NEW YORK--(BUSINESS WIRE)--As older Americans enjoy the fruits of their labor in their golden years, cognitive decline, fraudsters and even friends and family can put their financial security at risk.

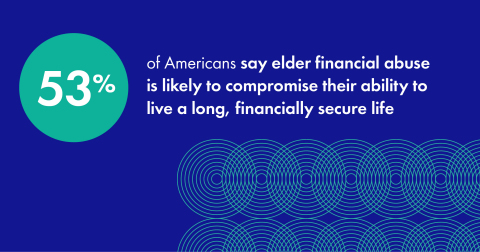

According to new research from AIG Life & Retirement, more than half of Americans (53 percent) say that elder financial abuse is likely to compromise their ability to live a long, financially secure life and nearly two thirds (65 percent) say the same for a close relative or friend.

Heightening this concern, almost half of seniors 65 or older (47 percent) manage their finances—from paying bills to handling investments —entirely on their own. As a result, many seniors leave themselves vulnerable to financial abuse, whether through financial scams perpetrated by strangers or financial exploitation conducted by family or friends.

Other key findings from the AIG Plan for 100 Elder Financial Abuse Survey include:

- Not only do many seniors handle money matters on their own, but only one in four invite a family member or someone they trust into conversations regarding their money (25 percent of seniors, compared to 21 percent of all adults).

- One protection against senior financial abuse is a durable power of attorney, yet 84 percent of all adults do not have or do not know if they have one in place (compared to 66 percent of seniors).

- Americans claim that if they were to fall victim to elder financial abuse, they would feel comfortable telling friends or family (81 percent) or a financial professional (80 percent) – but in reality, the overwhelming majority of cases go unreported. Nearly one in three (31 percent) Americans would not know how to report an elder financial abuse incident.

“We all want to age with grace, maintain independence for as long as possible, and have the freedom to manage our money accordingly,” said Kevin Hogan, Chief Executive Officer, AIG Life & Retirement. “But with 10,000 Americans turning 65 every day, the number of people living with Alzheimer’s and dementia is reaching unprecedented highs—leaving many vulnerable to manipulation and deceit. Longer lives and longer retirements often require a collaborative effort to help seniors protect themselves and ensure their savings can last a lifetime.”

The AIG Plan for 100 Elder Financial Abuse Survey is the latest in an ongoing series of research from AIG Life & Retirement’s Plan for 100, an initiative focused on educating and empowering individuals, employers and financial advisors to help Americans prepare for lives that could exceed 100 years. For seniors and their family members, the possibility of living to 100 will mean having to defend against threats like elder financial abuse.

Popular financial scams not on seniors’ radar

Senior financial abuse is a pervasive and expensive problem—with financial abuse estimated to rob America’s elderly of billions of dollars per year. Further, academic research reveals a jarring juxtaposition: as we age, our confidence in our financial abilities stays constant, while our financial literacy drops off dramatically—showing that even if we feel perfectly capable of going it alone, we may be slowly losing the faculty to continue to make prudent financial decisions.1

One component of elder financial abuse is financial scams, which are typically conducted by strangers catching unsuspecting seniors on the phone or through the internet to manipulate them into sending money. When asked about their knowledge of some of the most common financial scams, a majority of seniors did not have these threats on their radar:

- 60 percent are not aware of pigeon drop scams (victim is told that a considerable sum of money was found and will be shared with them if an upfront payment is received)

- 57 percent are not aware of romance scams (online romance where the victim is asked for money)

- 57 percent are not aware of invoice scams (victim is contacted by someone claiming to work on behalf of a company such as a utility to collect fees)

- 52 percent are not aware of pre-paid credit card/debit card scams (victim is asked to make payments to a utility or other company to address a debt; often the victim is asked to make multiple payments)

- 10 percent are not aware of any of 10 common financial scams

Seniors step up to safeguard their finances

Despite a lack of awareness of common financial scams, Americans—and seniors in particular—seem to recognize the need to protect themselves. The survey found that many are taking some steps to safeguard their personal information and wealth:

- Not responding to phone calls, texts or emails asking for urgent personal information (92 percent of seniors, 80 percent overall)

- Not clicking on links in emails from unknown senders (89 percent of seniors, 78 percent overall)

- Reviewing their credit report (65 percent of seniors, 57 percent overall)

- Setting up alerts from their financial institution (63 percent of seniors, 56 percent overall)

- Only providing personal financial information when they initiated the phone call (60 percent of seniors, 42 percent overall)

With many good habits in place, it’s no surprise that 86 percent of survey respondents 65 or over believe that they have the right protections to prevent senior financial abuse.

“Fear is a powerful motivator. Seniors have adopted valuable defense mechanisms to shield themselves from strangers looking to take their hard-earned savings,” said Michele Kryger, head of AIG’s Elder and Vulnerable Client Care unit, among the first of its kind in the financial services industry. “But when the financial abuser is someone who knows you—a friend, caretaker or even family—then you need an additional line of defense: a financial professional who can help safeguard your interests.”

While in most cases family members look out for their aging loved ones’ best interest, seniors are more likely to be taken advantage of by family than by strangers, according to the National Center on Elder Abuse.2 Still, seniors remain trusting of those dear to them; 81 percent of seniors in the AIG survey don’t believe anyone close to them would take advantage of them financially (compared to 74 percent of all adults).

Advisors help seniors plan ahead

Including an impartial third party can add an extra layer of protection. However, only 16 percent of Americans report they have a financial advisor in place to help manage their finances—and potentially protect against financial abuse. This cohort displayed positive financial behaviors, likely encouraged by their advisor. For example, almost two-thirds of those survey respondents with financial advisors (64 percent) report having a trusted contact in place with their financial advisor, a critical step in helping protect against abuse. A trusted contact is an individual designated by the account holder that a financial institution can contact if they are concerned about the account holder’s mental health or suspect financial abuse may be occurring.

Working with a financial advisor also increase the chances of making smart choices—those who partner with an advisor are more than two times as likely to have a durable power of attorney in place (36 percent vs. 16 percent). Those who work with a financial professional are also getting on the same page as their significant other; 90 percent of adults say they involve their spouse or significant other in conversations with their financial professional.

Reducing instances of senior financial abuse

Seniors and their family, financial advisors, financial services companies and the government all can play a role in thwarting financial abuse.

- Seniors and Their Family: Nearly half of respondents (46 percent) say family members have the most responsibility to protect seniors from financial abuse. A powerful way to protect against abuse is to plan ahead by having family conversations about a loved one’s wishes long before cognitive decline or an unforeseen incident occurs. For more information about common scams and potential red flags, see the AIG Plan for 100 report Protecting America’s Seniors from Financial Abuse.

- Financial Institutions: Nearly all Americans (92 percent) expect financial services companies to have safeguards in place to protect seniors from financial abuse. AIG maintains its Elder and Vulnerable Client Care unit that responds to suspected cases of financial exploitation of clients, raises awareness of senior financial exploitation with customer-facing teams, and provides mandatory training to all employees in its U.S. Life & Retirement businesses.

- Policy Makers: Americans believe that the government has a role to play in protecting seniors from financial abuse by raising awareness (77 percent), giving financial institutions more flexibility to protect their clients from senior financial abuse (55 percent), and increasing funding for agencies to protect seniors from financial abuse (49 percent). Increased funding for government agencies can support programs that aim to protect seniors from financial abuse and assist victims nationwide.

- Financial Advisors: Eighty-four percent of Americans expect their financial advisor or financial account representative to inform them when they suspect financial abuse, and 81 percent of seniors say if they were to fall victim to elder financial abuse, they would feel comfortable talking to an advisor. Financial advisors can help educate seniors on how to protect themselves, set up a trusted contact and a durable or springing power of attorney before a need arises, and facilitate important planning conversations.

AIG Elder Financial Abuse Survey Methodology

The AIG Elder Financial Abuse Survey was conducted by Morning Consult from June 20-23, 2019, among a national sample of 2,200 adults. The interviews were conducted online, and the data were weighted to approximate a target sample of adults based on age, race/ethnicity, gender, educational attainment and region. Results from the full survey have a margin of error of plus or minus 2 percentage points.

About AIG Life & Retirement

AIG Life & Retirement, a division of AIG (NYSE: AIG), brings together a broad portfolio of protection, retirement savings, investment and lifetime income solutions to help people achieve financial and retirement security. The business consists of four operating segments – Individual Retirement, AIG Retirement Services, Life Insurance and Institutional Markets – and holds longstanding, leading market positions in many of the markets it serves.

AIG Life & Retirement includes AIG member insurance companies American General Life Insurance Company (Houston, TX), The United States Life Insurance Company in the City of New York, and The Variable Annuity Life Insurance Company (VALIC), Houston, TX as well as their affiliates. Securities products are distributed by AIG Capital Services, Inc., member FINRA. Additional information about AIG Life & Retirement can be found at www.linkedin.com/showcase/aig-life-&-retirement.

About AIG

American International Group, Inc. (AIG) is a leading global insurance organization. Building on 100 years of experience, today AIG member companies provide a wide range of property casualty insurance, life insurance, retirement solutions, and other financial services to customers in more than 80 countries and jurisdictions. These diverse offerings include products and services that help businesses and individuals protect their assets, manage risks and provide for retirement security. AIG common stock is listed on the New York Stock Exchange.

Additional information about AIG can be found at www.aig.com | YouTube: www.youtube.com/aig | Twitter: @AIGinsurance www.twitter.com/AIGinsurance | LinkedIn: www.linkedin.com/company/aig. These references with additional information about AIG have been provided as a convenience, and the information contained on such websites is not incorporated by reference into this press release.

AIG is the marketing name for the worldwide property-casualty, life and retirement, and general insurance operations of American International Group, Inc. For additional information, please visit our website at www.aig.com. All products and services are written or provided by subsidiaries or affiliates of American International Group, Inc. Products or services may not be available in all countries and jurisdictions, and coverage is subject to underwriting requirements and actual policy language. Non-insurance products and services may be provided by independent third parties. Certain property-casualty coverages may be provided by a surplus lines insurer. Surplus lines insurers do not generally participate in state guaranty funds, and insureds are therefore not protected by such funds.

1 Finke, Howe and Huston, “Old Age and the Decline in Financial Literacy.” Management Science, 2016.

2 National Center on Elder Abuse, “Statistics and Data,” ncea.acl.gov/What-We-Do/Research/Statistics-and-Data.aspx