HONG KONG--(BUSINESS WIRE)--Oasis Management Company Ltd. (“Oasis”) is the manager to funds that beneficially own over 5.0% of GMO Internet Inc. (9449 JT) (“GMO Internet” or the “Company”), making Oasis one of the Company’s largest minority shareholders. Oasis has adopted the Japan FSA’s “Principles of Responsible Ownership” (a/k/a Japan Stewardship Code) and in line with those principles, Oasis monitors and engages with our investee companies.

Oasis has been continuously and judiciously monitoring GMO Internet, and sent a proposal regarding its strategic implementation and governance restructuring to the Company’s Board of Directors in July 2017. Oasis appreciates GMO Internet’s recent strategic moves, as we believe that some of the implementations were made in response to our proposal. However, we have concluded that GMO Internet may not be able to carry out governance restructuring expeditiously because we do not see the Company making progress on these issues, and the Company’s senior management and Board have not made themselves available to us to meet to discuss the issues.

Oasis aims to realize the sustainable growth of GMO Internet and increase the Company’s value for all stakeholders by resolving these issues through our shareholder proposals.

GMO Internet’s Corporate Governance Issues

Takeover defense measure

The existence of a potential acquirer benefits minority shareholders by strongly incentivizing board members and management to increase the corporate value and the stock price, and further disincentivizing mismanagement. This is particularly relevant in the case of GMO Internet, where a very large shareholder, Mr. Kumagai, exerts, in our view, excessive control of the company.

Our views on takeover defense measures reflect those of the Ito Commission, the Corporate Governance Code, and Institutional Shareholder Services (ISS), which recommend against the adoption of takeover defense measures designed to insulate and protect management, rather than reflect shareholders’ will. As a result of these recommendations, more than 150 Japanese companies have dropped or chosen not to renew their takeover defense measures over the past 10 years.

Yet, GMO Internet did not obtain shareholders’ approval when introducing a takeover defense measure in 2006. Moreover, their takeover defense measure does not require shareholders’ approval when being put into effect. Thus, GMO Internet’s takeover defense measure is particularly abusive.

We believe that GMO Internet’s takeover defense measure as it is currently structured prevents shareholders’ will from being reflected, and therefore is contrary to guidance indicated in “Policy Concerning Takeover Defense Measures to Ensure or Improve Corporate Value and Common Interests of the Shareholders,” published by the Ministry of Economy, Trade and Industry and the Ministry of Justice as of May 27, 2005, and in the “Corporate Governance Code - Sustainable Corporate Growth and Medium-to-Long Term Improvement of Corporate Value” (“CG Code”), published by Tokyo Stock Exchange, Inc. on June 1, 2015.

In addition, we doubt the independence and effectiveness of GMO Internet’s special committee for the takeover defense measure, whose role is to make decisions independent from the Board of Directors in the case of an acquisition offer. In particular, two out of four members of the special committee (Mr. Kinoshita and Mr. Ogura) were former corporate auditors of GMO Internet, one member (Mr. Ogura) currently serves as a Board director and member of the audit and supervisory committee, and one member (Mr. Masuda) currently serves as an external board director and member of the audit and supervisory committee.

According to Mr. Kumagai’s past interviews to multiple media outlets, he has in his sole discretion declined several offers to acquire GMO Internet, including an offer from an overseas fund to acquire the Company for JPY50 billion, when the Company faced serious risk of becoming insolvent due to overpaid claims associated with Orient Credit Co., Ltd. This was obviously an unauthorized performance by Mr. Kumagai, notwithstanding his ownership at the time of 47.70% of voting rights as well as his role as a Representative Director, Chairman and President of the Company.

Moreover, in the interviews, Mr. Kumagai explained that his “promises to his colleagues, his dream and his faith” were his reasons for rejecting the offers. However, as a result of this judgment, minority shareholders were heavily disadvantaged and harmed. As is apparent from the chart below, it took GMO Internet more than five years to trade above the JPY50 billion level we believe investors could have received in 2007.

Therefore, we are very concerned that minority shareholders have missed a number of attractive opportunities, after and in addition to the aforementioned case, as a consequence of Mr. Kumagai’s sole discretion, or as a result of decisions made by the Company in consideration of Mr. Kumagai’s interests.

At the current stock price level, GMO Internet is particularly attractive to acquirers. In our view, management has not done enough to increase shareholder value. The prospect of potential acquirers should further incentivize management to increase corporate value.

Weak governance structure

Oasis believes that a weak governance structure is another key reason behind GMO Internet’s secularly undervalued stock price.

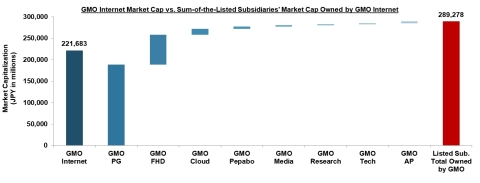

In fact, GMO Internet is valued at less than the value of the stake the Company owns in its listed subsidiaries (GMO Payment Gateway, Inc., GMO Financial Holdings, Inc., GMO CLOUD K.K., GMO Pepabo, Inc., GMO Media Inc., GMO Research, Inc., GMO TECH, Inc., and GMO AD Partners, Inc.). The valuation implies that the market gives a negative value to the Company’s operating businesses, which includes a cryptocurrency mining business. As one of the Company’s largest shareholders, we are not able to tolerate this. Board members and Company management should be held responsible.

Even though the Company’s stock price has rallied recently on expectations for its new cryptocurrency mining business, current operations are disappointing. In the third quarter of fiscal year ending December 2017, the Company only achieved operating profit of 63.1% of the Company’s annual guidance, current profit of 63.6%, and net income of 47.3%.

Furthermore, despite the disappointing business performance, according to GMO Internet’s Investor Relations team as of October 2017, Mr. Kumagai has not taken a meeting with shareholders -- an obvious failure of accountability to shareholders as a Representative Director and President of the Company. Hiding from accountability is not the appropriate response by management and further exhibits GMO Internet’s poor corporate governance.

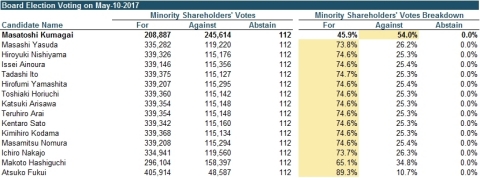

It appears that the majority of minority shareholders voted against Mr. Kumagai’s re-election to the Board of Directors in the latest general shareholder meeting on May 10, 2017. Oasis believes this means that minority shareholders expect GMO Internet to substantially improve its governance structure, including an effective assessment of Mr. Kumagai’s performance.

Regarding GMO Internet’s flawed governance structure; first, Mr. Kumagai has an effective control over election votes of the Company’s Board of Directors at general shareholders meetings, as he controls 40.86% of voting rights, despite this being one of the few governing body decisions upon which minority shareholders can exert influence.

Furthermore, for the Board of Directors to function effectively, both the decision-making function and the supervisory function are important, especially for a company like GMO Internet, where the authority is substantially focused with Mr. Kumagai. However, it appears that the current Board of Directors, with only three outside directors among 19 directors, is not separating supervision of management and execution functions, and is not maintaining effective supervision over Mr. Kumagai, who serves as a Representative Director and President and also performs as a Chair of the Board.

Lastly, according to disclosures from GMO Internet, Directors’ compensation has been determined by increasing or decreasing at a set rate based on quantitative and the qualitative target-setting and the evaluation of the level of achievement of such targets. However, it is unclear to shareholders what those targets are, how those targets are set, and how evaluations are carried out. Under the current governance structure, it is doubtful that these processes are carried out in alignment with the interests of minority shareholders.

Oasis shareholder proposals

Oasis has submitted the following six agenda items to GMO Internet for a general shareholders meeting for the fiscal year ended December 2017 in order to realize sustainable growth through governance restructuring. The full statement of Oasis’s shareholder proposals and further details about the campaign can be found on our campaign website: www.GMOCorpGov.com.

We believe all shareholders and stewards of capital should review these proposals closely. We believe they are all consistent with the Corporate Governance Code and the Stewardship Code, and Oasis encourages all shareholders to vote in favor of the proposals.

Proposals related to the abolition of the takeover defense measure:

- Agenda Item (1) – Abolishment of policy for large scale purchase of the Company’s shares.

- Agenda Item (2) – Partial amendment of the articles of incorporation (introduction method for Takeover Defense Measures).

Proposals related to governance restructuring:

- Agenda Item (3) – Partial amendment of the articles of incorporation (change to the system for company with nominating committee, etc.).

- Agenda Item (4) – Partial amendment of the articles of incorporation (Prohibition of concurrent posts of president and chairperson of the board of directors).

- Agenda Item (5) – Partial amendment of the articles of incorporation (election of directors by cumulative voting).

- Agenda Item (6) – Setting compensation amount for directors (excluding Audit and Supervisory Committee Members, and hereinafter the same in this Agenda Item unless particularly noted otherwise) (meaning adoption of a compensation structure linked with the interests of minority shareholders).

***

For all inquiries or comments from shareholders or employees, please contact GMOCorpGov_Shareholders@hk.oasiscm.com .

For all other inquiries, please contact Taylor Hall at thall@hk.oasiscm.com.

Oasis Management Company Ltd. manages private investment funds focused on opportunities in a wide array of asset classes across countries and sectors. Oasis was founded in 2002 by Seth H. Fischer, who leads the firm as its Chief Investment Officer. More information about Oasis is available at www.oasiscm.com.