BOSTON--(BUSINESS WIRE)--Over three-quarters (78%) of Americans say it’s up to them, not the government, to make sure they have enough money to live in retirement, but 77% are counting on family support to help fund their retirement, according to new survey findings published today by Natixis Global Asset Management.

Natixis commissioned a nationwide-survey of 750 individual investors and found:

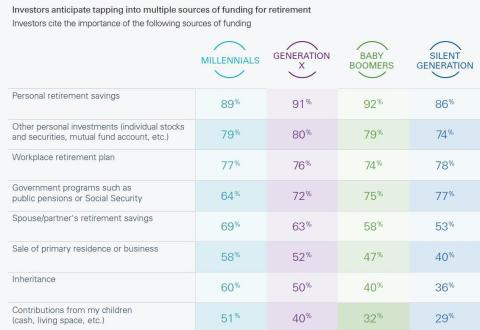

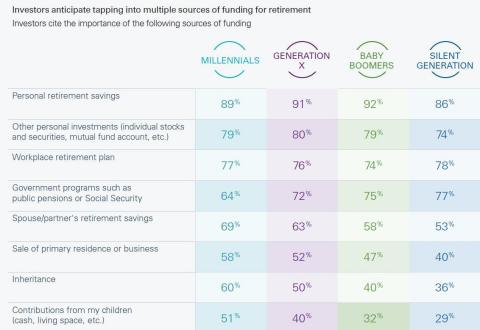

- Millennials are twice as likely as Boomers to think that a financial inheritance from their parents or grandparents and support from their children will be important to meeting their retirement needs; 62% of Millennials, compared to 31% of Boomers, expect to receive an inheritance to help fund their retirement. Furthermore, almost half (47%) of Millennials, compared to 24% of Boomers, say family assistance with finances and housing will be an important part of their financial security in retirement.

- Half of Americans (49%), including 60% of Millennials, and 43% of Boomers, will rely on cash from the sale of their homes and/or business in order to afford life in retirement.

- At least one-third of married couples – 33% of Millennials and 35% of Boomers – say their spouse’s retirement savings will be very important.

- Only about two in five (37%) expect Social Security to be a very important source of retirement income, including nearly half (47%) of Baby Boomers and 35% of Millennials. In fact, 41% of Millennials don’t expect Social Security benefits will even be available by the time they retire.

- Almost all Americans (98%) agree their personal savings and investments, including workplace retirement savings and other qualified retirement plans to be a very important source of the money they’ll need in retirement.

Millennial’s reliance on a financial inheritance may leave many short-changed in the end. Nearly seven in 10 (68%) Millennials say they expect to receive an inheritance, yet four in 10 (40%) Boomers don’t plan to leave one. More than half of Boomers (57%) think they won’t have anything left, and another 35% plan to spend whatever money that’s left on themselves.

In fact, Americans were the least likely among the 22 countries and regions surveyed to say they expected to leave an inheritance. In contrast, Mexicans were the most optimistic with 91% expecting to leave an inheritance, but only 37% expect to receive one. However, Americans were the second most generous in the global survey, with 53% saying they expect to donate a portion of their estate to charity, trailing only South Korea (54%). That compared to a global average of 37% of respondents.

“Our extensive research on investor behavior and expectations shows that younger investors are starting to plan and save for retirement earlier in life, in part because of the availability of workplace retirement savings plans,” said Ed Farrington, Executive Vice President of Retirement at Natixis Global Asset Management. “Yet many are underestimating the impact of taxes, inflation and increased longevity on their retirement savings, and are overestimating the planning their parents have done.”

Threats to Financial Security in Retirement

According to Natixis’ survey, Millennials expect to retire young. They say they plan to quit working at age 59, on average, a full six years earlier than Baby Boomers, who expect to retire at age 65. Millennials are saving at a rate based on their expectation to live for 25 years in retirement, which puts them at age 84 at the end of their financial plans. Yet one out of every four 65-year-olds today will live past age 90 and one out of 10 will live past age 95, according to data compiled by the Social Security Administration.1 The survey also found the cost of long-term care and out-of-pocket healthcare expenses are considered the biggest threats to financial security in retirement by both Baby Boomers and Millennials.

Few investors are concerned about inflation. For example, only 17% of Millennials say they have factored inflation into their retirement savings planning. A 3% annual inflation rate2 could mean that a $100 purchase today would cost $181 by the time Millennials retire, which could severely accelerate the pace with which they burn through accumulated savings.

The biggest surprise for Millennials, however, may be the impact of taxes given their expectation of an inheritance. Even among the six in 10 Baby Boomers who expect to leave an inheritance, more than four in 10 (44%) haven’t written a will, creating potential legal and tax consequences for their families and heirs. Moreover, many of the oldest Baby Boomers, who turn 70 ½ this year, are now required to take minimum distributions from their tax-deferred retirement savings, and are subject to a hefty 50% penalty if they don’t.3

Yet, nearly three in 10 (28%) Boomers don’t fully understand the Required Minimum Distribution (RMD) requirements, Natixis found. Even one-quarter (25%) of Boomers who have a financial advisor say their advisor has never talked with them about RMDs, and four in 10 (39%) have not explored proactive ways to manage the tax impact of their withdrawals.

The Role of Planning and Advice

Millennials, in general, have taken a more proactive and pragmatic approach to planning and saving for retirement than older generations have. Even at their young age, 59% of Millennials already have established a financial plan to help reach their retirement savings goals, on par with 56% of Baby Boomers who have done the same. Seventy-one percent of Millennials say they have a general figure in mind for how much money they need saved by the time they retire, and more than half (54%) have a clear idea of how much they need to save each year to meet that goal. Moreover, 78% of Millennials are getting professional advice compared to only 55% of Baby Boomers.

“Much of the retirement planning dialogue is focused on saving for retirement and that message is getting through to the younger generation, but too little attention and advice is given to planning for life in retirement,” added Farrington.

Natixis found that three in 10 (29%) retirees still don’t know how much income they need annually to live on, let alone meet other goals. Forty-six percent of Baby Boomers say they want to leave a portion of their remaining assets to charity, yet only 6% feel they need professional advice on how to do it.

Nearly two-thirds (64%) of Baby Boomers agree that they need financial advice even in retirement. At least one-third say they need professional advice to help with tax planning (33%), estate planning (33%) and understanding financial risks (37%). Nearly as many (27%) say they need help planning for financial implications of long-term care.

“It’s important for financial professionals to recognize that retirement isn’t the end of a journey, but rather a new chapter in people’s financial lives,” said David Giunta, CEO of the U.S. and Canada for Natixis Global Asset Management. “People clearly still want and need professional help to enable them to enjoy their retirement and leave a lasting legacy for their families.”

1 Social Security Administration, https://www.ssa.gov/planners/lifeexpectancy.html

2

BuyUpside Inflation Calculator, http://www.buyupside.com/calculators/inflationjan08.htm

3

IRS.gov, https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-required-minimum-distributions#8

Methodology

Natixis surveyed 750 individual investors across the United States with a minimum of $100,000 in investable assets. The group included 223 members of Generation Y, also known as Millennials (age 21 to 36); 251 from Generation X (age 37 to 52) and 236 Baby Boomers (age 53 to 72), as well as 85 retirees. The online survey was conducted in February 2017 and is part of a larger global study of 8,300 investors in 22 countries and regions from Asia, Europe, the Americas and the Middle East. Visit durableportfolios.com/Individual-Investor-Retirement-Survey-2017 for more information.

About Natixis Global Asset Management

Natixis Global Asset Management serves thoughtful investment professionals worldwide with more insightful ways to invest. Through our Durable Portfolio Construction® approach, we focus on risk to help them construct more strategic portfolios that seek to endure today’s unpredictable markets. We draw from deep investor and industry insights and partner closely with our clients to put objective data behind the discussion.

Natixis Global Asset Management is ranked among the world’s largest asset management firms.1 Uniting over 20 specialized investment managers globally ($895.6 billion AUM2), we bring a diverse range of solutions to every strategic opportunity. From insight to action, Natixis Global Asset Management helps our clients better serve their own with more durable portfolios.

Headquartered in Paris and Boston, Natixis Global Asset Management, S.A. is part of Natixis. Listed on the Paris Stock Exchange, Natixis is a subsidiary of BPCE, the second-largest banking group in France. Natixis Global Asset Management, S.A.’s affiliated investment management firms and distribution and service groups include Active Index Advisors®;3 AEW Capital Management; AEW Europe; AlphaSimplex Group; Axeltis; Darius Capital Partners; DNCA Investments;4 Dorval Asset Management;5 Emerise;6 Gateway Investment Advisers; H2O Asset Management;5 Harris Associates; Loomis, Sayles & Company; Managed Portfolio Advisors®;3 McDonnell Investment Management; Mirova;7 Natixis Asset Management; Ossiam; Seeyond;7 Vaughan Nelson Investment Management; Vega Investment Managers; and Natixis Global Asset Management Private Equity, which includes Seventure Partners, Naxicap Partners, Alliance Entreprendre, Euro Private Equity, Caspian Private Equity and Eagle Asia Partners. Not all offerings available in all jurisdictions. For additional information, please visit the company’s website at ngam.natixis.com | LinkedIn: linkedin.com/company/natixis-global-asset-management.

1 Cerulli Quantitative Update: Global Markets 2016

ranked Natixis Global Asset Management, S.A. as the 16th

largest asset manager in the world based on assets under management

($870.3 billion) as of December 31, 2015.

2

Net asset value as of March 31, 2017. Assets under management (AUM) may

include assets for which non-regulatory AUM services are provided.

Non-regulatory AUM includes assets which do not fall within the SEC’s

definition of ‘regulatory AUM’ in Form ADV, Part 1.

3 A

division of NGAM Advisors, L.P.

4 A brand

of DNCA Finance.

5 A subsidiary of Natixis

Asset Management.

6 A brand of Natixis

Asset Management and Natixis Asset Management Asia Limited, based in

Singapore and Paris.

7 Operated in the

U.S. through Natixis Asset Management U.S., LLC.