HARTFORD, Conn.--(BUSINESS WIRE)--Corbin Advisors, a research and advisory firm specializing in investor relations (IR), today released its quarterly Voice of Investor™ Earnings Primer, which captures trends in institutional investor sentiment. The survey, which marks the 40th issue of Inside The Buy-side®, was conducted from September 6 to October 2, 2019 and is based on responses from 76 institutional investors and sell side analysts globally, representing more than $2.1 trillion in equity assets under management.

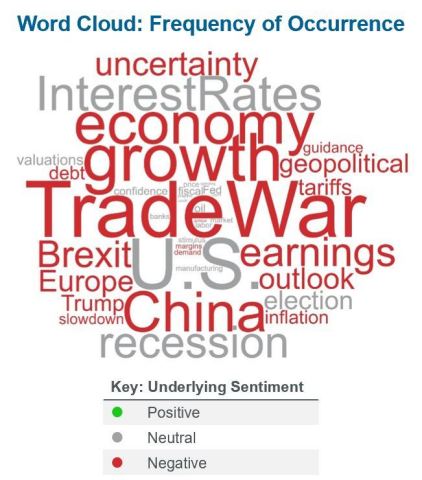

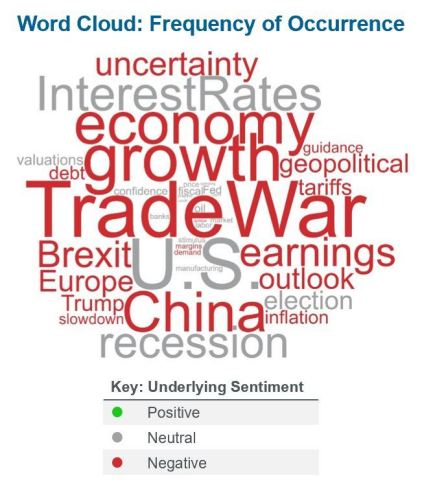

Almost half, 47%, of institutional investors and analysts expect earnings to Decrease sequentially and 39% expect Worse Than consensus results, registering near the highest level in nearly four years. For companies that lowered 2019 guidance last quarter, 50% of investors predict they will cut outlooks again.

Kim Forrest, Founder and CIO at Bokeh Capital Partners commented, “It depends on why companies lowered their 2019 outlooks. Some are fighting competitive trends. The ones that are truly being affected by the trade war may lower again.”

Despite broad-based concerns around the global growth slowdown, continued trade war impact and deteriorating capex levels, investors have seemingly accepted the “new normal” and sentiment is notably less downbeat this survey. Those classifying their sentiment as Bearish or Neutral to Bearish decreased to 39% from 53%, while management tone is described as cautious but confident as executives navigate the downturn.

Mark Mandziara, Senior Managing Director at BTC Capital Management adds, “Management tone has been neutral in the sense of not wanting to present a picture that is too hot or too cold. Use of the words ‘manageable’ and ‘sustain’ depict a scenario that while management conveys the ability to succeed within this environment, success is redefined as maintaining market share, margins and the status quo.”

The U.S. remains a bright spot. Expectations for 2019 GDP improved QoQ, with 54% predicting 2.5% growth, up from 41% last quarter, and while 8 in 10 investors believe a U.S. recession will happen in the next two years, fewer than 20% are calling for one in the next six months.

“Since experiencing strong economic growth in 2018, we have been in a slow and steady period of deceleration. The cumulative effect of increased geopolitical volatility, sustained policy uncertainty and trade conflicts has manifested itself in extreme caution in capex spending and inventory levels despite strong consumer demand and record-low unemployment,” said Rebecca Corbin, Founder and CEO of Corbin Advisors. “Heading into earnings season, investor expectations are seemingly aligned with the evolving corporate performance reality. However, we perceive a disconnect in that our research indicates a groundswell of corporate cost cutting actions across sectors, which will likely have a second order effect on consumers. According to our research, more than 3,600 companies globally implemented cost cutting actions last quarter, an 18% increase sequentially, while there was a 20% increase in those announcing headcount reductions. Industrials, Consumer Discretionary and Financials were the top sectors registering the highest level of announced employee layoffs. There is a trickle-down effect that has been playing out for over a year and will continue.”

Among sectors, Tech and Healthcare remain top choices for the fifth consecutive quarter, though Healthcare bulls receded substantially. Energy, Consumer Discretionary, Financials and Materials see the most bearish sentiment.

Since 2006, Corbin Advisors has tracked investor sentiment on a quarterly basis. Access Inside The Buy-side® and other research on real-time investor sentiment, IR best practices and case studies at CorbinAdvisors.com.

About Corbin Advisors

Corbin Advisors is a specialized investor relations (IR) advisory firm that partners with C-suite and IR executives to drive long-term shareholder value. We bring third-party objectivity as well as deep best practice knowledge and collaborate with our clients to execute sound, effective investor communication and engagement strategies. Our comprehensive services include perception studies, investor targeting and marketing, investor presentations, investor days, specialized research, and retainer and event-driven consulting.

Inside The Buy-side®, our industry-leading research publication, is covered by news affiliates globally and regularly featured on CNBC. To learn more about us and our impact, visit CorbinAdvisors.com.