BOSTON--(BUSINESS WIRE)--As fewer graduates enter the financial services industry1 and half of advisors are expected to retire within the next 14 years2, Fidelity Clearing & Custody Solutions today released research3 examining advisor satisfaction and best practices for retaining advisor talent. The research uncovered a significant opportunity to improve advisor satisfaction; while six in 10 advisors are satisfied with their career, only four in 10 are satisfied with their current firms.

“In this increasingly competitive talent market, it’s important that advisors have a strong sense of community and purpose at their firms, as well as clearly defined growth paths and meaningful roles that allow them to deliver real value to their clients,” said Charlie Phelan, vice president, Practice Management & Consulting for Fidelity Clearing & Custody Solutions. “The firms successfully retaining advisors are building engaged, connected teams, and also offering things like digital tools that help advisors work more efficiently.”

The Opportunity for Firms

According to Gallup, which defines

engaged employees as those who are involved in, enthusiastic about and

committed to their work and workplace4, engaged teams have

less turnover, greater profitability and higher productivity5.

Fidelity’s research uncovered opportunities for firm leaders to increase

engagement, particularly around helping advisors with their career

development and growth.

Of the advisors surveyed, only 55% indicated that someone at work had talked to them about their progress in the previous six months and only 51% said they understand what they need to do to get promoted to the next level – meaning there is an opportunity for leadership to better articulate advisor growth paths, support professional development and help individuals understand how their work contributes to the firm’s goals.

Key Elements of Engagement

“Firm leaders that are

successfully retaining advisors are focused on what I call the ‘ABCs of

engagement,’” said Phelan. “They’re a) asking for opinions and feedback,

so that advisors feel connected to the firm culture; b) building

programs that help meet advisor needs and help them develop; and c)

communicating clearly around everything, from the firm’s mission to what

it takes to be successful there.”

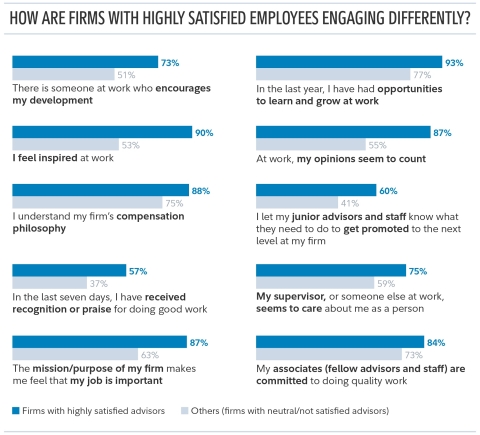

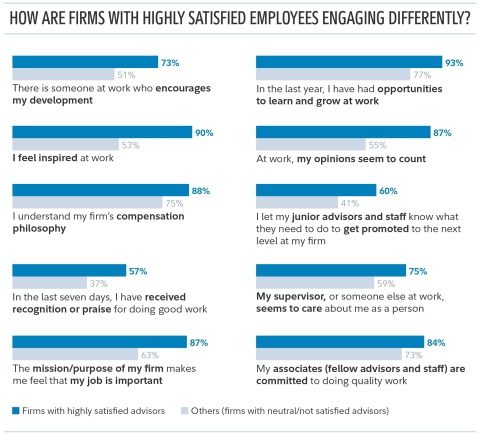

The Fidelity research pointed to an association between engagement and satisfaction. Advisors working at firms with highly satisfied employees were more likely to agree that their firms take part in engaging practices.

Why Retention Matters

Retention is especially important

because recruiting new advisors can be challenging – 59% of

advisors in the Fidelity survey feel it is a challenge for their firms

to find talent and staff that fits their needs. What’s more, while 55%

think their firm spends considerable time and resources on recruiting

new talent and staff, just 37% believe their firms have been effective

with their recruiting efforts to date.

To Learn More

Fidelity will host two upcoming events on

talent in the wealth management industry. On May 7, 2019, a Think Tank

Day will bring together leading firms to discuss overall talent

strategies and best practices. Industry leaders convening at Fidelity’s

12th Annual Recruiters Summit on May 23-24, 2019 will discuss practice

management tips and their insights specific to advisor retention and

recruiting.

More about the study and related actionable insights, including best practices for advisor retention, are available here.

About Fidelity Investments

Fidelity’s mission is to inspire

better futures and deliver better outcomes for the customers and

businesses we serve. With assets under administration of $7.4 trillion,

including managed assets of $2.7 trillion as of March 31, 2019, we focus

on meeting the unique needs of a diverse set of customers: helping more

than 30 million people invest their own life savings, 22,000 businesses

manage employee benefit programs, as well as providing more than 13,500

financial advisory firms with investment and technology solutions to

invest their own clients’ money. Privately held for more than 70 years,

Fidelity employs more than 40,000 associates who are focused on the

long-term success of our customers. For more information about Fidelity

Investments, visit https://www.fidelity.com/about.

For investment professional use only. Not authorized for distribution to the public as sales material in any form.

The content provided herein is general in nature and is for informational purposes only. This information is not individualized and is not intended to serve as the primary or sole basis for your decisions as there may be other factors you should consider.

Fidelity Clearing & Custody Solutions does not provide financial or investment advice. You should conduct your own due diligence and analysis based on your specific needs.

The registered trademarks and service marks appearing herein are the property of FMR LLC. Third parties referenced herein are independent companies and are not affiliated with Fidelity Investments. Listing them does not suggest a recommendation or endorsement by Fidelity Investments.

Fidelity Clearing & Custody Solutions® provides clearing, custody or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC. Members NYSE, SIPC. 200 Seaport Boulevard, Boston, MA 02210.

882905.1.0

© 2019 FMR LLC. All rights reserved.

1 Harvard Business School. Historical Career Statistics by

Industry: http://www.hbs.edu/recruiting/mba/data-and-statistics/employment-statistics.html.

2008-2018. Financial services includes: Investment

Banking/Sales/Trading, Investment Management/ Hedge Fund, Venture

Capital/Private Equity/LBO, Other Financial Services.

2

Cerulli Broker Dealer Marketplace 2017. Cerulli Advisor Metrics 2017,

The Cerulli Report: Advisor Metrics 2013

3 The 2018

Fidelity Talent - Employee Engagement Study was conducted with

Fidelity’s Financial Advisor Community (FAC), an online blind survey

panel (Fidelity not identified) managed by an independent firm not

affiliated with Fidelity Investments. The study was fielded in March and

April 2018. 464 active panelists completed the study. Advisor firm types

included a mix of banks, independent broker-dealers, insurance

companies, regional broker-dealers, RIAs, and national brokerage firms

(commonly referred to as wirehouses). FCCS asked the panel questions

originally created by Gallup for Gallup’s Employee Engagement Hierarchy

Model, an industry-standard approach of asking HR questions to solicit

feedback around employee engagement. The execution of the survey, the

collection of responses, and the scoring of responses was conducted

solely by FCCS, without involvement from Gallup. Qualitative research

was fielded August 1 through August 8, 2018 in three cities (Boston,

Chicago, and San Francisco). Participants included 25 financial

advisors. Participants included a mix of genders, ethnicities, sexual

orientation, industry tenures, firm types and career paths. Advisor firm

types included a mix of banks, independent broker-dealers, regional

broker-dealers, RIAs, and national brokerage firms (commonly referred to

as wirehouses).

4 Definition included in Gallup Daily:

U.S. Employee Engagement: https://news.gallup.com/poll/180404/gallup-daily-employee-engagement.aspx

5

2016 Gallup Study. Not wealth-management specific. Statistics

represented in December 21, 2016 article, The Damage Inflicted by Poor

Managers.