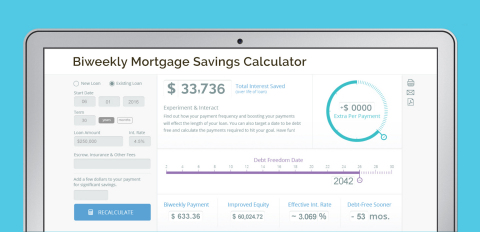

ORLANDO, Fla.--(BUSINESS WIRE)--AutoPayPlus is redefining the crowded online mortgage calculator space with the launch of its biweekly version that features interactive scales and charts to answer the questions that users have in real-time. The free biweekly mortgage calculator complements the company’s automated mortgage payment service that helps homeowners reach their financial goals faster.

A defining feature of the AutoPayPlus biweekly mortgage calculator is its “smart” ability to create financial what-if scenarios. For example, what if someone wants to pay off a mortgage before their child starts college? Using a debt freedom slider, users can calculate the payments needed to meet their financial objective.

Other features of the new biweekly mortgage calculator include:

- Calculates biweekly payments, effective interest rate and improved equity when using the automated loan payment service for mortgages.

- Takes into consideration escrow (tax and insurance).

- Shows amortization, including principal and interest, during the life of the loan.

“There are many mortgage calculators on the web today, but frankly, I haven’t seen anything as polished in terms of design and ease of use,” said AutoPayPlus CEO Robert Steenbergh. “Our goal was to improve on the typical user interface experience and create an exciting, colorful and modern presentation of information that appeals to today’s social and digital natives.”

AutoPayPlus offers homeowners a number of accelerated mortgage payment options including weekly, biweekly and bimonthly debit withdrawals. It also provides customers with access to a free financial planning toolkit to help them automate other bill payments, organize their finances, monitor their credit, and create a budget and savings plan for the future. The resources available include monthly VantageScore® 3.0 credit score with trending from TransUnion®, and credit monitoring and instant alerts from TransUnion® to help prevent identity theft.

AutoPayPlus is a personal financial management service offering loan and bill payment and personal equity building, credit monitoring and protection, and financial planning tools. Founded in 2003, the company has provided automated loan acceleration services to more than 155,000 consumers nationwide. It is an industry leader in early loan payoff services with an A+ rating from the Better Business Bureau and is fully compliant with all regulatory issues relevant to the marketplace. For more information visit https://www.autopayplus.com.