SAN FRANCISCO--(BUSINESS WIRE)--Charles Schwab today announced the upcoming launch of Schwab Intelligent Income, an income solution designed for people who want a simple, modern way to pay themselves in retirement, or any other time, from their investment portfolios. Schwab Intelligent Income will help answer critical and often complex income-related questions about how much to withdraw, how to invest based on individual goals and time horizon, and how to withdraw from a combination of taxable, non-taxable, and Roth accounts in a tax-smart and efficient way. Schwab Intelligent Income is expected to launch in January 2020.

“The transition from diligent saving and investing to creating steady income from that portfolio can be overwhelming,” says Jonathan Craig, Charles Schwab senior executive vice president and head of Investor Services. “Most services aimed at creating income for clients come with high costs, lack of flexibility, and long-term commitments. Schwab Intelligent Income solves the complexity of doing it on your own and removes the friction inherent in other income services by providing a flexible, low cost, and smart way to generate a predictable paycheck from your portfolio.”

Managing Income Needs

While Schwab Intelligent Income can help investors with a range of short- and long-term income goals, it will meet a significant need for the millions of people planning to retire who view the process of managing income as complicated and cumbersome. According to new Schwab research, people within five years of retirement are overwhelmed by:

- Running out of money in retirement (72%)

- Determining how much they can spend in retirement (57%)

- Managing the tax implications of withdrawing from multiple accounts (54%)

In fact, pre-retirees are more overwhelmed by these retirement income-related concerns than classic financial challenges like paying for college (27%), buying a home (33%), and losing a job (41%).

Overcoming Retirement Income Complexity

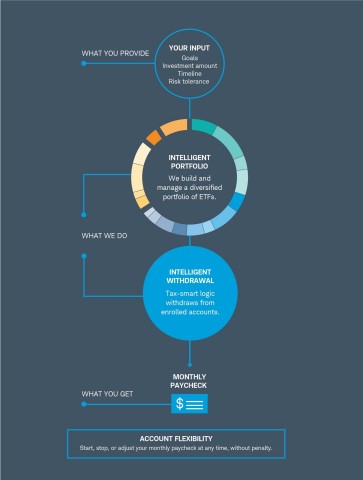

Schwab Intelligent Income will use the firm’s automated investing service Schwab Intelligent Portfolios® for portfolio management. For no additional fee, Schwab Intelligent Income will project, manage and automate multiple retirement income streams with a unique range of features including:

- Intelligent, tax smart approach that will implement a withdrawal strategy across taxable, IRA and Roth IRA accounts, Required Minimum Distribution considerations, tax-loss harvesting, dividends, and income, as well as automatic portfolio rebalancing back to an investor’s target asset allocation as money is distributed from the portfolio.

- A real-time digital dashboard that will enable investors to easily view their portfolio, recurring withdrawal, and the probability of meeting their withdrawal goal, with the flexibility to forecast and make changes based on their income needs.

- Guidance tailored to generating a predictable monthly withdrawal based on an investor’s specific financial situation, delivered through a customized, tax-efficient and low-cost automated approach that keeps investors on track. Live support from Schwab investment professionals is available 24/7/365.

- Automatic income deposit into a Schwab High Yield Investor Checking® account (linked to a Schwab One® brokerage account) or any other external bank account.

- Flexibility to stop, start, and adjust the withdrawal amount, frequency, and deposit location without penalty.

- Ongoing monitoring and alerts that will assess real-time portfolio performance against plan and notify clients if their monthly withdrawal rate is at risk based on market movements or other factors.

For those who want a comprehensive financial plan and unlimited guidance from a CERTIFIED FINANCIAL PLANNER™ professional, Schwab Intelligent Income will also be available together with the premium version of the firm’s digital advisory service, Schwab Intelligent Portfolios Premium™.

“So much of the focus in digital advice has been on developing tools for younger generations, but those closer to retirement are very open to using technology – in fact, 73 percent of pre-retirees tell us they’re comfortable using technology to manage their retirement income,” says Tobin McDaniel, Charles Schwab senior vice president of digital advice and innovation. “More than half of our existing digital advice clients are over the age of 50, and Schwab Intelligent Income aims to solve the retirement income concerns that are so common for this population – from the difficulty of managing multiple income sources to the fear of running out of money.”

To enroll in Schwab Intelligent Income, investors will answer a short set of questions that assess their financial situation, time horizon and risk tolerance, and then the tool will recommend the appropriate strategy across their taxable and retirement accounts. The portfolios are comprised of low-cost exchange-traded funds (ETFs) from Schwab and third-party providers including Vanguard, iShares and Invesco.

Schwab Intelligent Portfolios has a $5,000 minimum and charges no advisory fee. Schwab Intelligent Portfolios Premium has a $25,000 minimum and charges an initial one-time $300 fee for planning and a $30 monthly subscription ($90 billed quarterly).

Just as if they had invested on their own, clients in Schwab Intelligent Portfolios and Schwab Intelligent Portfolios Premium pay the operating expenses on the ETFs in the portfolio, which includes a combination of Schwab ETFs™ and funds from third party providers. Based on a client’s risk profile, a portion of the portfolio is placed in FDIC-insured deposit accounts at Schwab Bank.* Some cash alternatives outside of the program pay a higher yield. See additional cost information below.

Schwab Intelligent Portfolios Premium also features a Satisfaction Guarantee, which states that if a client is not completely satisfied for any reason, Schwab will refund any related fee or commission and work with the client to make things right.

More information about Schwab Intelligent Income is available here.

About the Research

The research was conducted through an online survey by Logica Research from June 27 to July 16, 2019, among a national sample of 1,000 Americans aged 55 and older with $100,000 or more in investible assets. Respondents self-defined as retired or within five years of retirement. The margin of error for the sample is three percentage points.

About Charles Schwab

At Charles Schwab we believe in the power of investing to help individuals create a better tomorrow. We have a history of challenging the status quo in our industry, innovating in ways that benefit investors and the advisors and employers who serve them, and championing our clients’ goals with passion and integrity.

More information is available at www.aboutschwab.com. Follow us on Twitter, Facebook, YouTube and LinkedIn.

Disclosures:

Brokerage Products: Not FDIC Insured • No Bank Guarantee • May Lose Value

The Charles Schwab Corporation (NYSE: SCHW) is a leading provider of financial services, with more than 365 offices and 12.2 million active brokerage accounts, 1.7 million corporate retirement plan participants, 1.4 million banking accounts, and $3.94 trillion in client assets as of November 30, 2019. Through its operating subsidiaries, the company provides a full range of wealth management, securities brokerage, banking, money management, custody, and financial advisory services to individual investors and independent investment advisors. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. (member SIPC, www.sipc.org), and affiliates offer a complete range of investment services and products including an extensive selection of mutual funds; financial planning and investment advice; retirement plan and equity compensation plan services; referrals to independent fee-based investment advisors; and custodial, operational and trading support for independent, fee-based investment advisors through Schwab Advisor Services. Its banking subsidiary, Charles Schwab Bank (member FDIC and an Equal Housing Lender), provides banking and lending services and products. More information is available at www.schwab.com and www.aboutschwab.com.

Please read the Schwab Intelligent Portfolios Solutions™ disclosure brochures for important information, pricing, and disclosures related to the Schwab Intelligent Portfolios and Schwab Intelligent Portfolios Premium programs.

Schwab Intelligent Portfolios® and Schwab Intelligent Portfolios Premium™ are made available through Charles Schwab & Co. Inc. (“Schwab”), a dually registered investment advisor and broker dealer. Schwab Intelligent Income™ is an optional feature for clients to receive recurring automated withdrawals from their accounts. Schwab does not guarantee the amount or duration of Schwab Intelligent Income withdrawals nor does it guarantee any specific tax results such as meeting Required Minimum Distributions.

Portfolio management services are provided by Charles Schwab Investment Advisory, Inc. ("CSIA"). Schwab and CSIA are subsidiaries of The Charles Schwab Corporation.

Schwab Intelligent Income is available in both Schwab Intelligent Portfolios and Schwab Intelligent Portfolios Premium. There is no advisory fee or commissions charged for Schwab Intelligent Portfolios. For Schwab Intelligent Portfolios Premium, there is an initial planning fee of $300 upon enrollment and a $30 per month advisory fee charged on a quarterly basis as detailed in the Schwab Intelligent Portfolios Solutions™ disclosure brochures. Investors in Schwab Intelligent Portfolios and Schwab Intelligent Portfolios Premium (collectively, “Schwab Intelligent Portfolios Solutions”) do pay direct and indirect costs. These include ETF operating expenses which are the management and other fees the underlying ETFs charge all shareholders. The portfolios include a cash allocation to FDIC-insured deposit accounts at Charles Schwab Bank (“Schwab Bank”).” Schwab Bank earns income on the deposits, and earns more the larger the cash allocation is. The lower the interest rate Schwab Bank pays on the cash, the lower the yield. Some cash alternatives outside of Schwab Intelligent Portfolios Solutions pay a higher yield. Schwab Intelligent Portfolios Solutions invests in Schwab ETFs. A Schwab affiliate, Charles Schwab Investment Management, receives management fees on those ETFs. Schwab Intelligent Portfolios Solutions also invests in third party ETFs. Schwab receives compensation from some of those ETFs for providing shareholder services, and also from market centers where ETF trade orders are routed for execution. Fees and expenses will lower performance, and investors should consider all program requirements and costs before investing. Expenses and their impact on performance, conflicts of interest, and compensation that Schwab and its affiliates receive are detailed in the Schwab Intelligent Portfolios Solutions disclosure brochures.

Schwab Intelligent Portfolios® and Schwab Intelligent Portfolios Premium™ are designed to monitor portfolios on a daily basis and will also automatically rebalance as needed to keep the portfolio consistent with the client’s selected risk profile. Trading may not take place daily.

Tax‐loss harvesting is available for clients with invested assets of $50,000 or more in their account. Clients must choose to activate this feature.

Diversification, automatic investing and rebalancing strategies do not ensure a profit and do not protect against losses.

If you are not completely satisfied for any reason, at your request Charles Schwab & Co., Inc. (“Schwab”), Charles Schwab Bank (“Schwab Bank”), or another Schwab affiliate, as applicable, will refund any eligible fee related to your concern within the required time frames. Schwab reserves the right to change or terminate the guarantee at any time. Go to schwab.com/satisfaction to learn what’s included and how it works.

*The cash allocation in Schwab Intelligent Portfolios and Schwab Intelligent Portfolios Premium will be accomplished through enrollment in the Schwab Intelligent Portfolios Sweep Program (Sweep Program), a program sponsored by Charles Schwab & Co., Inc. By enrolling in Schwab Intelligent Portfolios, clients consent to having the free credit balances in their Schwab Intelligent Portfolios brokerage accounts swept to FDIC-insured deposit accounts at Charles Schwab Bank through the Sweep Program. Funds deposited at Charles Schwab Bank are insured, in aggregate, up to $250,000 per depositor, for each account ownership category, by the Federal Deposit Insurance Corporation (FDIC).

(0120-95KX)