HARTFORD, Conn.--(BUSINESS WIRE)--Corbin Advisors, a research and advisory firm specializing in investor relations (IR), today released its quarterly Inside The Buy-side® Earnings Primer report, which captures trends in institutional investor sentiment. The survey was conducted from June 14 to 28, 2019 and is based on responses from 84 institutional investors and sell-side analysts globally, representing more than $2.3 trillion in equity assets under management.

Institutional investors and analysts express more cautious sentiment amid trade war concerns and signs of slowing growth. Neutral to Bearish or Bearish sentiment, which fell to 33% last quarter, increased to 53%. Perceived management tone is also described as slightly more cautious, with 34% of survey respondents characterizing executives as Neutral to Bearish or Bearish, up from 27% last quarter.

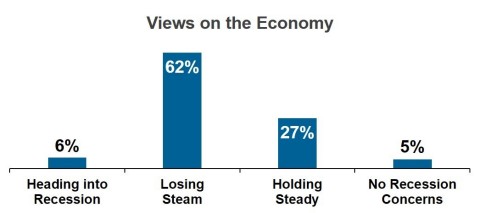

The majority, 62%, note the U.S. economy is Losing Steam but greater than 70% Do Not believe we will enter a recession in the next 12 months.

“The economy is losing steam; tax reform effects are fading, trade concern is causing capex to slow down and margins are under pressure,” noted Max Gokhman, Head of Asset Allocation at Pacific Life Fund Advisors.

Further contributing to increasingly cautious sentiment, 65% express High concern with trade wars and 54% believe a favorable resolution to the U.S./China trade dispute over the next six months is only Somewhat likely. Related, investors express increased concerns over continued economic slowdown in Europe and China and nearly half expect Global Capex and PMI to Worsen over the next 6 months. Notably, 70% are Not Concerned or only Somewhat Concerned about Brexit.

Continuing, 80% of survey respondents note they are placing More Emphasis on balance sheet strength versus a year ago, an increase from 70% last quarter. To that end, 52% cite debt paydown as the preferred use of excess free cash.

“Several channel checks indicate investor recognition that we have entered a slowing growth period, though the low interest rate environment and strength in the consumer are serving as equity market buffers,” said Rebecca Corbin, Founder and CEO of Corbin Advisors. “Few investors are calling for a recession in the next 12 months but are focused on demand trends and actions to position in a slowing growth environment amid continued deceleration overseas.”

While concerns continue to increase, some cautious optimism exists, largely driven by the low interest rate environment. To that end, 69% of investors expect the Fed Funds Rate to be 2.0% - 2.25% at 2019 year-end, indicating at least one rate cut is anticipated.

Among sectors, Healthcare, Technology and Communication Services registered the most significant increases in bullish sentiment, while Financials, Materials, Energy and Industrials are the most out-of-favor. REITs once again saw the lowest level of bearish sentiment in over three years.

Since 2006, Corbin Advisors has tracked investor sentiment on a quarterly basis. Access Inside The Buy-side® and other research on real-time investor sentiment, IR best practices and case studies at CorbinAdvisors.com.

About Corbin Advisors

Corbin Advisors is a specialized investor relations (IR) advisory firm that partners with C-suite and IR executives to drive long-term shareholder value. We bring third-party objectivity as well as deep best practice knowledge and collaborate with our clients to execute sound, effective investor communication and engagement strategies. Our comprehensive services include perception studies, investor targeting and marketing, investor presentations, investor days, specialized research, and retainer and event-driven consulting.

Inside The Buy-side®, our industry-leading research publication, is covered by news affiliates globally and regularly featured on CNBC.

To learn more about us and our impact, visit CorbinAdvisors.com.