NEW YORK--(BUSINESS WIRE)--Macellum Advisors GP, LLC (together with its affiliates, “Macellum”), Ancora Holdings, Inc. (together with its affiliates, “Ancora”), Legion Partners Asset Management, LLC (together with its affiliates, “Legion Partners”), and 4010 Capital, LLC (together with its affiliates, “4010 Capital” and, together with Macellum, Ancora and Legion Partners, the “Investor Group”) today issued an open letter to shareholders of Kohl’s Corporation (NYSE: KSS) (“Kohl’s” or the “Company”). The Investor Group is deemed to beneficially own, in the aggregate, 14,950,632 shares of the Company’s common stock, including 3,481,600 shares underlying call options currently exercisable, constituting approximately 9.5% of the Company’s outstanding common stock.

The full text of the letter is below, and additional information can be found at https://createvalueatkohls.com/.

March 5, 2021

Dear Fellow Stockholders,

Macellum Advisors GP, LLC (together with its affiliates, “Macellum”), Ancora Holdings, Inc. (together with its affiliates, “Ancora”), Legion Partners Asset Management, LLC (together with its affiliates, “Legion Partners”), and 4010 Capital, LLC (together with its affiliates, “4010 Capital” and, together with Macellum, Ancora and Legion Partners, the “Investor Group” or “we”) beneficially own, in the aggregate, 14,950,632 shares of common stock of Kohl’s Corporation (NYSE: KSS) (“Kohl’s” or the “Company”), including 3,481,600 shares underlying call options currently exercisable, constituting approximately 9.5% of Kohl’s outstanding stock. We have nominated nine highly-qualified, independent candidates for election to the Company’s Board of Directors (the “Board”) at the 2021 annual meeting of shareholders (the “2021 Annual Meeting”).

We believe Kohl’s fourth quarter earnings report and full year 2021 guidance substantiate the immediate need for change on the Board. The Board seems to be content performing just slightly better than the worst companies in retail. “Best of the worst” is not a viable strategy, nor does it satisfy shareholders like us seeking long-term superior performance. Kohl’s is enormously well positioned with off-mall locations, which has significant advantages, but it also means Kohl’s competes against thriving off-mall players like TJX Companies, Ross Stores, Target, Old Navy and Burlington. We believe that a refreshed Board must oversee the development of a robust road map to compete for market share broadly in the soft goods, discretionary sector.

Further, we do not believe the Company’s recent results are indicative of a strategy that is succeeding. The Investor Group believes that the Company’s weak earnings and guidance are demonstrative of a Board comprised of directors lacking relevant retail expertise who are not in a position to provide the necessary oversight to help Kohl’s get back on track. In our view, a substantially refreshed Board with relevant retail expertise can help devise a strategy to take market share back from competitors and not just settle for being better than troubled mall-based department stores.

The following are several key observations:

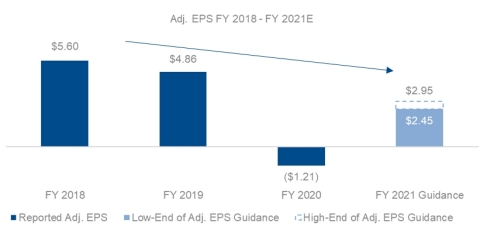

- 2021 guidance is highly disappointing compared to 2019. Kohl’s has set the mid-point of guidance for sales and earnings to a decline of (8.5%) and (44%), respectively, when compared to 2019. It is important to keep in mind that 2019 was itself a disappointing year for Kohl’s and not a meaningful yardstick for measuring a recovery. 2019 earnings guidance was lowered twice and margins declined precipitously - a recurring theme at Kohl’s. The further projected decline from 2019’s already-low earnings levels implies a significant amount of additional deleverage and suggests continued problems with gross margins and expense controls. Earnings before tax margins are projected to be down 200bp from 2019 to a record low of 3.00% (at the mid-point of guidance, excluding the pandemic influenced 2020). (See Figure 1)

- Setting low operating goals raises substantial questions about Board oversight and lack of urgency. The Investor Group was pleased to hear from management that it was setting a 7% to 8% operating margin target that can be achieved without sales recovering to 2019 levels. However, this newly unveiled goal suggests that the Company should have been able to reach a 7% to 8% operating margin in 2019, whereas it actually posted an operating margin of only 6.1%. The Investor Group is perplexed as to why a 6.1% operating margin was tolerated in 2019 when apparently a much higher operating margin was possible? Where was the urgency back then, and why has it taken the Board so long to oversee the construction of a plan to achieve improved margins? Why will it take three more years to achieve these levels of profitability if no sales growth is required? Furthermore, why is the Board apparently unwilling to commit to a sales growth goal in its strategic plan? As the Investor Group has stated, we believe the earnings power of Kohl’s can be substantially higher with a Board that has more relevant retail expertise. Unfortunately, we worry the answers to all these questions are simply that the Board is reticent to set quantifiable goals to which they can be held accountable.

- We believe the dramatic decline in the dividend directly contradicts the progress the Board is touting. The dividend being reinstated at a $1.00 annual run rate is disappointing considering Kohl’s paid a pre-pandemic run-rate dividend of $2.81. At least six other retailers, including TJX Companies, Ross Stores, American Eagle Outfitters, Gap, Guess and Dick’s Sporting Goods, have all reinstated their dividends at levels equal to or greater than pre-pandemic levels. The Investor Group is concerned that such a low dividend at Kohl’s may represent the Board’s belief that the earnings power of Kohl’s has been impaired by the pandemic for the long-haul. Further, the reinstatement of the dividend at this level is at odds with the rosy comments made about Kohl’s future performance by the Company’s CEO and CFO on the March 2, 2021 earnings call. At any rate, the Investor Group would have preferred to see a substantially larger share repurchase than the reinstatement of a dividend given the current share price. Nonetheless, if the Board views the resumption of a dividend payment as necessary, we believe the Company should provide a clearer message around why the dividend was set at such a low rate given the Company’s sizable current cash balance and the highly optimistic outlook articulated by management.

- The Company’s sales continue to underperform. The Company’s third and fourth quarter 2020 results do not suggest to us momentum in the business nor validation of the Company’s strategy. In fact, almost every retailer that experienced store closures during the pandemic is now seeing improving results. In our view, the need for change at Kohl’s is based on the Company’s decade long under-performance leading up to the pandemic. Until now, we have avoided commenting on the Company’s 2020 performance due to the “black swan” nature of the COVID pandemic. We do not believe such an exercise is helpful in determining the future of Kohl’s or assessing why change on the Board is required. However, since the Board seems determined to highlight the Company’s results during the pandemic as evidence that operations are improving, the Investor Group feels it is important to clarify the facts and what it views as a misleading characterization of the Company’s performance by the Board. As highlighted in the table below, Kohl’s results are far from a confirmation of the Company’s strategy being successful. In fact, Kohl’s most recent sales growth has exceeded that of only three of its peers. That Kohl’s could consider these results “strong” as stated in their February 22, 2021 letter is further evidence in our view of the Board’s “best of the worst” mentality.

Change in Sales by Rank: Q3 and Q4 2020 |

||||

|

Q3 |

Q4 |

||

HIBB (1) |

20% |

22% |

||

TGT |

21% |

21% |

||

BURL |

(6%) |

4% |

||

LB |

14% |

2% |

||

GPS (US Sales) |

2% |

(1%) |

||

Old Navy (US Sales) |

15% |

7% |

||

AEO |

(3%) |

(2%) |

||

TJX (US Sales) |

(3%) |

(2%) |

||

ANF (US Sales) |

(4%) |

(3%) |

||

ROST |

(2%) |

(4%) |

||

URBN |

(2%) |

(7%) |

||

DDS |

(26%) |

(18%) |

||

M |

(23%) |

(19%) |

||

JWN |

(16%) |

(20%) |

||

BBBY |

(5%) |

NA |

||

Average |

(2%) |

(2%) |

||

Peer Group Average (2) |

(7%) |

(7%) |

||

KSS |

(13%) |

(10%) |

Source: Company SEC Filings. |

Note: Peers ranked by Q4 sales change YoY. US Sales breakdown not available for AEO, LB and URBN. |

(1) Q4 represents comparable sales reported in preliminary results. |

(2) Peer Group includes: BBBY, BURL, DDS, GPS (US Sales), JWN, LB, M, ROST and TJX (US Sales). |

- We believe a sale leaseback transaction could create meaningful shareholder value. We believe the Board is trying to hide behind an antiquated indenture that is not “market” for an investment-grade retailer with $19 billion in revenue and only $180 million of net debt that is generating significant free cash flow. This indenture was written in 1995 when the Company had 125 stores and just over $1 billion in revenue. The Investor Group believes that the Board’s failure to address the overly restrictive nature of this indenture is yet another example of the Board’s ineffectiveness. In our view there are many possible solutions to rectify this situation, including to defease certain provisions in the indenture or amend the notes. Macy’s announcement on March 2, 2021 of a debt tender offer and consent solicitation is one of many examples of other retailers proactively working through issues of liability management. We believe the 1995 indenture should have been amended long ago, which would have likely enabled the liabilities of the Company to be structured more cost effectively with fewer restrictions. A sale leaseback transaction should be viewed as the equivalent of selling a non-core asset at 14-15x EBITDA while Kohl’s stock is trading at 5-5.5x EBITDA.

- We believe Kohl’s has an under-optimized balance sheet. With close to zero net debt, we are surprised that Kohl’s is not being more aggressive repurchasing their stock. The Company has $7-8 billion in real estate, an undrawn revolver of $1.5 billion and generates meaningful free cash flow. We support a conservative balance sheet, but in our view, this excessive conservatism is preventing the Company from creating long-term shareholder value.

- The Investor Group is skeptical that the Amazon returns program is accretive to current earnings. From an outside perspective, we have seen the program increase SG&A and yet revenue has seen little if any observable benefit. When we asked management detailed questions about the program, it was suggested to us that many of the costs associated with the program were merely fixed costs that Kohl’s was already incurring both in the form of store labor and reverse logistics. If this is true, it highlights that a substantial amount of costs at Kohl’s were not historically being managed for optimal efficiency. Our skepticism is further heightened by the fact that management is now stating that to measure how accretive Amazon returns are, shareholders need to consider the “lifetime value” of a customer, as Jill Timm, CFO, mentioned on the March 2, 2021 conference call. This would seem to contradict the prior statement that the program is accretive today. In our view, it could be years before a positive impact is felt on the bottom line, if ever. In addition, the Investor Group believes that there are certain “royalty payments” paid to Amazon related to this program that have not been adequately disclosed to investors.

- We do not believe Kohl’s recent stock performance shows the full picture. We are focused on the long-term performance of Kohl’s, both in evaluating the Board’s performance and the opportunity going forward. Kohl’s would like to focus the market’s attention on a very narrow time frame from the lows of the COVID pandemic to the current trading price, touting the fact that “Kohl’s stock has appreciated more than 170% since we released our new strategy in October...” If the Company is going to thrive going forward, we believe it is important for them to understand and address the fact that Kohl’s operational and financial performance have been deteriorating for years. In our view, a bump from the COVID lows is not evidence that the Board has corrected the strategic, structural, and cultural issues that have eaten away at performance for a decade.

Through a longer-term lens, Kohl’s shares have done one thing – UNDERPERFORMED as the table below clearly indicates:

Share Price Performance

|

||||||||

1 Year |

3 Year |

5 Year |

10 Year |

|||||

Kohl's Corporation |

7% |

(23%) |

10% |

23% |

||||

Peer Group (1) |

35% |

24% |

52% |

186% |

||||

ISS Peer Group (2) |

34% |

27% |

93% |

431% |

||||

Russell 2000 Index |

30% |

37% |

115% |

205% |

||||

S&P 500 Index |

17% |

39% |

111% |

255% |

||||

XRT |

107% |

95% |

131% |

331% |

||||

Kohl's Relative Performance: |

||||||||

Peer Group (1) |

(28%) |

(48%) |

(42%) |

(162%) |

||||

ISS Peer Group (2) |

(27%) |

(51%) |

(82%) |

(408%) |

||||

Russell 2000 Index |

(23%) |

(60%) |

(104%) |

(181%) |

||||

S&P 500 Index |

(10%) |

(63%) |

(101%) |

(231%) |

||||

XRT |

(101%) |

(118%) |

(121%) |

(307%) |

||||

Source: Company SEC Filings, Capital IQ as of 01/31/2021. |

(1) Peer Group includes: BBBY, BURL, DDS, GPS, JWN, LB, M, ROST and TJX. |

(2) ISS Peer Group includes: AN, BBY, KMX, DG, DLTR, FL, LAD, PAG, LB, M, JWN, ROST, GPS. |

- Majority of equity analysts are not positive. The Board points to recent equity analyst upgrades as evidence of market support for its strategy. A more sober assessment would include the fact that the many of the analysts cited the improving macro-environment, reopening of the US economy, and an expected rebound in apparel spending as key reasons for their upgrades. One analyst commented, “We do see opportunities for better execution around sales strategies, further SG&A reductions and faster shareholder returns. In addition, adding new expertise to the Board could help with the recovery.” Even after the recent analyst upgrades, we see a majority of analysts remaining neutral or negative on Kohl’s under the current Board, with ten neutral or sell ratings versus seven buy ratings. Further, the average analyst price target for Kohl’s stock was $48.50 prior to the release of the Investor Group letter versus a $52.70 closing price. This hardly seems supportive of the Company’s strategy. Nonetheless, we feel a key issue that management and the Board should be focused on is Kohl’s ability to compete in an ever-changing retail landscape, not how many analyst upgrades they received coming out of COVID lows. We believe that Kohl’s opportunity to deliver superior long-term results would be greatly enhanced by upgrading the Board with more relevant retail and governance skill sets.

- We remain concerned with the Board’s capital allocation discipline. The Board claims it has exercised “a long history of prudently managing our capital”, a statement we would dispute given nearly a decade of deteriorating returns on invested capital (ROIC). We are concerned over the Board’s past performance in capital allocation and their lack of critical expertise in this area. While the Investor Group is excited about the potential of the Sephora partnership and believe it can be a good investment, execution will be key. Unfortunately, this Company does not have a strong track record of successfully implementing ROIC-enhancing initiatives. Despite spending $6.6 billion in capital expenditures since 2011, the Company’s sales have remained flat, margins have declined and operating profits have declined by 44% as of the end of 2020. We feel that a Board with relevant retail expertise and capital markets experience can help guide the Company’s capital allocation more strategically and efficiently as opposed to what appears to be a desperate “try anything” approach.

- We disagree that the Company has properly aligned pay for performance. We are disappointed by Kohl’s assertion that “our executive compensation programs are directly linked to corporate performance with the objective of increasing long-term shareholder value.” In what the Investor Group considers one of the largest indictments of the Board performance, the long-term incentive plan goals set by the Board for fiscal years 2017 through 2019 implied that executives could receive target bonuses (100% of base) with average annual sales and average annual adjusted net income 2% and 23% below 2016 levels, respectively. This is truly appalling to us. As a result of this “pay for underperformance” plan, executives were granted the maximum threshold performance share unit award (200% of base) for 2017-2019 despite an increase in 3-year cumulative sales of less than 1% and a decline in 3-year cumulative net income of -12% (both compared to the 2014-2016 cumulative period, after adjusting for the reduction in corporate tax rates in 2017). In total, Michelle Gass was paid nearly $34 million over the 2017-2019 period, near the maximum allowable, during a period in which adjusted operating income declined by 11%.

The Board claims our efforts to refresh the Board will disrupt their momentum. However, based on the Company’s historical underperformance, we fear history will repeat itself in a series of failed initiatives and result in Kohl’s continuing to miss the mark with its customers, culminating with shareholders continuing to suffer subpar long-term returns. We are offering an opportunity for Kohl’s shareholders to select a Board committed to creating value for all shareholders. Shareholders deserve to have a Board with strong, relevant retail, capital allocation and governance expertise that will better support management to make Kohl’s an industry leader and an attractive investment again.

About Macellum

Macellum Advisors GP, LLC, together with its affiliates (collectively, “Macellum”) have substantial experience investing in consumer and retail companies and assisting such companies in improving their long-term financial and stock price performance. Macellum’s historical investments include: Collective Brands, GIII Apparel Group, Hot Topic, Charming Shoppes and Warnaco, among other companies. Macellum prefers to constructively engage with management to improve its governance and performance for the benefit of all stockholders, as we did with Perry Ellis. However, when management is entrenched, Macellum has run successful proxy contests to effectuate meaningful change, including at The Children’s Place Inc., Christopher & Banks Corporation, Citi Trends, Inc. and most recently at Bed Bath and Beyond Inc.

About Ancora

Ancora Holdings, Inc. is an employee owned, Cleveland, Ohio based holding company which wholly owns four separate and distinct SEC Registered Investment Advisers and a broker dealer. Ancora Advisors LLC specializes in customized portfolio management for individual investors, high net worth investors, investment companies (mutual funds), and institutions such as pension/profit sharing plans, corporations, charitable & “Not-for Profit” organizations, and unions. Ancora Family Wealth Advisors, LLC is a leading, regional investment and wealth advisor managing assets on behalf families and high net-worth individuals. Ancora Alternatives LLC specializes in pooled investments (hedge funds/investment limited partnerships). Ancora Retirement Plan Advisors, Inc. specializes in providing non-discretionary investment guidance for small and midsize employer sponsored retirement plans. Inverness Securities, LLC is a FINRA registered Broker Dealer.

About Legion Partners

Legion Partners is a value-oriented investment manager based in Los Angeles, with a satellite office in Sacramento, CA. Legion Partners seeks to invest in high-quality businesses that are temporarily trading at a discount, utilizing deep fundamental research and long-term shareholder engagement. Legion Partners manages a concentrated portfolio of North American small-cap equities on behalf of some of the world’s largest institutional and HNW investors.

About 4010 Capital

4010 Capital is a value-oriented investment manager with substantial experience investing in the consumer discretionary sector. 4010 Capital employs comprehensive fundamental analysis to invest in companies which it believes are trading at a discount to intrinsic value and have a pathway to improving operating performance.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Macellum Badger Fund, LLC, a Delaware limited partnership (“Macellum Badger”), Legion Partners Holdings, LLC, a Delaware limited liability company (“Legion Partners Holdings”) Ancora Holdings, Inc., an Ohio corporation (“Ancora Holdings”) and 4010 Capital, LLC, a Delaware limited liability company (“4010 Capital”), together with the other participants named herein, intend to file a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2021 annual meeting of shareholders of Kohl’s Corporation, a Wisconsin corporation (the “Company”).

MACELLUM BADGER, LEGION PARTNERS HOLDINGS, ANCORA HOLDINGS AND 4010 CAPITAL STRONGLY ADVISE ALL SHAREHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS' PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated to be Macellum Badger, Macellum Badger Fund II, LP, a Delaware limited partnership (“Macellum Badger II”), Macellum Advisors, LP, a Delaware limited partnership (“Macellum Advisors”), Macellum Advisors GP, LLC, a Delaware limited liability company (“Macellum GP”), Jonathan Duskin, Legion Partners Holdings, Legion Partners, L.P. I, a Delaware limited partnership (“Legion Partners I”), Legion Partners, L.P. II, a Delaware limited partnership (“Legion Partners II”), Legion Partners Special Opportunities, L.P. XV, a Delaware limited partnership (“Legion Partners Special XV”), Legion Partners, LLC, a Delaware limited liability company (“Legion LLC”), Legion Partners Asset Management, LLC, a Delaware limited liability company (“Legion Partners Asset Management”), Christopher S. Kiper, Raymond T. White, Ancora Holdings, Ancora Catalyst Institutional, LP, a Delaware limited partnership (“Ancora Catalyst Institutional”), Ancora Catalyst, LP, a Delaware limited partnership (“Ancora Catalyst”), Ancora Merlin, LP, a Delaware limited partnership (“Ancora Merlin”), Ancora Merlin Institutional, LP, a Delaware limited partnership (“Ancora Merlin Institutional”), Ancora Catalyst SPV I LP Series M (“Ancora SPV I Series M”), a series of Ancora Catalyst SPV I LP, a Delaware limited partnership (“Ancora SPV I”), Ancora Catalyst SPV I LP Series N, a series of Ancora SPV I (“Ancora SPV I Series N”), Ancora Catalyst SPV I LP Series O, a series of Ancora SPV I (“Ancora SPV I Series O”), Ancora Catalyst SPV I LP Series P, a series of Ancora SPV I (“Ancora SPV I Series P”), Ancora Catalyst SPV I SPC Ltd Segregated Portfolio G, a Cayman Islands segregated portfolio company (“Ancora Segregated Portfolio G”), Ancora Advisors, LLC, a Nevada limited liability company (“Ancora Advisors”), Ancora Alternatives LLC, an Ohio limited liability company (“Ancora Alternatives”), Ancora Family Wealth Advisors, LLC, an Ohio limited liability company (“Ancora Family Wealth”), The Ancora Group Inc., an Ohio corporation (“Ancora Inc.”), Inverness Holdings, LLC, a Delaware limited liability company (“Inverness Holdings”), Frederick DiSanto, 4010 Partners, LP, a Delaware limited partnership (“4010 Partners”), 4010 Capital, LLC, a Delaware limited liability company (“4010 Capital”), 4010 General Partner, LLC, a Delaware limited liability company (“4010 General Partner”), Steven E. Litt, Marjorie L. Bowen, James T. Corcoran, David A. Duplantis, Margaret L. Jenkins, Jeffrey A. Kantor, Thomas A. Kingsbury, Margenett Moore-Roberts and Cynthia S. Murray.

As of the date hereof, Macellum Badger directly beneficially owns 273,611 shares of Common Stock, par value $0.01 par value per share, of the Company (the “Common Stock”), including 56,400 shares underlying long call options currently exercisable and 1,000 shares in record name. As of the date hereof, Macellum Badger II directly beneficially owns 8,443,121 shares of Common Stock including 1,943,600 shares underlying long call options currently exercisable. As the investment manager of Macellum Badger and Macellum Badger II, Macellum Advisors may be deemed to beneficially own the 273,611 shares of Common Stock beneficially directly owned by Macellum Badger, including 56,400 shares underlying long call options currently exercisable and 8,443,121 shares of Common Stock beneficially owned directly by Macellum Badger II, including 1,943,600 shares underlying long call options currently exercisable. As the general partner of Macellum Badger, Macellum Badger II and Macellum Advisors, Macellum GP may be deemed to beneficially own the 273,611 shares of Common Stock beneficially owned directly by Macellum Badger, including 56,400 shares underlying long call options currently exercisable and 8,443,121 shares of Common Stock beneficially owned directly by Macellum Badger II, including 1,943,600 shares underlying long call options currently exercisable. As the sole member of Macellum GP, Mr. Duskin may be deemed to beneficially own the 273,611 shares of Common Stock beneficially owned directly by Macellum Badger, including 56,400 shares underlying long call options currently exercisable and 8,443,121 shares of Common Stock beneficially owned directly by Macellum Badger II, including 1,943,600 shares underlying long call options currently exercisable.

As of the date hereof, Legion Partners I directly beneficially owns 1,891,990 shares of Common Stock, including 567,900 shares underlying long call options, Legion Partners II directly beneficially owns 111,360 shares of Common Stock, including 43,000 shares underlying long call options, Legion Partners Special XV directly beneficially owns 108,400 shares of Common Stock, including 25,900 shares underlying long call options, and Legion Partners Holdings directly beneficially owns 100 shares of common stock of the Company in record name and as the sole member of Legion Partners Asset Management and sole member of Legion LLC, Legion Partners Holdings may also be deemed to beneficially own the 1,891,990 shares of Common Stock beneficially owned directly by Legion Partners I, including 567,900 shares underlying long call options, 111,360 shares of Common Stock beneficially owned directly by Legion Partners II, including 43,000 shares underlying long call options, and 108,400 shares of Common Stock beneficially owned directly by Legion Partners Special XV, including 25,900 shares underlying long call options. As the general partner of each of Legion Partners I and Legion Partners II and co-general partner of Legion Partners Special XV, Legion LLC may be deemed to beneficially own the 1,891,990 shares of Common Stock beneficially owned directly by Legion Partners I, including 567,900 shares underlying long call options, 111,360 shares of Common Stock beneficially owned directly by Legion Partners II, including 43,000 shares underlying long call options, and 108,400 shares of Common Stock beneficially owned directly by Legion Partners Special XV, including 25,900 shares underlying long call options. As the investment advisor of each of Legion Partners I, Legion Partners II and Legion Partners Special XV, Legion Partners Asset Management may be deemed to beneficially own the 1,891,990 shares of Common Stock beneficially owned directly by Legion Partners I, including 567,900 shares underlying long call options, 111,360 shares of Common Stock beneficially owned directly by Legion Partners II, including 43,000 shares underlying long call options, and 108,400 shares of Common Stock beneficially owned directly by Legion Partners Special XV, including 25,900 shares underlying long call options. As a managing director of Legion Partners Asset Management and managing member of Legion Partners Holdings, Mr. Kiper may be deemed to beneficially own the 1,891,990 shares of Common Stock beneficially owned directly by Legion Partners I, including 567,900 shares underlying long call options, 111,360 shares of Common Stock beneficially owned directly by Legion Partners II, including 43,000 shares underlying long call options, and 108,400 shares of Common Stock beneficially owned directly by Legion Partners Special XV, including 25,900 shares underlying long call options and 100 shares of Common Stock beneficially owned directly by Legion Partners Holdings. As a managing director of Legion Partners Asset Management and managing member of Legion Partners Holdings, Mr. White may be deemed to beneficially own the 1,891,990 shares of Common Stock beneficially owned directly by Legion Partners I, including 567,900 shares underlying long call options, 111,360 shares of Common Stock beneficially owned directly by Legion Partners II, including 43,000 shares underlying long call options, and 108,400 shares of Common Stock beneficially owned directly by Legion Partners Special XV, including 25,900 shares underlying long call options and 100 shares of Common Stock beneficially owned directly by Legion Partners Holdings.

As of the date hereof, Ancora Catalyst Institutional directly beneficially owns 553,445 shares of Common Stock, including 113,200 shares underlying long call options. As of the date hereof, Ancora Catalyst directly beneficially owns 43,867 shares of Common Stock, including 9,600 shares underlying long call options. As of the date hereof, Ancora Merlin Institutional directly beneficially owns 549,030 shares of Common Stock, including 113,200 shares underlying long call options. As of the date hereof, Ancora Merlin directly beneficially owns 48,283 shares of Common Stock, including 9,600 shares underlying long call options. As of the date hereof, Ancora SPV I Series M directly beneficially owns 601,401 shares of Common Stock, including 116,800 shares underlying long call options. As of the date hereof, Ancora SPV I Series N directly beneficially owns 424,050 shares of Common Stock, including 80,800 shares underlying long call options. As of the date hereof, Ancora SPV I Series O directly beneficially owns 417,670 shares of Common Stock, including 79,600 shares underlying long call options. As of the date hereof, Ancora SPV I Series P directly beneficially owns 423,820 shares of Common Stock, including 85,200 shares underlying long call options. As of the date hereof, Ancora Segregated Portfolio G directly beneficially owns 592,000 shares of Common Stock, including 122,000 shares underlying long call options. As of the date hereof, 422,259 shares of Common Stock were held in a certain managed account for which Ancora Advisors serves as the investment adviser to (the “Ancora Advisors SMA”), including 103,800 shares underlying long call options. As of the date hereof, 7,198 shares of Common Stock were held in a certain managed account for which Ancora Family Wealth serves as the investment advisor of certain separately managed accounts (the “SMAs”). As the investment adviser to the Ancora Advisors SMA, Ancora Advisors may be deemed to beneficially own the 422,259 shares of Common Stock held in the Ancora Advisors SMA, including 103,800 shares underlying long call options. As the investment adviser to each of Ancora Catalyst Institutional, Ancora Catalyst, Ancora Merlin, Ancora Merlin Institutional, Ancora SPV I Series M, Ancora SPV I Series N, Ancora SPV I Series O, Ancora SPV I Series P, and Ancora Segregated Portfolio G, Ancora Alternatives may be deemed to beneficially own the 553,445 shares of Common Stock beneficially owned directly by Ancora Catalyst Institutional, including 113,200 shares underlying long call options, 43,867 shares of Common Stock beneficially owned directly by Ancora Catalyst, including 9,600 shares underlying long call options, 48,283 shares of Common Stock beneficially owned directly by Ancora Merlin, including 9,600 shares underlying long call options, 549,030 shares of Common Stock beneficially owned directly by Ancora Merlin Institutional, including 113,200 shares underlying long call options, 601,401 shares of Common Stock beneficially owned directly by Ancora SPV I Series M, including 116,800 shares underlying long call options, 424,050 shares of Common Stock beneficially owned directly by Ancora SPV I Series N, including 80,800 shares underlying long call options, 417,670 shares of Common Stock beneficially owned directly by Ancora SPV I Series O, including 79,600 shares underlying long call options, 423,820 shares of Common Stock beneficially owned directly by Ancora SPV I Series P, including 85,200 shares underlying long call options and 592,000 shares of Common Stock beneficially owned directly by Ancora Segregated Portfolio G, including 122,000 shares underlying long call options. As the investment adviser to the SMAs, Ancora Family Wealth may be deemed to beneficially own the 7,198 shares of Common Stock held in the SMAs. As the sole member of Ancora Advisors, Ancora Inc. may be deemed to beneficially own the 422,259 shares of Common Stock held in the Ancora Advisors SMA, including 103,800 Shares underlying long call options currently exercisable. As the sole member of Ancora Family Wealth, Inverness Holdings may be deemed to beneficially own the 7,198 shares of Common Stock held in Ancora Family Wealth. As the sole member of each of Ancora Alternatives and Inverness Holdings and the sole shareholder of Ancora Inc., Ancora Holdings may be deemed to beneficially own the 553,445 shares of Common Stock beneficially owned directly by Ancora Catalyst Institutional, including 113,200 shares underlying long call options, 43,867 shares of Common Stock beneficially owned directly by Ancora Catalyst, including 9,600 shares underlying long call options, 48,283 shares of Common Stock beneficially owned directly by Ancora Merlin, including 9,600 shares underlying long call options, 549,030 shares of Common Stock beneficially owned directly by Ancora Merlin Institutional, including 113,200 shares underlying long call options, 601,401 shares of Common Stock beneficially owned directly by Ancora SPV I Series M, including 116,800 shares underlying long call options, 424,050 shares of Common Stock beneficially owned directly by Ancora SPV I Series N, including 80,800 shares underlying long call options, 417,670 shares of Common Stock beneficially owned directly by Ancora SPV I Series O, including 79,600 shares underlying long call options, 423,820 shares of Common Stock beneficially owned directly by Ancora SPV I Series P, including 85,200 shares underlying long call options, and 592,000 shares of Common Stock beneficially owned directly by Ancora Segregated Portfolio G, including 122,000 shares underlying long call options, 422,259 shares of Common Stock held in the Ancora Advisors SMA, including 103,800 Shares underlying long call options currently exercisable and 7,198 shares of Common Stock held in the SMAs. As the Chairman and Chief Executive Officer of Ancora Holdings, Mr. DiSanto may be deemed to beneficially own the 553,445 shares of Common Stock beneficially owned directly by Ancora Catalyst Institutional, including 113,200 shares underlying long call options, 43,867 shares of Common Stock beneficially owned directly by Ancora Catalyst, including 9,600 shares underlying long call options, 48,283 shares of Common Stock beneficially owned directly by Ancora Merlin, including 9,600 shares underlying long call options, 549,030 shares of Common Stock beneficially owned directly by Ancora Merlin Institutional, including 113,200 shares underlying long call options, 601,401 shares of Common Stock beneficially owned directly by Ancora SPV I Series M, including 116,800 shares underlying long call options, 424,050 shares of Common Stock beneficially owned directly by Ancora SPV I Series N, including 80,800 shares underlying long call options, 417,670 shares of Common Stock beneficially owned directly by Ancora SPV I Series O, including 79,600 shares underlying long call options, 423,820 shares of Common Stock beneficially owned directly by Ancora SPV I Series P, including 85,200 shares underlying long call options, and 592,000 shares of Common Stock beneficially owned directly by Ancora Segregated Portfolio G, including 122,000 shares underlying long call options, 422,259 shares of Common Stock held in the Ancora Advisors SMA, including 103,800 Shares underlying long call options currently exercisable and 7,198 shares of Common Stock held in the SMAs.

As of the date hereof, 4010 Partners directly beneficially owns 39,000 shares of Common Stock, including 11,000 shares underlying long call options. As the investment manager of 4010 Partners and co-general partner of Legion Partners Special XV, 4010 Capital may be deemed to beneficially own the 39,000 shares of Common Stock beneficially owned directly by 4010 Partners, including 11,000 shares underlying long call options and 108,400 shares of Common Stock beneficially owned directly by Legion Partners Special XV, including 25,900 shares underlying long call options. As the general partner of 4010 Partners, 4010 General Partner may be deemed to beneficially own the 39,000 shares of Common Stock beneficially owned directly by 4010 Partners, including 11,000 shares underlying long call options. As a managing director of 4010 Capital, Mr. Litt may be deemed to beneficially own the 39,000 shares of Common Stock beneficially owned directly by 4010 Partners, including 11,000 shares underlying long call options and 108,400 shares of Common Stock beneficially owned directly by Legion Partners Special XV, including 25,900 shares underlying long call options.

As of the date hereof, Marjorie L. Bowen directly beneficially owns 27 shares of Common Stock. As of the date hereof, none of James T. Corcoran, David A. Duplantis, Margaret L. Jenkins, Jeffrey A. Kantor, Thomas A. Kingsbury, Margenett Moore-Roberts or Cynthia S. Murray own beneficially or of record any securities of the Company.