CipherTrace Research Finds Insider Frauds Skyrocketed in 2019 Contributing to Total Crypto-Crime Losses of $4.5 Billion

CipherTrace Research Finds Insider Frauds Skyrocketed in 2019 Contributing to Total Crypto-Crime Losses of $4.5 Billion

Banking Intertwined with Crypto-Assets and 66 Percent of Dark Market Vendors Selling Stolen Financial Products

Snapshot of Key Trends and CipherTrace Research:

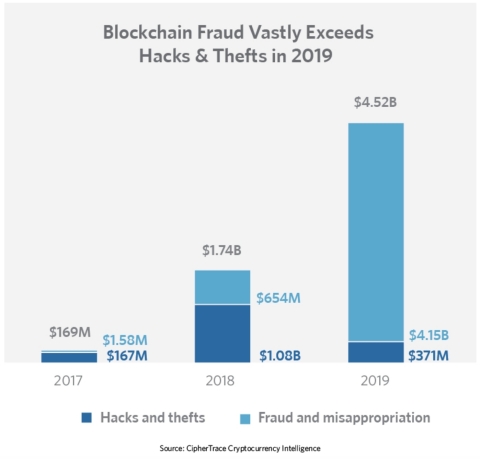

- Cryptocurrency-related thefts and hacks drop year over year to $370.7 million

- Losses stemming from fraud and misappropriation of funds jump 533 Percent to $4.1 billion

- European Crypto-Fiat exchanges must now comply with AMLD5

- Enforcement of FATF and BSA funds “Travel Rules” has virtual asset service providers scrambling for feasible ways to comply

MENLO PARK, Calif.--(BUSINESS WIRE)--CipherTrace, the leader in cryptocurrency intelligence for enabling the blockchain economy, today released its Q4 2019 Cryptocurrency Anti-Money Laundering Report. Among key research findings, CipherTrace discovered that cryptocurrency users, exchanges and investors suffered $4.5 billion in crypto-related losses resulting from thefts, hacks, and fraud. The lion’s share of those losses stem from the staggering growth of Ponzi schemes, exit scams, and misappropriation of funds crimes, the value of which rose 533 percent year over year.

CipherTrace Labs also revealed traditional financial services have become increasingly infused with crypto assets. For instance, results of an extensive analysis of the blockchain found almost all U.S. banks harbor illicit virtual asset related money service businesses (MSBs), including cryptocurrency exchanges. Of additional concern for banks, 66 percent of dark market vendors sell stolen financial products and compromised accounts for cryptocurrency. And virtually all (97 percent) of ransomware attacks use bitcoin as the payment rail.

“Our research revealed some surprising trends in 2019,” said David Jevans, CEO of CipherTrace. “First, there was a dramatic shift away from outright thefts and exchange hacks and toward Ponzi schemes, exit scams, and other con games. Second, like them or not, banks have a lot more virtual assets lurking in their accounts and payment networks than most in the industry had previously thought. Banks need new capabilities to ferret out illicit MSBs, terrorist financing, and other major sources of risk.”

The report also provides an overview of regulatory moves throughout the world. This includes a comprehensive chart of anti-money laundering (AML) regulations by country, an update on the respective blockchain-related enforcement authority of the SEC, FinCEN, and the CFTC, and detailed reports on major regulatory and eCrime developments in various countries.

Trends in Theft, Fraud, Hacks and Misappropriation of Funds:

Crypto criminals had a banner year in 2019. According to CipherTrace Labs, total cryptocurrency crime increased 160 percent from 2018. However, as the report suggests, if 2019 had a Person of the Year, it would have been The Malicious Insider. The culprits behind most of the losses were fraudsters operating inside everything from seemingly legitimate blockchain projects that were actually exit scams to crypto Ponzi and pyramid schemes. Ultimately, all that $4.5B worth of illicit cryptocurrency needs to be laundered.

Crypto-Asset Blind Spots Expose Banks to Risk

CipherTrace Labs research also found that the typical top 10 U.S. bank unknowingly facilitates approximately $2 billion in illicit cryptocurrency transactions each year. In its report, CipherTrace affirmed that stealth MSBs using accounts and payment networks expose financial institutions to significant AML and counter terrorism financing (CTF) compliance risk.

Further research revealed banks paid record AML fines globally in 2019—more than $6.2 billion. This number could increase in 2020 as crypto-related money laundering and sanction evasion enforcement ramps up.

“As crypto-assets become increasingly entangled in traditional financial services, AML and CTF compliance risks are on the rise,” said Stephen Ryan, COO of CipherTrace. “Virtual assets are now pervasive in bank accounts and payment networks, and banks must find ways to deal with the risks. Effectively mitigating cryptocurrency risks requires equipping compliance officers with the best tools and intelligence to gain visibility into this new asset class.”

Darknet Markets:

The CipherTrace report also outlined a multi-year research project into darknet markets and other illicit vendors, which revealed that of dark market vendors:

- 40 percent hawked compromised bank account or credit card credentials for as little as 1 percent of face value

- 24 percent offered compromised payment services accounts

- 2 percent sold stolen cryptocurrency private keys

These findings further highlighted the issues banks and financial institutions face with regards to payment fraud and virtual asset laundering risks.

The research also showed that bitcoin is the payment of choice for cyber extortionists. During the last year, they demanded BTC as payment in 97 percent of ransomware attacks. All of this extorted bitcoin will need to be laundered before criminals can use the funds.

2020 Will Be a Year of Intense Regulatory Changes

In its overview of 2019 regulation, CipherTrace chronicles many new rules from international financial authorities, as well as proposed guidelines currently under debate. The research team identified varying levels of maturity and sophistication in AML/CTF regimes around the globe. For instance, AMLD5 went into effect across the European Union early January regulating crypto-fiat exchanges for the first time in most EU countries.

Additionally, CipherTrace described urgency among its customers and industry players around pending FATF Travel Rule legislation. Exchanges and financial institutions in the G20 have less than six months to find a solution for dealing with this major compliance conundrum—how to comply with the requirement to share sender and receiver information before executing cryptocurrency transactions, while protecting confidentiality. In the US, financial institutions including virtual asset service providers (VASPs) have been reminded by FinCEN that they must meet their funds Travel Rule obligations under the BSA or face enforcement actions.

About CipherTrace

CipherTrace enables the blockchain economy. The company’s mission includes protecting financial institutions from compliance risks and making it easier for them to serve trusted crypto asset business customers. The world’s leading cryptocurrency intelligence also streamlines AML compliance for cryptocurrency exchanges and keeps bad actors off exchanges and other virtual asset service providers. Monitoring solutions help to grow the crypto ecosystem by making virtual assets safe and accepted by governments. And the world’s best blockchain forensics tools speed investigations of eCrimes.

The company was founded in 2015 by experienced Silicon Valley entrepreneurs with deep expertise in cybersecurity, eCrime, payments, banking, encryption, and virtual currencies. The US Department of Homeland Security Science and Technology (S&T) and DARPA initially funded CipherTrace. For more information, visit www.CipherTrace.com or follow us on Twitter @CipherTrace.

Contacts

John Jefferies, CipherTrace Chief Financial Analyst

media@ciphertrace.com

650-542-0200