CHICAGO--(BUSINESS WIRE)--In anticipation of Amazon’s second annual Prime Day, new analysis from Market Track, LLC, the leading provider of advertising, promotions, pricing and eCommerce intelligence solutions, found that Amazon’s pricing for top sellers in high-demand categories like TVs, video games, and tablets were lower on Black Friday 2015 than on the inaugural Prime Day.

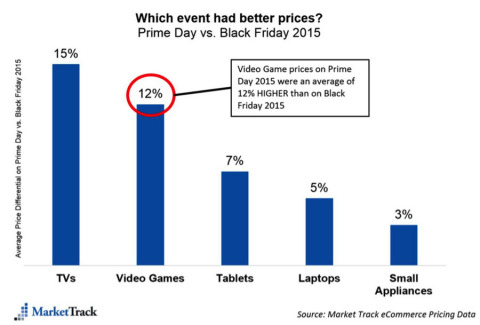

In their analysis of Amazon’s 2015 Prime Day prices vs. Amazon’s 2015 Black Friday prices, Market Track discovered that, on average, Amazon’s prices were 9% lower on Black Friday. All categories measured featured lower prices during the traditional post-Thanksgiving shopping event, with TVs showing prices 15% higher on Prime Day, and video games showing 12% higher.

Market Track reviewed online prices for 380 products stocked on Amazon between last year’s Prime Day and Black Friday 2015, and compared pricing across the two events.

- Prices for Laptops were 5% cheaper on Black Friday than on Prime Day

- Prices for Small Appliances were 3% cheaper

- Prices for Tablets were 7% cheaper

- Prices for TVs were 15% cheaper

- Prices for Video Games were 12%

Last year, Amazon marked its 20th anniversary by creating its annual Prime Day event on July 15th. New and existing global Prime members had access to thousands of “Lightning Deals,” seven popular “Deals of the Day” and unlimited, free two-day shipping. The deals lasted throughout the day, with new deals being offered as often as every ten minutes. For shoppers who were not already Prime members, they could sign up for a free 30-day Prime membership to take advantage of the sale. This move to drive memberships was highly regarded as Amazon’s way to further solidify its position as a go-to source when people decide to shop online.

“Amazon’s inaugural Prime Day event created off-season competitive pressure that caused a ripple effect of response across eCommerce, with multiple retailers announcing rival events on the same day in an effort to compete with Amazon,” said Traci Gregorski, senior vice president of marketing at Market Track. She continued, “We were not shocked to find that Black Friday prices for top holiday products beat Prime Day prices, since they did not specifically say prices would be lower in the promotions of the event leading up to Prime Day. The goal of the event was multi-faceted—yes, Amazon succeeded in driving sales, but their focus was also to incentivize consumers to subscribe to a Prime membership. They hoped to get people to try the service and then drive loyalty through access to additional perks that come with Prime such as video streaming and cloud storage. The timing of the event was also a week before the launch of Jet.com.”

The best Prime Day deals did in fact rival the best Black Friday deals, however Amazon didn’t include some of their most in-demand products in their Prime Day offerings last year. Market Track found that out of 450 of Amazon’s best sellers in categories associated with Black Friday such as tablets, laptops and digital cameras, only 43 of those on the list were discounted by more than 10%.

“Consumer reaction to Amazon’s Prime Day event, in spite of Amazon’s record sales and membership enrollment, was less than favorable due to a misalignment of expectations,” continued Gregorski. “Amazon promoted the event as having ‘more deals than Black Friday’ which created some disappointment when the categories they featured were more varied and less geared toward what consumers typically associate with holiday deals. Regardless of the bad reaction, Amazon accomplished the goal of getting even more people hooked on their Prime service.”

About Market Track

Headquartered in Chicago, Illinois, Market Track is the leading provider of subscription-based advertising, promotions, eCommerce and pricing intelligence solutions in North America. Through its monitoring of multi-channel trade and promotional advertising as well as pricing and eCommerce activity, Market Track provides the most comprehensive coverage of key media channels available. Offered via a web-based SaaS platform, Market Track’s solutions enable advertisers, agencies, retailers, and manufacturers of consumer goods to efficiently monitor and analyze causal data, creative execution, and ad spending to maximize the value of their marketing campaigns. Clients use Market Track’s capabilities to determine how competing retailers, products, and brands are being advertised, priced, and promoted both in-store and online. The company’s granular creative assets and data cover nearly every retail trade class, product category, and media channel. For more information, please visit www.markettrack.com.