SANTA MONICA, Calif.--(BUSINESS WIRE)--Institutional assets tracked by the Wilshire Trust Universe Comparison Service® (Wilshire TUCS®) saw a median return of 3.59 percent for all plan types in the fourth quarter and a median one-year gain of 14.72 percent. Wilshire TUCS, a cooperative effort between Wilshire Analytics, the investment technology unit of Wilshire Associates Incorporated (Wilshire®), and custodial organizations, is considered the most widely accepted benchmark for the performance and allocation of institutional assets in North America.

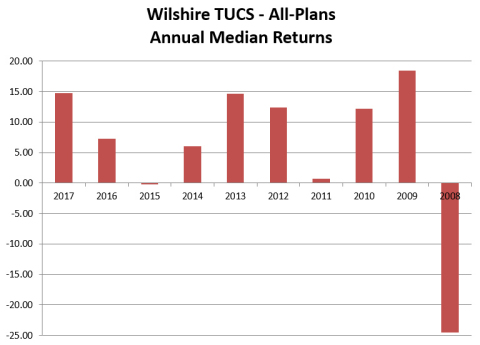

“This quarter marked the ninth consecutive positive quarter, the longest string of positive quarterly returns for all plan types since June 1998, which marked a string of 14 positive quarters in a row,” said Robert J. Waid, managing director, Wilshire Associates. “Fourth quarter returns boosted the one-year return to 14.72 percent for the year ending December 31, 2017, compared to 7.24 percent for the year ending December 31, 2016. This was the best one-year return since the year ending June 30, 2014 ended with 15.51 percent and fourth consecutive quarter to post an annual return above 10 percent.”

Wilshire TUCS returns were supported by continued strong performance across all major asset classes. The Wilshire 5000 Total Market Index℠ returned 6.39 percent for the fourth quarter and 20.99 percent for the year ending December 31, 2017, while the MSCI AC World ex U.S. for international equities rose 5.00 percent in the fourth quarter and 27.19 percent for the year. The Wilshire Bond Index℠ also gained 0.89 percent in the fourth quarter and 4.82 percent for the year. This resulted in a positive range of median plan-type returns in the fourth quarter, as the low median return was 2.76 percent for Taft Hartley Health and Welfare Funds and the high median return was 3.74 percent for Public Funds with assets greater than $1 billion. For one-year returns, the low median return was 12.30 percent for Taft Hartley Health and Welfare Funds and the high median return was 15.96 percent for Public Funds with assets greater than $5 billion.

2017 had the best median plan returns of the past three years, which translated to multi-year median plan returns of 7.04, 8.44 and 5.93 percent for three-, five- and ten-year returns, respectively.

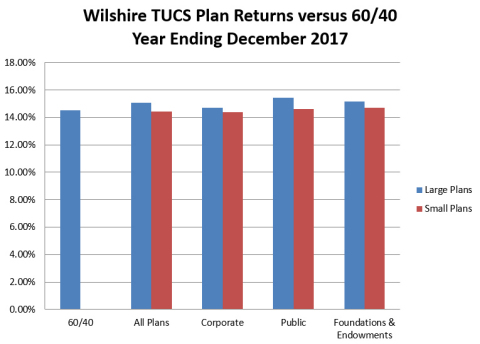

“Even with U.S. equities continuing as one of the top performing asset classes, the 60/40 portfolio trailed the median plan return, with a return of 14.52 percent,” said Waid. “Generally, large plans have greater exposure to international equities than small plans, so it is not surprising that large plans outperformed small plans for the year.”

The data and charts in this article are copyrighted and owned by Wilshire Associates Incorporated.

About Wilshire Associates

Wilshire Associates, a leading global, independent investment consulting and services firm, provides consulting services, analytics solutions and customized investment products to plan sponsors, investment managers and financial intermediaries. Its business units include, Wilshire Analytics, Wilshire Consulting, Wilshire Funds Management and Wilshire Private Markets.

The firm was founded in 1972, providing revolutionary technology and acting as an early innovator in the application of investment analytics and research to investment managers in the institutional marketplace. Wilshire also is credited with helping to develop the field of quantitative investment analysis that uses mathematical tools to analyze market risks. All other business units evolved from Wilshire’s strong analytics foundation. Wilshire developed the Wilshire 5000 Total Market Index℠ and became an early innovator in creating integrated asset/liability analysis/simulation models as well as practical models in risk budgeting through beta and active risk analysis. Wilshire has grown to a firm of approximately 275 employees serving the investment needs of institutional clients around the world.

Based in Santa Monica, California, Wilshire serves in excess of 500 clients across 20 countries with combined assets exceeding $8 trillion*. With ten offices worldwide, Wilshire Associates and its affiliates are dedicated to providing clients with the highest quality products and services. Wilshire® and Trust Universe Comparison Service®, TUCS® are registered service marks of Wilshire Associates Incorporated. Wilshire 5000 Total Market Index℠ and Wilshire US Small-Cap Index℠ are service marks of Wilshire Associates Incorporated.

Website: www.wilshire.com

Follow

us: @WilshireAssoc

*Client assets are as represented by Pensions and Investments (P&I), detailed in P&I’s “Largest Retirement Funds” and P&I’s “Largest Money Managers (U.S. institutional tax-exempt assets)” as of 9/30/16 and 12/31/16, and published 2/6/17 and 5/29/17, respectively). The data and charts in this article are copyrighted and owned by Wilshire Associates Incorporated.