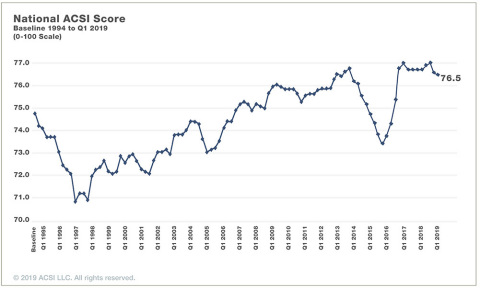

ANN ARBOR, Mich.--(BUSINESS WIRE)--Overall U.S. customer satisfaction dips for a second consecutive quarter, falling 0.1% to a score of 76.5 (on a scale of 0 to 100) on the American Customer Satisfaction Index (ACSI®).

While neither a large decline nor a score substantially lower than the prior nine quarters, this score reflects the lowest aggregate ACSI level since the third quarter of 2016.

Why is ACSI slipping and what are the implications?

“The news about economic growth during the first quarter of 2019 was interpreted by most media outlets as positive and as evidence the economy continues to be strong,” said Claes Fornell, ACSI Founder and Chairman. “However, upon closer examination and adding the weakness in customer satisfaction, the picture becomes a warning sign.”

Consumer spending growth – the largest component of GDP – was far below normal. It’s extremely rare, and unsustainable for the economy to grow at a healthy rate unless consumer spending increases by 3-4%. For reference, the first quarter number was 1.19%. The reason for the weakened consumer spending is evident from the weakness in customer satisfaction, which tends to suppress consumer demand.

This doesn’t always happen, however – as the ACSI fell sharply in 2014 and 2015 without any negative effect on spending, but that had more to do with pent-up demand following the Great Recession and continued employment growth. This time, there’s also employment growth, but not as strong as most media reports indicate.

Unemployment sank to 3.6% – the lowest since 1969. But a sizable part of that came from a fall in the labor force participation rate: More people without work stopped looking, and they are not counted in the unemployment data.

The level of unemployment is low, and to some extent is responsible for the stagnant or slightly reduced level of aggregate customer satisfaction. When labor markets are tight there’s more employee turnover, especially in service industries. That tends to adversely affect service quality, thereby having a negative effect on customer satisfaction.

When unemployment is low, it usually puts pressure on firms to increase wages, and to the extent that firms raise prices by passing on higher cost of labor to consumers, also tends to have a negative effect on customer satisfaction and consumer spending. Wages and hourly earnings are indeed up, but not by much. In fact, while the latter are up 3.2% over the past year, inflation negated as much as 60% of that since the consumer price index increased 1.9%.

Unless consumer spending growth increases – and there is some indication that it rose at a sharper rate in March – by about three times what it was in the first quarter, GDP growth is unlikely to remain strong. For such spending to grow at a faster rate, it would help if consumers were more satisfied with the goods and services offered in the market place, households had more disposable income, and inflation stayed in check.

It’s difficult to envision all that happening in the near future. While ACSI data predict continual weak consumer spending, there might be a rebound of sorts, if only due to a reversal to the mean in the sense that first quarter spending was abnormally low. But overall, the U.S. economy will most likely run into headwinds fairly soon.

The national ACSI score reflects customer satisfaction across sectors and industries over a rolling 12-month period. For more, follow the ACSI on LinkedIn and Twitter at @theACSI or visit www.theacsi.org.

No advertising or other promotional use can be made of the data and information in this release without the express prior written consent of ACSI LLC.

About ACSI

The American Customer Satisfaction Index (ACSI®) has been a national economic indicator for 25 years. It measures and analyzes customer satisfaction with more than 400 companies in 46 industries and 10 economic sectors, including various services of federal and local government agencies. Reported on a scale of 0 to 100, ACSI scores are based on data from interviews with roughly 300,000 customers annually. For more information, visit www.theacsi.org.

ACSI and its logo are Registered Marks of the University of Michigan, licensed worldwide exclusively to American Customer Satisfaction Index LLC with the right to sublicense.