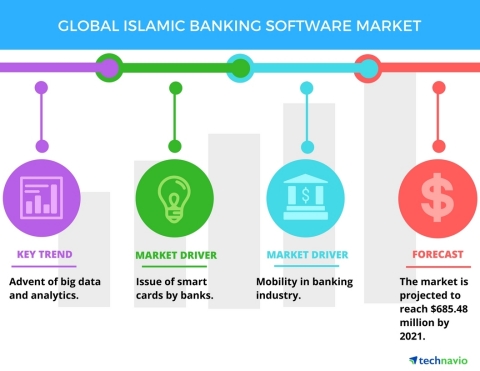

LONDON--(BUSINESS WIRE)--Technavio market research analysts forecast the global Islamic banking software market to grow at a CAGR of close to 13% during the forecast period, according to their latest report.

The market study covers the present scenario and growth prospects of the global Islamic banking software market for 2017-2021. The report also lists retail banking and corporate banking as the two major application segments, of which the retail banking segment accounted for more than 52% of the market share in 2016.

According to Amrita Choudhury, a lead analyst at Technavio for enterprise application research, “The concept of Islamic banking started from the ban on riba in the Quran, which refers to earning interest or profit on money loaned. Therefore, Islamic banks earn profits only by investing in their clients' businesses. One of the major reasons for the growth of this market is the increasing adoption of advanced technology and the increasing acceptance of Islamic banking. Furthermore, the penetration of Islamic banking is increasing with the increasing Islamic assets in countries such as Saudi Arabia, the UAE, Malaysia, and Qatar.”

This report is available at a USD 1,000 discount for a limited time only: View market snapshot before purchasing

Buy 1 Technavio report and get the second for 50% off. Buy 2 Technavio reports and get the third for free.

Technavio analysts highlight the following three market drivers that are contributing to the growth of the global Islamic banking software market:

- Issue of smart cards by banks

- Increasing Sukuk issuance

- Mobility in banking industry

Looking for more information on this market? Request a free sample report

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Issue of smart cards by banks

With the growing transaction volumes and the introduction of new digital payment solutions, the banking sector is facing the biggest challenge to keep the magnitude of fraudulent activities low without compromising on the convenience of the customers. The tamper-free nature of smart cards is encouraging banks to issue them instead of traditional magnetic tape-based debit and credit cards. Banks are implementing initiatives to promote the use of smart cards as this makes it easier for them to track the activities of customers. This helps in better customer management and offering customer loyalty programs.

“Smart cards protect against security threats that range from misuse of user passwords to sophisticated system hacks. The cost of managing password resets for banking enterprises is very high, making smart cards a cost-effective solution. The demand for smart cards in the banking sector is increasing, and this will drive the growth of the market during the forecast period,” says Amrita.

Increasing Sukuk issuance

Sukuk commonly refers to the Islamic equivalent of bonds. However, as opposed to conventional bonds, which merely confer ownership of the debt, Sukuk grants the investor a share of an asset along with the commensurate cash flows and risks. Sukuk securities adhere to Islamic laws, sometimes referred to as Shariah principles, which prohibit the charging or payment of interest.

The Sukuk growth rate is currently 10%-15% in the global financial markets. With the increasing number of Sukuk issuance, it is difficult for banks and financial organizations to monitor and manage them. Islamic banking software helps in the efficient management of Sukuk investments made by every customer, which augurs well for the growth of the market.

Mobility in banking industry

Several financial enterprises are now adopting an array of mobile devices, wireless networks, and related services to help their employees remain connected, enhance customer service, and reduce costs through BYOD initiatives. The adoption of mobile computing with the significant growth of mobile computing devices such as Apple iPad and Android-based tablets has mandated financial institutions to cater to the requirements of various customers by developing suitable applications.

This has also resulted in the increased adoption of mobile-based applications for financial transactions and getting the latest updates on various products and services. The increased use of mobile banking by customers has necessitated the development of compatible mobile applications by several banking firms.

Browse Related Reports:

- Global Forestry Software Market 2017-2021

- Global Smart City ICT Infrastructure Market 2017-2021

- Global Configure Price and Quote (CPQ) Software Market 2017-2021

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 10,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

If you are interested in more information, please contact our media team at media@technavio.com.