NEW YORK--(BUSINESS WIRE)--A new GfK study shows wide gaps between what consumers hope to receive from their banks – in terms of service and financial advice – and what they actually get.

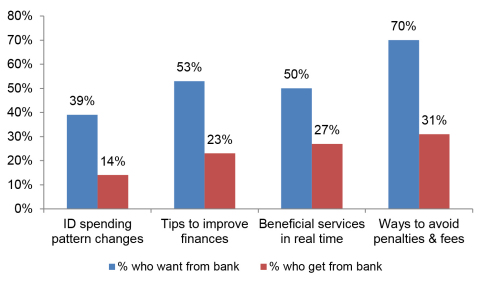

The research shows differences of 13 to almost 40 percentage points between consumer desire and satisfaction around key bank benefits, including

- point out ways to avoid penalties and fees: 39-point gap

- offer tips to improve finances: 30-point gap

- identify changes in spending patterns: 24-point gap

- suggest beneficial services in real time: 23-point gap

- alert customer about unusual bank activity: 13-point gap

- provide third-party offers based on behavior and location: 10-point gap

See chart above for more information.

Despite these apparent signs of dissatisfaction, only 6% consumers say they are likely to move their accounts in the next 6 months. By contrast, 73% report being unlikely to do so, and 19% are unsure. Compared to 2015 data, the proportions of both likely and unlikely respondents grew slightly, while the unsure group narrowed.

Artificial intelligence (AI) applications like chatbots – which can handle basic customer service interactions online or by phone – hold the promise of filling in these service gaps, given the right data and programming. But almost two-thirds of respondents (65%) say they have never interacted with a chatbot and are not interested in doing so.

Another 15% have never used a chatbot but are interested in trying one; 10% say they have had a bad experience with a chatbot; and 8% report having a good experience with one.

Some notable reasons why people might be interested in using chatbots, according to the survey, are to cut banking costs and fees and reduce human bias. But 60% of consumers say they are worried about information security in relation to chatbots, and 34% feel their financial needs to be handled by this kind of technology.

“Banks are leaving opportunities to engage and satisfy customers on the table,” said Keith Bossey, SVP in GfK’s Financial Services practice. “Our research shows that switching banks is still viewed as a major step, both logistically and emotionally. But the vast numbers of innovative online banking and cash-transfer services coming onto the market may change this perception much quicker than banks expect. They need to find ways to identify the moments when person-to-person service really matters to customers, and refine the chatbot experience for other occasions.”

GfK’s study was conducted in April 2017 among 1,003 members (ages 18 and above) of KnowledgePanel®, the largest probability-based online panel that is representative of the adult US population.

About GfK

GfK is the trusted source of relevant market and consumer information that enables its clients to make smarter decisions. More than 13,000 market research experts combine their passion with GfK’s long-standing data science experience. This allows GfK to deliver vital global insights matched with local market intelligence from more than 100 countries. By using innovative technologies and data sciences, GfK turns big data into smart data, enabling its clients to improve their competitive edge and enrich consumers’ experiences and choices.

For more information, please visit www.gfk.com/us or follow GfK on Twitter .