CAMDEN, N.J.--(BUSINESS WIRE)--Campbell Soup Company (NYSE:CPB) today announced it has completed the acquisition of Snyder’s-Lance, Inc. for $50 per share in an all-cash transaction, which represents an enterprise value of approximately $6.1 billion.

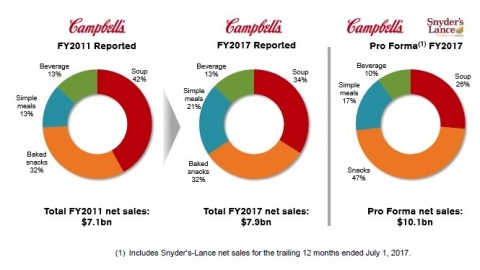

"Snyder's-Lance represents a strategic and transformative acquisition for Campbell, creating a $10-billion company with nearly half of our annual net sales in the faster-growing snacks category," said Denise Morrison, Campbell’s President and Chief Executive Officer. "The combination of Campbell and Snyder's-Lance creates a unique, diversified snacking portfolio of differentiated brands and a large variety of better-for-you snacks for consumers. I am excited about the combination and confident that it will create significant shareholder value through both revenue growth and cost synergies."

Snyder’s-Lance Integration with Pepperidge Farm to Form Campbell Snacks

To unlock the power of the combined brand portfolio, and achieve both cost and potential revenue opportunities, Campbell is integrating the Pepperidge Farm and Snyder’s-Lance portfolios to create a unified snacking organization in the U.S. called Campbell Snacks. The unit will be led by Carlos Abrams-Rivera, former President, U.S. Biscuits and Snacks, who will report to Luca Mignini, President, Global Biscuits and Snacks.

“We carefully selected leaders from Campbell and Snyder's-Lance to form the Campbell Snacks leadership team based on their expertise and understanding of how to leverage both businesses to support overall growth and profitability across the enterprise,” said Abrams-Rivera. “The Campbell Snacks team will focus on optimizing the value of our U.S. snacks business to deepen our partnership with customers through the power of the combined portfolio.”

The Campbell Snacks leadership team includes:

- Chris Foley, Senior Vice President/Chief Marketing Officer, Campbell Snacks, will lead efforts to drive innovation and brand building across the expanded snacks portfolio. Foley joined Campbell in 1999.

- To ensure end-to-end manufacturing excellence and a focus on value capture, Bill Livingstone, Vice President, Supply Chain, Snyder’s-Lance, will oversee supply chain operations at Snyder’s-Lance; and Paul Serra, Vice President, Supply Chain, Pepperidge Farm, will oversee supply chain operations at Pepperidge Farm. Livingstone previously was responsible for overall supply chain for U.S. Biscuits and Bakery for the past eight years. Serra served as general manager for Arnott’s Malaysia & Singapore business.

- Cory Onell, has been appointed Vice President, Sales, Customer Development and DSD Operations for Campbell Snacks. He will oversee the Snyder’s-Lance Customer and Category Sales organization along with the Direct Store Delivery (DSD) operations at Pepperidge Farm and Snyder’s-Lance. Onell joined Pepperidge Farm in 2017 as Vice President, U.S. Sales and DSD Operations.

- George Vindiola, Vice President, Research and Development, Campbell Snacks, will oversee product development and innovation for the combined portfolio. Vindiola joined Pepperidge Farm in 2016, bringing more than 20 years of research and leadership experience from Frito-Lay and PepsiCo/Frito-Lay.

- Matt Wilken, Vice President, Strategy, Campbell Snacks, will accelerate business strategy across Campbell Snacks. Wilken has been with Snyder’s-Lance for the last seven years in business strategy.

Additional leaders have been named to oversee finance, legal, information technology, human resources and communications.

Mignini said, "We have the insights and know-how in snacks to execute and grow in this space. I am very confident that Carlos and the expertise of the Campbell Snacks leadership team will continue to drive momentum in the businesses and achieve the cost synergies we have outlined. We are taking a disciplined approach to the integration of Snyder's-Lance to ensure its success."

The New Campbell

Campbell’s diversified snacking portfolio enables the company to offer real food options to millions of families who enjoy a wide range of eating occasions throughout each day. The Campbell Snacks portfolio will feature Pepperidge Farm’s iconic brands, including Goldfish and Milano, along with Snyder’s-Lance’s well-known brands, such as Snyder’s of Hanover, Lance, Kettle Brand, KETTLE chips, Cape Cod, Snack Factory Pretzel Crisps, Emerald and Late July.

Campbell's global baked snacks product portfolio, including its Pepperidge Farm, Arnott’s and Kelsen businesses, generated approximately $2.5 billion in net sales in fiscal year 2017. With the addition of Snyder’s-Lance, snacking will now represent approximately 47 percent of Campbell’s annual net sales (previously 32 percent). Campbell’s soup portfolio will represent approximately 26 percent of the company’s annual net sales.

Significant Value Creation Through Cost Synergies and Growth

Campbell expects to achieve approximately $170 million in cost synergies by end of fiscal 2022. Additionally, Campbell expects to achieve approximately $125 million of Snyder’s-Lance’s existing cost transformation program.

Based on the significance of the acquisition, Campbell has initiated a systematic approach that engages both companies to quickly share key learnings and best practices. Campbell will integrate key control functions, including supply chain and quality, and finance.

Snyder’s-Lance reported $2.2 billion in net sales for the year ended Dec. 30, 2017.

Campbell will discuss the impact of Snyder’s-Lance to its fiscal 2018 guidance when the company reports third-quarter earnings on May 18, 2018.

About Campbell Soup Company

Campbell (NYSE:CPB) is driven and inspired by our Purpose, “Real food that matters for life’s moments.” We make a range of high-quality soups and simple meals, beverages, snacks and packaged fresh foods. For generations, people have trusted Campbell to provide authentic, flavorful and readily available foods and beverages that connect them to each other, to warm memories and to what’s important today. Led by our iconic Campbell’s brand, our portfolio includes Pepperidge Farm, Bolthouse Farms, Arnott’s, V8, Swanson, Pace, Prego, Plum, Royal Dansk, Kjeldsens, Garden Fresh Gourmet, Pacific Foods, Snyder's of Hanover, Lance, Kettle Brand, KETTLE Chips, Cape Cod, Snack Factory Pretzel Crisps, Pop Secret, Emerald, Late July and other brand names. Founded in 1869, Campbell has a heritage of giving back and acting as a good steward of the planet’s natural resources. The company is a member of the Standard and Poor’s 500 and the Dow Jones Sustainability Indexes. For more information, visit www.campbellsoupcompany.com or follow company news on Twitter via @CampbellSoupCo. To learn more about how we make our food and the choices behind the ingredients we use, visit www.whatsinmyfood.com.

Forward-Looking Statements

This release contains “forward-looking statements” that reflect the company’s current expectations about the impact of its future plans and performance on the company’s business or financial results. These forward-looking statements rely on a number of assumptions and estimates that could be inaccurate and which are subject to risks and uncertainties. The factors that could cause the company’s actual results to vary materially from those anticipated or expressed in any forward-looking statement include (1) changes in consumer demand for the company’s products and favorable perception of the company’s brands; (2) the risks associated with trade and consumer acceptance of product improvements, shelving initiatives, new products and pricing and promotional strategies; (3) the impact of strong competitive responses to the company’s efforts to leverage its brand power with product innovation, promotional programs and new advertising; (4) changing inventory management practices by certain of the company’s key customers; (5) a changing customer landscape, with value and e-commerce retailers expanding their market presence, while certain of the company’s key customers continue to increase their significance to the company’s business; (6) the company’s ability to realize projected cost savings and benefits from its efficiency and/or restructuring initiatives; (7) the company’s ability to manage changes to its organizational structure and/or business processes, including selling, distribution, manufacturing and information management systems or processes; (8) product quality and safety issues, including recalls and product liabilities; (9) the ability to complete and to realize the projected benefits of acquisitions, divestitures and other business portfolio changes, including with respect to the Snyder’s-Lance acquisition; (10) disruptions to the company’s supply chain, including fluctuations in the supply of and inflation in energy and raw and packaging materials cost; (11) the uncertainties of litigation and regulatory actions against the company; (12) the possible disruption to the independent contractor distribution models used by certain of the company’s businesses, including as a result of litigation or regulatory actions affecting their independent contractor classification; (13) the impact of non-U.S. operations, including trade restrictions, public corruption and compliance with foreign laws and regulations; (14) impairment to goodwill or other intangible assets; (15) the company’s ability to protect its intellectual property rights; (16) increased liabilities and costs related to the company’s defined benefit pension plans; (17) a material failure in or breach of the company’s information technology systems; (18) the company’s ability to attract and retain key talent; (19) changes in currency exchange rates, tax rates, interest rates, debt and equity markets, inflation rates, economic conditions, law, regulation and other external factors; (20) unforeseen business disruptions in one or more of the company’s markets due to political instability, civil disobedience, terrorism, armed hostilities, extreme weather conditions, natural disasters or other calamities; and (21) other factors described in the company’s most recent Form 10-K and subsequent Securities and Exchange Commission filings. The company disclaims any obligation or intent to update the forward-looking statements in order to reflect events or circumstances after the date of this release.