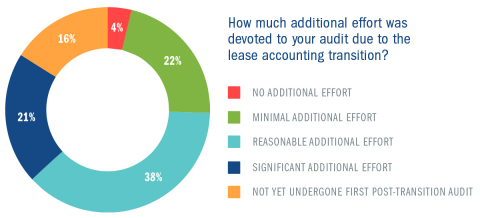

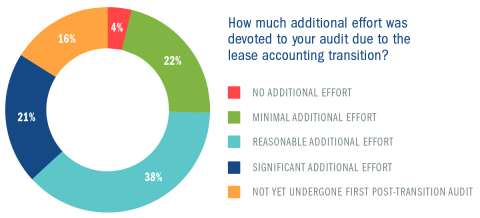

ATLANTA--(BUSINESS WIRE)--The first audits completed under the landmark new lease accounting standard are in, and companies say they were a struggle. In fact, half of public companies that have completed their first post-transition audit under the new lease rules report additional effort was needed for the process, according to a LeaseQuery survey. However, the process is yielding benefits for companies in terms of providing greater transparency for lease modification and uncovering critical cash flow during the COVID-19 crisis.

A new survey of 240 accountants from lease accounting technology provider, LeaseQuery, conducted in partnership with Encoursa, Post-Transition Lease Audit Playbook: What Companies Need to Know to Prepare, provides insights into the obstacles faced before, during and after the audit. Takeaways are two-fold with lessons learned for public company peers, as well as constructive advice for private companies and nonprofits transitioning to the new accounting standards ASC 842 and IFRS 16.

“Although the extension for lease accounting compliance by the FASB and GASB was welcome news for private and governmental organizations in the wake of the pandemic, deadlines are still on the horizon,” said Jennifer Booth, VP of Accounting at LeaseQuery. “The challenge of a post-transition audit is looming for many private companies and has been vastly underestimated. This massive undertaking coupled with financial pressures due to COVID-19 have created a crucial need for better capital management including transparency into leases to maximize cash flow and liquidity.”

Key survey findings also include:

● Audit Unlocks Financial Insights. While the post-transition audit process was a challenge, accountants say they identified more cash flow opportunities and enhanced data transparency. More than half of public companies (58%) discovered embedded leases during their post-transition audit preparation, and 26% updated their internal controls for lease terminations and modifications. Better visibility into business data and a holistic view of leases can provide substantial advantages for businesses looking to renegotiate terms during the pandemic.

● Auditors are Essential. Auditors can play a critical role in transitioning to the new standard effectively, but companies should do more to open up communication and collaboration. While two-thirds of respondents say their auditors have full access to the organizations’ lease accounting solution, 44% say their auditor had no involvement in the transition process. Just 20% of organizations had auditors who set up planning meetings prior to the first audit, and only 18% of companies reported having auditors who guided them through the lease accounting transition.

● SOC Reports are Vital in Examining Internal Controls. Private companies and nonprofits should follow the advice of 53% of companies who chose a software solution backed by a SOC report, which can significantly reduce the required testing performed by the company and auditors to complete their audit.

● Take Advantage of Technology. While the survey found 50% of respondents leveraged lease software to prepare for and complete the audit, 38% used Excel or another spreadsheet program. Those who originally thought Excel would do the trick for minimal lease changes are now facing difficulties accurately accounting for numerous leases being renegotiated due to COVID-19. This clearly highlights the need for a more sophisticated lease accounting and compliance tool that can provide real-time insights for better decision making.

For more information, read the full report: Post-Transition Lease Audit Playbook: What Companies Need to Know to Prepare

About the Survey

LeaseQuery’s report, Post-Transition Lease Audit Playbook: What Companies Need to Know to Prepare, is based on a survey conducted in partnership with Encoursa, of 240 accountants, 100 of which have completed their organizations’ first audit following the transition to the FASB ASC 842 and IFRS 16 lease accounting standards.

About LeaseQuery

LeaseQuery helps more than 10,000 accountants and other finance professionals eliminate lease accounting errors through its CPA-approved lease accounting software. It is the first lease accounting software built by accountants for accountants. By providing specialized consulting services in addition to its software solution, LeaseQuery facilitates compliance with the most comprehensive regulatory reform in 40 years for companies across all sectors.

About Encoursa

Encoursa provides quality continuing professional education to CPAs. Encoursa hosts NASBA-accredited CPE webinars for growth-oriented professionals looking for high-quality, affordable continuing education. To do this, Encoursa partners with leading companies who choose to present their solutions to CPAs and finance professionals in a live, educational format. Encoursa also features presenters who speak on topics such as ethics and financial statement preparation. Visit encoursa.com to learn more.