TROY, Mich.--(BUSINESS WIRE)--Despite the strain of reduced access to branch offices, managing a dispersed workforce and administering an historic $669 billion small business loan program in a matter of weeks, U.S. banks have risen to the challenge for small business customers during the pandemic. According to the J.D. Power 2020 U.S. Small Business Banking Satisfaction StudySM, released today, overall small business banking customer satisfaction has climbed to a record high this year. However, while overall performance is strong in this sector, there are some gaps, with the smaller businesses in the study having significantly lower satisfaction scores than their larger small business counterparts.

“The pandemic has created a moment of truth for small business banking customers and, by and large, their banks delivered, generating significantly improved satisfaction for problem resolution, products and fees, reputation and reliability,” said Paul McAdam, senior director of banking and payments intelligence at J.D. Power. “Overall, these banks have delivered when their customers needed them most. But the performance is not balanced across all small business segments. While customer satisfaction among larger small businesses has improved, the smaller businesses in our study—those with annual sales volume below $2.5 million—have seen significant declines in satisfaction. That’s a sign that many banks still need to refine their small business formulas to address this highly diverse market.”

Following are some key findings of the 2020 study:

- Small business banking customer satisfaction reaches record high: Overall satisfaction among small businesses is 822 (on a 1,000-point scale), up two points from 2019. The overall level of trust with their bank among small businesses also improves.

- Not all small businesses created equal: Larger small businesses (those with annual sales of $2.5-$20 million) have a nine-point increase in customer satisfaction in 2020 from 2019, but smaller businesses with annual sales of less than $2.5 million have a five-point decrease in satisfaction from a year ago. These smaller businesses indicate significantly more negative economic and business outlooks, with 19% of such businesses saying they are still temporarily closed.

- PPP plays big role in small business customer satisfaction: Overall, 36% of small business banking customers applied for a Paycheck Protection Program (PPP) loan through their primary bank. Customer satisfaction is significantly higher (838) when the PPP application was approved than when it was declined or still pending approval (796). Additionally, trust, advocacy and retention are significantly higher when customers are satisfied with their bank’s support related to PPP.

- Account managers make a difference: Small business banking customer satisfaction is significantly higher when a dedicated account manager is assigned to the business. Account managers also play a key role in driving satisfaction with PPP loans and overall pandemic response by helping customers resolve problems and address concerns.

Study Rankings

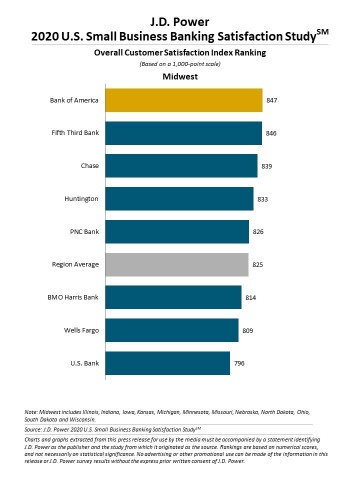

Bank of America ranks highest in the Midwest region with a score of 847, followed by Fifth Third Bank (846) and Chase (839).

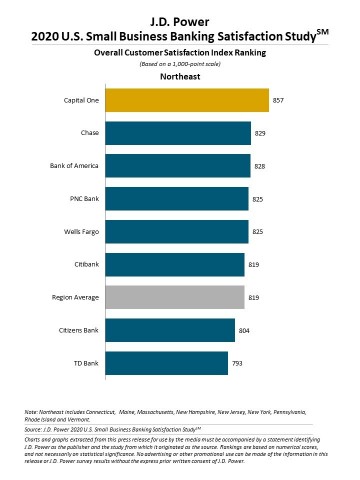

Capital One ranks highest in the Northeast region with a score of 857. Chase (829) ranks second and Bank of America (828) ranks third.

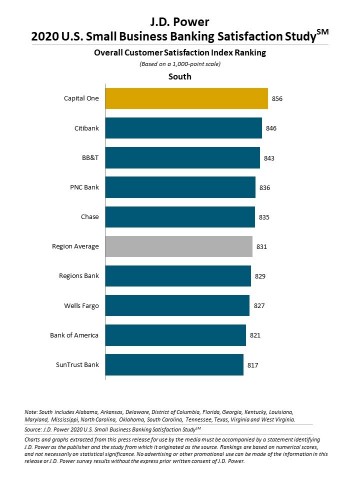

Capital One ranks highest in the South region with a score of 856. Citibank (846) ranks second and BB&T (843) ranks third.

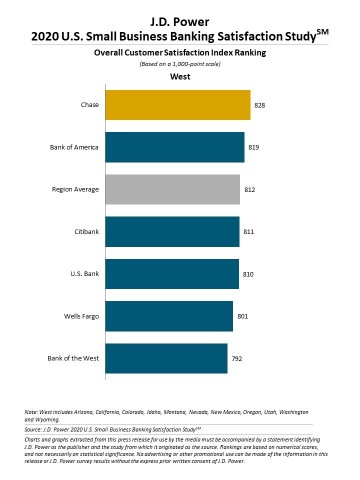

Chase ranks highest in the West region for an eighth consecutive year, with a score of 828. Bank of America (819) ranks second.

The 2020 U.S. Small Business Banking Satisfaction Study includes responses from 7,507 small business owners or financial decision-makers at small businesses that use business banking services. The study was fielded from June through August 2020.

For more information about the U.S. Small Business Banking Satisfaction Study, visit https://www.jdpower.com/resource/us-small-business-banking-satisfaction-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2020142.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power is headquartered in Troy, Mich., and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info