SAN FRANCISCO--(BUSINESS WIRE)--At-Bay, the insurance company for the digital age, today announced the closing of a $34 million Series C, led by Qumra Capital. At-Bay also announced M12, Microsoft’s venture fund, as an investor in the company. At-Bay raised a total of $74 million in 2020, having closed a Series B only nine months ago in March, and $91 million since founding in 2016.

“The centuries old industry of insurance has proven to be ripe for disruption, with the recent string of success of startups like Lemonade, Root and Hippo. At-Bay is the next insurance startup in line to breakout as they remake specialty insurance with digital-first products and services,” said Boaz Dinte, Managing Partner, Qumra Capital.

M12 first invested at the end of the Series B, and doubled down on their commitment to At-Bay in the Series C, along with existing investors Acrew Capital, Khosla Ventures, Lightspeed Venture Partners, Munich Re Ventures and entrepreneur Shlomo Kramer.

“At-Bay has built a different kind of insurance company, designed from the ground up to address the risk of doing business in the modern technology-driven economy,” said Lior Litwak, Partner at M12. “Securing a modern technology stack is a complex undertaking, especially for small and medium-sized organizations without the resources or sophistication to defend themselves against the organized threats they face today. We see immense potential in the new layer of cyber risk analysis and mitigation At-Bay can bring to these businesses.”

The Series C punctuates a year of remarkable growth for At-Bay. Over the past 12 months, the company has grown all of the following topline metrics by 600%: premium, total number of insureds and total liabilities. At-Bay has tripled its team size, while establishing a regional presence in New York, Atlanta, Chicago, Portland, Los Angeles and Dallas. With this financing, At-Bay’s Series C valuation has increased nearly 10X over the course of 12 months. At-Bay has grown at this incredible pace while maintaining a frequency of claims less than half of the industry average.

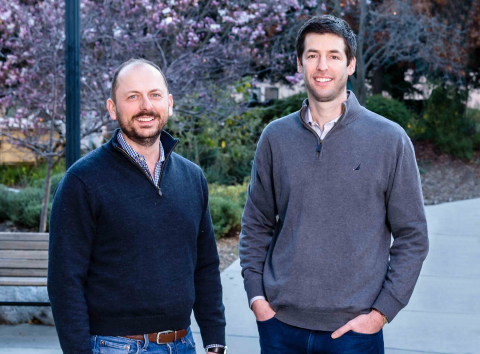

“Insurance is now an imperative for businesses to mitigate cyber risk, which is fast becoming the greatest threat they face. At-Bay helps businesses prevent cyber loss before it happens, with an in-house security team continuously monitoring the network of every company in our portfolio, offering actionable insights to strengthen security. This modern approach to risk management is not only driving strong demand for our insurance, but also enabling us to improve our products and minimize loss to our insureds,” said Rotem Iram, co-founder and CEO, At-Bay.

With the additional funding, At-Bay will continue growing the team, launching new products, establishing digital collaborations, and improving the company’s automated underwriting platform, which enables brokers to get bindable quotes in seconds, along with clear and actionable security insights to help clients avoid a cyberattack before it happens.

"The significant investment we’ve raised this year will enable us to deepen our active risk monitoring and security services, while expanding into new markets with new products aimed at helping companies manage risk in the digital age," said Roman Itskovich, co-founder and Chief Risk Officer.

For more information, and to view job openings, please visit At-Bay’s new website, www.at-bay.com.

About At-Bay

At-Bay is the insurance company for the digital age. By combining world class technology with industry leading insurance expertise, we designed an insurance company from the ground up that empowers businesses to thrive in the digital world. As a Managing General Underwriter (MGU), At-Bay underwrites insurance policies through HSB Specialty Insurance Company, rated A++ by A.M. Best Company and part of Munich Re. At-Bay is backed by Acrew Capital, Khosla Ventures, Lightspeed Venture Partners, M12, Munich Re Ventures and entrepreneur Shlomo Kramer. www.at-bay.com

About Qumra Capital

Qumra is the first Israeli-based Capital fund to focus on the Israeli late stage market, looking for exceptionally ambitious and visionary teams and businesses. Qumra focuses on highly analytical, data driven companies that can successfully scale to global leadership in their domain and invest in rapidly growing companies with a proven market fit. Portfolio companies include Fiverr, JFrog, Appsflyer, Riskified, Guardicore and JoyTunes. https://qumracapital.com

About M12

M12, Microsoft's venture fund, invests in enterprise software companies primarily in the Series A through C funding stages with a focus on applied AI, business applications, infrastructure, security, and vanguard technologies. As part of its value-add to portfolio companies, M12 offers unique access to strategic go-to-market resources and relationships globally. M12 has offices in San Francisco, Seattle, London, Tel Aviv, and Bengaluru. https://m12.vc