HONG KONG--(BUSINESS WIRE)--Galaxy Entertainment Group (“GEG”, “Company” or the “Group”) (HKEx stock code: 27) today reported selected unaudited financial data for the three months period ended 31 March 2019. (All amounts are expressed in HKD unless otherwise stated)

Q1 2019 RESULTS HIGHLIGHTS

GEG: Strong Mass Performance, Challenging VIP Segment

- Q1 Group Net Revenue of $13.0 billion, down 8% year-on-year and down 8% quarter-on-quarter

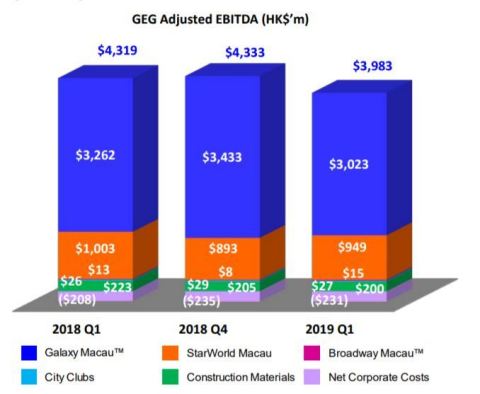

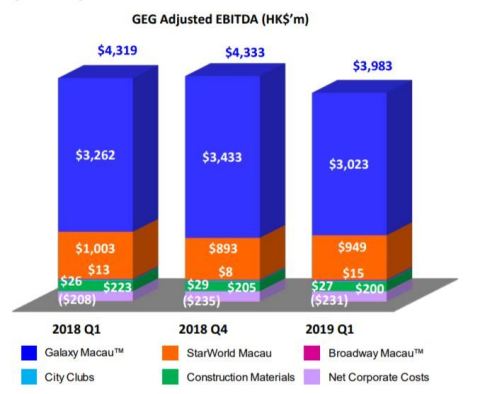

- Q1 Group Adjusted EBITDA of $4.0 billion, down 8% year-on-year, down 8% quarter-on-quarter

- Played lucky in Q1 which increased Adjusted EBITDA by approximately $111 million, normalized Q1 Adjusted EBITDA of $3.9 billion, down 12% year-on-year and down 9% quarter-on-quarter

- Latest twelve months Adjusted EBITDA of $16.5 billion, up 8% year-on-year, down 2% quarter-on-quarter

Galaxy MacauTM: Solid Mass Performance while Maintaining Margin

- Q1 Net Revenue of $9.3 billion, down 6% year-on-year and down 11% quarter-on-quarter

- Q1 Adjusted EBITDA of $3.0 billion, down 7% year-on-year, down 12% quarter-on-quarter

- Played lucky in Q1 which increased Adjusted EBITDA by approximately $39 million, normalized Q1 Adjusted EBITDA of $3.0 billion, down 13% year-on-year and down 8% quarter-on-quarter

- Hotel occupancy for Q1 across the five hotels was virtually 100%

StarWorld Macau: Solid Mass Performance while Maintaining Margin

- Q1 Net Revenue of $3.0 billion, down 7% year-on-year and flat quarter-on-quarter

- Q1 Adjusted EBITDA of $949 million, down 5% year-on-year, up 6% quarter-on-quarter

- Played lucky in Q1 which increased Adjusted EBITDA by approximately $68 million, normalized Q1 Adjusted EBITDA of $881 million, down 5% year-on-year and down 13% quarter-on-quarter

- Hotel occupancy for Q1 was virtually 100%

Broadway Macau™: A Unique Family Friendly Resort, Strongly Supported By Macau SMEs

- Q1 Net Revenue of $151 million, up 6% year-on-year and up 5% quarter-on-quarter

- Q1 Adjusted EBITDA of $15 million, up 15% year-on-year, up 88% quarter-on-quarter

- Played lucky in Q1 which increased Adjusted EBITDA by approximately $4 million, normalized Q1 Adjusted EBITDA of $11 million, up 10% year-on-year and up 57% quarter-on-quarter

- Hotel occupancy for Q1 was 95%

Balance Sheet: Healthy Balance Sheet

- Cash and liquid investments were $49.3 billion and net cash was $42.5 billion as at 31 March 2019

- Debt of $6.8 billion as at 31 March 2019, primarily reflects ongoing treasury yield management initiative

- Paid the previously announced special dividend of $0.45 per share on 26 April 2019

Development Update: Continue to Pursue Development Opportunities

- Cotai Phases 3 & 4 – Continue with development works for Phases 3 & 4, with a strong focus on non-gaming, primarily targeting MICE, entertainment, family facilities and also including gaming

- Hengqin – Refining our plans for a lifestyle resort to complement our high-energy entertainment resorts in Macau

- International – Continuously exploring opportunities in overseas markets, including Japan

Dr. Lui Che Woo, Chairman of GEG said:

“Overall given the prevailing market conditions, I believe the Group delivered a solid financial result. During the first quarter, Macau experienced a number of events that impacted the market, most notably in the VIP segment. These included the introduction of the full smoking ban plus increased competition from both local and regional casinos that have a significant economic advantage compared to Macau.

We continue to progress with the previously announced $1.5 billion renovation enhancement program in both Galaxy MacauTM and StarWorld Macau. Whilst there has been some disruption, we believe this enhancement program will make our resorts even more attractive to guests. We anticipate to complete this program in the early part of 2020.

In Q1 2019, GEG reported net revenue of $13.0 billion, down 8% year-on-year and down 8% quarter-on-quarter. Adjusted EBITDA was $4.0 billion, down 8% year over year and down 8% quarter-on-quarter.

We paid the previously announced special dividend of $0.45 per share on 26 April 2019. Our balance sheet remains healthy and liquid with total cash and liquid investments of $49.3 billion and net cash of $42.5 billion as at 31 March 2019.

Macau has continued to see strong growth in visitor arrivals post the opening of the Hong Kong-Zhuhai-Macau Bridge and the continued buildout of the High Speed Rail Network. Visitor arrivals in the first quarter were 10.4 million, up 21% year-on-year.

We continue with our development works for Phases 3 & 4, and with our planning for a lifestyle resort in Hengqin. We also continue with our efforts in Japan where we have submitted numerous Requests For Information to selected Japanese cities and prefectures.

2019 is an important year for China and Macau with a particular focus on three major events. These include celebrating the 70th anniversary of the founding of the People’s Republic of China, it is also the 20th anniversary of the return of Macau to China. Further, we look forward to the election of the next Chief Executive who will take office in 2019.

We remain confident in the medium to longer term outlook for Macau in general and GEG specifically given the continued growth in demand for tourism, leisure and travel from Mainland China. We also believe the integration of Macau into the Greater Bay Area will be positive for the development of Macau. We are committed to supporting the Macau Government’s vision to develop Macau into a World Center of Tourism and Leisure.”

Macau Market Overview

In the first quarter, Gross Gaming Revenue (“GGR”) was impacted by the introduction of the full smoking ban and increased competition from both local and regional casinos. Macau GGR for Q1 2019 was $73.9 billion, down 0.5% year-on-year and down 3% quarter-on-quarter. VIP GGR was $36.1 billion, down 13% year-on-year and down 11% quarter-on-quarter.

In Q1 2019, visitor arrivals to Macau were 10.4 million, up 21% year-on-year. Visitors from Mainland China grew at a faster rate of 24% year-on-year. Overnight visitors were up 9% year-on-year and accounted for 46% of total visitation. The average length of stay for overnight visitors was 2.2 days. Meanwhile, visitors from the cities in the Greater Bay Area grew by 17% year-on-year to 1.4 million.

Group Financial Results

In Q1 2019, the Group posted net revenue of $13.0 billion, down 8% year-on-year and down 8% quarter-on-quarter. Adjusted EBITDA was $4.0 billion, down 8% year-on-year and down 8% quarter-on-quarter. Galaxy Macau™’s Adjusted EBITDA was $3.0 billion, down 7% year-on-year and down 12% quarter-on-quarter. StarWorld Macau’s Adjusted EBITDA was $949 million, down 5% year-on-year and up 6% quarter-on-quarter. Broadway Macau™’s Adjusted EBITDA was $15 million, up 15% year-on-year and up 88% quarter-on-quarter.

GEG played lucky in Q1 2019 which increased Adjusted EBITDA by approximately $111 million. Normalized Q1 Adjusted EBITDA was $3.9 billion, down 12% year-on-year and down 9% quarter-on-quarter.

The Group’s total GGR on a management basis1 in Q1 2019 was $15.4 billion, down 10% year-on-year and down 10% quarter-on-quarter. Total mass table GGR was $7.3 billion, up 9% year-on-year and flat quarter-on-quarter. Total VIP GGR was $7.4 billion, down 25% year-on-year and down 18% quarter-on-quarter. Total electronic GGR was $606 million, up 1% year-on-year and down 11% quarter-on-quarter.

|

Group Key Financial Data |

|||||||

| (HK$'m) | |||||||

| Q1 2018 | Q4 2018 | Q1 2019 | |||||

| Revenues: | |||||||

| Net Gaming | 11,921 | 12,138 | 11,091 | ||||

| Non-gaming | 1,301 | 1,369 | 1,338 | ||||

| Construction Materials | 911 | 651 | 616 | ||||

| Total Net Revenue | 14,133 | 14,158 | 13,045 | ||||

| Adjusted EBITDA | 4,319 | 4,333 | 3,983 | ||||

|

Gaming Statistics2 |

|||||||

| (HK$'m) | |||||||

| Q1 2018 | Q4 2018 | Q1 2019 | |||||

|

Rolling Chip Volume3 |

288,792 | 260,505 | 203,568 | ||||

| Win Rate % | 3.4% | 3.5% | 3.6% | ||||

| Win | 9,868 | 9,034 | 7,429 | ||||

|

Mass Table Drop4 |

28,510 | 31,571 | 30,463 | ||||

| Win Rate % | 23.6% | 23.2% | 24.1% | ||||

| Win | 6,715 | 7,328 | 7,345 | ||||

| Electronic Gaming Volume | 17,829 | 18,191 | 16,178 | ||||

| Win Rate % | 3.4% | 3.7% | 3.7% | ||||

| Win | 601 | 681 | 606 | ||||

|

Total GGR Win5 |

17,184 | 17,043 | 15,380 | ||||

Balance Sheet and Special Dividend

As of 31 March 2019, cash and liquid investments were $49.3 billion and net cash was $42.5 billion. Total debt was $6.8 billion, primarily reflects an ongoing treasury management exercise where interest income on cash holdings exceeds corresponding borrowing costs. GEG paid the previously announced special dividend of $0.45 per share on 26 April 2019. Our balance sheet combined with cash flow from operations allows us to return capital to shareholders via special dividends and to fund both our Macau development pipeline and international expansion ambitions.

Galaxy Macau™

Galaxy Macau™ is the primary contributor to Group revenue and earnings. In Q1 2019, Galaxy Macau™’s net revenue was $9.3 billion, down 6% year-on-year and down 11% quarter-on-quarter. Adjusted EBITDA was $3.0 billion, down 7% year-on-year and down 12% quarter-on-quarter. Adjusted EBITDA margin under HKFRS was 33% (Q1 2018: 33%).

Galaxy Macau™ played lucky in Q1 2019 which increased Adjusted EBITDA by approximately $39 million. Normalized Q1 Adjusted EBITDA was $3.0 billion, down 13% year-on-year and down 8% quarter-on-quarter.

Hotel occupancy for Q1 across the five hotels was virtually 100%.

|

Galaxy Macau™ Key Financial Data |

|||||||

| (HK$'m) | |||||||

| Q1 2018 | Q4 2018 | Q1 2019 | |||||

| Revenues: | |||||||

| Net Gaming | 8,732 | 9,201 | 8,130 | ||||

| Hotel / F&B / Others | 819 | 858 | 829 | ||||

| Mall | 293 | 302 | 305 | ||||

| Total Net Revenue | 9,844 | 10,361 | 9,264 | ||||

| Adjusted EBITDA | 3,262 | 3,433 | 3,023 | ||||

| Adjusted EBITDA Margin | 33% | 33% | 33% | ||||

|

Gaming Statistics6 |

|||||||

| (HK$'m) | |||||||

| Q1 2018 | Q4 2018 | Q1 2019 | |||||

|

Rolling Chip Volume7 |

204,938 | 172,378 | 135,344 | ||||

| Win Rate % | 3.5% | 3.8% | 3.9% | ||||

| Win | 7,153 | 6,612 | 5,253 | ||||

|

Mass Table Drop8 |

16,754 | 18,593 | 17,906 | ||||

| Win Rate % | 27.0% | 27.8% | 28.3% | ||||

| Win | 4,524 | 5,178 | 5,068 | ||||

| Electronic Gaming Volume | 13,590 | 12,851 | 11,106 | ||||

| Win Rate % | 3.7% | 4.5% | 4.5% | ||||

| Win | 509 | 573 | 502 | ||||

| Total GGR Win | 12,186 | 12,363 | 10,823 | ||||

StarWorld Macau

In Q1 2019, StarWorld Macau’s net revenue was $3.0 billion, down 7% year-on-year and flat quarter-on-quarter. Adjusted EBITDA was $949 million, down 5% year-on-year and up 6% quarter-on-quarter. Adjusted EBITDA margin under HKFRS was 32% (Q1 2018: 31%).

StarWorld Macau played lucky in Q1 2019 which increased Adjusted EBITDA by approximately $68 million. Normalized Q1 Adjusted EBITDA was $881 million, down 5% year-on-year and down 13% quarter-on-quarter.

Hotel occupancy for Q1 was virtually 100%.

|

StarWorld Macau Key Financial Data |

|||||||

| (HK$'m) | |||||||

| Q1 2018 | Q4 2018 | Q1 2019 | |||||

| Revenues: | |||||||

| Net Gaming | 3,088 | 2,839 | 2,858 | ||||

| Hotel / F&B / Others | 109 | 121 | 115 | ||||

| Mall | 13 | 13 | 14 | ||||

| Total Net Revenue | 3,210 | 2,973 | 2,987 | ||||

| Adjusted EBITDA | 1,003 | 893 | 949 | ||||

| Adjusted EBITDA Margin | 31% | 30% | 32% | ||||

|

Gaming Statistics9 |

|||||||

| (HK$'m) | |||||||

| Q1 2018 | Q4 2018 | Q1 2019 | |||||

|

Rolling Chip Volume10 |

82,293 | 87,317 | 67,580 | ||||

| Win Rate % | 3.2% | 2.7% | 3.2% | ||||

| Win | 2,670 | 2,386 | 2,165 | ||||

|

Mass Table Drop11 |

8,547 | 9,620 | 9,265 | ||||

| Win Rate % | 20.0% | 16.9% | 18.9% | ||||

| Win | 1,709 | 1,630 | 1,749 | ||||

| Electronic Gaming Volume | 1,710 | 2,010 | 2,018 | ||||

| Win Rate % | 2.5% | 2.1% | 2.3% | ||||

| Win | 43 | 42 | 46 | ||||

| Total GGR Win | 4,422 | 4,058 | 3,960 | ||||

Broadway Macau™

Broadway Macau™ is a unique family friendly, street entertainment and food resort supported by Macau SMEs, it does not have a VIP gaming component. In Q1 2019, Broadway Macau™’s net revenue was $151 million, up 6% year-on-year and up 5% quarter-on-quarter. Adjusted EBITDA was $15 million, up 15% year-on-year and up 88% quarter-on-quarter. Adjusted EBITDA margin under HKFRS was 10% (Q1 2018: 9%).

Broadway Macau™ played lucky in Q1 2019 which increased Adjusted EBITDA by approximately $4 million. Normalized Q1 Adjusted EBITDA was $11 million, up 10% year-on-year and up 57% quarter-on-quarter.

Hotel occupancy for Q1 was 95%.

|

Broadway Macau™ Key Financial Data |

|||||||

| (HK$'m) | |||||||

| Q1 2018 | Q4 2018 | Q1 2019 | |||||

| Revenues: | |||||||

| Net Gaming | 75 | 69 | 76 | ||||

| Hotel / F&B / Others | 56 | 63 | 64 | ||||

| Mall | 11 | 12 | 11 | ||||

| Total Net Revenue | 142 | 144 | 151 | ||||

| Adjusted EBITDA | 13 | 8 | 15 | ||||

| Adjusted EBITDA Margin | 9% | 6% | 10% | ||||

|

Gaming Statistics12 |

|||||||

| (HK$'m) | |||||||

| Q1 2018 | Q4 2018 | Q1 2019 | |||||

|

Mass Table Drop13 |

368 | 346 | 342 | ||||

| Win Rate % | 19.7% | 18.9% | 20.3% | ||||

| Win | 73 | 65 | 70 | ||||

| Electronic Gaming Volume | 409 | 574 | 554 | ||||

| Win Rate % | 2.4% | 2.3% | 2.7% | ||||

| Win | 10 | 13 | 15 | ||||

| Total GGR Win | 83 | 78 | 85 | ||||

City Clubs

In Q1 2019, City Clubs contributed $27 million of Adjusted EBITDA to the Group’s earnings, up 4% year-on-year and down 7% quarter-on-quarter.

|

City Clubs Key Financial Data |

|||||||

| (HK$'m) | |||||||

| Q1 2018 | Q4 2018 | Q1 2019 | |||||

| Adjusted EBITDA | 26 | 29 | 27 | ||||

|

Gaming Statistics14 |

|||||||

| (HK$'m) | |||||||

| Q1 2018 | Q4 2018 | Q1 2019 | |||||

|

Rolling Chip Volume15 |

1,562 | 810 | 644 | ||||

| Win Rate % | 2.9% | 4.4% | 1.6% | ||||

| Win | 45 | 36 | 11 | ||||

|

Mass Table Drop16 |

2,841 | 3,012 | 2,950 | ||||

| Win Rate % | 14.4% | 15.1% | 15.5% | ||||

| Win | 409 | 455 | 458 | ||||

| Electronic Gaming Volume | 2,119 | 2,756 | 2,500 | ||||

| Win Rate % | 1.9% | 1.9% | 1.7% | ||||

| Win | 40 | 53 | 43 | ||||

| Total GGR Win | 494 | 544 | 512 | ||||

Construction Materials Division

The Construction Materials Division contributed Adjusted EBITDA of $200 million, down 10% year-on-year and down 2% quarter-on-quarter.

Development Update

Galaxy Macau™ and StarWorld Macau

To maintain our attractiveness and competitiveness, we are proceeding on a $1.5 billion property enhancement program for Galaxy Macau™ and StarWorld Macau. This program not only enhances our attractiveness, but also includes preparation work for the effective future integration and connectivity of Phases 3 & 4.

Cotai – The Next Chapter

GEG is uniquely positioned for long term growth. We continue with development works for Phases 3 & 4, which will include approximately 4,500 hotel rooms, including family and premium high end rooms, 400,000 square feet of MICE space, a 500,000 square feet 16,000-seat multi-purpose arena, F&B, retail and casinos, among others. We look forward to formally announcing our development plans in the future.

Hengqin

We continue to make progress with our concept plan for a lifestyle resort on Hengqin that will complement our high energy resorts in Macau.

International

Our Japan based team continues with our Japan development efforts. We view Japan as a great long term growth opportunity that will complement our Macau operations and our other international expansion ambitions. GEG, together with Monte-Carlo SBM from the Principality of Monaco and our Japanese partners, look forward to bringing our brand of World Class IRs to Japan.

Selected Major Awards in Q1 2019

| Award | Presenter | ||||

| GEG | |||||

| Gaming Operator of the Year Australia & Asia | 12th International Gaming Awards | ||||

| Galaxy MacauTM | |||||

| Integrated Resort of the Year | 12th International Gaming Awards | ||||

| Best Wedding Venue | New Express Fashion Awards 2018 | ||||

| Asia’s Most Popular Parent-Child Travel Resort City Supreme Award | The 19th Golden Horse Awards of China | ||||

| 2018 Platinum International Aquatic Safety Award - Grand Resort Deck | Jeff Ellis & Associates (E&A) | ||||

| Romantic Wedding Venue – Integrated Resort of the Year | All About Wedding Awards 2018 | ||||

| StarWorld Macau | |||||

| Asia’s Best Catering Service Hotel Supreme Award | The 19th Golden Horse Awards of China | ||||

| Construction Materials Division | |||||

| Occupational Health Award 2018-19 - Joyful @ Healthy Workplace Best Practices Award (Enterprise / Organisation Category) - Excellence Award | Occupational Safety and Health Council | ||||

Outlook

The first quarter proved to be demanding, particularly in the VIP segment. Growth in visitor arrivals is solid driven by the continued build out of infrastructure such as the Hong Kong-Zhuhai-Macau Bridge, the ongoing expansion of the High Speed Rail Network and the integration of Macau into the Greater Bay Area.

We continue with the construction works of Phases 3 & 4. These new developments will cater to the next wave of tourists and the resorts will be the only next generation products in Macau.

We continue to progress with the previously announced $1.5 billion renovation enhancement program and expect this program to be completed in early 2020.

We also continue with planning for a lifestyle resort in Hengqin that will complement our high energy resorts in Macau. We are also progressing with our efforts in Japan and continue to actively build relationships with all stakeholders.

We are well positioned for future growth with a healthy and liquid balance sheet. This certainly allows us to continue with our development plans, international expansion ambitions and pay special dividends.

We would like to thank all of our hard working staff who contribute greatly to our success and we are actively supporting the Macau Government on achieving their vision of building Macau into a World Centre of Tourism and Leisure.

- END -

About Galaxy Entertainment Group (HKEx stock code: 27)

Galaxy Entertainment Group (“GEG” or the “Group”) is one of the world’s leading resorts, hospitality and gaming companies. It primarily develops and operates a large portfolio of integrated resort, retail, dining, hotel and gaming facilities in Macau. The Group is listed on the Hong Kong Stock Exchange and is a constituent stock of the Hang Seng Index.

GEG is one of the three original concessionaires in Macau with a successful track record of delivering innovative, spectacular and award-winning properties, products and services, underpinned by a “World Class, Asian Heart” service philosophy, that has enabled it to consistently outperform and lead the market in Macau.

GEG operates three flagship destinations in Macau: on Cotai, Galaxy Macau™, one of the world’s largest integrated destination resorts, and the adjoining Broadway Macau™, a unique landmark entertainment and food street destination; and on the Peninsula, StarWorld Macau, an award winning premium property.

The Group has the largest undeveloped landbank of any concessionaire in Macau. When The Next Chapter of its Cotai development is completed, GEG’s resorts footprint on Cotai will double to more than 2 million square meters, making the resorts, entertainment and MICE precinct one of the largest and most diverse integrated destinations in the world. GEG is also planning to develop a world class, lifestyle leisure resort on a 2.7 square kilometer land parcel on Hengqin adjacent to Macau. This resort will complement GEG’s offerings in Macau, and at the same time differentiate it from its peers while supporting Macau in its vision of becoming a World Centre of Tourism and Leisure.

In July 2015, GEG made a strategic investment in Société Anonyme des Bains de Mer et du Cercle des Etrangers à Monaco (“Monte-Carlo SBM”), a world renowned owner and operator of iconic luxury hotels and resorts in the Principality of Monaco. GEG continues to explore a range of international development opportunities with Monte-Carlo SBM including Japan.

GEG is committed to delivering world class unique experiences to its guests and building a sustainable future for the communities in which it operates.

For more information about the Group, please visit www.galaxyentertainment.com

1 The primary difference between statutory gross revenue and management basis gross revenue is the treatment of City Clubs revenue where fee income is reported on a statutory basis and gross gaming revenue is reported on a management basis. At the group level the gaming statistics include Company owned resorts plus City Clubs.

2 Gaming statistics are presented before deducting commission and incentives.

3 Reflects junket rolling chip volume only.

4 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

5 Total GGR win includes gaming win from City Clubs.

6 Gaming statistics are presented before deducting commission and incentives.

7 Reflects junket rolling chip volume only.

8 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

9 Gaming statistics are presented before deducting commission and incentives.

10 Reflects junket rolling chip volume only.

11 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

12 Gaming statistics are presented before deducting commission and incentives.

13 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

14 Gaming statistics are presented before deducting commission and incentives.

15 Reflects junket rolling chip volume only.

16 Mass table drop includes the amount of table drop plus cash chips purchased at the cage.