BOSTON--(BUSINESS WIRE)--When it comes to saving for retirement, investors are acting on the wisdom of starting as early as possible by saving in an IRA, even as early as childhood, according to Fidelity Investments®, the nation’s largest IRA provider.i Increasingly, when deciding which type of IRA to choose, among those who qualify, Roth IRAs continue to be the savings vehicle of choice, allowing investors to balance long-term retirement saving goals with shorter term financial obligations.

In the first five months of 2019, Fidelity has seen steady interest in IRAs, including:

- Across all generations, a 5% increase in the number of Roth IRA accounts receiving contributions in 2019 versus 2018 and a 3% increase in dollars contributed during the same period.

- Millennials had the largest year-over-year increase in the number of Roth IRA accounts receiving contributions and dollars contributed at 13% and 11%, respectively.ii

- Accounts held by millennials made up the largest percentage of Roth IRAs receiving contributions (43%), compared to 34% of accounts held by Generation X and 23% of accounts held by boomers.iii

- Of all dollars contributed to Roth IRAs so far in 2019, 38% were contributed to accounts owned by millennials, followed by boomers and Generation X at 31% each.iv

- New Roth IRA accounts were opened at a rate of an 11% increase over 2018, with millennials opening 16% more than they did in 2018.

“Saving regularly is a discipline that needs to be developed if individuals want to successfully achieve their retirement goals. Still, many investors want an element of flexibility in their retirement savings vehicles in case the money is ever needed prior to retirement,” said Melissa Ridolfi, vice president of college and retirement leadership at Fidelity Investments. “The flexibility to make withdrawals of contributions without penalties or taxes is a unique benefit of Roth IRAs that has become especially attractive to millennials.”

The Many Benefits of Roth IRAs

Roth IRAs are different from Traditional IRAs, which are taxed once an investor begins taking distributions in retirement. The tax treatment and flexibility of Roth IRAs are just a few of their advantages:

- Tax Advantaged Growth: Assets in a Roth IRA grow tax free as contributions are made with after-tax money. Although there's no tax deduction for Roth IRAs, as there can be with a Traditional IRA, any growth or earnings from the investments in the account are free from federal taxes (and possibly state and local taxes), with a few conditions. v

- Flexibility Approaching Retirement: Since contributions to a Roth IRA are made with after-tax dollars, those funds can be accessed at any time for any reason—without taxes or penalties. In addition, qualified withdrawals of earnings may be penalty-free, such as after age 59½, for first-time home purchase, and certain medical expenses.vi

- Freedom in Retirement: Unlike a Traditional IRA, individuals can contribute to a Roth IRA at any age as long as they have earned income within the contribution limits. In addition, there are no lifetime distribution requirements. This a big difference from Traditional IRAs, which require minimum distributions starting at age 70½.

Higher Contribution Limits for 2019: First Increase in Six Years

Starting this year, the IRS raised the annual contribution limits for both Roth and Traditional IRAs by $500 to $6,000.vii An additional $500 may not seem like much now, but over time the growth of that extra savings can add up. For many investors it’s easier to make smaller, regular contributions, and the earlier they begin the better, in order to realize the power of dollar cost averaging.

Roth IRAs For Kids Seeing Continued Growth

As the oldest millennials approach 40, they are driving the biggest increases in account openings of Fidelity’s Roth IRA for Kids for their children. In fact, Millennial custodians had the greatest year-over-year increase in both the number of Roth IRA for Kids accounts having contributions (84%) and in terms of dollars contributed (94%), followed by Generation X at 53% and 43%, respectively. New account openings of Roth for Kids by Millennials were up 73% over 2018.viii

“Parents who understand the importance of teaching their children with earned income about saving and investing are giving them a big financial head start in life by starting when they’re young,” said Ridolfi.

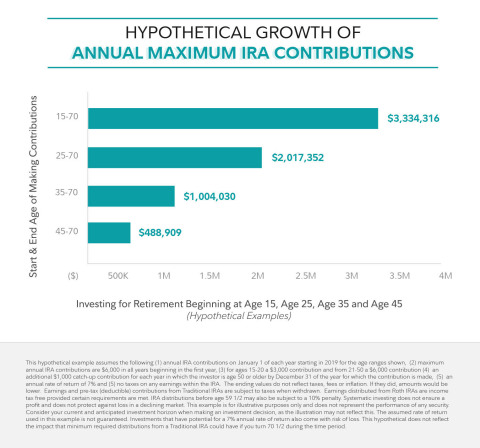

The earlier children begin saving, the greater the growth potential for their IRA. The chart below shows the hypothetical growth of annual contributions made to an IRA starting at ages 15, 25, 35, and 45.

Roth IRA Resources

Whether an individual is saving for one’s own retirement or helping jump start a savings plan for a minor child with income, a Roth IRA can help establish the discipline to get started saving and stick with it. Fidelity offers the following educational resources to help investor learn more about Roth IRAs:

- Fidelity Viewpoints: Why save in a Roth IRA in your 20s and 30s, and Save for the future with a Roth IRA.

- Fidelity’s Learning Center: Turbocharge your child’s retirement with a Roth IRA for Kids.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $7.7 trillion, including managed assets of $2.8 trillion as of June 30, 2019, we focus on meeting the unique needs of a diverse set of customers: helping more than 30 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 financial advisory firms with investment and technology solutions to invest their own clients’ money. Privately held for more than 70 years, Fidelity employs more than 40,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about.

Keep in mind that investing involves risk.

The value of your investment will fluctuate over time and may gain or lose money.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Investments and Fidelity are registered service marks of FMR LLC.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Investments Institutional Services Company, Inc.

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

200 Seaport Boulevard, Boston, MA 02110

889598.1.0

© 2019 FMR LLC. All rights reserved.

i Cerulli Associates' The Cerulli Edge®—Retirement Edition, 1Q 2019 based on an industry survey of firms reporting total IRA assets administered for 1Q 2019.

ii Fidelity customer data for contributions between January 1, 2019 and May 31, 2019 as compared to January 1, 2018 to May 31, 2018.

iii Fidelity customer data from January 1, 2019 to May 31, 2019.

iv Fidelity customer data from January 1, 2019 to May 31, 2019.

vA distribution of earnings from a Roth IRA is tax free and penalty free, provided the five-year aging requirement has been satisfied and one of the following conditions is met: age 59½, disability, qualified first-time home purchase, or death.

vi A distribution of earnings from a Roth IRA is tax free and penalty free, provided the five-year aging requirement has been satisfied and one of the following conditions is met: age 59½, disability, qualified first-time home purchase, or death.

vii Additionally, catch-up contributions of $1,000 are still available for those customers age 50 years old and older.

viii Fidelity customer data for contributions between January 1, 2019 and May 31, 2019 as compared to January 1, 2018 to May 31, 2018.