROXY STATEMENT, AND OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC BY SWN, IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT SWN, INDIGO, THE PROPOSED TRANSACTION AND RELATED MATTERS. The definitive proxy statement and other relevant materials (when they become available) and any other documents filed by SWN with the SEC may be obtained free of charge at the SEC’s website, at www.sec.gov or through SWN’s website at www.swn.com. These documents may also be obtained free of charge from SWN by requesting them by mail at Investor Relations, 10000 Energy Drive, Spring, Texas 77389, or by telephone at (832) 796-7906.

Participants in the Solicitation

SWN and its directors, executive officers and certain other members of management and employees may be deemed to be participants in the solicitation of proxies from SWN’s shareholders with respect to the approval of the issuance of shares of SWN common stock in the Proposed Transaction. Information regarding the ownership of SWN's stock and other securities by SWN's directors and executive officers is included in SEC filings on Forms 3, 4, and 5, which can be found through SWN's website (www.swn.com) or through the SEC's website at www.sec.gov. Information can also be found in SWN's other SEC filings, including the company's Annual Report on Form 10-K for the fiscal year ended 2020 filed with the SEC on March 1, 2021, and its definitive proxy statement for the 2021 annual meeting of shareholders filed with the SEC on April 8, 2021. More detailed and updated information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement and other materials to be filed with the SEC in connection with the Proposed Transaction. Shareholders should read the proxy statement carefully when it becomes available before making any voting or other decisions.

Use of Projections

The financial, operational, industry and market projections, estimates and targets in this news release are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond SWN's and Indigo's control. The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of significant business, economic, regulatory and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the financial, operational, industry and market projections, estimates and targets, including assumptions, risks and uncertainties described in "Forward-looking Statements" above.

Explanation of Non-GAAP Financial Measures

The Company reports its financial results in accordance with accounting principles generally accepted in the United States of America (“GAAP”). However, management believes certain non-GAAP performance measures may provide financial statement users with additional meaningful comparisons between current results, the results of its peers and of prior periods.

Non-GAAP financial measures the Company may present from time to time are net debt, net cash flow, free cash flow and EBITDA, which excludes certain charges or amounts. Net debt is defined as short-term debt plus long-term debt less cash and cash equivalents. EBITDA is defined as net income (loss) plus interest, income tax expense (benefit), depreciation, depletion and amortization, expenses associated with the restructuring charges, impairments, legal settlements and gains (losses) on unsettled derivatives less gains (losses) on sale of assets and gains on early extinguishment of debt over the prior 12 month period. Net cash flow is defined as cash flow from operating activities before changes in operating assets and liabilities. Free cash flow is defined as net cash flow less accrual based capital expenditures, and estimated free cash flow for future periods is based on strip pricing as of April 30, 2021. The Company has included information concerning Net debt / EBITDA because it is used by certain investors as a measure of the ability of a company to service or incur indebtedness and because it is a financial measure commonly used in the energy industry. Net debt / EBITDA should not be considered in isolation or as a substitute for net income, net cash provided by operating activities or other income or cash flow data prepared in accordance with generally accepted accounting principles or as a measure of the Company’s profitability or liquidity. Net debt / EBITDA, as defined above, may not be comparable to similarly titled measures of other companies. Management presents these measures because (i) they are consistent with the manner in which the Company’s position and performance are measured relative to the position and performance of its peers, (ii) these measures are more comparable to earnings estimates provided by securities analysts, and (iii) charges or amounts excluded cannot be reasonably estimated and guidance provided by the Company excludes information regarding these types of items. These adjusted amounts are not a measure of financial performance under GAAP.

The Company does not provide a reconciliation to estimated free cash flow because the Company does not provide the GAAP financial measures of net income or loss or net cash provided by operating activities on a forward-looking basis because it is unable to predict, without unreasonable effort, certain components thereof including, but not limited to capital expenditures, production and realized prices for production. These items are inherently uncertain and depend on various factors, many of which are beyond its control. As such, any associated estimate and its impact on GAAP performance and cash flow measures could vary materially based on a variety of acceptable management assumptions.