NEWARK, N.J.--(BUSINESS WIRE)--Emerging markets, which already command nearly 60 percent of global GDP on a purchasing power parity basis, will collectively drive global growth over the next decade, but investors would be wise to reconsider how they approach these markets. Increasingly, says PGIM, emerging markets will be the masters of their own economic fate, making a one-size-fits-all classification of emerging markets obsolete.

PGIM, among the world’s top 10 asset managers with more than $1 trillion in assets under management, is the global investment management businesses of Prudential Financial, Inc. (NYSE: PRU).

In Emerging Markets at the Crossroads PGIM argues the export-led, externally oriented growth model that propelled emerging markets forward since the 1980s has stalled. As aging populations reduce the long-term growth potential of developed markets, and the backlash against globalization and free trade continues, emerging markets will increasingly choose their own individual paths. Gone is the rising developed market tide that lifted all boats. Therefore, PGIM urges investors to embrace an active, locally informed investment approach that positions their portfolios for emerging market divergence, and takes advantage of the opportunities from the increasing resilience and declining contagion risk across many emerging markets.

“We believe the opportunity will increasingly be to capture the alpha of outperforming emerging market sectors, themes and securities rather than chasing the beta of the broad emerging markets universe,” said Taimur Hyat, chief strategy officer, PGIM. “This requires building portfolios from the bottom up—the historical emerging market equity investing approach of rotating exposures to countries will no longer be adequate.”

Emerging market investors will need to focus on the cross-cutting themes, sectors and securities that drive investment returns, PGIM says.

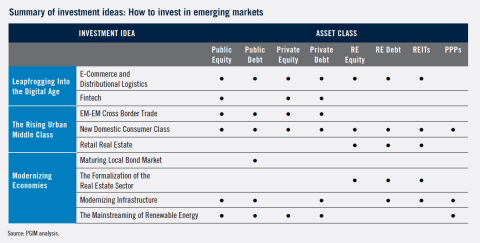

PGIM calls attention to three themes that will underpin emerging market investment opportunities going forward:

- Leapfrogging into the digital era: The rapid adoption of fintech, e-commerce and the distributional logistics necessary for e-commerce to thrive, represent attractive avenues for investing in emerging markets.

- Intra-emerging market trade and domestic opportunities from the rising urban middle class: The rapidly growing middle class in emerging markets is increasingly urban, aspirational, connected and wealthy. This new wave of consumers will create investment opportunities linked to intra-emerging market trade, as well as more domestically focused opportunities in retail real estate, consumer durables, healthcare and pharmaceuticals, and the leisure and recreation sectors.

- Structural transitions in local bond markets, real estate and infrastructure as emerging markets modernize their economies: As domestic capital markets deepen, local bond markets will mature, potentially extending into local government and securitized debt opportunities. In parallel, there will be new opportunities for investors as the real estate sector formalizes and as governments seek long-term private capital to close the massive infrastructure gap.

“Navigating the risks and participating in the opportunities offered by this new emerging market order will be an increasingly important driver of portfolio returns in a world where developed markets are likely to offer diminished yields and subdued growth prospects over the long term,” Hyat said. “We believe investors who act soon will reap the greatest rewards, for as emerging markets continue to close the economic gap with developed markets, the unique investment opportunities they afford will become increasingly scarce.”

Download Emerging Markets at the Crossroads.

About PGIM and Prudential Financial, Inc.

With 14 consecutive years of positive third-party institutional net flows, PGIM, the global asset management businesses of Prudential Financial, Inc. (NYSE: PRU), ranks among the top 10 largest asset managers in the world with more than $1 trillion in assets under management as of March 31, 2017. PGIM’s businesses offer a range of investment solutions for retail and institutional investors around the world across a broad range of asset classes, including fundamental equity, quantitative equity, public fixed income, private fixed income, real estate and commercial mortgages. Its businesses have offices in 16 countries across five continents.

Prudential’s additional businesses offer a variety of products and services, including life insurance, annuities and retirement-related services. For more information about PGIM, please visit pgim.com. For more information about Prudential, please visit news.prudential.com.

0616-1500