LONDON--(BUSINESS WIRE)--Quantzig, a global data analytics and advisory firm, that delivers actionable analytics solutions to resolve complex business problems has announced the completion of its recent engagement- Customer Segmentation: Improving Customer Retention Rate in Asian Market.

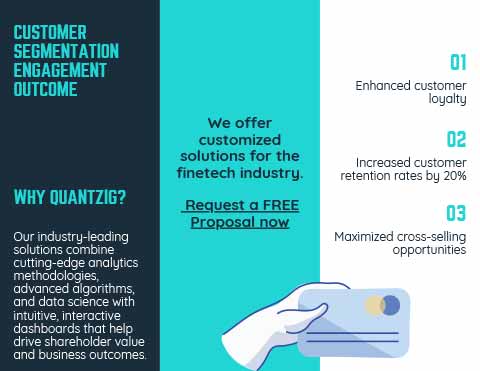

The case study aligns perfectly with Quantzig’s commitment to helping its clients transform business processes using data and analytical insights. It also offers comprehensive insights into:

- The role of customer segmentation in enhancing customer loyalty

- The benefits of customer segmentation

- The challenges facing the fintech industry in 2020

Request a FREE proposal to better understand the scope of our success story and gain comprehensive insights into the business benefits of customer segmentation.

According to Quantzig’s customer segmentation analytics experts, “Customer segmentation relies on identifying key differentiators that divide customers into groups that can be targeted.”

The fintech companies mostly leverage computer programs and other technologies to support financial and banking services. Broadly, fintech is defined as a technological innovation in financial services. Companies functioning in the fintech industry exist in the market to provide and improve the existing financial and banking infrastructure. The breakthrough moment for the fintech industry was the disruption of global financial services. Major fintech industry players originated around that period to give a financial boost to other businesses and individuals by leveraging advanced technical solutions. The client in this study, is an American company with operations around the world. The client was looking forward to understanding the customer segments in the Asian market and segregating the customer in terms of need-based and value-based models.

Speak to our analytics experts to learn how customer segmentation and profiling solutions can help fintech industry players to drive profitable outcomes using a new marketing plan.

Customer Segmentation: Business Outcome

1: Enhanced customer loyalty

2: Increased customer retention rates by 20%

3: Maximized cross-selling opportunities

Request a free demo to gain comprehensive insights into our customer segmentation solutions portfolio for the fintech industry.

Customer segmentation helps organizations in the fintech industry to classify customers into measurable segments based on customer needs, behavior, and preferences. The use of advanced analytics methodologies also enables FinTech companies to determine the profit potential of every customer segment by leveraging a data-driven customer segmentation strategy. Furthermore, customer segmentation analytics enables them to allocate their marketing budget as per the customer segment to stay ahead of their competitors.

About Quantzig

Quantzig is a global analytics and advisory firm with offices in the US, UK, Canada, China, and India. For more than 15 years, we have assisted our clients across the globe with end-to-end data modeling capabilities to leverage analytics for prudent decision making. Today, our firm consists of 120+ clients, including 45 Fortune 500 companies. For more information on our engagement policies and pricing plans, visit: https://www.quantzig.com/request-for-proposal