NEW YORK--(BUSINESS WIRE)--Large shipping losses are at a record low having fallen by more than 20% year-on-year, according to marine insurer Allianz Global Corporate & Specialty SE’s (AGCS) Safety & Shipping Review 2020. However, the coronavirus crisis could endanger the long-term safety improvements in the shipping industry for 2020 and beyond, as difficult operating conditions and a sharp economic downturn present a unique set of challenges.

“Coronavirus has struck at a difficult time for the maritime industry as it seeks to reduce its emissions, navigates issues such as climate change, political risks and piracy, and deals with ongoing problems such as fires on vessels,” says Baptiste Ossena, Global Product Leader Hull Insurance, AGCS. “Now the sector also faces the task of operating in a very different world with the uncertain public health and economic implications of the pandemic.”

The annual AGCS study analyzes reported shipping losses over 100 gross tons (GT) and also identifies 10 challenges of the coronavirus crisis for the shipping industry, which could impact safety and risk management.

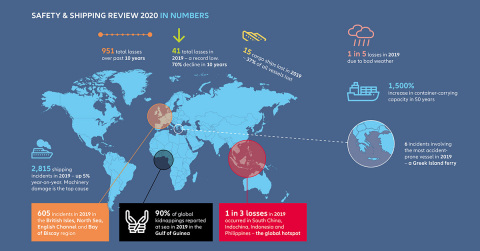

In 2019, 41 total losses of vessels were reported around the world, down from 53 one year earlier. This represents an approximate 70% decline over 10 years and is a result of sustained efforts in the areas of regulation, training and technological advancement, among others. More than 950 shipping losses have been reported since the start of 2010.

Coronavirus challenges

The shipping industry has continued to operate through the pandemic, despite disruption at ports and to crew changes. While any reduction in sailings due to coronavirus restrictions could see loss activity fall in the interim, the report highlights 10 challenges that could heighten risks. Among these are:

- The inability to change crews is impacting the welfare of sailors, which could lead to an increase in human error on board vessels.

- Disruption of essential maintenance and servicing heightens the risk of machinery damage, which is already one of the major causes of insurance claims.

- Reduced or delayed statutory surveys and port inspections could lead to unsafe practices or defective equipment being undetected.

- Cargo damage and delay are likely as supply chains come under strain.

- The ability to respond quickly to an emergency could also be compromised with consequences for major incidents, which are dependent on external support.

- The growing number of cruise ships and oil tankers in lay-up around the world pose significant financial exposures, due to the potential threat from extreme weather, piracy or political risks.

“Ship-owners also face additional cost pressures from a downturn in the economy and trade,” says Captain Rahul Khanna, Global Head of Marine Risk Consulting at AGCS. “We know from past downturns that crew and maintenance budgets are among the first areas that can be cut and this can impact the safe operations of vessels and machinery, potentially causing damage or breakdown, which in turn can lead to groundings or collisions. It is crucial that safety and maintenance standards are not impacted by any downturn.”

Top loss locations and most affected ships

According to the report, the South China, Indochina, Indonesia and Philippines maritime region remains the top loss location with 12 vessels in 2019 and 228 vessels over the past decade – one in four of all losses. High levels of trade, busy shipping lanes, older fleets, typhoon exposure, and safety issues on some domestic ferry routes are contributing factors. However, in 2019, losses declined for the second successive year. The Gulf of Mexico (4) and the West African Coast (3) rank second and third.

Cargo ships (15) accounted for more than a third of vessels lost in the past year, while foundered (sunk/submerged) was the main cause of all total losses, accounting for three in four (31). Bad weather accounted for one in five losses. Issues with car carriers and roll-on/roll-off (ro-ro) vessels remain among the biggest safety issues. Total losses involving ro-ros are up year-on-year, as well as smaller incidents (up by 20%) – a trend continuing through 2020.

Number of smaller shipping incidents on the rise

While total losses continue to see a positive trend, the number of reported shipping incidents (2,815) increased by 5% year-on-year, driven by machinery damage, which caused over one in three incidents (1,044). A rise in incidents in the waters of the British Isles, North Sea, English Channel and Bay of Biscay (605), meant it replaced the East Mediterranean as the top hotspot for the first time since 2011, accounting for one in five incidents worldwide.

There were almost 200 reported fires on vessels over the past year, up 13%, with five total losses in 2019 alone. Mis-declared cargo is a major cause. Taking steps to address this issue is vital as it will only worsen as vessels become bigger and the range of goods transported grows. Chemicals and batteries are increasingly shipped in containers and pose a serious fire risk if they are mis-declared or wrongly stowed.

Geopolitical tensions and cyber impact shipping safety

Meanwhile, events in the Gulf of Oman and the South China Sea show political rivalries are increasingly being played out on the high seas and shipping will continue to be drawn into geopolitical disputes. Heightened political risk and unrest globally has implications for shipping, such as the ability to secure crews and access ports safely. In addition, piracy remains a major threat with the Gulf of Guinea re-emerging as the global hotspot. Latin America is seeing armed robbery increase and there is renewed activity in the Singapore Strait.

Ship-owners are also increasingly concerned about the prospect of cyber-conflicts. There has been a growing number of GPS spoofing attacks on ships, particularly in the Middle East and China, while there have been reports of a 400% increase in attempted cyber-attacks on the maritime sector since the coronavirus outbreak.

Other risk topics in the AGCS Safety & Shipping Review include:

- Targets to cut emissions will shape shipping risk for years to come. The aim to halve CO2 emissions by 2050 will require the industry to radically change fuels, engine technology and even vessel design. Progress on addressing climate change could stall with the focus on the coronavirus pandemic. This must not be allowed to happen.

- New technology not a panacea, but an increasingly useful tool: Shipping tech can be positive for safety and claims and is increasingly being deployed to combat some of the risks highlighted in the report – from reducing the threat of fire on vessels through temperature monitoring of cargo to integrating suppression systems in drones in the future. Increased use of industrial control systems to monitor and maintain engines could significantly reduce machinery damage and breakdown incidents, one of the biggest causes of claims.

- Unluckiest ships – The most accident-prone vessels of the last year were two Greek Island ferries and a bulk carrier in North America, all involved in six different incidents.

About Allianz Global Corporate & Specialty

Allianz Global Corporate & Specialty (AGCS) is a leading global corporate insurance carrier and a key business unit of Allianz Group. We provide risk consultancy, Property-Casualty insurance solutions and alternative risk transfer for a wide spectrum of commercial, corporate and specialty risks across 10 dedicated lines of business.

Our customers are as diverse as business can be, ranging from Fortune Global 500 companies to small businesses, and private individuals. Among them are not only the world’s largest consumer brands, tech companies and the global aviation and shipping industry, but also wineries, satellite operators or Hollywood film productions. They all look to AGCS for smart answers to their largest and most complex risks in a dynamic, multinational business environment and trust us to deliver an outstanding claims experience.

Worldwide, AGCS operates with its own teams in 32 countries and through the Allianz Group network and partners in over 200 countries and territories, employing over 4,450 people. As one of the largest Property-Casualty units of Allianz Group, we are backed by strong and stable financial ratings. In 2019, AGCS generated a total of €9.1 billion gross premium globally.

For more information please visit http://www.agcs.allianz.com/ or follow us on Twitter @AGCS_Insurance and LinkedIn.

Cautionary Note Regarding Forward-Looking Statements