PORTLAND, Ore.--(BUSINESS WIRE)--PWCC Marketplace, the largest seller of investment-caliber trading cards, has released year-end 2018 performance data on investment returns associated with vintage and modern trading cards, a tangible asset class that has seen growing popularity amid a more liquid marketplace for collectibles.

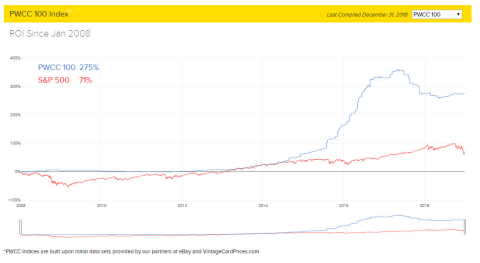

In early 2018, the company created a set of indices, including the PWCC Top 500 and the PWCC Top 100, that show how different subsets of the market – the 500 and 100 most valuable trading cards (as defined by sales price, trading velocity and other factors)– have tracked against the S&P 500.

As of December 31, 2018, the PWCC Top 500 index achieved a 10-year return on investment of 165 percent and a five-year ROI of 163 percent. The PWCC Top 100 performed even better, achieving a 10-year ROI of 275 percent (see figure below) and a five-year ROI of 263 percent. Both scenarios represent a significant outperformance of the S&P 500 over the same periods.

As markets for traditional assets remain volatile amid financial turmoil and economic uncertainty, nontraditional assets--including art, wine, and collectibles--are getting a closer look from investors.

“Trading cards represent one of the most liquid and established segments of this market, thanks to decades of transaction history,” said Brent Huigens, CEO of PWCC Marketplace. “We took these reams of data and found a compelling story behind the numbers: that trading cards as an asset class have outperformed more traditional asset classes across all market conditions and time horizons. 2018 was no exception.”

He added: “While the comparison to the stock market of late is interesting, the future growth could be far more extreme as trading cards become increasingly apparent to investors of tangible assets.”

PWCC obtains original sales data through a partnership with VintageCardPrices.com and uses its own proprietary software to capture trading card value. PWCC has been collecting and tracking these figures since 2008.

About PWCC Marketplace

Since 1998, PWCC has provided buyers and sellers of both vintage and modern graded trading cards with an efficient, secure and predictable marketplace. Compared to traditional, more fragmented auction environments, PWCC offers technology-driven efficiencies in line with electronic financial exchanges, including reduced transaction costs, faster turnaround times, increased liquidity and greater transparency. PWCC’s proven platform provides collectors and investors with the most trusted way to invest in trading cards. Find out more and follow live auctions at www.pwccmarketplace.com.