COSTA MESA, Calif.--(BUSINESS WIRE)--Small business customers are significantly more satisfied with their credit cards and more likely to recommend their issuers than are consumer credit card customers. However, according to the inaugural J.D. Power U.S. Small Business Credit Card Satisfaction Study,SM released today, business customers are twice as likely as their consumer counterparts to switch to another brand of card. They also give issuers relatively low marks for rewards, benefits and services.

The J.D. Power 2019 U.S. Small Business Credit Card Satisfaction Study is a new syndicated benchmarking study that measures customer satisfaction with the largest small business credit card issuers in the U.S. by examining six factors (in descending order of importance): channel activities; benefits and services; credit card management; credit card terms; rewards; and key moments.

“Business credit card issuers are doing a great job with relationship building, getting the formula right on dedicated account management, customized reporting and digital tools,” said John Cabell, Director, Wealth and Lending Intelligence at J.D. Power. “But they may have a blind spot when it comes to the product itself. Basics like credit card terms and benefits and services are the lowest-scoring factors in our study. That’s important, because these perks are the keys to new customer acquisition and existing customer retention–areas where business credit card issuers have a clear weak spot.”

Following are some key findings of the 2019 study:

- Small business credit cards get high marks for customer satisfaction: Overall satisfaction among small business credit card customers is 849 (on a 1,000-point scale), which is 43 points higher than among the general consumer credit card population. Small business cards also earn significantly higher Net Promoter Scores®1 than their consumer counterparts.

- High rates of digital and mobile interaction among business customers: More than three-fourths (80%) of small business customers have interacted with their business credit card issuer’s website in the past three months and 69% have interacted via mobile, both of which are significantly more frequent than interactions by consumer credit card customers. Small business customers also have high satisfaction with their website and mobile experiences (876 and 869, respectively). By contrast, satisfaction with phone-based customer service is 851.

- Room for improvement on benefits and services: The areas where business credit card issuers are falling short are credit card terms; rewards; and benefits and services. While credit card terms—the factor associated with rates, fees and credit limits—might be expected to draw less consumer attention, a lack of interest in rewards and benefits should be cause for concern. Small business credit card customers are twice as likely as consumer credit card customers to switch cards (8.3% vs. 3.1%, respectively, saying they “definitely will” switch), making retention and new customer acquisition important ingredients in the small business credit card mix.

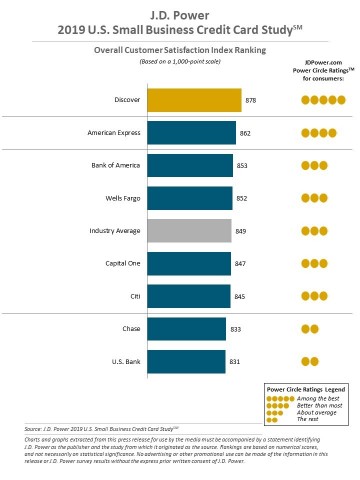

Credit Card Customer Satisfaction Rankings

Discover ranks highest in customer satisfaction among national issuers, with a score of 878. American Express (862) ranks second and Bank of America (853) ranks third.

The 2019 Small Business Credit Card Satisfaction Study includes responses from 3,312 credit card customers and was fielded from June through August 2019.

For more information about the 2019 Small Business Credit Card Satisfaction Study, visit https://www.jdpower.com/business/resource/us-small-business-credit-card-study.

See the online press release at http://www.jdpower.com/pr-id/2019226.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. These capabilities enable J.D. Power to help its clients drive customer satisfaction, growth and profitability. Established in 1968, J.D. Power has offices serving North America, South America, Asia Pacific and Europe.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 Net Promoter System®, Net Promoter Score®, NPS® and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.