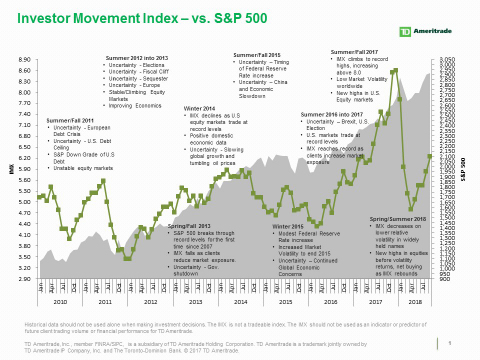

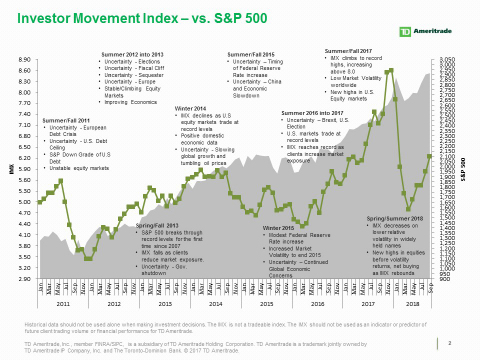

OMAHA, Neb.--(BUSINESS WIRE)--The September Investor Movement Index® rose for a fifth consecutive month, increasing to 6.23, TD Ameritrade, Inc.1 announced today. The Investor Movement Index, or the IMXSM, is a proprietary, behavior-based index created by TD Ameritrade that aggregates Main Street investor positions and activity to measure what investors actually were doing and how they were positioned in the markets.

September IMX

The September 2018 Investor Movement Index for the four weeks ended September 28, 2018 reveals:

- Reading: 6.23 (compared to 5.82 in August)

- Trend direction: positive

- Trend length: 5 months

- Score relative to historic ranges: Middle

Retail investor optimism continued to increase during the September period, with TD Ameritrade clients dialing up their exposure to equity markets. Despite light volatility during the period, TD Ameritrade client accounts were impacted by net buying activity and increased relative volatility in widely held names, including Apple Inc. (AAPL), Facebook Inc. (FB), and General Electric (GE).

“Clients upped their exposure to the markets as the Dow continued at strength,” said JJ Kinahan, chief market strategist at TD Ameritrade. “As we head into the fourth quarter, investors appeared to be setting themselves up for the possibility of continued strength despite tariffs and midterm elections looming over the markets.”

TD Ameritrade clients were net buyers of popular stocks in the September IMX period including:

- Amazon.com Inc. (AMZN), which reached an all-time high on the back of multiple analyst upgrades.

- Apple Inc. (AAPL), after releasing three new iPhone models and reaching an all-time high.

- Advanced Micro Devices Inc. (AMD), which rose 200 percent since the start of the year.

- Tesla Inc. (TSLA), which saw volatility after the SEC announced a lawsuit against CEO Elon Musk for misleading shareholders with a tweet.

- Alibaba Group Holding (BABA), after announcing Walgreens Boots Alliance Inc. (WBA) would launch a business-to-consumer platform on Alibaba to market beauty products to consumers in China.

Despite being net buyers, TD Ameritrade clients took profits in popular names, including:

- Bank of America Corp. (BAC) and Citigroup Inc., which sold off near month-end, and despite the Federal Reserve raising rates, there were fears the yield curve could continue to flatten.

- Exxon Mobile Corp. (XOM) and ConocoPhillips Corp. (COP), after oil prices continued higher, with COP reaching a 52-week high.

- Nvidia Corp. (NVDA), after reaching an all-time high.

- Qualcomm Inc. (QCOM), which hit a 52-week high, with each stock receiving multiple analyst upgrades.

U.S. equity markets were up again for the sixth consecutive month, with the Dow Jones Industrial Average reaching a record in September – the first since January – inching closer to the 27,000 mark. The S&P 500 was also up, while the Nasdaq Composite was down just slightly by 0.8 percent. September was marked by another milestone, as the Federal Reserve raised rates by a quarter-percent, which is the first time the Fed raised rates over 2 percent since the government’s intervention in 2008. While the markets remained high, October brings a new season of earnings and midterm election campaigning that will likely take a greater note.

About the IMX

The IMX value is calculated based on a complex proprietary formula. Each month, TD Ameritrade pulls a sample from its client base of more than 11 million funded accounts, which includes all accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly IMX.

For more information on the Investor Movement Index, including historical IMX data going back to January 2010; to view the full report from September 2018; or to sign up for future IMX news alerts, please visit www.tdameritrade.com/IMX. Additionally, TD Ameritrade clients can chart the IMX using the symbol $IMX in either the thinkorswim® or TD Ameritrade Mobile Trader platforms.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold.

Past performance of a security, strategy, or index is no guarantee of future results or investment success.

Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The IMX is not a tradable index. The IMX should not be used as an indicator or predictor of future client trading volume or financial performance for TD Ameritrade.

For the latest TD Ameritrade news and information, follow the company on Twitter, @TDAmeritradePR.

Source: TD Ameritrade Holding Corporation

About TD Ameritrade Holding Corporation

TD Ameritrade

provides investing

services and education

to more than 11 million client accounts totaling more than $1.2 trillion

in assets, and custodial

services to more than 6,000 registered investment advisors. We are a

leader in U.S. retail trading, executing an average of more than 780,000

trades per day for our clients, more than a quarter of which come from

mobile devices. We have a proud history

of innovation, dating back to our start in 1975, and today our team

of nearly 10,000-strong is committed to carrying it forward. Together,

we are leveraging the latest in cutting edge technologies and one-on-one

client care to transform lives, and investing, for the better. Learn

more by visiting TD Ameritrade’s newsroom

at www.amtd.com,

or read our stories at Fresh

Accounts.

1TD Ameritrade, Inc. is a broker-dealer subsidiary of TD Ameritrade Holding Corporation. Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) /SIPC (www.SIPC.org).