MENLO PARK, Calif.--(BUSINESS WIRE)--New research released today in the CipherTrace 2018 Q2 Cryptocurrency Anti-Money Laundering Report finds that three times more cryptocurrency was stolen from exchanges in the first half of 2018 than in all of 2017. The report also explains why Cyber extortionists, dark markets and ransomware perpetrators prefer bitcoin for their cryptocurrency payments. Furthermore, these dirty funds all need to be “laundered,” which results in a multi-billion-dollar and growing cryptocurrency money laundering problem that is attracting the attention of regulators globally.

The research report, which looks at the state of the cryptocurrency Anti-Money Laundering (AML) market, provides insights into the pending global cooperation and crackdown by the G20 international 37-nation financial crime-fighting Financial Action Task Force (FATF). The current rules, which seem strict on the surface, call for exchanges to: be registered or licensed, verify customers’ identities, prevent money laundering, and report suspicious trading and transactions. Unfortunately, they are voluntary. But according to Reuters, the FATF is currently discussing making crypto exchange rules binding. Additional global enforcement action is also expected from US Financial Crimes Enforcement Network (FinCEN), and it will likely target money laundering services, crypto-to-crypto exchanges and privacy coins.

“Until now, the lack of regulatory guidance has hindered the broader adoption of cryptocurrencies. Now we are seeing the big guys coming together asking for cryptocurrency anti-money laundering regulation—it is inevitable, it will be unified, and it will be global. There will be little room for privacy coins without AML or mixers in these Know Your Customer and Anti-Money Laundering regulated regimes. This will also be a wake-up call for virtual currency exchanges and financial institutions, exposing them to the risk of facing stiff penalties,” commented Dave Jevans, CEO, CipherTrace and co-chair of the Cryptocurrency Working Group at the APWG.org.

New Sophisticated Technology Tracks Cryptocurrency Through the Blockchain Ecosystem

These developments are driving a significant and increased demand for crypto AML intelligence. In response, today CipherTrace is also launching the general availability of its new Cryptocurrency AML Compliance Solution to help exchanges, hedge funds, ICOs, money transfer agents and banks safely participate in crypto asset markets while minimizing compliance efforts and costs. This fast and powerful tool—which can handle massive numbers of transactions and value—traces the flow of funds through the crypto ecosystem to find the “tainted money.”

- CipherTrace’s superior cryptocurrency intelligence is a result of advanced cryptocurrency intelligence gathering techniques and machine learning algorithms. These are guided by a deep understanding of eCrime and blockchain threat vectors applied to vast amounts of private and open source data. The CipherTrace AML solution features the first Crypto Intelligence Sharing Network for the best attribution on the market with 1.5 to 2 million new attribution data points added per week.

- CipherTrace technology calculates risk scores for transactions based on whether the funds have traveled through illegal dark markets, money mixers, gambling sites or are associated with known criminals. This transaction risk rating also simplifies compliance efforts by rapidly identifying and highlighting risky transactions for further scrutiny or action.

- The industry-leading CipherTrace API provides near real-time transaction risk scoring for exchanges, financial institutions and other high-volume users. The API also can trigger deeper analysis required for Suspicious Activity Reports (SARs). Bulk upload and analysis capabilities further speed up complex investigations and larger audits.

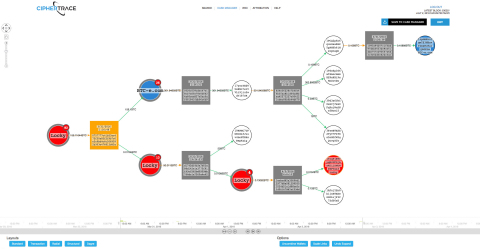

- With CipherTrace’s intuitive user interface (UI), non-technical users can perform analysis, which starts with a visual representation of the transaction. Once a transaction is identified as high-risk or non-compliant, the user can click to drill down and look for relationships, or search back through related transactions or multiple parts of a transaction and see any useful patterns.

- In addition, users can step forward and backward in the transaction history of suspicious transactions. The platform’s UI further makes it easy to perform deeper inspection and analysis of suspicious transactions, trace flows and link blockchain events.

CipherTrace’s cryptocurrency intelligence, bitcoin forensics and crypto transaction risk score help to assure compliance and build trust in the blockchain economy for all law-abiding participants.

“Already, clients in crypto exchanges, hedge funds and law enforcement are seeing massive improvements in the time it takes them to investigate, monitor and report on AML violations,” said Stephen Ryan, COO, CipherTrace.

“Many of these RegTech and cryptocurrency technologies—which were once thought experimental or just for cryptos—are fast becoming mainstream compliance expectations among regulators. Cryptocurrency exchanges have invested extensively in legal services and detailed AML programs. Now, they must back this commitment by investing in compliance infrastructure and giving their compliance professionals the resources and tools they need to get the job done,” said Joe Ciccolo, CAMS, CFE, AMLCA, President, BitAML, Inc.

For more information:

- CipherTrace 2018 Q2 Cryptocurrency Anti-Money Laundering Report: https://info.ciphertrace.com/crypto-aml-report-q218

- New crypto AML compliance product details: https://ciphertrace.com/aml-for-cryptocurrencies/

About CipherTrace

CipherTrace develops blockchain security, AML compliance and enforcement solutions that make cryptocurrencies, crypto tokens and enterprise private blockchains safe and secure. CipherTrace was founded in 2015 in California USA. CipherTrace operates globally and has top cryptocurrency, payments and security executives and programmers on its team. Founded by experienced Silicon Valley entrepreneurs in 2015, CipherTrace was funded by DHS Science and Technology and DARPA to develop their cryptocurrency tracing capabilities. The team has deep expertise in cyber security, payment systems, banking, encryption, bitcoin mining and were the early participants in the bitcoin community. CipherTrace has the backing of leading Silicon Valley venture capital investors.