NEW YORK--(BUSINESS WIRE)--The stress of the 2017 tax-year filing deadline has passed and, though many Americans may be eager to put away their financial records, now is the perfect time to plan for the future. Instead of filing and forgetting it, the American Institute of CPAs (AICPA) encourages Americans to use the information in their tax return to develop a plan that will put them on the path to reach their financial goals.

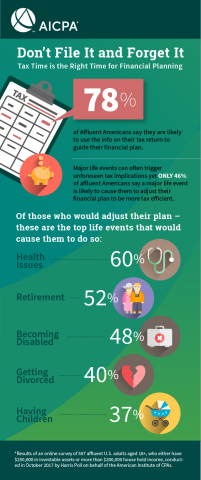

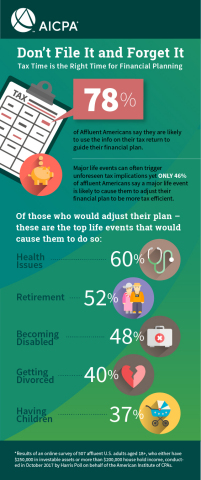

According to a survey of 507 affluent Americans (either $250,000 in investable assets or more than $200,000 household income) conducted online by The Harris Poll for the AICPA before the new tax law passed, nearly 8 in 10 affluent Americans (78 percent) said they are likely to use the information on their tax return to guide their financial plan.

This underscores the bridge between taxes and financial planning. A tax return can double as a roadmap to a more prosperous financial future. In it, Americans can find details of their cash flows, important investment information, insights to retirement and estate planning and identify overlooked strategies to help them achieve their financial goals. With the significant changes brought about by the Tax Cuts and Jobs Act now in effect for the 2018 tax-year, Americans should revisit their financial plan while all their documents are readily available.

“By not taking advantage of various tax planning strategies, Americans could be leaving money on the table every year that could have gone towards their children’s education, their family’s healthcare savings, or towards retirement,” said Andrea Millar, CPA/PFS, director – financial planning, Association of International Certified Professional Accountants. “In today’s dynamic tax environment, taking some time after tax season to ensure your financial plan is in synch with the current law will allow you to feel more confident you’re on track to meet your financial goals.”

The survey found nearly a quarter of affluent adults (23 percent) received a notice from the IRS that they have overpaid taxes in the past 10 years and were owed a refund. In addition, 14 percent underpaid and owed the IRS money. Over or under withholding payroll tax can be a strategic move. But winding up with a big tax bill or a large refund can also indicate that adjustments are in order. And with updated withholding tables from the new tax law in effect, now is a perfect time to do this.

While tax law often changes, life events such as having a child, divorce or purchasing a home can also have a major impact on an individual’s tax situation. Alarmingly, less than half of affluent adults (46 percent) said it is likely that a major life event would cause them to adjust their financial plan to be more tax efficient. Of those who would be likely to make changes, the leading causes cited were health issues (60 percent), followed by retirement (52 percent), becoming disabled (48 percent), getting divorced (40 percent) and having children (37 percent).

“With the new tax law in effect, tax planning strategy is going to be very different this year,” said Millar. “Every individual’s personal financial situation is fluid and requires periodic adjustment. Major life events like having children, getting married or even switching jobs can be a good opportunity to sit down with a CPA financial planner to develop a holistic financial plan.”

The survey found that affluent adults appreciate the value of a financial planner with substantial tax expertise. By nearly a nine-to-one ratio, affluent Americans (53 percent) say working with individuals, such as CPA financial planners, would make them more likely to reach their financial goals (versus 6 percent less likely). Financial planning is not just for the wealthy. Every American can benefit from knowing where their money is going and taking advantage of opportunities to incorporate planning strategies available to them in the tax law.

With tax-filing season having just concluded, CPA financial planners suggest Americans review their returns and see if any the following opportunities make sense for them:

- Make your 2018 contributions as early as possible: Taxpayers should make their contributions to tax-advantaged accounts, such as IRAs, 529s, and workplace retirement plans, as early in the year as possible. By making these contributions earlier rather than later, taxpayers will benefit from additional tax-free compounding growth, which can be substantial over time. Time is an asset for financial growth and taxpayers should take advantage of it by making their contributions to any tax advantaged accounts as early in the year as possible.

- 529 College Savings Plan for education expenses: For families with kids going to private elementary or high school, take advantage of the new 529 provision that allows you to pay $10,000 per year, per child, from a 529. If your state gives you a deduction for amounts contributed (check with your state’s plan to find out any limits on each year’s deduction), even if you don’t have a 529 established, it could make sense to deposit up to that deductible limit in the account first before paying education expenses, which can lower your state income taxes. Your CPA can help you work out the logistics.

- Participate in employer 401(k): If your company has a matching program and you're not participating in it, then you're missing out on an opportunity to reduce your tax burden while you save for retirement. As you review your W-2, you'll be able to tell how much you contributed in the prior year. Make sure you’re contributing enough to get the full company match, otherwise you’re essentially turning down a “free” 100 percent return on your contribution. For the 2018 tax-year, the contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan is $18,500.

- Review employee benefits: Tax time can be a good opportunity to review your employee benefits and determine if any changes need to be made during the next open enrollment period. Lots of companies are offering ways to save their employees money such as health savings accounts or pre-tax commuter benefits. Ask your Human Resources department for a benefits manual if you haven't received one already.

- Review investments: An annual investment review is always recommended to ensure that your goals and life circumstances have not changed, which will have an impact on your asset allocation. Moreover, you should determine if you need to re-balance your investments to maintain your desired level of risk. Also, consider if potentially switching to more tax efficient investments makes sense for your financial goals. A CPA financial planner can help you determine the most appropriate strategy for your unique situation.

- Consider bunching medical expenses into 2018: If you have been putting off a procedure or visiting a medical specialist, now may be the best time to schedule that appointment. Under the new law, the 7.5 percent of income medical deduction threshold will be in place only for the 2017 and 2018 tax years. After that, the threshold reverts back to 10 percent of income. For what is and isn’t deductible, visit the IRS website.

Want help? Start your financial plan here: CPA financial planner Lori Luck is hosting a free webcast on Friday, April 27, 2018 at 1:00 PM ET where she will walk Americans through the steps showing them how they can use their tax return to develop a well-rounded comprehensive financial plan. Register for free here.

For more information on how tax reform will affect tax filing next year, click here.

Survey Methodology

This survey was conducted online by The Harris Poll for AICPA within the United States from September 26 to October 10, 2017, among 507 affluent U.S. adults aged 18+, who either have $250,000 in investable assets or more than $200,000 house hold income. Results are weighted to bring them into line with their actual proportions in the population.

About the AICPA’s PFP Division

The AICPA’s Personal Financial Planning (PFP) Section is the premier provider of information, tools, advocacy, and guidance for CPAs and other professionals who specialize in providing estate, tax, retirement, risk management, and investment planning advice to individuals, families, and business owners. The primary objective of the PFP Section is to support its members by providing resources that enable them to perform PFP services in the highest professional manner.

CPA financial planners are held to the highest ethical standards and are uniquely able to integrate their extensive knowledge of tax and business planning with all areas of personal financial planning to provide objective and integrated guidance for their clients. The AICPA offers the Personal Financial Specialist (PFS) credential exclusively to CPAs who have demonstrated their expertise in personal financial planning through examination, experience and learning, enabling them to gain competence and confidence in PFP disciplines.

About the American Institute of CPAs

The American Institute of CPAs (AICPA) is the world’s largest member association representing the CPA profession, with more than 418,000 members in 143 countries, and a history of serving the public interest since 1887. AICPA members represent many areas of practice, including business and industry, public practice, government, education and consulting. The AICPA sets ethical standards for its members and U.S. auditing standards for private companies, nonprofit organizations, federal, state and local governments. It develops and grades the Uniform CPA Examination, offers specialized credentials, builds the pipeline of future talent and drives professional competency development to advance the vitality, relevance and quality of the profession.

The AICPA maintains offices in New York, Washington, DC, Durham, NC, and Ewing, NJ.

Media representatives are invited to visit the AICPA Press Center at www.aicpa.org/press

About the Association of International Certified Professional Accountants

The Association of International Certified Professional Accountants (the Association) is the most influential body of professional accountants, combining the strengths of the American Institute of CPAs (AICPA) and The Chartered Institute of Management Accountants (CIMA) to power opportunity, trust and prosperity for people, businesses and economies worldwide. It represents 650,000 members and students in public and management accounting and advocates for the public interest and business sustainability on current and emerging issues. With broad reach, rigor and resources, the Association advances the reputation, employability and quality of CPAs, CGMAs and accounting and finance professionals globally.