HARTFORD, Conn--(BUSINESS WIRE)--Corbin Advisors, a leading research and advisory firm specializing in investor relations (IR), today released its Voice of Investor™ Industrial Sentiment Survey, which reveals investor sentiment remains largely downbeat, with several key performance indicators receiving the most pessimistic views in our survey’s history. The survey, part of Corbin Advisors’ Inside The Buy-side® publication, is based on responses from 34 institutional investors and sell side analysts globally who actively follow the industrial sector. Buy-side firms manage ~$896 billion in assets and have ~$107 billion invested in industrials.

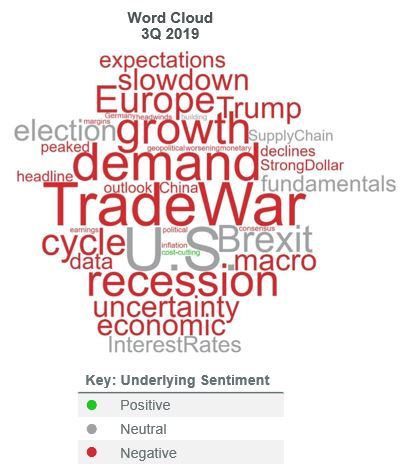

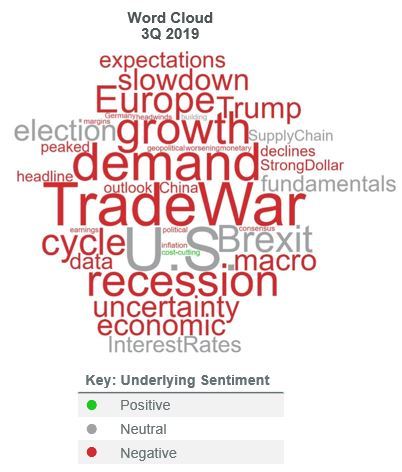

Nearly all key performance indicators – Revenue Growth, EPS and Margins – are expected to decelerate quarter-over-quarter amid tariff impact and resulting slowing global growth. Indeed, over half of the study group expects Organic Growth and EPS to Worsen sequentially, registering near the highest levels since December 2015, when outsized concerns around Oil & Gas and China and emerging market growth spiked. Margins are also expected to be remain pressured by 43% of investors. Views on FCF are mixed; while 37% expect levels to Worsen quarter-over-quarter, the highest level in survey history, 41% predict levels will look similar to last quarter.

Expectations are nearly universal for slowing growth, with 53% anticipating 2019 industrial organic growth to be less than 2.5%. Still, only one-quarter believes we will enter a recession in the next 6 months while a much greater percentage, or 67%, expect a contraction to push out to within 24 months. Despite continued downbeat views, our research identified some contrarians this quarter, with 12% reporting Bullish sentiment, doubling from last quarter.

Tobias Basse, Analyst at NORD/LB commented, “Industrial earnings should come in line to expectations. The U.S. macroeconomic environment should not be as bad as some financial analysts seem to believe and as the U.S. yield curve might suggest.”

Continuing, nearly 50% report industrial stocks are Overvalued, with 41% Holding quarter-over-quarter. Amid macroeconomic compression, 90% expect cost-cutting actions this quarter, an increase from 67% last quarter, and 68% describe cost-cutting as the most compelling investment theme in the industrial universe. In addition, investors are keen on exposure weighted toward North America, pure plays and companies with a large aftermarket component. As well, 60% report increased emphasis on balance sheet strength to evaluate downside risk and despite growth expectations tempering, 57% continue to cite reinvestment as their preferred use of cash, the highest among all choices.

“Our survey this quarter continues to capture downbeat views on key performance indicators amidst slowing global growth and weakening demand, particularly in the manufacturing sector,” commented Rebecca Corbin, Founder and CEO of Corbin Advisors. “A very low bar has been set for expectations and investors are focused on companies controlling the controllable. They remain supportive of reinvestment to capture available growth and, as growth has come down, are placing greater emphasis on margin resiliency. To that end, investors are focused on companies addressing cost-cutting initiatives, demonstrating balance sheet strength, including deleveraging, and providing sensitivity analyses that protect EPS and FCF across a continuum of potential economic scenarios. Large-caps are favored over small-caps, as they are perceived to have more levers to pull in a downsizing economy.”

In terms of sector bets, Defense remains the top pick among industries for the 8th consecutive quarter, while Water and Agriculture saw the most meaningful improvements in bullish sentiment. Auto remains the biggest laggard for the 14th consecutive quarter, with Commercial Aerospace and Industry Equipment & Components receiving the most significant spikes in bearish sentiment.

About Corbin Advisors

Corbin Advisors is a specialized investor relations (IR) advisory firm that partners with C-suite and IR executives to drive long-term shareholder value. We bring third-party objectivity as well as deep best practice knowledge and collaborate with our clients to execute sound, effective investor communication and engagement strategies. Our comprehensive services include perception studies, investor targeting and marketing, investor presentations, investor days, specialized research, and retainer and event-driven consulting.

Since 2006, Corbin Advisors has tracked investor sentiment on a quarterly basis. Access Inside The Buy-side® and other research on real-time investor sentiment, IR best practices and case studies at CorbinAdvisors.com. To see Founder and CEO Rebecca Corbin discuss 3Q19 Earnings on CNBC, Please Click Here.

To learn more about us and our impact, visit CorbinAdvisors.com.