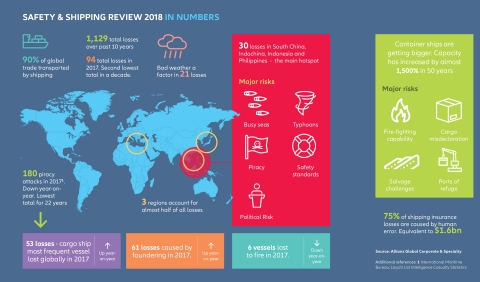

NEW YORK--(BUSINESS WIRE)--Large shipping losses have declined 38% over the past decade, according to Allianz Global Corporate & Specialty’s (AGCS) Safety & Shipping Review 2018, with this downward trend continuing in 2017. Recent events such as the collision of the oil tanker “Sanchi” and the impact of the NotPetya malware on harbor logistics underscore both the traditional and emerging risk challenges faced by the shipping sector.

There were 94 total losses reported around the shipping world in 2017, down 4% year-on-year (98) – the second lowest in 10 years after 2014. Bad weather, such as typhoons in Asia and hurricanes in the U.S., contributed to the loss of more than 20 vessels, according to the annual review, which analyzes reported shipping losses over 100 gross tons (GT).

“The decline in frequency and severity of total losses over the past year continues the positive trend of the past decade. Insurance claims have been relatively benign, reflecting improved ship design and the positive effects of risk management policy and safety regulation over time,” says Baptiste Ossena, Global Leader Hull & Marine, AGCS. “However, as the use of new technologies on board vessels grows, we expect to see changes in the maritime loss environment in the future.”

New risk exposures for the shipping sector include:

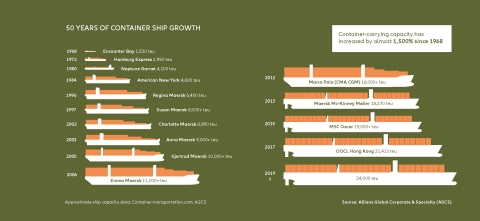

- Ever-larger container ships pose fire containment and salvage issues.

- Changing climate conditions bring new route risks, particularly in the Arctic and North Atlantic waters.

- Environmental scrutiny is growing as the industry seeks to cut emissions, which brings new technical risks coupled with the threat of machinery damage.

- Shippers continue to grapple with balancing the benefits and risks of increasing automation on board. The NotPetya cyber-attack caused cargo delays and congestion at nearly 80 ports, further underlying the growth of cyber risk.

“New Bermuda Triangle”, Dangerous Seas, and Friday 13th

Nearly one third of shipping losses in 2017 (30) occurred in the South China, Indochina, Indonesia and Philippines maritime region, up 25% annually, driven by activity in Vietnamese waters. This area has been the major global loss hotspot for the past decade, leading some media commentators to label it the “new Bermuda Triangle.” The major loss factors are actually weather - in November 2017, Typhoon Damrey caused six losses, busy seas and lower safety standards on some domestic routes.

Outside of Asia, the East Mediterranean and Black Sea region is the second major loss hotspot (17) followed by the British Isles (8).There was a 29% annual increase in reported shipping incidents in Arctic Circle waters (71), according to AGCS analysis.

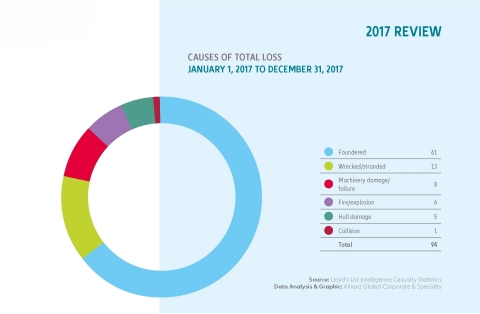

Cargo vessels (53) accounted for more than half of all vessels lost globally in 2017. Fishing and passenger vessel losses are down year-on-year. Bulk carriers accounted for five of the 10 largest reported total losses by GT. The most common cause of global losses remains foundering (sinking), with 61 sinkings in 2017. Wrecked/stranded ranks second (13), followed by machinery damage/failure (8).

Analysis shows Friday is the most dangerous day at sea – 175 of 1,129 total losses reported have occurred on this day over the past decade. Friday the 13th really can be unlucky – three ships were lost on this day in 2012 including the Costa Concordia, the largest-ever marine insurance loss.

Human Error: Still a big issue. Data can help.

Despite decades of safety improvements, the shipping industry has no room for complacency. Fatal accidents such as the “Sanchi” oil tanker collision in January 2018 and the loss of the “El Faro” in Hurricane Joaquin in late 2015 persist, and human behavior is often a factor. It is estimated that 75% to 96% of shipping accidents involve human error1. It is also behind 75% of 15,000 marine liability insurance industry claims analyzed by AGCS – costing $1.6bn2.

“Crews are under increasing pressure as shipping supply chains are streamlined for greater efficiency. While vessels once spent weeks in port, turn-around times for a cargo ship are now measured in days; such tight schedules can have a detrimental effect on safety culture and decision-making,” stated Andrew Kinsey, Sr. Marine Risk Consultant, AGCS. “There is always the need to strike the right balance between safety and commercial pressures. We need to look at behavior modification and how to get personnel to move away from normalizing risk.”

Moving forward, better use of data and analytics could help as the shipping industry produces a significant amount of data, but could utilize it better to produce real-time findings and alerts. New insights from crew behavior and near-misses can identify trends as predictive analysis may be the difference between a safe voyage and a disaster.

Shippers get serious about cyber threat as penalties increase

Cyber incidents like the global NotPetya malware event have served as a wake-up call for the shipping sector. Many operators previously thought themselves isolated from this threat. At the same time, new European Union laws such as the Network and Information Security Directive (NIS), which requires large ports and maritime transport services to report any cyber incidents and brings financial penalties, will exacerbate the fall-out from any future failure – malicious or accidental.

Other key risk topics include:

Autonomous shipping and drones: Legal, safety and cyber security issues are likely to limit widespread growth of crewless ships, for now. Human error risk will still be present in decision-making algorithms and onshore monitoring bases. Drones and submersibles, however, have the potential to make a significant contribution to shipping safety and risk management. Future use could include pollution assessment, cargo tank inspections, monitoring pirates and assessment of the condition of a ship’s hull in a grounding incident.

Climate change: Climate change is impacting ice hazards for shipping, freeing up new trade routes in some areas, while increasing the risk of ice in others – over 1,000 icebergs drifted into North Atlantic shipping lanes last year3, creating potential collision hazards. Cargo volumes on the Northern Sea Route reached a record high in 2017.

Emission Levels: Estimates suggest that the shipping sector’s emissions levels are as high as Germany’s, prompting a recent pledge to reduce all emissions by 50% in the long-term, alongside existing commitments to reduce sulphur oxide emissions by 2020. As the industry looks to technical solutions to achieve these aims, there could be accompanying risk issues with engines and bunkering of biofuels, as well as operator training.

About Allianz Global Corporate & Specialty

Allianz Global Corporate & Specialty (AGCS) is the Allianz Group's dedicated carrier for corporate and specialty insurance business. AGCS provides insurance and risk consultancy across the whole spectrum of specialty, alternative risk transfer and corporate business: Marine, Aviation (incl. Space), Energy, Engineering, Entertainment, Financial Lines (incl. D&O), Liability, Mid-Corporate and Property insurance (incl. International Insurance Programs).

Worldwide, AGCS operates with its own teams in 34 countries and through the Allianz Group network and partners in over 210 countries and territories, employing almost 4,700 people of 70 nationalities. AGCS provides insurance solutions to more than three quarters of the Fortune Global 500 companies, writing a total of €7.4 billion gross premium worldwide in 2017.

AGCS SE is rated AA by Standard & Poor’s and A+ by A.M. Best.

For more information please visit www.agcs.allianz.com or follow us on Twitter @AGCS_Insurance, LinkedIn and Google+.

Cautionary Note Regarding Forward-Looking Statements

1 AGCS, Safety & Shipping 1912-2012 From Titanic to Costa

Concordia

2 AGCS, Global Claims Review: Liability In

Focus, 2017

3 US Coast Guard International Ice Patrol