NEWARK, Calif.--(BUSINESS WIRE)--Drawing upon 25 years of expertise guiding Silicon Valley startups, the new RoseRyan Rapid Diagnostic for Emerging Growth is now available to startups interested in gauging their financial readiness for scaling.

As an interactive session with RoseRyan, the diagnostic scores companies on their overall financial health. The rapid review is simple yet comprehensive, providing emerging growth companies with a dashboard of results. It involves a tech-enabled questionnaire and scoring system to evaluate if the startup has what’s needed to support growth, achieve future milestones and satisfy investors.

Offered on a complimentary basis during its introductory period, the assessment provides actionable insights from an award-winning finance and accounting consultancy that has fueled the success of hundreds of startups and knows what investors want.

RoseRyan: Helping Startups Avoid Drama Since 1993

Says Tracey Hashiguchi, Head of Emerging Growth Solutions at RoseRyan, “Startups operate at lightning speed with big goals and visions. Yet their own finance operations often come up short, leaving them bereft of timely, accurate information. The result? We see it all the time: They’re flying blind and basing decisions on faulty assumptions.”

“This diagnostic quickly shines a light on what’s not going to cut it come go-time,” she adds. “If your VC-backed company is barreling toward a milestone—like a revenue goal or a new funding round—you don’t want to get held up by a missing system or process. These cost a lot to fix at the last minute, and we know that since we regularly do this emergency work.”

Hashiguchi comments, “Companies that have all the components of a solid financial foundation have a huge advantage—this new RoseRyan diagnostic is the perfect vehicle for getting a handle on your company’s financial capacity for liftoff.”

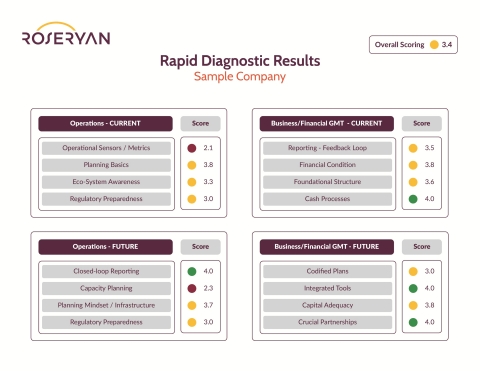

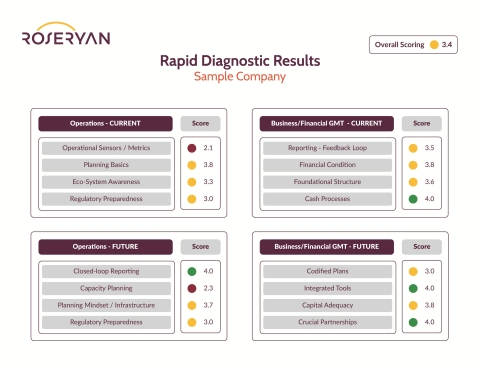

Quickly Assessing 16 Key Business & Finance Areas for Scaling

During the RoseRyan Rapid Diagnostic for Emerging Growth, startups are guided through an evaluation of 16 key finance and operational areas, which are each rated on a 1 to 5 scale. The dialogue covers the most essential areas of the startup related to accounting and finance, yielding a condensed view of the company’s ability to sustain growth.

At the end of the assessment, companies receive a scorecard with an overall score. Topics assessed include the company’s financial systems and processes as well as growth plans, operations, competition, debt, partners and supply chain.

Benefits to Fast-Moving Startup Companies

The RoseRyan Rapid Diagnostic for Emerging Growth benefits any startup that wants to determine where it stands on a host of finance fundamentals and receive actionable advice.

Notes Kathy Ryan, the CEO and founder of RoseRyan, “This easy, interactive exercise for entrepreneurs, owners and C-suite leaders offers visibility into what is really going on in the business. It’s insight from a team that expertly gets companies investor-ready and has navigated hundreds of startups through all sorts of scenarios since 1993.”

The new tool’s benefits include:

- Rapid assessment of the startup’s financial and operational health—so companies can take action, to fill any gaps and prepare for growth

- Identification of the critical finance and operational issues and risks that could slow down or endanger the startup

- Feedback to company leaders on how far they’ve come and what’s necessary to get to the next stage

- A scorecard that reveals what the startup needs to shore up for the next stage of growth.

Ryan emphasizes, “Startups get a strategic snapshot, so they can easily prioritize what needs to get addressed.”

Requesting Your Startup’s Free Diagnostic

Fast-moving companies can jumpstart their understanding of how prepared their finance function is for scaling by using the RoseRyan Rapid Diagnostic for Emerging Growth. Learn more and request a diagnostic here: www.bit.ly/rapid_diagnostic.

Upcoming Webinar Oct. 1: Companies Take New Diagnostic for a Spin

Interested startups can also check out RoseRyan’s October 1 webinar, “Scoring Your Financial Strength: What Startups Learn from a Rapid Diagnostic.” Webinar attendees will hear what two companies at different stages of growth learned from their diagnostics and how they rated on the 16 areas. Register here: http://bit.ly/finfoundation.

About RoseRyan

RoseRyan takes dynamic companies further, faster, by delivering specialized finance and accounting solutions at every stage of your company’s growth. Versed in Silicon Valley’s rapid pace and unique business environment, our consulting firm has helped more than 850 companies since 1993. Our focus is on tech, life sciences and private equity yet our experience and expertise allow us to consult in other industries; ecommerce, mobile, internet and social media among them. Our broad solution areas focus on emerging growth, interim finance, corporate governance and strategic projects, and our new RoseRyan company, Kukuza AssociatesTM focuses on cannabis accounting and finance. No matter what stage of the business lifecycle you’re at, the size of your business or the scale of your next endeavor, RoseRyan has a wide range of tailored finance solutions just when you need them to accelerate growth. Learn more at www.roseryan.com.