Schroders Global Investor Study 2020: Most Americans Believe They Will Gain More Returns When Invested in Sustainable Funds

Schroders Global Investor Study 2020: Most Americans Believe They Will Gain More Returns When Invested in Sustainable Funds

NEW YORK--(BUSINESS WIRE)--According to Schroders Global Investor Study 2020*, higher returns, rather than just the positive societal and environmental impacts are driving Americans’ adoption of investing in sustainable funds, with 55% of Americans being more likely to invest in sustainable funds for their more attractive return profile. This study of more than 23,000 people who invest from 32 locations globally, including 2,000 in the US, also found that only 4% cited they will not invest in sustainable funds due to a perception that they would offer inferior returns – this is down from 27% in 2018.

Marc Brookman, CEO of Schroders North America, said:

“It is exciting to see the sustainable investment conversation move from values, to value-creation. US investors are increasingly convinced that there is no trade-off between performance and sustainable investing and in fact, many social issues will be a driver of returns, today and in the future. 2020 has brought human capital management and diversity into the limelight and our award-winning impact measurement tools such as SustainEx, allows us to quantify the social and environmental impacts of our investments as we help clients meeting their needs and objectives.”

Sarah Bratton Hughes, Head of Sustainability – North America, Schroders, added:

“Last year marked a turning point where we first saw greater interest in sustainable investing across generations, with Gen X outpacing Millennials. While we have long-believed that systematically integrating sustainable investment principles into our investment process will lead to better long-term risk-adjusted returns, 2020 has proven a turning point that the evidence is increasingly clear that investing sustainably could lead to better long-term outcomes.

Throughout 2020 the COVID-19 pandemic, supply chain disruption, social unrest around inequalities and damage resulting from climate change has proven a company’s ability to manage all their stakeholders is key to their long-term success – we call this trend ‘corporate karma.’”

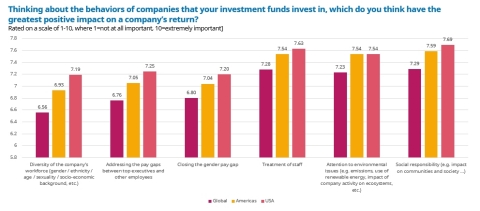

While climate change is still high on the agenda, social issues, particularly human capital management and the treatment of workers are at the top of American’s concerns regarding corporate behavior. According to the survey results, attention to environmental issues is third likely to drive a company’s performance (7.54), while D&I was last at 7.19 and addressing pay gaps between top execs and other employees (7.25) and then closing the gender pay gap (7.20). On a scale of 1 to 10, with 10 being extremely important, the two key factors that ranked the highest for Americans were social responsibility at 7.69 and treatment of staff at 7.63.

Communication and education are key to adoption. Just two years ago, 57% of Americans cited that they lacked adequate information around sustainable investing. In contrast, today, 53% of American financial advisors are providing information on sustainable investing almost every time they speak to their clients. This is significantly higher than the global average of 33%.

To find out more about Schroders Global Investor Study 2020 and read the full report, please click here.

*In April 2020, Schroders commissioned an independent online survey of over 23,000 people who invest from 32 locations around the globe. This spanned countries across Europe, Asia, the Americas and more. This research defines people as those who will be investing at least $10,000 (or the equivalent) in the next 12 months and who have made changes to their investments within the last 10 years.

Note to Editors

Schroders plc

As a global investment manager, we actively and responsibly manage investments for a wide range of institutions and individuals, to help them meet their financial goals and prepare for the future. The world is forever changing, and with our clients at the centre of everything we do, we understand the need to continue to adapt and evolve our business in line with what matters most to our clients today, and in the future.

Our ongoing success is built on a history of experience and expertise, whereby we partner with our clients to construct innovative products and solutions across our five business areas consisting of Private Assets & Alternatives, Solutions, Mutual Funds, Institutional and Wealth Management and invest in a wide range of assets and geographies. By combining our commitment to active management and focus on sustainability, our strategic capabilities are designed to deliver positive outcomes for our clients.

We are responsible for $649.6 billion* assets of our clients, managed locally by 42 investment teams worldwide. As a global business with over 5,000 talented staff across 35 locations, we are able to stay close to our clients and understand their needs. We have over 200 years of experience in investment and innovation and remain committed to creating a better future by investing responsibly for our clients.

Further information about Schroders can be found at www.schroders.com/us.

Important Information:

The views and opinions stated are those of the individuals quoted and are subject to change. This document does not purport to provide investment advice and the information contained is for informational purposes and not to engage in any trading activities. Any proprietary analytical Environmental Social Governance (ESG) tools mentioned, such as SustainEx, are designed to enhance the research process but do not guarantee favourable results. Schroder Investment Management North America Inc. (“SIMNA”) is an SEC registered investment adviser providing asset management products and services to clients in the US and Canada. Schroder Fund Advisors LLC (“SFA”) is a wholly-owned subsidiary of SIMNA Inc. and is registered as a limited purpose broker-dealer with FINRA and markets certain investment vehicles for which SIMNA Inc. is an investment adviser. SIMNA Inc. and SFA are indirect wholly-owned subsidiaries of Schroders plc, a UK public company with shares listed on the London Stock Exchange. Further information about Schroders can be found at www.schroders.com/us or by calling (212) 641-3800.

*as of June 30, 2020

Contacts

Jennifer Manser, Head of Marketing & Communications, Americas

212-632-2947

Jennifer.Manser@schroders.com

Prosek Partners

Sarah Levine - 646.818.9289

Pro-schroders@prosek.com