BOSTON--(BUSINESS WIRE)--In its year-end review of advisor-managed portfolios, Natixis Investment Managers’ Portfolio Clarity® US Trends Report shows moderate portfolios returned -5.1% for calendar year 2018, following a painful fourth quarter that saw a sharp decline of -8.3%, driven by US equities. Despite significant equity losses, advisors increased allocations to US large-cap and growth stocks, counterbalanced by short-duration government bonds, marking the return of fixed income’s traditional role as a risk reducer.

The US Trends Report provides a twice-yearly analysis of moderate portfolios reviewed by Natixis’ Portfolio Research & Consulting Group. According to the analysis, US equities were the biggest contributor to the fourth quarter losses, as large-caps declined 13.5% and small-caps were down just over 20%. Even so, US large-caps still outpaced international for the year, besting emerging market equities by 10% and international developed equities by 9.2%.

Despite the significant underperformance of US equity in Q4 2018, advisors increased their allocations to US large-cap and growth stocks. They also favored emerging market over foreign developed equity, yet despite increasing allocations, emerging market equity contributed less risk to diversified portfolios.

On the fixed income side, advisors shortened duration throughout the year, with credit quality at above-average levels and allocations to short and ultrashort bonds reaching all-time highs. Short-term and ultrashort-term bond allocations accounted for 17% of the fixed income sleeve, while the allocation to intermediate-term bonds was just under 30%. The 10-year Treasury yield started the year at 2.4% and climbed to 3.23% in November before retreating into year-end.

As advisors digested the outlook for rising interest rates and economic growth, they increased government bond holdings to 8%, on average, in the fourth quarter as ballast, while maintaining exposure to higher yielding fixed income, resulting in reduced risk as intended. The strategy proved out especially well for top quartile portfolios’ performance, where higher fixed income allocations contributed to better overall return, smaller drawdowns and lower risk. For 2018, top quartile portfolios returned -3.1% compared to bottom quartile portfolio performance of -7.0%.

“The big takeaway for 2018 was the increase in volatility coupled with rising rates that pushed investors towards higher quality fixed income,” said Marina Gross, Executive Vice President of Natixis’ Portfolio Research and Consulting Group. “We remain optimistic for equity performance over the remainder of this year, but we see controlled upside pressure on yields. For this reason, extending duration, rather than running from it, might serve investors better over time.”

Growing use of minimum volatility products

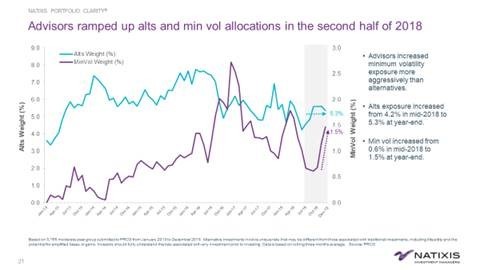

According to the US Portfolio Trends analysis, 22% of advisors now use minimum volatility products in their portfolios, following the uptick in equity volatility in 2018. Advisors have mainly used minimum volatility products in the large-cap space, most commonly with large blend, foreign large blend and diversified emerging markets.

“As volatility continues, we expect this trend will also continue, amplified by investor concerns over late-cycle dynamics and increased sensitivities to systemic trading,” added Gross.

Allocation trends by asset class

During the second half of 2018, the clearest trend in asset allocation was the slight uptick in the use of alternative funds, with alternatives exposure increasing from 4.2% in mid-2018 to 5.3% at year-end. Despite that fact, alternatives are still well below highs in 2016 of 7.5% as investors appear to be more interested in higher quality credit than in alternatives as ballast for their portfolios.

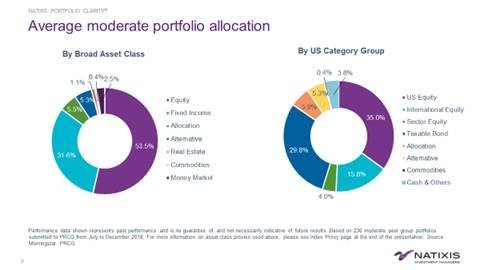

- Equities: 53.5%, down from 53.7% at year-end in 2017

- Fixed income: 31.6%, down from 31.8%

- Alternatives: 5.3%, up from 5.2%

- Asset allocation funds: 5.5%, up from 4.8%

- Cash/money market: 2.5%, down from 3.9%

- Other: 1.5%

Methodology

The US Trends Report provides a twice-yearly analysis of moderate portfolios submitted to the Natixis Portfolio Clarity® consultant team for review. Analysis compares performance and asset allocations of Moderate Model Portfolios with each other and selected benchmarks. Data in this issue represents 236 portfolios submitted by financial advisors from 7/1/18 to 12/31/18 and 3,765 portfolios submitted from 1/1/13 to 12/31/18.

About the Portfolio Research & Consulting Group

Natixis Portfolio Clarity® is the portfolio consulting service of Natixis Investment Managers. Specialized consultants provide objective portfolio analysis to investment professionals who seek a deeper level of insight, using sophisticated analytical tools to identify and quantify sources of risk and return.

For more information, visit im.natixis.com/us/natixis-portfolio-clarity.

This material is provided for informational purposes only and should not be construed as investment advice. The views and opinions expressed are as of December 2018. Any opinions or forecasts contained herein reflect the subjective judgments and assumptions of the authors only and do not necessarily reflect the views of Natixis Investment Managers, or any of its affiliates. There can be no assurance that developments will transpire as forecast, and actual results will be different. Data and analysis does not represent the actual or expected future performance of any investment product. We believe the information, including that obtained from outside sources, to be correct, but we cannot guarantee its accuracy. The information is subject to change at any time without notice.

Risks

Investing involves risk, including the risk of loss. Unlike passive investments, there are no indexes that an active investment attempts to track or replicate. Thus, the ability of an active investment to achieve its objectives will depend on the effectiveness of the investment manager. Alternative investments involve unique risks that may be different from those associated with traditional investments, including illiquidity and the potential for amplified losses or gains. Investors should fully understand the risks associated with any investment prior to investing. Diversification does not guarantee a profit or protect against a loss.

About Natixis Investment Managers

Natixis Investment

Managers serves financial professionals with more insightful ways to

construct portfolios. Powered by the expertise of more than 20

specialized investment managers globally, we apply Active Thinking® to

deliver proactive solutions that help clients pursue better outcomes in

all markets. Natixis ranks among the world’s largest asset management

firms1 ($917.1 billion/€802.1 billion AUM2).

Headquartered in Paris and Boston, Natixis Investment Managers is a subsidiary of Natixis. Listed on the Paris Stock Exchange, Natixis is a subsidiary of BPCE, the second-largest banking group in France. Natixis Investment Managers’ affiliated investment management firms and distribution and service groups include Active Index Advisors®;3 AEW; Alliance Entreprendre; AlphaSimplex Group; Darius Capital Partners; DNCA Investments;4 Dorval Asset Management;5 Flexstone Partners;6 Gateway Investment Advisers; H2O Asset Management;5 Harris Associates; Investors Mutual Limited; Loomis, Sayles & Company®; Managed Portfolio Advisors®;3 McDonnell Investment Management;7 Mirova;8 MV Credit; Naxicap Partners; Ossiam; Ostrum Asset Management; Seeyond;8 Seventure Partners; Vaughan Nelson Investment Management; and Vega Investment Managers. Not all offerings available in all jurisdictions. For additional information, please visit the company’s website at im.natixis.com | LinkedIn: linkedin.com/company/natixis-investment-managers.

Natixis Investment Managers includes all of the investment management and distribution entities affiliated with Natixis Distribution, L.P. and Natixis Investment Managers S.A.

Natixis Distribution, L.P. is a limited purpose broker-dealer and the distributor of various registered investment companies for which advisory services are provided by affiliates of Natixis Investment Managers.

1 Cerulli Quantitative Update: Global Markets 2018 ranked

Natixis Investment Managers as the 16th largest asset manager in the

world based on assets under management as of December 31, 2017.

2

Net asset value as of December 31, 2018. Assets under management

(“AUM”), as reported, may include notional assets, assets serviced,

gross assets and other types of non-regulatory AUM. AUM does not include

Vega Investment Managers, which was transferred to Natixis Wealth

Management in December 2018.

3 A division of Natixis

Advisors, L.P.

4 A brand of DNCA Finance.

5

A subsidiary of Ostrum Asset Management.

6 Flexstone

Partners assets as of 9/30/18. Flexstone was established in 2018 by

bringing together four specialized private investments firms: Caspian

Private Equity, Euro-Private Equity France, Euro-Private Equity Swiss

and Eagle Asia Partners.

7 Natixis Investment Managers

transferred ownership of McDonnell Investment Management, LLC to Loomis,

Sayles & Company, L.P. on 1/1/19.

8 Operated in the

U.S. through Ostrum Asset Management U.S., LLC.

2478100.1.1