TORONTO--(BUSINESS WIRE)--Following lackluster returns in the Canadian stock market in 2017, financial advisors are concerned that higher levels of market volatility, interest rate hikes, and possible asset bubbles threaten investment returns for 2018. This environment can also lead investors to make costly mistakes – and managing the emotional reactions of clients could be advisors’ greatest challenge in 2018.

Those are some of the most important findings of a survey released by Natixis Investment Managers. The company’s Center for Investor Insight surveyed 150 Canadian financial and investment advisors about their market challenges and how they are positioning client portfolios. According to the findings, 94% of respondents said that preventing clients from making investment decisions based on their feelings is important to their success. In addition, 34% of advisors reported that their clients reacted emotionally to recent market movements, and just 43% believe investors are prepared for a market downturn.

Financial advisors also have their work cut out as they navigate through the market’s choppy waters. As survey respondents strive to grow assets under management by an average of 14% over the next 12 months, they see several potential roadblocks. Among the survey’s findings:

- Threats to investment performance: Advisors see rising volatility as the biggest potential threat to the markets. Seventy-three percent say it would negatively affect overall investment performance; trailing as perils are asset bubbles (63%), geopolitical events (57%) unwinding of quantitative easing (57%), interest rate increases (56%), the low yield environment (55%), regulation (43%) and currency fluctuations (41%).

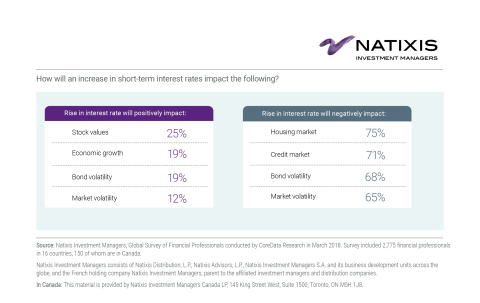

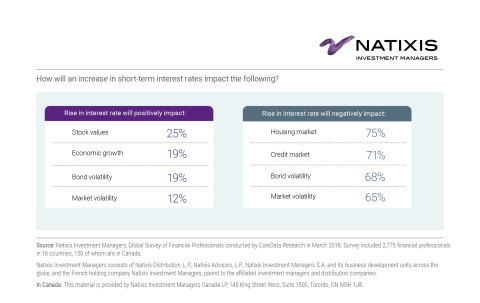

- Impact of short-term rate increase: Advisors say an increase in central bank short-term interest rates is expected to adversely affect the housing market (75%), credit market (71%), bond volatility (68%), overall market volatility (65%) consumer spending (62%) and economic growth (53%).

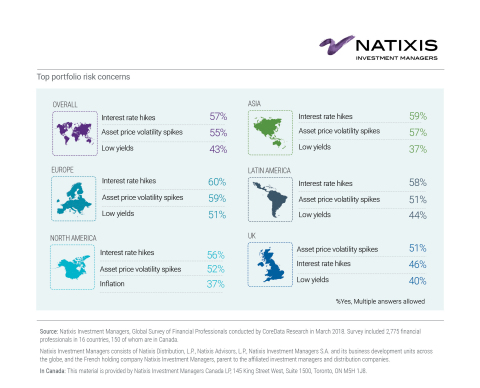

- Portfolio risks: Advisors’ top risk concerns are interest rate hikes (51%), asset price volatility spikes (45%), and low yields (38%). (Notably, advisors already are acting in response to the biggest perceived threat – rising rates – by managing bond durations.)

- Concerns about bubbles: Advisors believe there are asset bubbles in the real estate market (49%), the tech sector (23%), the stock market (23%), and bond market (22%). They show the most concern for crypto-currencies. After those currencies experienced a considerable run up in 2017, 69% of respondents see them as a potential bubble that could burst in 2018.

“Whether it is buying indiscriminately when markets are rising or selling in a panic when they are declining, investors often make their worst decisions when driven by their emotions,” said Abe Goenka, Chief Executive Officer of Natixis Investment Managers Canada. “Advisors have an important role to play in all markets, helping investors to be aware of the harm emotionally driven investing can cause and assisting them in dispassionately examining their goals, risk tolerance and timeframe. Our research shows they are increasingly turning to active managers for the tools and flexibility to diversify their clients’ portfolios and reduce risk.”

Active Management: Front and Center in 2018

According to the survey, advisors are turning to active managers and deploying alternative investments to manage new and numerous risks facing their clients.

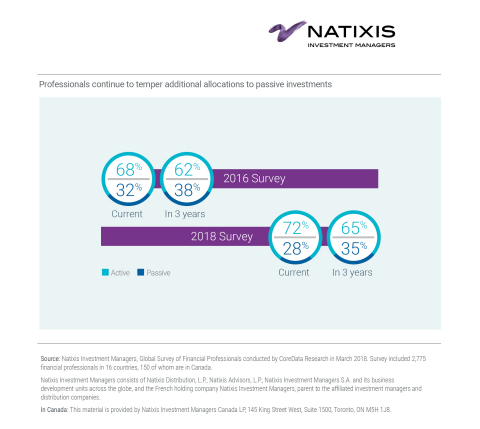

Nearly nine in 10 (86%) advisors say the risks in the market add up to an environment that favors active management. These professionals demonstrate a clear preference for actively managed investments and continue to allocate the majority of assets to these strategies. Advisors who responded to Natixis’ 20161 survey reported that 68% of the assets they manage were allocated to active strategies and 32% to passive. They projected that within three years they would moderate their active allocations to 62% and increase passive allocations to 38%. Instead, allocations to active actually have increased in the past two years. Respondents in this year’s survey now say they have 72% allocated to active management.

Greater sentiment toward active management could generate a further shift to active strategies, which have become essential in recent years as advisors seek opportunities to generate alpha. Advisors say that passive strategies, in contrast, are used mainly for their lower fees (56%). Notably, 75% of advisors believe individual investors are unaware of the risks of passive investing, and the same number has a false sense of security about this type of investing.

Alternatives Regaining Momentum

Financial advisors also believe it is important to invest in alternatives to obtain benefits such as moderating volatility, producing alpha and generating stable income. Survey results show that 66% of advisors recommend alternative investments to clients today. Their strategies include real estate/REITS (35%), infrastructure (33%), real assets (29%), commodities (19%), hedge fund strategies (17%), and private equity (15%). Nearly half (47%) give an alternative strategy more than three years to prove itself.

Among those who recommend alternative investments, advisors see a number of liquid alternative strategies playing distinct roles in their portfolios:

- Diversification: Advisors most commonly cite global tactical asset allocation (40%) and multi alternatives (37%) as best for diversification.

- Fixed-income replacement: Top choices for providing a source of stable income include option writing (34%) and real estate (17%).

- Volatility management: Advisors cite market-neutral (48%) and long-short equity (24%) as best suited to manage volatility risk.

- Enhance returns: One quarter (25%) cite global tactical asset allocation as their top choice for enhancing returns. They also see long-short equity (20%) as useful in meeting this objective.

- Inflation hedge: Advisors view real estate (18%) as best for inflation hedging strategies.

- Reduce risk: Top choices for risk mitigation include long-short equity (25%), long-short credit (21%), and market neutral (18%).

Clients Need Practical Education in Today’s Choppy Markets

Investors need to know themselves and the markets in order to make sound decisions, especially during growing volatility. Yet, just over half (53%) of advisors in the Natixis survey believe investors understand the risks of the current market environment, and an even smaller number (43%) believe that investors are prepared for a market downturn. Eighty-one percent say the extended period of higher markets has made investors complacent about risk, and 82% say risk awareness often comes too late, with investors not recognizing risk until bad outcomes have occurred.

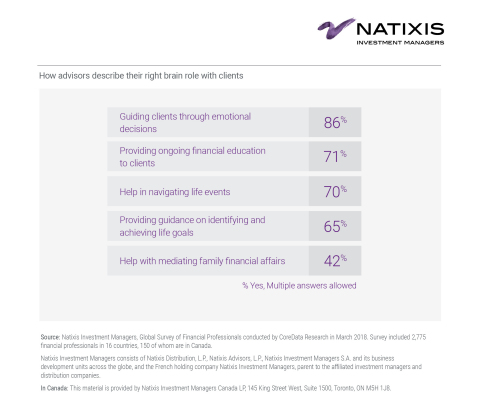

Based on advisors’ views for markets for the next 12 months, their skills will be in high demand. According to the survey, other than giving investment advice, financial advisors describe their role with clients as:

1. Guiding clients through “emotional” decisions (86%)

2. Providing

ongoing financial education (71%)

3. Help in navigating life events

(70%)

4. Providing guidance on identifying and achieving life goals

(65%)

5. Help with mediating family financial affairs (42%)

“Financial advisors see a world in flux in the coming year, and their ability to serve their clients will require a unique pairing of skills,” said David Goodsell, Executive Director of Natixis Investment Managers’ Center for Investor Insight. “On one hand, they will need a firm analytical grasp of the forces driving the market in order to adjust investment strategy. On the other, they will need to understand the motivations of investors to avoid emotional decisions that could disrupt long-term plans. To be successful, advisors will need to be in close communication with their clients, and their advice will need to come from both the right side and the left side of the brain.”

Methodology

Natixis Investment Managers 2018 Global

Financial Professionals Survey was conducted by CoreData Research March

2018. Survey included 2,775 financial professionals, including wirehouse

advisors, registered investment advisors and independent brokers and

dealers, with $113.7 billion in assets, in 16 countries and territories

in Asia, Continental Europe, Latin America, the United Kingdom and the

Americas. In Canada, CoreData surveyed 150 financial professionals.

These findings are also published in a new whitepaper titled “Meeting of

the Mind.” For more information, visit im.natixis.com/us/research/financial-professional-survey-2018.

About the Natixis Center for Investor Insight

As part of the

Natixis Investment Institute, the Center for Investor Insight is

dedicated to the analysis and reporting of issues and trends important

to investors, financial professionals, money managers, employers,

governments and policymakers globally. The Center and its team of

independent and affiliated researchers track major developments across

the markets, economy, and investing spectrum to understand the attitudes

and perceptions influencing the decisions of individual investors,

financial professionals, and institutional decision makers. The Center’s

annual research program began in 2010, and now offers insights into the

perceptions and motivations of over 59,000 investors from 31 countries

around the globe.

About Natixis Investment Managers

Natixis Investment

Managers serves financial professionals with more insightful ways to

construct portfolios. Powered by the expertise of 26 specialized

investment managers globally, we apply Active ThinkingSM to deliver

proactive solutions that help clients pursue better outcomes in all

markets. Natixis ranks among the world’s largest asset management firms2

with more than $1 trillion assets under management3 (€818.1

billion AUM).

Headquartered in Paris and Boston, Natixis Investment Managers is a subsidiary of Natixis. Listed on the Paris Stock Exchange, Natixis is a subsidiary of BPCE, the second-largest banking group in France. Natixis Investment Managers’ affiliated investment management firms and distribution and service groups include Active Index Advisors®;4 AEW; AlphaSimplex Group; Axeltis; Darius Capital Partners; DNCA Investments;5 Dorval Asset Management;6 Gateway Investment Advisers; H2O Asset Management;6 Harris Associates; Investors Mutual Limited; Loomis, Sayles & Company; Managed Portfolio Advisors®;4 McDonnell Investment Management; Mirova;7 Ossiam; Ostrum Asset Management; Seeyond;7 Vaughan Nelson Investment Management; Vega Investment Managers; and Natixis Private Equity Division, which includes Seventure Partners, Naxicap Partners, Alliance Entreprendre, Euro Private Equity, Caspian Private Equity;8 and Eagle Asia Partners. Not all offerings available in all jurisdictions. For additional information, please visit the company’s website at im.natixis.com | LinkedIn: linkedin.com/company/natixis-investment-managers.

Natixis Investment Managers includes all of the investment management and distribution entities affiliated with Natixis Distribution, L.P. and Natixis Investment Managers S.A.

In Canada: This material is provided by Natixis Investment Managers Canada LP.

1 Natixis Investment Managers 2016 Global Survey of 2,550

Financial Advisors conducted by CoreData Research in July 2016.

2

Cerulli Quantitative Update: Global Markets 2017 ranked Natixis

Investment Managers (formerly Natixis Global Asset Management) as the

15th largest asset manager in the world based on assets under management

as of December 31, 2016.

3 Net asset value as of March

31, 2018 is $1.008 trillion. Assets under management (“AUM”), as

reported, may include notional assets, assets serviced, gross assets and

other types of non-regulatory AUM.

4 A division of

Natixis Advisors, L.P.

5 A brand of DNCA Finance.

6

A subsidiary of Ostrum Asset Management.

7 Operated in

the U.S. through Ostrum Asset Management U.S., LLC.

8 Caspian

Private Equity is a joint venture between Natixis Investment Managers,

L.P. and Caspian Management Holdings, LLC.