Oomnitza Partners with Shasta Ventures and Riverside Acceleration Capital in Latest Round of Funding

Oomnitza Partners with Shasta Ventures and Riverside Acceleration Capital in Latest Round of Funding

Investment during a global pandemic emphasizes the value of an integrated IT asset management solution in the current work-from-home industry transition

SAN FRANCISCO--(BUSINESS WIRE)--Oomnitza, one of the leading technology solutions that delivers a platform to secure and manage a corporation’s digital estate, announced it has completed its Series B institutional funding round of $12.5 million, led by Shasta Ventures and Riverside Acceleration Capital (RAC). More than 130 enterprise and Fortune 500 customers across a range of industries already rely on Oomnitza’s holistic approach to managing and securing IT infrastructure.

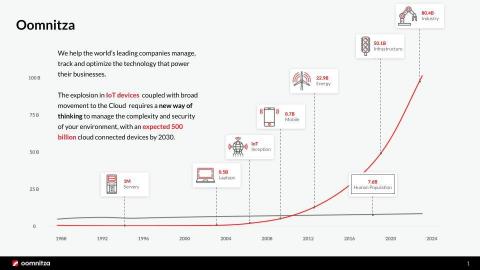

Oomnitza helps customers manage their rapidly evolving IT infrastructure by addressing critical requirements for security, compliance, procurement and employee experience. The Oomnitza platform can secure, operate and oversee an enterprise’s complete digital estate. It is the one technology which can deliver this comprehensive and integrated view of critical IT infrastructure, and as a result, provides the fastest time to value in the enterprise to date.

“We are seeing accelerated digital transformation in organizations adapting to a new normal,” said Arthur Lozinski, CEO and Co-Founder of Oomnitza. “We are fortunate to have capital partners who understand those customer trends. During this proliferation of digital technology, companies are valuing the scale and robustness that Oomnitza provides.”

Digitalization requires a new way of thinking about security and compliance. Oomnitza’s SaaS-based platform helps customers quickly and easily leverage the systems in their environment to automate manual processes.

“Customers love Oomnitza’s breakout technology to solve complex challenges of managing IT infrastructure,” said Nitin Chopra, Partner, Shasta Ventures. “Arthur and his team have created a fast growing and operationally brilliant organization. Oomnitza is positioned to become the cornerstone solution in every enterprise’s IT infrastructure.”

Oomnitza’s platform provides the security and operational tools to manage the entire corporate digital estate, including the end-user hardware, installed / SaaS software, networking infrastructure, virtual cloud services, retail devices, healthcare machines and a broad variety of IT assets.

“We are excited to support Oomnitza during this important time as the team expands its solutions portfolio and customer base,” said Jonathan Drillings, Partner, Riverside Acceleration Capital. “As a SaaS platform, Oomnitza’s architecture already took advantage of the key benefits of the cloud, to deliver a modern, effective approach to asset management. In today’s work environment, where so many businesses are operating virtually, this approach becomes even more valuable. IT teams need help figuring out logistics for thousands of home offices, versus the traditional centralized office we were so accustomed to. Oomnitza’s technology is helping their customers manage through the current work environment, and should continue to do so, no matter what shape it takes going forward.”

Oomnitza delivers the IT industry’s most comprehensive and integrated view of the IT estate, correlating assets with people across the entire asset lifecycle, delivering value across a broad range of industries and process requirements. Oomnitza is headquartered in San Francisco. For more information, visit www.oomnitza.com.

Shasta Ventures puts entrepreneurs first. A leading early-stage venture capital firm, Shasta partners with bold creative entrepreneurs who are passionate about building great products that deliver amazing work experiences. Founded in 2004, Shasta Ventures has more than $1B under management and specializes in enterprise software start-ups. Our portfolio features Anaplan, Appsheet, Apptio, Glint, Zuora and many promising start-ups. Find out more at www.shastaventures.com.

About Riverside Acceleration Capital

Riverside Acceleration Capital (RAC) provides flexible growth capital to expansion-stage B2B software and technology companies, through an investment structure that maximizes alignment while minimizing dilution. RAC is part of The Riverside Company, a global private equity firm focused on investing in growing businesses valued at up to $400 million. Since its founding in 1988, Riverside has made more than 650 investments. The firm's international private equity and structured capital portfolios include more than 100 companies. For more information, visit www.riverside.ac.

Contacts

Regina Parundik

m: 412.559.1614

e: regina@cobblecreative.com