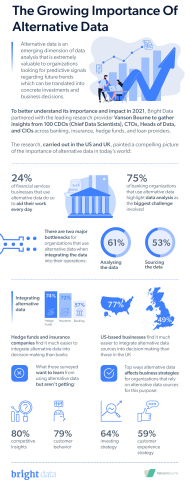

LONDON--(BUSINESS WIRE)--Bright Data (formerly Luminati Networks), a leading online data collection platform, has today released new research findings that highlight the importance of alternative data in financial services. The insights, gathered in cooperation with the leading market research experts Vanson Bourne, demonstrate the impact alternative data is having in the US and UK versus legacy/traditional data. The survey concluded that nearly a quarter (24%) of financial services professionals who work for organisations that collect alternative data use it to aid their work every day. The research queried respondents from financial services sectors, including insurance, banking, and hedge funds and found a clear dependence on external data sources, with 95% of financial services organisations relying on outside information to contribute towards business success in the past year.

The research findings also shed light on the obstacles that financial institutions face when deploying and working with alternative data. Three-quarters (75%) of banking professionals that use alternative data state data analysis as their biggest challenge. Additionally, the survey unveiled the insights that respondents are not currently getting from alternative data. For example, 80% of those surveyed expressed they require more competitive insights from alternative data, and 79% hoped to get information on customer behaviour from the data. These findings show that even though many financial services professionals are using alternative data, there’s a lack of understanding about how to properly analyse the information to unlock insights.

Further key findings from the survey include:

- Professionals from insurance companies (74%) and hedge funds (72%) find it much easier to integrate alternative data into decision-making than those at banks (57%).

- Sixty-four percent (64%) of organisations that rely on alternative data sources when building business strategies say that alternative data impacts their investing strategy, and 59% say it impacts their customer experience strategy.

- Seventy-seven percent (77%) of US respondents find it easy or very easy to integrate alternative data sources into decision-making, compared to only 49% of UK respondents.

“Gone are the days where quarterly earnings reports could be relied on as the main source of data for decision-making,” said Or Lenchner, CEO of Bright Data. “Financial services institutions are seeking out alternative/external data for up-to-the-minute insights that provide the most relevant, reliable and accurate data available. We’ve seen a significant increase in businesses within the space turning to Bright Data to collect alternative data. We look forward to continuing to empower these organisations with tailored online data that guides their most important business strategies and decisions.”

The survey asked 100 employees from insurance, banking, hedge and quant funds, and loan companies about their alternative data usage. The group was representative of US and UK respondents and included employees who work within the IT and data departments of their organisations.

To learn more about how Bright Data can help financial services organisations unlock insights with alternative data, visit here.