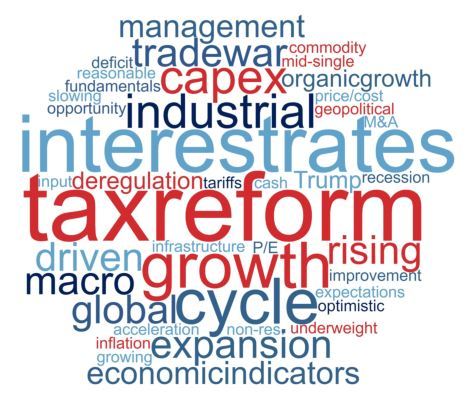

HARTFORD, Conn.--(BUSINESS WIRE)--Corbin Advisors, a specialized investor relations (IR) advisory firm, today released its quarterly Industrial Sentiment Survey, which reveals strong 1Q18 results are expected to be driven by accelerated organic growth and positive tax reform impact. The survey, part of Corbin’s Inside The Buy-side® publication, is based on responses from 25 institutional investors and sell-side analysts globally who actively follow the industrial sector.

Optimism continues into 1Q18 earnings season, as 60% forecast sequential improvement and more than 95% anticipate earnings to be In Line with or Better Than consensus. Organic growth and EPS are still expected to improve but at more muted levels than last quarter’s all-time highs. Meanwhile, margin outlooks temper as more than 60% report a High level of concern with rising input costs.

Continuing, 65% believe we are Mid-to-Late to Late in the Industrial cycle with 46% forecasting earnings will peak in 2019.

Views on nearly all regional economy prospects softened, with sentiment on Eurozone, Mexico and Japan dampening the most. Still, China, which has been out-of-favor, and India, saw increased optimism.

Despite increased uncertainty, 83% of respondents describe their sentiment as Neutral to Bullish or Bullish while none characterize their views as Bearish. As well, nearly 40% report they were Net Buyers amid the recent equity market dislocations.

“We are at an interesting inflection point this earnings season, as many companies will likely report strong growth momentum in the first quarter but are now faced with rising inflation and interest rates, as well as the emergence of trade war uncertainty,” said Rebecca Corbin, Founder and CEO of Corbin Advisors. Ms. Corbin added, “The majority of investors are forecasting 2018 Industrial organic growth rates at a healthy 5% or greater, as companies continue to invest in innovation, capacity expansion and technology. Managements’ discussions on 2018 guidance outlooks will be in focus as investors seek clarity on the long-term impact of these mounting headwinds.”

Surveyed financial professionals are most bullish on Defense, which saw the highest sentiment ever recorded for any industry, as well as Commercial Aerospace. Conversely, Auto remains the biggest laggard for the fifth consecutive quarter, while bearish sentiment increased on Non-Resi and Resi Construction and Chemicals.

Since 2006, Corbin Advisors has tracked investor sentiment on a quarterly basis. Access Inside The Buy-side® and other research on real-time investor sentiment, IR best practices and case studies at www.CorbinAdvisors.com.

About Corbin Advisors

Corbin Advisors is a specialized investor relations (IR) advisory firm that partners with C-suite and IR executives to drive long-term shareholder value. We bring third-party objectivity as well as deep best practice knowledge and collaborate with our clients to execute sound, effective investor communication and engagement strategies. Our comprehensive services include perception studies, investor targeting and marketing, investor presentations, investor days, specialized research, and retainer and event-driven consulting.

Inside the Buy-side®, our industry-leading research publication, is covered by news affiliates globally and regularly featured on CNBC.

To learn more about us and our impact, visit www.CorbinAdvisors.com.