After One Year of COVID-19, New Square Data Reveals the Share of Cashless Businesses Has More Than Doubled

After One Year of COVID-19, New Square Data Reveals the Share of Cashless Businesses Has More Than Doubled

Findings Suggest the Increase in Digital Payments Sparked by COVID-19 Is Here to Stay

SAN FRANCISCO--(BUSINESS WIRE)--Today, Square, Inc. (SQ) released a new report highlighting the impact of COVID-19 on global commerce and payments behavior. One year after the onset of the pandemic, the steady increase in cashless adoption rates and online and contactless payments demonstrates a renewed preference toward digitization among business owners and consumers. This is the fourth installment of Square’s Making Change series, which examines whether or not we’re headed toward a cashless society.

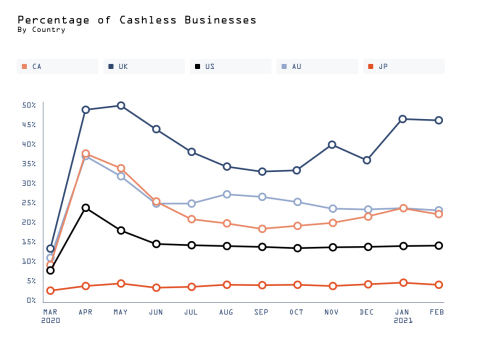

From pre-pandemic 2020 to today, we’ve seen the share of cashless businesses* more than double in the U.S., Australia, Canada, and the UK, and nearly double in Japan. In February 2020 in the U.S. alone, just 6.3% of Square sellers were cashless businesses, which jumped to 14% by February 2021. During that same period, the share of cash transactions decreased from 37.4% in February 2020 to 30.5% in February 2021.

Following U.S. businesses that have been with Square since 2015, we saw a slightly more substantial dip in cash usage during 2020, which indicates the shift away from cash this past year would have taken nearly three years without the pandemic.

Square Economist Felipe Chacon explains, “A year ago, there was no telling whether the sudden spike in cashless businesses and digital payment options was going to last. But today, we can look to markets where the pandemic has largely been eradicated, such as Australia, and see that the increase is sticking with business owners and consumers beyond the pandemic.”

We worked with Shelle Santana, Assistant Professor of Marketing at Bentley University, to lend her perspective on the ever-changing state of commerce. “It’s important to balance this past year’s universal increase in cashlessness with the fact that cash usage is still pretty resilient. In the summer of 2020, some people were wondering whether cash would become a relic of the past out of sheer necessity. We see now that even though cash transactions are declining, they still represent about 1 in every 3 transactions in the U.S. That’s not insignificant.”

From February 2020 through February 2021, both online and contactless** payment options became increasingly popular among business owners and consumers alike:

- 45% of U.S. Square sellers were accepting online payments by the end of February 2021, up from 30% a year ago.

- 74% of U.S. Square sellers were accepting contactless payments by the end of February 2021, up from 64% a year ago.

Despite the widespread growth in digital payment methods this past year, survey results from Wakefield Research serve as a reminder that a less-cash society is not necessarily indicative of a cashless one:

- 73% of American consumers and 68% of small business owners say the U.S. will never become a completely cashless society.

- However, among U.S. small business owners who disagree, 22% think the U.S. will become completely cashless in 10 years or fewer, up from just 13% in 2019.

*Cashless businesses are defined as those that are accepting 95% or more of payments via cashless methods (in-person debit, credit, or contactless payments; Square Online payments; or card-not-present payments).

**Defined as payments made in person with a contactless reader using a credit/debit card or mobile device.

About Square, Inc.

Square, Inc. (NYSE: SQ) builds tools to empower businesses and individuals to participate in the economy. Sellers use Square to reach buyers online and in person, manage their business, and access financing. And individuals use Cash App to spend, send, store, and invest money. Square has offices in the United States, Canada, Japan, Australia, Ireland, Spain, and the UK.

Contacts

Media Contact:

press@squareup.com