TLALNEPANTLA DE BAZ, Mexico--(BUSINESS WIRE)--Mexichem, S.A.B. de C.V. (BMV: MEXCHEM*) (“the Company” or “Mexichem”) today announced its unaudited results for 4Q16 and full year. The figures have been prepared in accordance with International Financial Reporting Standards (“NIIF” or “IFRS”), having US dollars as the functional and reporting currency. All comparisons are made against the same period of the prior year, unless specified to the contrary.

Given that Mexichem’s reported earnings results (including the impact of the incident at PMV’s VCM plant) differ substantially from its reported operating results (without the impact), for clarification purposes this report contains reported EBIT, EBITDA and net income including the one-time net benefit related to PMV´s VCM plant, as well as *Adjusted EBIT, EBITDA and net income which exclude that effect. Additional details are contained on page 11.

Mexichem’s Audit Committee and Board of Directors have authorized to change the Company’s accounting policy related to fixed assets valuation from the revaluation method to the historical cost recognition method. Effective in 1Q17, Mexichem will reduce its fixed assets and equity value on its balance sheet by eliminating the revaluation value that has been accrued since Mexichem adopted IFRS in 2010. For comparative purposes, starting with the 1Q17 report, and during 2017, Mexichem will include an annex to its quarterly information showing the 2016 fixed assets and equity value as if the accounting policy change would have been authorized in 1Q16. Additional details are contained on page 15.

Fourth Quarter 2016 Financial and Operating Highlights

- Consolidated revenue was $1.3 billion, a 5% y-o-y increase;

- EBITDA increased 16% to $247 million while excluding the one-time benefit from a legal settlement in 4Q15 EBITDA increased 21%; Adjusted EBITDA increased 7% to $227 million; excluding the Fluor one time effect adjusted EBITDA increased 12%

- On a constant currency basis, consolidated revenue, EBITDA and Adjusted EBITDA increased 9%, 20% and 11%, respectively (tables on pg.16); while excluding the Fluor effect, EBITDA and adjusted EBITDA increased 25% and 16%, respectively

- Consolidated EBITDA margin expanded 194 bps to 19.6% and Adjusted EBITDA margin expanded 38 bps to 18%;

- Net majority income increased to $65 million; Adjusted net majority income increased to $58 million from a net loss;

- Free cash flow increased 17% to $228 million.

CONSOLIDATED SELECTED FINANCIAL RESULTS

| Fourth Quarter | January - December | |||||||||||||

| Consolidated (mm US$) | 2016 | 2015 |

% Var. |

2016 | 2015 | % Var. | ||||||||

| Net Sales | 1,260 | 1,205 | 5% | 5,350 | 5,612 | -5% | ||||||||

| Operating Income | 152 | 115 | 32% | 514 | 516 | 0% | ||||||||

| EBITDA | 247 | 213 | 16% | 884 | 910 | -3% | ||||||||

| EBITDA Margin | 19.6% | 17.7% | 194 | 16.5% | 16.2% | 30 | ||||||||

| Net Majority Income | 65 | -2 | N/A | 238 | 135 | 76% | ||||||||

| Operating Cash Flow Before Capex | 335 | 409 | -18% | 643 | 825 | -22% | ||||||||

| Total CAPEX (organic & JV) | -95 | -199 | -53% | -414 | -666 | -38% | ||||||||

| Free Cash Flow | 228 | 195 | 17% | 175 | 95 | 85% | ||||||||

| Adjusted Operating Income* | 132 | 115 | 15% | 556 | 516 | 8% | ||||||||

| Adjusted EBITDA* | 227 | 213 | 7% | 926 | 910 | 2% | ||||||||

| Adjusted EBITDA Margin* | 18.0% | 17.7% | 38 | 17.3% | 16.2% | 109 | ||||||||

| Adjusted Net Maj. Income* | 58 | -2 | N/A | 262 | 135 | 94% | ||||||||

Full Year 2016 Financial and Operating Highlights

- Consolidated revenue was $5.4 billion and in a constant currency basis was $5.6 billion, a decline of 5% and flat, respectively;

- EBITDA was $884 million; Adjusted EBITDA increased 2% to $926 million; while excluding the Fluor legal settlement EBITDA declined 2% and Adjusted EBITDA, increased 3%;

- On a constant currency basis, EBITDA and Adjusted EBITDA were up 3% and 8%, respectively {tables on pg.16}. EBITDA and Adjusted EBITDA without the Fluor one-time benefit increased 4% and 9%, respectively;

- Consolidated EBITDA margin expanded 30bps to 16.5% and Adjusted EBITDA margin expanded 109 bps to 17.3%;

- Net majority income increased 76% to $238 million, and adjusted net majority income increased 94% to $262 million;

- Free Cash Flow was $175 million, up 85%;

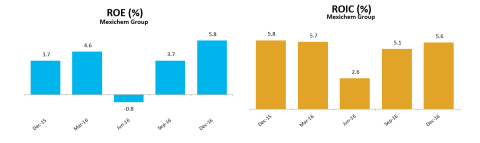

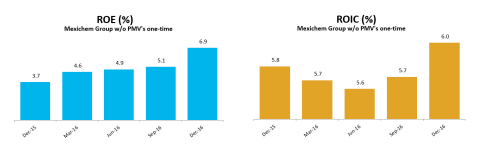

- Full year ROE & ROIC were 5.8% and 5.6%; adjusted ROE and ROIC were 6.9% and 6.0%, respectively;

- Net Debt to reported EBITDA and to Adjusted EBITDA improved to 1.8x and 1.7x, respectively.

MANAGEMENT COMMENTARY

Performance and Outlook

The fourth quarter represented a strong finish to 2016. Our continued focus on increasing profitability levels by prioritizing sales of higher margin, specialty products, facilitating cross selling and achieving operating efficiencies led to substantial growth in EBITDA, EBITDA margin and net majority income. As a result, we were able to report full year EBITDA performance that exceeded our guidance and to lay the foundation for further progress in 2017.

Our achievements in the fourth quarter took place within a difficult operating environment, with economic uncertainty and the strength of the U.S. dollar creating headwinds for many global industrial companies, including Mexichem. We are pleased to report that we were able to more than offset these impacts thanks to a more favorable product mix, cost containment and operating improvements across our organization.

The results of our key Business Groups were similar to our expectations and demonstrated the importance of our diversified product portfolio and geographical footprint. Resins, Compounds and Derivatives, which represented 97% of the Vinyl Group’s sales, expanded its EBITDA margin by 62 basis points in the quarter, benefitting from modestly improved pricing for certain specialty products, particularly in Europe; Fluor posted a 40.5% EBITDA margin along with an improvement in end market demand; and Fluent overcame a $7 million currency impact to report a 14.8% EBITDA margin, reflecting positive year-on-year comparisons in all key regions.

Full year results, adjusted for one-time items, showed similar positive trends. EBITDA margin expanded by 109 basis points (adjusting full year 2015 with Fluor legal settlement, the margin expanded by 125 bps) reflecting higher margins in Vinyl and Fluent, and relatively stable margin performance in Fluor. Throughout 2016, our key groups have taken steps to prioritize sales of non-commoditized, specialty products and to improve their manufacturing processes. As a result, we are enhancing our relationships with customers and progressively increasing the Company’s returns on investments.

Mexichem ended 2016 in a strong financial position, with a solid operating framework and a clear strategy for continued growth in the periods ahead. Adjusted net income almost doubled compared to last year’s levels, and our free cash flow increased by 85% due to the wind-down of large capital investments. The largest of these investments, our joint venture ethylene cracker in Texas, was completed on time and on budget. The cracker will become progressively more accretive to EBITDA throughout the year as Mexichem increasingly improves its position along the cost curve. For 2017, our current budget anticipates capital expenditures of approximately one third less than we invested in 2016.

We also expect our 2017 results to benefit from the bolt-on acquisitions we completed in 2016 to extend our specialty product portfolio, increase our customer base and enter new geographic markets. Additional organic growth programs, including the expansion of our Compounds business and the acceleration of sales synergy programs throughout our business units should contribute positively to EBITDA performance in 2017, as will measures we took in 2016 to streamline the Company’s operations.

Mexichem has entered 2017 with a very manageable net debt to EBITDA and to Adjusted EBITDA ratios of 1.8x and 1.7x respectively, cash and cash equivalents of over $700 million and increasing free cash flow. These resources give us the financial flexibility to opportunistically invest in organic and acquisition growth opportunities that can enhance our global operations and provide positive returns for all stakeholders.

Early in 2017, Mexichem was named to the FTSE4Good Emerging Index, in recognition of our commitment to high standards of environmental, social and governance practices. We are very proud of this accomplishment as it highlights the progress we are making to achieve consistent, positive impact across our value chain.

Mexichem’s resilient performance in 2016, which was challenging year for our Company, speaks to the successful efforts of our more than 18,000 employees in over 30 countries, who are pulling together to make us a unified, global company with shared ideals and values. Thank you!

Clarifications

In the fourth quarter of 2015 the Company completed a restructuring process in its Fluor Business Group resulting in a total of $49.9 million being reported as “discontinued operations” in full year 2015 results, in accordance with the IFRS regulations.

As part of our core strategy of shifting to higher margin products in our Fluent Business Group, at the end of the 1Q16 we decided to exit from our pressure pipe business in the US, which impacts our Fluent US/ AMEA Business. The decision was made in order to shift our capacity from pressure pipes, where products have low margins to Datacom where margins are higher. As a result, in the 4Q16 we reclassified the results we had in the 1Q16 from this pressure pipe business as discontinued operations, having a net effect of $18 million in revenues and $6 million in EBITDA. For a comparable basis, the 2015 reported figures were also reclassified as discontinued operations having a net effect of $96 million in revenues and $5 million in EBITDA.

Finally, during 2016 Mexichem performed an analysis in order to define if the company is the “agent” or “principal” in terms of IAS 18 Revenue, with the objective to determine the way in which the freight cost should be recorded and reported in our P&L. The conclusion is that the company is “principal” and then, the cost freight should be presented in Cost of Goods Sold (COGS) instead of Sales, General and Administrative Expenses (SG&A), as it was reported during the first three quarters of 2016 and in previous years. As a consequence, during the fourth quarter of 2016, we reclassified the FY16 freight cost from SG&A to COGS.

The freight costs related to the 1st, 2nd, 3rd and 4th quarters of 2016 were $73 million, $79 million, $78 million and $70 million, respectively, while those from 2015 were $83 million, $84 million, $78 million and $71 million, respectively. For 2016 1st, 2nd, and 3rd quarters freight cost impacted the 4Q16 COGS. This reclassification does not have any effect in EBITDA, but it does have an effect on reported gross profit.

The restructured figures with the abovementioned effects are shown in Appendix I. The reconciliation of the figures reported in 2015 and the first three quarters of 2016, are shown in Appendix II

During 2016 we performed an analysis which has led us to present the elimination of investment in subsidiaries under the heading “Other Asset” by Business Group instead of “Consolidated Eliminations”. The comparative information by segment following this reclassification is included in Appendix III.

REVENUES

Fourth quarter 2016 reported revenues were $1.3 billion, up 5% from 4Q15. As a result of the appreciation of the U.S. dollar against most other currencies, consolidated sales were affected by $54 million, with the most notable impact in our Fluent LatAm and Europe operations. Softer demand in our Vinyl and Fluent business groups was partially offset by better product mix which guided our reported and adjusted EBITDA, EBITDA Margins, ROE and ROIC up when compared with 4Q15.

On a constant currency basis, total sales would have increased 9% year-on-year.

Revenues for full year 2016 were $5.4 billion while the Company posted $5.6 million in FY15, $263 million less or 5% below. However, of this decline in revenue, 94% was the result of a currency translation effect. On a constant currency basis, total sales would have been $5.6 billion, flat year-on-year. The previously mentioned has been consistent with our strategy to pursue more profitable sales rather than just volumes.

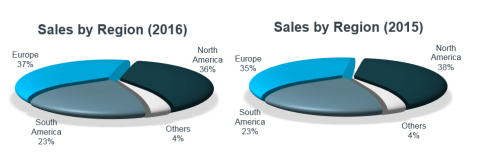

SALES BY REGION

The United States represented 16% of total sales in 2016, Brazil accounted for 6%, and the UK and Germany represented 8% and 13%, respectively.

During 2016 the dollar denominated sales from our Mexican companies represented only 9% of our total sales and 39% of those were exports to US representing only 3.5% of our total sales from which 88% were exports from our Fluor Mexican Companies, with fluorspar representing the highest proportion of those exports, product in which the US is deficient.

EBITDA AND ADJUSTED EBITDA

Reported EBITDA for 4Q16 was $247 million, inclusive of a $20 million benefit from our assembly insurance coverage at the PMV plant, compared to $213 million in the fourth quarter last year, representing an increase of 16% (adjusting 4Q15 EBITDA with the $9 million one-time benefit related to the legal settlement the company announced in its 4Q15 quarterly report, EBITDA would have increased 21%).

Adjusted EBITDA for the quarter was $227 million (excluding $20 million from our assembly insurance coverage), up 7% from 4Q15 (without the Fluor settlement in 4Q15, an increase of 12%) but in a constant currency basis Adjusted EBITDA would have been $235 million, an increase of 11% from 4Q15 (16% adjusting 4Q15 EBITDA with the Fluor one-time benefit). Adjusted EBITDA margin would have expanded 26 basis points to 17.9%. The year-on-year increases were primarily the result of more favorable prices in our Vinyl Business Group, a shift towards higher margin products in our Fluent operations, as well as increased efficiencies across businesses.

For the full year 2016, reported EBITDA was $884 million, down 3% from 2015 but adjusting 4Q15 with the Fluor one-time legal settlement benefit, EBITDA would have decreased 2%. Adjusted EBITDA in 2016 reached $926 million, 2% higher than FY15, but excluding the 4Q15 benefit would have increased 3%. This slight increase in EBITDA, on an adjusted basis was achieved despite a $56 million foreign exchange impact during 2016. On a constant currency basis, Adjusted EBITDA for the full year 2016 would have increased 8% to $982 million, adjusted by the Fluor legal settlement would have increased 9%.

OPERATING INCOME AND ADJUSTED OPERATING INCOME

For the fourth quarter of 2016, Mexichem reported operating income of $152 million, an increase of 32%, adjusting 4Q15 by the Fluor legal settlement, operating income would have increased 43%. The increase in operating income was mainly the result of the factors mentioned before. Adjusted operating income was $132 million, an increase of 15% from 4Q15 or 25%, when adjusted by the Fluor one-time benefit. Adjusted operating margin was 10.5%, representing a margin expansion of 93 basis points from 9.5%.

Full year operating income was $514 million, flat year on year. Full year operating income would have increased by 1%, adjusting for the one-time Fluor benefit in 4Q15. On a fully adjusted basis, operating income improved 10% to $556 million (excluding Fluor 4Q15 effect).

FINANCIAL COSTS

In 4Q16, financial costs decreased $33 million or 54% from $60 million to $28 million. 4Q16 included a gain of $3 million related to the Euro-denominated intercompany loan coverage unwind, a $7 million FX gain related to the Mexican peso denominated debt; as well as a $22 million decrease in FX losses related to the net liabilities in other currencies.

In 2016 financial costs decreased $82 million or 34%. FY15 financial costs included a $12 million loss related to a Euro-denominated intercompany loan that was covered in 4Q15, but did not generate FX losses in 2016. In 4Q16 the intercompany loan was fully paid and the hedge was unwinded, resulting in a $3 million gain. Additionally, during 2016 the Mexican Peso denominated debt reported a $16 million FX gain while the Company experienced a $27 million decrease in FX losses in the net liabilities. Finally, hyperinflationary economic impact in 2016 was reduced by $17 million and interest decreased by $7 million from 2015, due to FX variations.

TAXES

Current tax in 4Q16, without considering the write-off, increased by $49 million compared to 4Q15; because of Mexichem’s consolidated financial figures, some companies reported net income before taxes but some others report losses. Additionally, as reported in our 4Q15 quarterly report, the annual tax provision was adjusted downwards by $10 million due to a reduction in the income tax provision associated with the recognition of tax benefits, $3 million of which was associated with a reduction in the mining tax provision because of a legal criteria dictated in the second half of 2015, and finally the increment in the profit before tax of $54 million.

Deferred tax in 4Q16 decreased by $15 million compared to 4Q15, mainly due to the recognition of tax losses triggered by a foreign exchange rate loss in the countries where the functional currency is different than local currency.

On a YoY basis, without considering the write off, the cash tax rate for the full year 2016 decreased from 51% to 48%, mainly due to the net income and net losses before taxes in Mexichem’s companies explained before.

Deferred taxes YoY decreased by $15 million due to the increase in tax losses in some of Mexichem’s operations.

The cash tax rate for full year 2015 was 51%, while for full year 2016 in adjusted basis was 48%, a decline of 300 bps. However, when the cash tax is calculated based on the companies that generate net income before taxes, cash tax rate in 2015 was 28%, but 32% in 2016, an increase of 400 bps.

The FY16 reported effective tax rate was 34%, and in 2015 it was 32%, a 200 bps increase, related to higher income before taxes while full year 2016 adjusted effective tax rate was 31%.

MAJORITY INCOME (LOSS)

In 4Q16, the Company reported net majority income of $65 million, compared to a net loss of $2 million in 4Q15. Adjusted net income for 4Q16 was $58 million, compared to a $2 million loss in 4Q15. For the full year 2016, net income grew 76% to $238 million while adjusted net income grew 94% to $262 million.

OPERATING CASH FLOW HIGHLIGHTS

| Fourth Quarter | January - December | |||||||||||||

| 2016 | 2015 |

% Var. |

2016 | 2015 | % Var. | |||||||||

| EBITDA | 247 | 213 | 16% | 884 | 910 | -3% | ||||||||

| One time non-cash Items | 12 | 0 | 37 | 0 | ||||||||||

| Cash Tax | -62 | -13 | 388% | -189 | -141 | 34% | ||||||||

| Net Interest | -46 | -45 | 4% | -171 | -178 | -4% | ||||||||

| Bank Commissions | -3 | 1 | N/A | -11 | -12 | -5% | ||||||||

| Monetary Position and Exchange loss | 6 | -27 | N/A | -12 | -74 | -84% | ||||||||

| Change in Trade Working Capital | 180 | 280 | -36% | 106 | 319 | -67% | ||||||||

| Operating Cash Flow Before Capex | 335 | 409 | -18% | 643 | 825 | -22% | ||||||||

| CAPEX (Organic) | -54 | -95 | -43% | -204 | -276 | -26% | ||||||||

| CAPEX (Total JV) | -77 | -189 | -59% | -376 | -715 | -47% | ||||||||

| CAPEX JV (OXY SHARE) | 37 | 85 | -57% | 166 | 325 | -49% | ||||||||

| NET CAPEX JV | -40 | -104 | -61% | -210 | -390 | -46% | ||||||||

| Total CAPEX (organic & JV) | -95 | -199 | -53% | -414 | -666 | -38% | ||||||||

| Cash Flow | 240 | 210 | 14% | 229 | 159 | 44% | ||||||||

| Dividends | -12 | -15 | -20% | -54 | -64 | -15% | ||||||||

| Free Cash Flow | 228 | 195 | 17% | 175 | 95 | 85% | ||||||||

- The decrease in operating cash flow before capital expenditures was mainly due to Mexichem´s working capital management during 2015 which generated a $319 million change in working capital, improving our cash generation that was dedicated to fund the Company´s share in the JV with OxyChem. During 2016 the efficiency in working capital continued, but the capital needs of the Company were reduced less than in 2015. In 4Q15, Mexichem reduced its working capital needs by $280 million compared to 3Q15, and in 4Q16 working capital needs were reduced by an additional $180 million from 3Q16 levels, demonstrating Mexichem’s continued ability to operate with significantly reduced working capital requirements as a result of inventory optimization. The reduction in working capital requirements in 2016 compared to the similar period last year was made despite the seasonality of our business, particularly relating to Fluent’s USA/Canada and European operations.

- Capital expenditures in 4Q16 decreased 53% to $95 million, $37 million of which was invested in the ethylene cracker, $3 million as carryover in PMV, and $54 million allocated to organic projects.

As of December 31, 2016, Mexichem’s equity investment in the ethylene cracker reached $688 million, which represents 95% of the total equity investment that Mexichem contracted with OxyChem to gain a 50% stake in the joint venture. In 1Q17, we will contribute in equity the last $35 million, approximately.

NET WORKING CAPITAL

| 2016 Variation | 2015 Variation | |||||||||||||

| dec-16 | dec-15 | D ($) | dec-15 | dec-14 | D ($) | |||||||||

| Working Capital | 140 | 246 | 106 | 246 | 565 | 319 | ||||||||

The Net Working Capital balance as of December 31, 2016 when compared to the same period last year reflected a $106 million decline in working capital requirements.

FINANCIAL DEBT

| Last Twelve Months | ||||||

| Dec 2016 | Dec 2015 | |||||

| Net Debt USD | 1,587 | 1,703 | ||||

| Net Debt/EBITDA 12 M | 1.8x | 1.9x | ||||

| Net Debt/Adj EBITDA 12 M | 1.7x | 1.9x | ||||

| Interest Coverage | 4.6x | 4.3x | ||||

| Adj Interest Coverage | 4.8x | 4.3x | ||||

| Outstanding Shares | 2,100,000,000 | 2,100,000,000 | ||||

Total financial debt as of December 31, 2016 was $2.3 billion plus $1.4 million in letters of credit with maturities of more than 180 days for a total financial debt of $2.3 billion, while cash and cash equivalents totaled $714 million, resulting in net financial debt of $1.6 billion.

The Net Debt / EBITDA ratio was 1.8x at December 31, 2016, while the Interest Coverage was 4.6x. The Net Debt /Adjusted EBITDA ratio was 1.7x and Adjusted Interest Coverage was 4.8x. Adjusted EBITDA in this case excludes the on-time charge accrued in 2Q16, the one-time benefit net of expenses accrued in 3Q16, and the benefit from our assembly insurance coverage included in the property policy at the PMV plant recognized in the 4Q16.

CONSOLIDATED BALANCE SHEET

| USD in thousands | ||||||

|

Balance Sheet |

Dec 2016 | Dec 2015 | ||||

|

Total assets |

8,806,002 | 8,669,676 | ||||

| Cash and temporary investments | 713,607 | 653,274 | ||||

| Receivables | 802,846 | 798,779 | ||||

| Inventories | 606,389 | 647,984 | ||||

| Others current assets | 437,361 | 151,816 | ||||

| Long term assets | 6,245,799 | 6,417,823 | ||||

|

Total liabilities |

4,908,448 | 4,990,895 | ||||

| Current portion of long-term debt | 57,693 | 43,653 | ||||

| Suppliers | 1,269,704 | 1,201,021 | ||||

| Other current liabilities | 657,600 | 573,887 | ||||

| Long-term debt | 2,241,370 | 2,291,422 | ||||

| Other long-term liabilities | 682,081 | 880,912 | ||||

|

Consolidated shareholders'equity |

3,897,554 | 3,678,781 | ||||

| Minority shareholders'equity | 918,447 | 776,419 | ||||

|

Majority shareholders'equity |

2,979,107 | 2,902,362 | ||||

|

Total liabilities & shareholders' equity |

8,806,002 | 8,669,676 | ||||

Financial Assets

On April 20th, 2016, an explosion occurred in the VCM plant inside the Petrochemical Complex Pajaritos, where two of the three facilities of PMV are located (VCM and Ethylene). The chlorine and caustic soda plant is located on a separate site. There was no damage to the chlorine-caustic soda plant, but there was business interruption in the supply of raw material. The VCM plant (Clorados III) is the one that sustained most of the damage, the major economic impact of which was the write-off of the asset and the shutdown of that plant.

Mexichem’s assets including those in PMV are adequately insured at today’s replacement value, while the related non-cash charge was calculated at book value. The Company’s insurance coverage includes: i) environmental responsibility, ii) damage to property, iii) damage to assets during assembly process, iv) business interruption, v) liability for damage to third parties, and vi) liability of directors and officers.

In the 4Q16 PMV recognized a $20 million benefit from its assembly insurance coverage. PMV and Resins, Compounds and Derivatives has recognized income of $37 million for business interruption that offset fixed costs that were not absorbed and its margin.

During FY16 PMV recognized, $287 million related to asset write off, of which $276 million and $9 million were recognized in other expenses and other comprehensive income (equity), respectively; and $42 million related to amounts of indemnifications, legal expenses, and other costs, which represented a charge of $318 million. During the third quarter of 2016, PMV gathered sufficient information to decide to recognize the account receivable related to insurance coverage, which for the full year amounted $276 million related to property damage, assembly insurance coverage, third party expenses, and expenses incurred under directors’ and officers’ coverage. The onetime expenses were offset by the full year account receivable which generated a net expense effect of $42 million.

PMV has presented its claims to its insurance companies.

Finally, in 2016 PMV and Resins, Compounds and Derivatives recognized income of $51 million for business interruption that offset fixed costs that were not absorbed and its margin.

Contingent Asset

PMV together with its shareholders, Mexichem & Pemex, are evaluating several strategic options for the business in the future, reason why the Company adopted a conservative policy with respect to the monetary amount recognized in the account receivable, reflecting the stated cash value of the plant as of December 31st 2015. When the business plan is finalized, the exact dollar amount of the account receivable could change.

Contingent Liability

As a result of the VCM Plant (Clorados III) incident described in the contingent asset disclosure, PMV performed an environmental assessment to determine if any pollutants were deposited in areas surrounding the facility, delivered the report to the environmental authorities and is working with them in order to determine, if any, the environmental damages. Also PMV could be responsible for third party injuries, if any. Based on the information the Company has as of this report, there is no evidence that there are additional relevant liabilities.

As mention previously, depending on the decision taken by PMV and its shareholders, once the business future is decided, PMV will evaluate the impacts in the rest of its assets in Pajaritos Complex. The remaining fixed asset value of the PMV’s plants inside Pajaritos Complex is $213 million.

CONSOLIDATED INCOME STATEMENT

| USD in thousands | Fourth Quarter | January - December | ||||||||||||||||||||

| INCOME STATEMENT | 2016 | Write off |

2016 w/o |

2015 | % | 2016 | Write off |

2016 w/o |

2015 | % | ||||||||||||

| Net sales | 1,260,152 | 1,260,152 | 1,204,526 | 5% | 5,349,807 | 5,349,807 | 5,612,392 | -5% | ||||||||||||||

| Cost of sales | 1,001,124 | 1,001,124 | 914,193 | 10% | 4,143,473 | 4,143,473 | 4,369,294 | -5% | ||||||||||||||

| Gross profit | 259,028 | - | 259,028 | 290,333 | -11% | 1,206,334 | - | 1,206,334 | 1,243,098 | -3% | ||||||||||||

| Operating expenses | 107,451 | 19,613 | 127,064 | 175,398 | -28% | 692,095 | (42,218) | 649,877 | 727,272 | -11% | ||||||||||||

| Operating income | 151,577 | (19,613) | 131,964 | 114,935 | 15% | 514,239 | 42,218 | 556,457 | 515,826 | 8% | ||||||||||||

| Financial cost | 27,513 | 27,513 | 60,400 | -54% | 162,931 | 162,931 | 245,215 | -34% | ||||||||||||||

| Equity in income of associated entity | 611 | 611 | (2,207) | N/A | (2,873) | (2,873) | (3,080) | -7% | ||||||||||||||

| Income from continuing operations before income tax0 | 123,453 | (19,613) | 103,840 | 56,742 | 83% | 354,181 | 42,218 | 396,399 | 273,691 | 45% | ||||||||||||

| Cash tax | 61,578 | 61,578 | 12,620 | 388% | 189,295 | 189,295 | 140,883 | 34% | ||||||||||||||

| Deferred taxes | (20,037) | (5,884) | (25,921) | (4,607) | 463% | (67,374) | (237) | (67,611) | (52,468) | 29% | ||||||||||||

| Income tax | 41,541 | (5,884) | 35,657 | 8,013 | 345% | 121,921 | (237) | 121,684 | 88,415 | 38% | ||||||||||||

| Income from continuing operations | 81,912 | (13,729) | 68,183 | 48,729 | 40% | 232,260 | 42,455 | 274,715 | 185,276 | 48% | ||||||||||||

| Discontinued operations | (5,389) | (5,389) | (54,147) | -90% | (10,780) | (10,780) | (54,165) | -80% | ||||||||||||||

| Consolidated net income | 76,523 | (13,729) | 62,794 | (5,418) | N/A | 221,480 | 42,455 | 263,935 | 131,111 | 101% | ||||||||||||

| Minority stockholders | 11,207 | (6,053) | 5,154 | (3,206) | N/A | (16,919) | 18,718 | 1,799 | (4,059) | N/A | ||||||||||||

| Net income | 65,316 | (7,676) | 57,640 | (2,212) | N/A | 238,399 | 23,737 | 262,136 | 135,170 | 94% | ||||||||||||

| EBITDA | 246,856 | (19,613) | 227,243 | 212,643 | 7% | 883,754 | 42,218 | 925,972 | 910,421 | 2% | ||||||||||||

OPERATING RESULTS BY BUSINESS GROUP

VINYL Business Group (37% and 34% of Mexichem’s sales (before eliminations) and Adjusted EBITDA respectively, in 2016)

| Fourth Quarter | January - December | |||||||||||||

| Vinyl | 2016 | 2015 |

% Var. |

2016 | 2015 | % Var. | ||||||||

| Volume (K Tons) | 580 | 655 | -11% | 2,474 | 2,541 | -3% | ||||||||

| Total Sales* | 496 | 506 | -2% | 2,032 | 2,140 | -5% | ||||||||

| Operating Income** | 66 | 32 | 107% | 127 | 159 | -20% | ||||||||

| Adjusted Operating Income** | 46 | 32 | 45% | 169 | 159 | 6% | ||||||||

| EBITDA** | 101 | 74 | 37% | 272 | 313 | -13% | ||||||||

| Adjusted EBITDA** | 82 | 74 | 10% | 314 | 313 | 0% | ||||||||

*Intercompany sales were $41 million and $32 million in 4Q16 and 4Q15, respectively. And as of December 2016 and 2015 were $152 million and $162 million, respectively. **Includes Ingleside expenses of $5 million (2016)

| Fourth Quarter | January - December | |||||||||||||

| Resins, Compounds & Derivatives | 2016 | 2015 |

% Var. |

2016 | 2015 | % Var. | ||||||||

| Volume (K Tons) | 525 | 543 | -3% | 2,179 | 2,121 | 3% | ||||||||

| Total Sales* | 487 | 486 | 0% | 1,982 | 2,065 | -4% | ||||||||

| Operating Income** | 32 | 29 | 12% | 155 | 145 | 8% | ||||||||

| EBITDA** | 62 | 58 | 5% | 272 | 264 | 3% | ||||||||

*Intercompany sales were $48 million and $44 million in the 4Q16 and 4Q15, respectively, and as of December 2016 and 2015 were $184 million and $215 million, respectively. Of these amounts $7 million and $12 million were invoiced to PMV in 4Q16 and 4Q15, respectively and $33 million and $53 million accrued to December 2016 and 2015. **Includes Ingleside LLC expenses of $5 million (2016)

| Fourth Quarter | January - December | |||||||||||||

| PMV | 2016 | 2015 |

% Var. |

2016 | 2015 | % Var. | ||||||||

| Volume (K Tons) | 61 | 162 | -62% | 394 | 650 | -39% | ||||||||

| Total Sales* | 17 | 52 | -67% | 115 | 222 | -48% | ||||||||

| Operating Income | 33 | 3 | 1117% | -29 | 14 | N/A | ||||||||

| Adjusted Operating Income | 14 | 3 | 399% | 13 | 14 | -8% | ||||||||

| EBITDA | 40 | 16 | 156% | 0 | 49 | N/A | ||||||||

| Adjusted EBITDA | 20 | 16 | 30% | 42 | 49 | -15% | ||||||||

*Intercompany sales invoiced to Resins, Compounds and Derivatives were $0.8 million and $20 million in 4Q16 and 4Q15, respectively. And, as of December 2016 and 2015 were $33 million and $94 million, respectively.

In 4Q16, the Vinyl Business Group reported an 11% decline in volumes, and a 2% reduction in sales, mainly as a result of the explosion that occurred on April 20, 2016 in the VCM (Clorados III) plant inside the Pajaritos Complex.

Revenues were $496 million in 4Q16, slightly below the $506 million the Company reported in 4Q15, as a recovery in selling prices partially offset the decline in volumes.

EBITDA for the Vinyl Business Group increased 37% to $101 million, mainly as a result of the recognition of $20 million related to the PMV´s assembly insurance coverage. Adjusted EBITDA (excluding PMV’s one-time effects except business interruption) grew 10% to $82 million from $74 million. EBITDA and Adjusted EBITDA margin were 20.4% and 16.5%.

In 4Q16, Resins, Compounds and Derivatives revenues were flat, as the decline of 3% in volumes year over year was offset by higher prices and a better product mix. Operations in Europe were key drivers.

4Q16 EBITDA for Resins, Compounds and Derivatives was $62 million, 5% higher than the 4Q15, reflecting an improvement in operating performance, which generated an expansion in EBITDA margin of 60 bps to 12.0% from 12.6%.

In Resins, Compounds and Derivatives, 4Q16 operating income was $32 million, 12% higher than $29 million reported in 4Q15.

In 4Q16, PMV sales were $17 million, most of it from chlorine-caustic soda operations. Reported EBITDA in PMV was $40 million in 4Q16 while adjusted EBITDA totaled $20 million.

For the full year 2016, the Vinyl Business Group’s sales were down 5%, mainly as a result of the explosion that occurred on April, 20th 2016 in the VCM plant (Clorados III) in the Pajaritos Complex. Reported EBITDA was down 13%, from $313 million in 4Q15 to $272 million in 4Q16 mainly as a result of the PMV asset write-off associated with the explosion in the VCM plant (Clorados III). Adjusted EBITDA was $314 million with an adjusted EBITDA margin of 15.5%, 83 basis points higher than 14.6% margin in FY2015.

FLUENT Business Group (53% and 45% of Mexichem’s sales (before eliminations) and Adjusted EBITDA, respectively, in 2016)

| Fourth Quarter | January - December | |||||||||||||

| Fluent | 2016 | 2015 |

% Var. |

2016 | 2015 | % Var. | ||||||||

| Sales | 671 | 615 | 9% | 2,892 | 3,027 | -4% | ||||||||

| Fluent LatAm | 286 | 266 | 7% | 1,075 | 1,172 | -8% | ||||||||

| Fluent Europe | 279 | 297 | -6% | 1,268 | 1,310 | -3% | ||||||||

| Fluent US/AMEA | 111 | 55 | 103% | 560 | 555 | 1% | ||||||||

| Intercompany Eliminations | (5) | (3) | 52% | (10) | (10) | -1% | ||||||||

| Operating Income | 59 | 51 | 17% | 269 | 253 | 7% | ||||||||

| EBITDA | 100 | 89 | 13% | 421 | 409 | 3% | ||||||||

Please refer to page 3 for clarifications regarding 4Q15 and 2015 figures.

In 4Q16, the Fluent Business Group reported a $56 million increase in sales, despite a negative impact of $45 million which was related to the appreciation of the U.S. dollar against almost all other global currencies. Fluent US has continued to take actions to diversify its end markets, and a more favorable product mix in the 4Q16 resulted in higher EBITDA margins, despite lower sales.

| 4Q15 | In million dollars | 4Q16 | Sub16 | Sub16/4Q15 | ||||||

| Revenues | Revenues | FX | Total | % Var Comp | ||||||

| 266 | Fluent LatAm | 286 | 25 | 311 | 17% | |||||

| 297 | Fluent Europe | 279 | 18 | 297 | 0% | |||||

| 55 | Fluent US/AMEA | 111 | 2 | 113 | 106% | |||||

| -3 | Intercompany Eliminations | -5 | 0 | - 5 | 52% | |||||

| 615 | Total | 671 | 45 | 716 | 17% | |||||

On a constant currency basis, total sales in the Fluent Business Group would have been $716 million, a 17% increase year over year. Fourth quarter reported EBITDA was $100 million, an increase of 13% mainly due to improved efficiencies in Europe and US. Fluent Business Group EBITDA margin expanded 44 bps to 14.8%.

On a constant currency basis, EBITDA increased 20% in 4Q16, to $106 million and EBITDA margin would be 14.9%

In 2016 total reported revenues decreased 4% while on a constant currency basis, revenues increased 3%. This is mainly explained in the table below:

| 2015 | In million dollars | 2016 | 2016/ 2015 | Sub16 | Sub16/2016 | |||||||

| Revenues | Revenues | % Var Comp | FX | Total | % Var Comp | |||||||

| 1,172 | Fluent LatAm | 1,075 | -8% | 169 | 1,244 | 6% | ||||||

| 1,310 | Fluent Europe | 1,268 | -3% | 48 | 1,316 | 0% | ||||||

| 555 | Fluent US/AMEA | 560 | 1% | 11 | 571 | 3% | ||||||

| -10 | Intercompany Eliminations | -10 | -1% | 0 | - 10 | 2% | ||||||

| 3,027 | Total | 2,892 | -4% | 228 | 3,120 | 3% | ||||||

Reported EBITDA grew 3%, mainly due to the increased profitability of all the three regional operations. EBITDA margin expanded 105 basis points year over year to 14.6%.

Excluding the exchange rate translation effect of the U.S. dollar in Fluent Europe, US/AMEA and LatAm, which totaled $54 million in 2016, EBITDA would have increased 16% compared to 2015, with an EBITDA margin expansion of 171 bps to 15.2% compared to 13.5% in 2015.

FLUOR BUSINESS GROUP (11% and 25% of Mexichem’s sales (before eliminations) and Adjusted EBITDA, in 2016)

| Fourth Quarter | January - December | |||||||||||||

| Fluor | 2016 | 2015 |

% Var. |

2016 | 2015 | % Var. | ||||||||

| Sales | 133 | 115 | 16% | 583 | 608 | -4% | ||||||||

| Operating Income | 39 | 46 | -16% | 168 | 177 | -5% | ||||||||

| EBITDA | 54 | 59 | -9% | 228 | 241 | -6% | ||||||||

In 4Q16 the Fluor Group reported a 16% increase in sales, reflecting a 1% increase in volumes, supported mainly by the upstream business. We continued to successfully diversify end markets, with the cement industry performing well and customers accounting for an average of 36% of our met spar volumes in the 4Q16.

The Fluor Business Group reported EBITDA of $54 million, with an EBITDA margin of 40.5%. During 4Q15, our Fluor Business Group accrued a $9 million one-time benefit associated with a legal settlement. In 4Q16 reported EBITDA declined 9% from $59 million to $54 million while adjusting 4Q15 EBITDA by the one-time benefit mentioned above, EBITDA would have increased by $4 million or 8%. Operating income was $39 million, a decline of 16% year over year, but would have increased 5.4% when adjusting for the one-time benefit mentioned before.

In 2016 revenues were $583 million, down 4%, mainly due to weaker pricing of fluorspar and lower volumes in the first nine months of the year. In 2016 EBITDA declined by 6%, or $13 million, to $228 million with an EBITDA margin of 39.1%.

RECENT EVENTS

- Mexichem was selected as a member of the FTSE4Good Emerging Index first edition after demonstrating strong Environmental, Social and Governance (ESG) practices.

- Mexichem’s Audit Committee and Board of Directors have authorized on February 20 and February 21, respectively, to change the Company’s accounting policy related to fixed assets valuation from the revaluation method to the historical cost recognition method. Effective in 1Q17, Mexichem will reduce its fixed assets and equity value on its balance sheet by eliminating the revaluation value that has been accrued since Mexichem adopted IFRS in 2010. For comparative purposes, starting with the 1Q17 report, and during 2017, Mexichem will include an annex to its quarterly information showing the 2016 fixed assets and equity value as if the accounting policy change would have been authorized in 1Q16. The estimate figures (not audited) of this policy change at the beginning of 2017, represent a reduction on PP&E, deferred tax liabilities, and equity of $494 million, $160 million and $334 million, respectively in the consolidated balance sheet. In the consolidated income statement they represent a reduction in 2016, 2015 and 2014 in depreciation of $38 million, $39 million and $43 million respectively with their correspondent deferred tax of $11 million, $11 million and $13 million.

- As we reported in the 2Q16 our subsidiary Mexichem Brasil Industria de Transformação Plástica, Ltda. (before Amanco Brasil, Ltda.) was notified in 2016 by the Brazilian Administrative Council of Economic Defense (CADE), about supposed violations to the competitiveness economic legislation in Brazil, perpetrated by the subsidiary and some executives from 2003 to 2009. Mexichem is completely committed with the compliance of local regulations in every country in which it has operations. As up to date, this administrative procedure is in a stage in which the management of the Company couldn’t estimate the size of the obligation which, if that is the case, could result from this procedure.

For all the news please visit the following webpage http://www.mexichem.com/news/

Conference Call Details:

Mexichem will host a conference call to discuss its 4Q16 results on February 24, 2017 at 10:00 am Mexico City /11:00 NY. To access the call, please dial 001-855-817-7630 (Mexico), or 1-888-349-0106 (United States) or 1-412-902-0131 (International). All callers should dial in a minimum of 15 minutes prior to the start time and ask for the Mexichem conference call.

The call will also be available through an audio only live webcast until May 24th, 2017. A replay of the call will be available approximately two hours after the end of the call. The replay can be accessed via Mexichem’s website at www.mexichem.com.

RECONCILIATION SUMMARY BY BUSINESS GROUP

Fourth Quarter 2016 Financial and Operating Highlights

| Revenues | EBITDA | EBITDA Margin | Adjusted EBITDA | Adj. EBITDA Margin | ||||||||||||||||||||||||||||

| In million dollars | 4Q15 | 4Q16 |

% Var. |

4Q15 | 4Q16 |

% Var. |

4Q15 | 4Q16 | bps | 4Q15 | 4Q16 |

% Var. |

4Q15 | 4Q16 | bps | |||||||||||||||||

| Vinyl | 506 | 496 | -2% | 74 | 101 | 37% | 14.6% | 20.4% | 579 | 74 | 82 | 10% | 14.6% | 16.5% | 184 | |||||||||||||||||

| Fluent | 615 | 671 | 9% | 89 | 100 | 13% | 14.4% | 14.8% | 44 | 89 | 100 | 13% | 14.4% | 14.8% | 44 | |||||||||||||||||

| Fluor | 115 | 133 | 16% | 59 | 54 | -9% | 51.6% | 40.5% | - 1,106 | 59 | 54 | -9% | 51.6% | 40.5% | -1,106 | |||||||||||||||||

| Energy | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||||

| Eliminations / Holding | -32 | -41 | 31% | -10 | -8 | -12% | -10 | -8 | -12% | |||||||||||||||||||||||

| Mexichem Consolidated | 1,205 | 1,260 | 5% | 213 | 247 | 16% | 17.7% | 19.6% | 194 | 213 | 227 | 7% | 17.7% | 18.0% | 38 | |||||||||||||||||

| 4Q15 | In million dollars | 4Q16 | Sub16 | Sub16/4Q15 | ||||||

| Revenues | Revenues | FX | Total | % Var Comp | ||||||

| 506 | Vinyl | 496 | 5 | 502 | -1% | |||||

| 615 | Fluent | 671 | 45 | 716 | 17% | |||||

| 1,121 | Ethylene (Vinyl + Fluent) | 1,168 | 51 | 1,218 | 9% | |||||

| 115 | Fluor | 133 | 3 | 136 | 19% | |||||

| 0 | Energy | 0 | 0 | 0 | ||||||

| -32 | Eliminations/ Holding | -41 | 0 | - 41 | 31% | |||||

| 1,205 | Total | 1,260 | 54 | 1,314 | 9% | |||||

| 4Q15 | In million dollars | 4Q16 | 4Q16 | Sub16 | Sub Adj 16 | Sub16/4Q15 | SubAdj16/4Q15 | |||||||||

| EBITDA | EBITDA | Adj. EBITDA | FX | Total | Total | % Var Comp | % Var Comp | |||||||||

| 74 | Vinyl | 101 | 82 | 1 | 103 | 83 | 39% | 12% | ||||||||

| 89 | Fluent | 100 | 100 | 7 | 106 | 106 | 20% | 20% | ||||||||

| 162 | Ethylene (Vinyl + Fluent) | 201 | 181 | 8 | 209 | 189 | 29% | 17% | ||||||||

| 59 | Fluor | 54 | 54 | 0 | 54 | 54 | -9% | -9% | ||||||||

| 0 | Energy | 0 | 0 | 0 | 0 | 0 | 0% | |||||||||

| -10 | Eliminations/ Holding | -8 | -8 | 0 | - 8 | - 8 | -12% | -12% | ||||||||

| 213 | Total | 247 | 227 | 8 | 255 | 235 | 20% | 11% | ||||||||

Sub=Subtotal

2016 Financial and Operating Highlights

| Revenues | EBITDA | EBITDA Margin | Adjusted EBITDA | Adj. EBITDA Margin | ||||||||||||||||||||||||||||

| In million dollars | 2015 | 2016 |

% Var. |

2015 | 2016 |

% Var. |

2015 | 2016 | bps | 2015 | 2016 |

% Var. |

2015 | 2016 | bps | |||||||||||||||||

| Vinyl | 2,140 | 2,032 | -5% | 313 | 272 | -13% | 14.6% | 13.4% | - 124 | 313 | 314 | 0% | 14.6% | 15.5% | 83 | |||||||||||||||||

| Fluent | 3,027 | 2,892 | -4% | 409 | 421 | 3% | 13.5% | 14.6% | 105 | 409 | 421 | 3% | 13.5% | 14.6% | 105 | |||||||||||||||||

| Fluor | 608 | 583 | -4% | 241 | 228 | -6% | 39.7% | 39.1% | - 63 | 241 | 228 | -6% | 39.7% | 39.1% | - 63 | |||||||||||||||||

| Energy | 0 | 2 | 0 | 1 | 0 | 1 | ||||||||||||||||||||||||||

| Eliminations / Holding | -162 | -159 | -2% | -54 | -38 | -28% | -54 | -38 | -28% | |||||||||||||||||||||||

| Mexichem Consolidated | 5,612 | 5,350 | -5% | 910 | 884 | -3% | 16.2% | 16.5% | 30 | 910 | 926 | 2% | 16.2% | 17.3% | 109 | |||||||||||||||||

| 2015 | In million dollars | 2016 | Sub16 | Sub16/2015 | ||||||

| Revenues | Revenues | FX | Total | % Var Comp | ||||||

| 2,140 | Vinyl | 2,032 | 11 | 2,043 | -5% | |||||

| 3,027 | Fluent | 2,892 | 228 | 3,120 | 3% | |||||

| 5,167 | Ethylene (Vinyl + Fluent) | 4,924 | 239 | 5,163 | 0% | |||||

| 608 | Fluor | 583 | 7 | 589 | -3% | |||||

| 0 | Energy | 2 | 0 | 2 | ||||||

| -162 | Eliminations/ Holding | -159 | 0 | - 159 | -2% | |||||

| 5,612 | Total | 5,350 | 246 | 5,595 | 0% | |||||

| 2015 | In million dollars | 2016 | 2016 | Sub16 | Sub Adj 16 | Sub16/2015 | SubAdj16/2015 | |||||||||

| EBITDA | EBITDA | Adj. EBITDA | FX | Total | Total | % Var Comp | % Var Comp | |||||||||

| 313 | Vinyl | 272 | 314 | 2 | 274 | 316 | -13% | 1% | ||||||||

| 409 | Fluent | 421 | 421 | 54 | 475 | 475 | 16% | 16% | ||||||||

| 722 | Ethylene (Vinyl + Fluent) | 693 | 736 | 56 | 749 | 792 | 4% | 10% | ||||||||

| 241 | Fluor | 228 | 228 | 0 | 228 | 228 | -6% | -6% | ||||||||

| 0 | Energy | 1 | 1 | 0 | 1 | 1 | ||||||||||

| -54 | Eliminations/ Holding | -38 | -38 | 0 | - 38 | - 38 | -28% | -28% | ||||||||

| 910 | Total | 884 | 926 | 56 | 940 | 982 | 3% | 8% | ||||||||

ABOUT MEXICHEM

Mexichem is a global leader in plastic piping and one of the world’s largest chemical and petrochemical companies. It has more than 50 years of experience. The Company contributes to global development by delivering an extended portfolio of products to high growth sectors such as infrastructure, housing, datacom and water management, among others. With operations in over 30 countries, 120 facilities worldwide and more than 18,000 employees, Mexichem has the rights to produce fluorspar in two mines in Mexico, as well as 8 formation academies and 16 R&D lab. Operations are divided into two value chains and three business units: Ethylene Chain: Vinyl and Fluent Business and Fluor Value Chain, which includes Fluor business group. Mexichem has annual revenues of US$5.3 billion and has been traded on the Mexican Stock Exchange for more than 30 years. The company is member of the Mexican Stock Exchange Sustainability Index and the sustainability emerging markets index FTSE4Good.

Forward-looking Statements

In addition to historical information, this press release contains "forward-looking" statements that reflect management's expectations for the future. The words “anticipate,” “believe,” “expect,” “hope,” “have the intention of,” “might,” “plan,” “should” and similar expressions generally indicate comments on expectations. The final results may be materially different from current expectations due to several factors, which include, but are not limited to, global and local changes in politics, the economy, business, competition, market and regulatory factors, cyclical trends in relevant sectors; as well as other factors that are highlighted under the title “Risk Factors” on the annual report submitted by Mexichem to the Mexican National Banking and Securities Commission (CNBV). The forward-looking statements included herein represent Mexichem’s views as of the date of this press release. Mexichem undertakes no obligation to revise or update publicly any forward-looking statement for any reason unless required by law.”

Mexichem has implemented a Code of Ethics that rules its relationships with its employees, clients, suppliers and general groups. Mexichem’s Code of Ethics is available for consulting in the following link: http://www.mexichem.com/Codigo_de_etica.html Additionally, according to the terms contained in the Securities Exchange Act No 42, Mexichem Audit Committee established a mechanism of contact, which allows that any person that knows the unfulfilment of operational and accounting records guidelines and lack of internal controls of the Code of Ethics, from the Company itself or from the subsidiaries that this controls, file a complaint which is anonymously guaranteed. The whistleblower program is facilitated by a third party. The telephone number in Mexico is 01-800-062-12-03. The website is http://www.ethic-line.com/mexichem and contact e-mail is mexichem@ethic-line.com. Mexichem’s Audit Committee will be notified of all complaints for immediate investigation.

INDEPENDENT ANALYSTS

| Currently, the following investment firms have analysts who cover Mexichem: | ||||

| 1. | -Actinver | |||

| 2. | -Bank of America Merrill Lynch | |||

| 3. | -Banorte-Ixe | |||

| 4. | -Barclays | |||

| 5. | -BBVA Bancomer | |||

| 6. | -BTG Pactual | |||

| 7. | -Citigroup | |||

| 8. | -Credit Suisse | |||

| 9. | -GBM-Grupo Bursátil Mexicano | |||

| 10. | -Grupo Santander | |||

| 11. | -HSBC | |||

| 12. |

-Intercam |

|||

| 13. | -Invex Casa de Bolsa | |||

| 14. | -Interacciones | |||

| 15. | -ITAU BBA | |||

| 16. | -JP Morgan | |||

| 17. | -Morgan Stanley | |||

| 18. | -Monex | |||

| 19. | -UBS | |||

| 20. | -Vector | |||

INTERNAL CONTROL

Mexichem’s bylaws provide the existence of the Audit and Corporate Practices Committees, intermediate corporate organs constituted in agreement with the applicable law to assist the Board of Directors to carry on their functions. Through these committees and the external auditor it is given reasonable safety that transactions and company’s acts are executed and registered in accordance with the terms and parameters set by the Board and directives of Mexichem, the applicable law and different general guidelines, criterion and IFRS (International Financial Reporting Standards).

APPENDIX I: CONSOLIDATED RESTRUCTURED FIGURES OF QUARTERLY RESULTS AS A CONSEQUENCE OF FLUOR AND FLUENT BUSINESS GROUPS DISCONTINUED OPERATIONS, AND FREIGHT RECLASSIFICATIONS

STATEMENT OF CONSOLIDATED RESULTS

| USD in thousands | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | ||||||||||||||||||||||

| 2016 | 2015 | Var | 2016 | 2015 | Var | 2016 | 2015 | Var | 2016 | 2015 | Var | |||||||||||||||

| Net Sales | 1,262,383 | 1,437,475 | -12% | 1,427,005 | 1,516,719 | -6% | 1,400,267 | 1,453,672 | -4% | 1,260,152 | 1,204,526 | 5% | ||||||||||||||

| Cost of Sales | 975,125 | 1,151,280 | -15% | 1,077,283 | 1,165,256 | -8% | 1,089,941 | 1,138,565 | -4% | 1,001,124 | 914,193 | 10% | ||||||||||||||

| Gross Profit | 287,258 | 286,195 | 0% | 349,722 | 351,463 | 0% | 310,326 | 315,107 | -2% | 259,028 | 290,333 | -11% | ||||||||||||||

| Operating Expenses | 177,986 | 193,798 | -8% | 470,453 | 176,486 | 167% | (63,794) | 181,590 | -135% | 107,451 | 175,398 | -39% | ||||||||||||||

| Operating Income | 109,272 | 92,397 | 18% | (120,731) | 174,977 | 374,120 | 133,517 | 180% | 151,577 | 114,935 | 32% | |||||||||||||||

| Financial Cost | 43,411 | 67,932 | -36% | 41,516 | 61,575 | -33% | 50,491 | 55,308 | -9% | 27,513 | 60,400 | -54% | ||||||||||||||

| Equity in income of associated companies | (927) | 727 | (2,688) | (222) |

1111% |

131 | (1,378) | -110% | 611 | (2,207) | ||||||||||||||||

| Income from continuing operations before income tax | 66,788 | 23,738 | 181% | (159,559) | 113,624 | 323,498 | 79,587 | 306% | 123,453 | 56,742 | 118% | |||||||||||||||

| Income tax | 17,388 | 7,943 | 119% | (30,093) | 43,211 | 93,085 | 29,248 | 218% | 41,541 | 8,013 | 418% | |||||||||||||||

| Income from continuing operations after income tax | 49,400 | 15,795 | 213% | (129,466) | 70,413 | 230,413 | 50,339 | 358% | 81,912 | 48,729 | 68% | |||||||||||||||

| Discontinued operations | 583 | (1,662) | 599 | (2,446) | (6,573) | 4,090 | -261% | (5,389) | (54,147) | -90% | ||||||||||||||||

| Consolidated net income | 49,983 | 14,133 | 254% | (128,867) | 67,967 | 223,840 | 54,429 | 311% | 76,523 | (5,418) | ||||||||||||||||

| Minority Stock holders | (610) | (4,837) | -87% | (96,067) | 3,571 | 68,551 | 413 | 16498% | 11,207 | (3,206) | ||||||||||||||||

| Majority stock holders | 50,593 | 18,970 | 167% | (32,800) | 64,396 | 155,289 | 54,016 | 187% | 65,316 | (2,212) | ||||||||||||||||

| EBITDA | 200,418 | 199,007 | 1% | (29,401) | 266,320 |

111% |

465,881 | 232,451 | 100% | 246,856 | 212,643 | 16% | ||||||||||||||

This figures have been restructured including the changes mentioned in Appendix II

APPENDIX II: SUMMARY RECONCILIATION OF MEXICHEM’S CONSOLIDATED RESULTS WITH THE DISCONTINUED OPPERATION OF FLUENT PRESSURE PIPES AND FREIGHTS RECLASIFFICATION

| USD mm | Changes reported in 2015 | |||||||

| INCOME STATEMENT |

2015 |

Disc. operations |

2015 |

|||||

| Net sales | 5,708,309 | (95,917) | 5,612,392 | |||||

| Cost of sales | 4,156,282 | 213,012 | 4,369,294 | |||||

| Gross Profit | 1,552,027 | (308,929) | 1,243,098 | |||||

| Operating expenses | 1,043,170 | (315,898) | 727,272 | |||||

| Operating Income | 508,857 | 6,969 | 515,826 | |||||

| Financial cost | 245,215 | - | 245,215 | |||||

| Equity income of associated entities | (3,080) | - | (3,080) | |||||

| Income from continued operations before income tax | 266,722 | 6,969 | 273,691 | |||||

| Cash tax | 138,095 | 2,788 | 140,883 | |||||

| Deferred tax | (52,468) | - | (52,468) | |||||

| Income Tax | 85,627 | 2,788 | 88,415 | |||||

| Income from continued operations | 181,095 | 4,181 | 185,276 | |||||

| Discontinued Operations | (49,984) | (4,181) | (54,165) | |||||

| Net Consolidated Income | 131,111 | - | 131,111 | |||||

| EBITDA | 905,313 | 5,108 | 910,421 | |||||

*The chart above shows the reconciliation of the figures from FY 2015 that were reported on February 24th 2015, that included Fluor discontinued operations versus the FY 2015 restructured figures presented in this report, that include, Fluent discontinued operations ($96 million in sales, $102 million in COGS, and $5 million in EBITDA) and freight reclassifications from SG&A to COGS ($316 million).

| USD mm | Changes reported in 2016 | |||||||

| INCOME STATEMENT |

2016 |

Disc. Operations |

2016 |

|||||

| Net sales | 5,367,625 | (17,818) | 5,349,807 | |||||

| Cost of sales | 3,938,174 | 205,299 | 4,143,473 | |||||

| Gross Profit | 1,429,451 | (223,117) | 1,206,334 | |||||

| Operating expenses | 922,394 | (230,299) | 692,095 | |||||

| Operating Income | 507,057 | 7,182 | 514,239 | |||||

| Financial cost | 162,931 | - | 162,931 | |||||

| Equity income of associated entities | (2,873) | - | (2,873) | |||||

| Income from continued operations before income tax | 346,999 | 7,182 | 354,181 | |||||

| Cash tax | 189,295 | - | 189,295 | |||||

| Deferred tax | (70,247) | 2,873 | (67,374) | |||||

| Income Tax | 119,048 | 2,873 | 121,921 | |||||

| Income from continued operations | 227,951 | 4,309 | 232,260 | |||||

| Discontinued Operations | (10,780) | - | (10,780) | |||||

| Net Consolidated Income | 217,171 | 4,309 | 221,480 | |||||

| EBITDA | 877,621 | 6,133 | 883,754 | |||||

*The chart above shows the reconciliation of the figures from FY 2016 reported during 1Q16, 2Q16, 3Q16 and 4Q16 presented in this report, versus the FY2016 as if 1Q16, 2Q16 and 3Q16 were reported including Fluent discontinued operations ($18 million in sales, $24 million in COGS, and $6 million in EBITDA) and freight reclassifications from SG&A to COGS ($230 million). Numbers included in the “discontinued operations and freight reclassification” column are related only to the effects of 1Q16, 2Q16 and 3Q16; 4Q16 has been already presented including the Fluent discontinued operation and the freights reclassification related to this period.

APPENDIX III: SUMMARY RECONCILIATION OF INFORMATION BY SEGMENT

Reclassifications - Comparative information by segment reported in 4Q 2016 interim financial notes (Note 4) for the year ended December 31, 2015, has been reclassified retrospectively to conform with the presentation used as of December 31, 2016, to present the elimination of investment in subsidiaries by business group under the heading of other assets, which were previously presented under the heading of consolidated eliminations column. This reclassification does not impact the consolidated assets amount.

| As of December 31, 2016 | ||||||||||||||||

| Vinyl | Energy | Fluor | Fluent | Holding | Eliminations | Consolidated | ||||||||||

| Current Assets | ||||||||||||||||

| Cash and Cash equivalents | 127,472 | 813 | 124,235 | 304,083 | 157,004 | - | 713,607 | |||||||||

| Net Account Receivable | 611,299 | (2,687) | 112,421 | 466,636 | (7,088) | - | 1,180,581 | |||||||||

| Other current assets | 240,496 | 2,162 | 333,082 | 418,588 | 393,351 | (742,714) | 644,965 | |||||||||

| Assets held for sale | - | - | 7,566 | 13,484 | - | - | 21,050 | |||||||||

| Total Current Assets | 979,267 | 288 | 577,304 | 1,202,791 | 543,267 | (742,714) | 2,560,203 | |||||||||

| Property, plant and equipment | 2,679,949 | 8,344 | 389,516 | 1,121,736 | 2,035 | - | 4,201,580 | |||||||||

| Net other assets | 623,165 | 7,597 | 157,794 | 1,430,387 | 4,849,495 | (5,024,219) | 2,044,219 | |||||||||

| Total Assets | 4,282,381 | 16,229 | 1,124,614 | 3,754,914 | 5,394,797 | (5,766,933) | 8,806,002 | |||||||||

| Current Liabilities | ||||||||||||||||

| Bank loans and current portion of long-term debt | 18,707 | - | 19,473 | 19,513 | - | - | 57,693 | |||||||||

| Suppliers and letters of credit of suppliers | 785,279 | 2 | 40,997 | 437,575 | 5,851 | - | 1,269,704 | |||||||||

| Other current liabilities | 544,422 | 773 | 48,906 | 352,422 | 454,789 | (756,919) | 644,393 | |||||||||

| Liabilities associated with asset held for sale | - | - | 12,216 | 991 | - | - | 13,207 | |||||||||

| Total Current Liabilities | 1,348,408 | 775 | 121,592 | 810,501 | 460,640 | (756,919) | 1,984,997 | |||||||||

| Bank loans and long-term debt | 95,699 | - | 51,652 | 2,977 | 2,091,042 | - | 2,241,370 | |||||||||

| Long-term other liabilities | 547,664 | 114 | 201,979 | 643,348 | (76,266) | (634,758) | 682,081 | |||||||||

| Total Liabilities | 1,991,771 | 889 | 375,223 | 1,456,826 | 2,475,416 | (1,391,677) | 4,908,448 | |||||||||

| December 31st, 2015 | ||||||||||||||||

| Vinyl | Energy | Fluor | Fluent | Holding | Eliminations | Consolidated | ||||||||||

| Current Assets | ||||||||||||||||

| Cash and Cash equivalents | 128,778 | 77 | 98,071 | 254,181 | 172,167 | - | 653,274 | |||||||||

| Net Account Receivable | 283,084 | (5) | 125,863 | 484,233 | (8,831) | - | 884,344 | |||||||||

| Other current assets | 269,751 | 307 | 349,241 | 423,497 | 444,090 | (789,156) | 697,730 | |||||||||

| Assets held for sale | - | - | 11,533 | 4,972 | - | - | 16,505 | |||||||||

| Total Current Assets | 681,613 | 379 | 584,708 | 1,166,883 | 607,426 | (789,156) | 2,251,853 | |||||||||

| Property, plant and equipment | 2,620,435 | 5,078 | 420,104 | 1,157,053 | 257 | - | 4,202,927 | |||||||||

| Net other assets | 2,400,698 | 4,802 | 309,726 | 1,708,524 | 3,967,105 | (6,175,959) | 2,214,896 | |||||||||

| Total Assets | 5,702,746 | 10,259 | 1,314,538 | 4,032,460 | 4,574,788 | (6,965,115) | 8,669,676 | |||||||||

| Elimination reclasification | (1,779,917) | (4,802) | (129,858) | (268,442) | (827,403) | 3,010,422 | - | |||||||||

| Total Assets | 3,922,829 | 5,457 | 1,184,680 | 3,764,018 | 3,747,385 | (3,954,693) | 8,669,676 | |||||||||

| Current Liabilities | ||||||||||||||||

| Bank loans and current portion of long-term debt | 16,103 | - | 17,879 | 9,671 | - | - | 43,653 | |||||||||

| Suppliers and letters of credit of suppliers | 709,595 | 1 | 38,957 | 451,244 | 1,224 | - | 1,201,021 | |||||||||

| Other current liabilities | 490,786 | 156 | 67,111 | 374,147 | 449,357 | (827,287) | 554,270 | |||||||||

| Liabilities associated with asset held for sale | - | - | 19,617 | - | - | - | 19,617 | |||||||||

| Total Current Liabilities | 1,216,484 | 157 | 143,564 | 835,062 | 450,581 | (827,287) | 1,818,561 | |||||||||

| Bank loans and long-term debt | 83,445 | - | 84,320 | 5,771 | 2,117,886 | - | 2,291,422 | |||||||||

| Long-term other liabilities | 496,332 | 91 | 209,364 | 750,607 | 71,596 | (647,078) | 880,912 | |||||||||

| Total Liabilities | 1,796,261 | 248 | 437,248 | 1,591,440 | 2,640,063 | (1,474,365) | 4,990,895 | |||||||||