Fidelity® Study: Having the Right Roadmap Can Reduce the Financial Stress of Divorce, Although 75% of Divorcees Admit to Simply Figuring Things out Financially as They Went Along

Fidelity® Study: Having the Right Roadmap Can Reduce the Financial Stress of Divorce, Although 75% of Divorcees Admit to Simply Figuring Things out Financially as They Went Along

- Sharing Financial Responsibilities During Marriage can Help Make You Financially Stronger

- More Than One Third of Divorcees Haven’t Fully Recovered Financially Five Years After Saying “I Don’t”

- Fidelity Launches New Online Experience to Help People Navigate all Aspects of Divorce and Other Key Life Moments

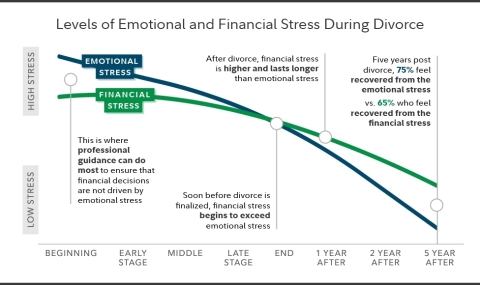

BOSTON--(BUSINESS WIRE)--Which is going to hurt more during a divorce—the emotional or financial aspects? According to Fidelity Investments®’ Divorce and Money study, which examines the financial and emotional well-being of Americans who have gone through a divorce, it depends where they are in the process. For most people, the emotional aspects feel most difficult to deal with up-front: 56% identified the emotional aspects as “very stressful” at the beginning, versus 43% who said the same about the financial aspects. However, once the divorce decree is signed, the game changes and financial stress becomes greater and longer-lasting—with more than one third of respondents (35%) saying five years post-divorce, they have yet to fully financially recover.

To help people planning for, or currently experiencing, a divorce navigate more smoothly through what can be a difficult time in their lives, Fidelity has introduced an online experience as one component of its newly-introduced Life Events offering. The ‘Getting Divorced’ experience is designed to help people untangle an often complex process, from assessing one’s situation and building a professional team, to negotiating terms and rebuilding one’s life.

“When it comes to recovering from divorce, the good news is, it’s possible to get through it and actually be in better shape both financially and emotionally than when you started,” said Meredith Stoddard, experience lead, Life Event Planning at Fidelity Investments. “Going through a divorce can bring up a wide range of emotions – such as sadness, fear, anxiety or relief. With so much at stake, most people look back and wish they had more guidance. What the research shows is that the key is to get involved and stay involved in the finances.”

Gender seems to play a role in when that “tipping point” occurs between emotional and financial stress. For women, financial stress begins to exceed emotional stress shortly after the divorce is finalized. For men, it’s right before the divorce is finalized. The Divorce and Money study also reveals the following:

- 46% say they were surprised how hard the process was emotionally. For those with children, it’s slightly higher (47%).

- 56% of respondents say smaller, less important details were sometimes harder to work out than the bigger things.

- On that note, almost four in ten (39%) say deciding who was going to get the pets was one of the hardest things to deal with emotionally—making it one of the top answers, along with working out alimony (40%) or childcare responsibilities (58%).

Can anything be done to help improve one’s chances for a better outcome when it comes to the uncoupling process, at least, financially? The survey findings suggest when it comes to money matters, the key to a “successful” divorce is identical to that of a “successful” marriage: mutual engagement. During the marriage, it’s important for both parties to have at least some involvement in most aspects of the finances, both short- and long-term; just as importantly, during the divorce process, it can benefit both partners to do their research, formulate a strategy and stay involved at all points. Those who do so tend to take less time rebounding financially.

During the Marriage, Don’t be a Financial Bystander

Being financial partners with your spouse may not save your marriage, but it could better prepare you to handle a divorce and rebound more quickly. The good news is that most divorced people report having been involved in the day-to-day finances during their marriage (83% men; 85% women). However, it’s a different story when it comes to long-term and retirement investing: for this aspect, while 82% of men report being involved, only 60% of women say the same. The research shows it’s far more difficult to recover if you’ve allowed your partner to have complete control over the finances throughout married life—and that there are definite advantages to being completely engaged in all aspects of the finances.

During the Divorce Process, Avoid the Temptation to “Wing It”

Divorce is a complex process in so many ways—emotionally, financially and legally. And yet, three-quarters of respondents (75%) say they simply “figured things out as they went along” instead of using online or print resources to help map out a plan. Furthermore, 66% found it hard to ask for help or support. Surprisingly, these numbers only grow larger the longer couples were married: 83% of older couples married more than 21 years were more inclined to wing it, even though the length of time together would suggest they probably have more complex financial needs.

Despite this, most people (65% men, 79% women) would have found a roadmap to get through the divorce valuable. It’s easy to see why, because the survey suggests the upside of moving forward with a plan tends to be there are more positive financial outcomes and fewer surprises.

New Chapters, New Opportunities: the Keys to Working through the Divorce Process

The silver lining from the study? Even though it may seem overwhelming, once the divorce has been worked through, for many, there can be a happy ending. In fact, the vast majority of respondents report they have recovered both emotionally and financially from their divorce experience. Further, most say they are now in better shape financially (58%) and emotionally (78%) than they were when getting divorced.

An important key to success is to stay as level-headed and realistic as possible throughout the process. To help level set, Fidelity suggests the following first steps:

- Get a clear understanding of your financial situation. A comprehensive picture of your assets and liabilities can help with negotiating and build a new budget.

- Choose a legal path compatible with your interests and situation. DIY, mediator, attorney, or a hybrid approach.

- Gather documents to get the legal process rolling. Tax returns, pay stubs, bank statements, investment and retirement account statements, car registrations, and insurance policies.

- Engage a support network. Trusted friends, family and even a professional counselor – someone who can help you evaluate options and think straight about big decisions.

Fidelity Offers Guidance, Resources on How to Make the Divorce Process Less Stressful

For those who have been through the experience and feel badly about making mistakes, it may be comforting to know, they’re not alone. In fact, it’s a fairly common feeling, since more than half (54%) of respondents acknowledge making financial mistakes during their divorce. The respondents also have suggestions on how to make the process less stressful.

- Avoid making hasty decisions simply to gee the divorce over with.

- Try to keep your emotions out of the financial discussions.

- Have a financial plan for moving forward after divorce is over.

- Know your full financial picture before the divorce process.

For those looking for help at any point in the divorce process, Fidelity has resources, tools and the guidance to help sort through things where and when you need it – whether it’s a roadmap from end to end, the ability to dive into a topic to get trusted insights and actionable next steps, or a chance to look ahead and learn what to expect. They include:

- Fidelity’s new Life Events offering, an online experience designed to help people plan for, anticipate and react to major moments that happen in their lives—where and when they need it.

- The new ‘Getting Divorced’ experience is designed to help individuals planning for, or currently experiencing, a divorce navigate what can be a difficult time in their lives – from assessing your situation and finding your professional team, to negotiating terms and rebuilding your life. Some helpful material: a divorce document checklist, suggestions on how to assemble a team of experts and various Viewpoints articles providing additional insights.

- In-person guidance at Fidelity’s 197 nationwide investor centers or by calling 800-FIDELITY.

About the Fidelity Investments Divorce and Money Study

This study presents findings from a nationwide survey of 1,107 Americans, ages 25 to 75, who had divorced within the past six months to 10 years. The survey was fielded in October 2019 by Versta Research, an independent research firm not affiliated with Fidelity Investments. The results of this survey may not be representative of all adults meeting the same criteria as those surveyed for this study. For additional findings from the study, a Fact Sheet can be found on Fidelity.com.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $8.2 trillion, including discretionary assets of $3.1 trillion as of November 30, 2019, we focus on meeting the unique needs of a diverse set of customers: helping more than 30 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 financial advisory firms with investment and technology solutions to invest their own clients’ money. Privately held for more than 70 years, Fidelity employs more than 40,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit www.fidelity.com/about.

Fidelity Investments and Fidelity are registered service marks of FMR LLC.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

912443.1.0

© 2020 FMR LLC. All rights reserved.

Contacts

Contact for Media Only:

Corporate Communications

(617) 563-5800

fidelitycorporateaffairs@fmr.com

Ted Mitchell

(401) 292-3084

ted.mitchell@fmr.com

Follow us on Twitter @FidelityNews